Treasury Keeps Bond Auctions Sizes Unchanged At Record High As It Warns On Debt Ceiling

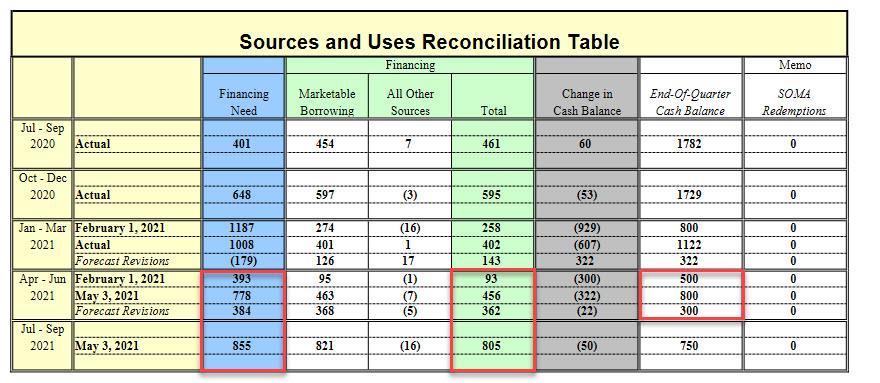

Two days after the US Treasury surprised rates watchers by unveiling that it would sell nearly 5x more Treasuries in the current quarter than previously expected ($465BN vs $95BN) and $1.3TN over the second half of the fiscal year while reducing the amount of cash released from the TGA...

Source: Treasury Sources and Uses Table

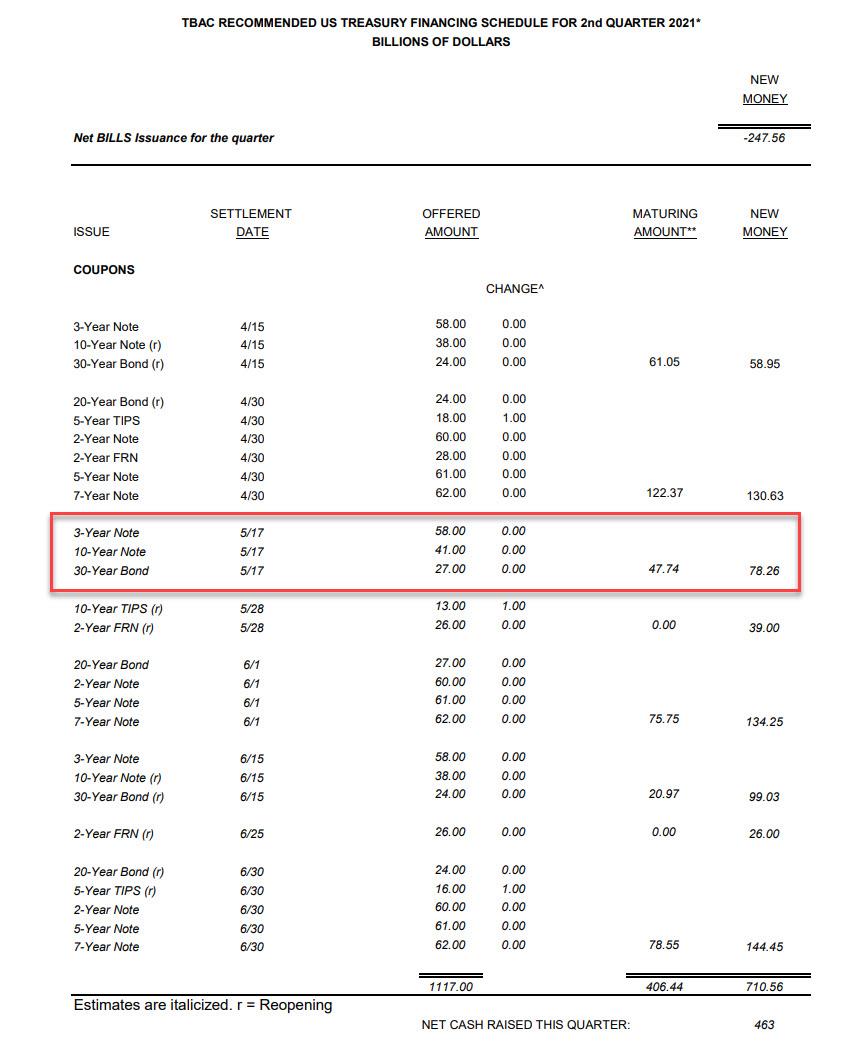

... at 830am on Wednesday in its latest quarterly Refunding Announcement, the Treasury announced that it would keep its quarterly auction of long-term coupon debt unchanged, and at an all-time high, of $126 billion (vs $84 billion a year ago) to refund approximately $47.7 billion of Treasury notes and bonds maturing on May 15, 2021. This issuance will raise new cash of approximately $78.3 billion. The securities to be auctioned off are:

-

$58BN in 3-year notes maturing 2024 on May 11, unch from $58BN in February

-

$41BN in 10-year notes maturing 2031 on May 12, unch from $41BN in February

-

$27BN in 30-year bonds maturing 2051 on May 13, unch from $27BN in February.

As Bloomberg notes, this was the first time in more than a year that the refunding total hasn’t risen, "suggesting that financing needs have peaked."

The Treasury said that other nominal note and bond auction sizes are expected to remain unchanged during the quarter as well, the Treasury said adding that as usual, the balance of Treasury financing requirements over the quarter will be met with weekly bill auctions, cash management bills (CMBs), and monthly note, bond, Treasury Inflation-Protected Securities (TIPS), and 2-year Floating Rate Note (FRN) auctions.

"Between April 2020 and February 2021, Treasury substantially increased issuance sizes for nominal coupon and FRN securities and has announced its intention to gradually increase TIPS issuance this year" the refunding announcement said. "Treasury believes that these previously announced changes continue to provide sufficient capacity for Treasury to address near-term projected borrowing needs. Accordingly, Treasury is announcing that it anticipates no changes to nominal coupon and FRN auction sizes over the upcoming May to July 2021 quarter."

Discussing its projected financing needs, the Treasury said it "continues to face uncertain and sizable borrowing needs due to expenditures associated with the government’s response to COVID-19 as well as the impact of the pandemic on economic activity and government receipts." It also said that it plans to address any seasonal or unexpected variations in borrowing needs over the next quarter through changes in regular bill auction sizes and/or CMBs.

The Treasury also warned that it may face challenges if Congress fails to suspend or increase the federal debt limit when the current suspension runs out at the end of July. On previous occasions, the Treasury has used various measures to keep servicing federal debt outstanding while lawmakers and the White House wrangled over raising the ceiling. But this year could bring added strains, the department said.

The Bipartisan Budget Act of 2019 suspended the debt limit through July 31, 2021.[1] Treasury expects that Congress will raise or suspend the debt limit in a timely manner. If Congress has not acted by July 31, Treasury, as it has in the past, may take certain extraordinary measures to continue to finance the government on a temporary basis. In light of the substantial COVID-related uncertainty about receipts and outlays in the coming months, it is very difficult to predict how long extraordinary measures might last. Treasury is evaluating a range of potential scenarios, including some in which extraordinary measures could be exhausted much more quickly than in prior debt limit episodes.

Consistent with guidance provided in November, TIPS (inflation-linked) auctions during the quarter will increase by $1b each relative to most recent comparable new issue or reopening; that would mean a $13b 10-year reopening in May, a $16b 5-year reopening in June and a $16b 10-year new issue in July:

-

10-year TIPS reopening in May of $13 billion

-

5-year TIPS reopening in June of $16 billion

-

10-year TIPS new issue in July of $16 billion

While flexibility will be maintained to adjust TIPS issuance plans at each quarterly refunding announcement, Treasury expects total gross issuance of TIPS to increase by $10BN to $20BN in CY 2021.

Also notably, there was no new guidance on issuance of 20-year bonds, security the Treasury resurrected last year. But the department said FINRA which currently publishes aggregate statistics on Treasury securities volumes, detailed last week that it will modify that report in May to provide greater detail on the 20-year securities sector going forward.

The Treasury also didn’t provide any fresh insights on its continuing analysis of the idea of issuing debt linked to the Secured Overnight Financing Rate, the Federal Reserve’s preferred replacement rate to Libor.

The Treasury also addressed the all-important topic of its cash balance and bill issuance, and continuing our observations from Monday, it said that it now expects its cash balance to decline to $450BN at the expiration of the debt limit suspension on July 31 resulting from reductions in bill issuance; which are expected to reduce bills outstanding by around $150BN. However, the actual cash balance on July 31 may vary from this assumption based on changes to expected outflows in that period. The reduction in the cash balance between now and July 31 will be achieved by using cash on hand to cover near-term outlays and modest reductions in bill issuance.

Based on current forecasts, Treasury estimates that the reduction in bills outstanding between now and July 31 could be about $150 billion, which is approximately one-third the size of the decline in bill supply that has already occurred since February 2021 refunding. As expectations for receipts and outlays evolve over the coming months, this estimated reduction in bills outstanding may also change, but Treasury does not anticipate bill issuance to be as volatile as it has been in the past when prior debt limit suspensions expired.

As a reminder, the Treasury is still holding a huge (if smaller) cash pile, and the prior ramping up in auctions means the Treasury doesn’t need to further boost its debt issuance even after the enactment of the $1.9 trillion March pandemic-relief bill. The Treasury accumulated a record cash balance of $1.8 trillion at one point last year.

Over the upcoming quarter, Treasury will also continue to supplement its regular benchmark bill financing with a regular cadence of CMBs. Treasury anticipates that weekly issuance of 6- and 17-week CMBs for Thursday and Tuesday settlement, respectively, will continue at least through the end of July. Maintaining these CMBs will provide the requisite flexibility to address potential changes in borrowing needs resulting from uncertainty associated with the fiscal outlook.

While there were no major surprises in this quarterly refunding, Bloomberg reminds us that big decisions on debt issuance loom later this year, with the government’s borrowing needs are set to shrink rapidly as Covid-19 stimulus spending ebbs and the economic recovery sets in (unless of course Universal Basic Income becomes a permanent fixture of the USSA). While President Joe Biden is calling for $4 trillion in further initiatives, those are aimed over several years, with tax hikes planned to help pay for them.

As such, Treasury Secretary Janet Yellen and her team will need to decide whether and how quickly to shrink sales of so-called coupon-bearing debt -- securities that pay interest. Her predecessor Steven Mnuchin actively sought to lengthen the average maturity of Treasuries to take advantage of historically low longer-term rates. The majority of Wall Street bond dealers had predicted the Treasury would make no changes to nominal coupon-bearing debt auctions. Several forecast reductions beginning as early as August. Sales of notes and bonds ranging from seven to 30 years have doubled in size thanks to Covid-19 spending, HSBC Holdings Plc estimates show.

“Even if Congress passes a large-scale infrastructure package which is funded over a five to 10-year horizon, Treasury’s current auction schedule leaves it more than adequately financed in coming years,” Jay Barry, a strategist at JPMorgan Chase & Co. wrote in a note last week. “Treasury should begin making cuts to its auction sizes in relatively short order.”

Refunding statement aside, the minutes from the TBAC's most recent meeting noted that historically large issuance sizes in recent quarters had generated sufficient financing capacity at this time, and that coupon sizes could likely be reduced later this year or early next year. TBAC also debated whether it would be beneficial to make near-term cuts for specific maturity points, such as the 20-year bond, or to hold off on recommending any cuts until it becomes clearer that Treasury should begin more broad-based cuts.

Committee also recommended that Treasury continue to increase TIPS auction sizes at a pace consistent with the $10-20b increase in gross issuance for CY2021 that was announced at November 2020 quarterly refunding, and suggested considering the high-end of the range by increasing the size of 5-year TIPS auctions by slightly more than the increases in other TIPS securities based on relatively high demand.

TBAC then reviewed a presentation on lessons learned from recent episodes of market volatility and stressed liquidity conditions in the Treasury market, examining market structure, dynamics in the non-bank financial sector, and potential ways to improve market functioning during periods of heightened uncertainty.

The presenting member suggested potential solutions designed to assist Treasury market participants in navigating periods of heightened volatility, rather than attempting to prevent these episodes. He also said that the most promising policy proposals were the adjustments to the leverage ratio and the standing repo facility

Fred Pietrangeli, director of the Office of Debt Management, noted that the September cash balance estimate of $750 billion assumes that Congress has taken actions to resolve the debt limit. Pietrangeli said that despite the net marketable borrowing needs, primary dealers anticipate Treasury will be overfinanced in upcoming fiscal years and may need to consider coupon cuts either later this year or early next year.

Debt Manager Kyle Lee described more details regarding dealers’ expectations for Treasury issuance, noting that dealers argued that for FY2022 and beyond, reductions in nominal coupon auction sizes could help avoid “a significant decline in bill supply” and were expected across the curve.

Some primary dealers suggested that Treasury could consider greater auction size reductions in tenors that appeared to have relatively less demand at auction or that were increased relatively more over the last year.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more