Trannies Tumble To Worst Losing Streak Since Nixon As Yields Hit 2019 Lows

Biggest US payrolls miss since 2008 and the biggest collapse in China exports in years (after the biggest credit injection ever)...

Take your pick from China - tech-heavy small-cap dominated CHINEXT surged over 5% while mega cap-heavy China 50 tumbled almost 5%...(SHCOMP ended the week marginally lower with the worst day since October and first losing week of the year)...

(Click on image to enlarge)

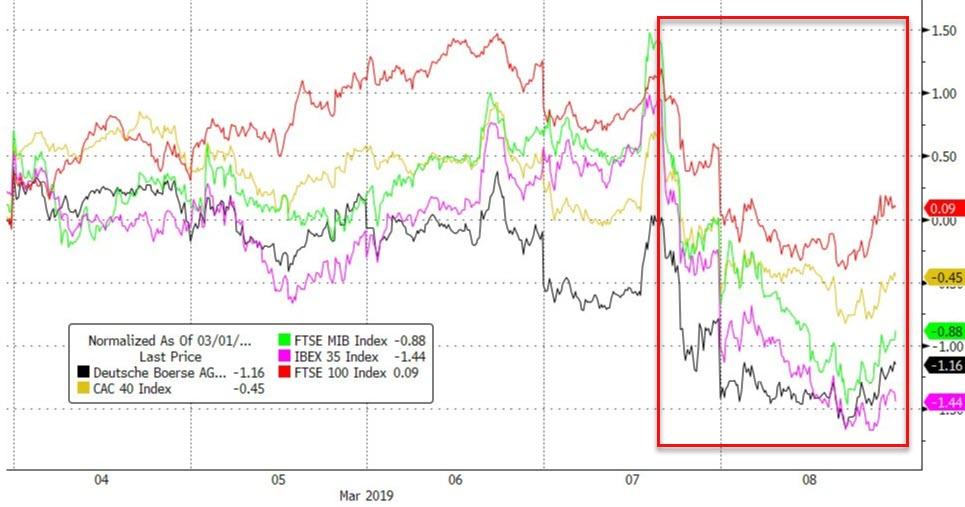

By the end of the week, only UK's FTSE managed to hold on to gains as weakness rippled through global markets in the late half of the week...

(Click on image to enlarge)

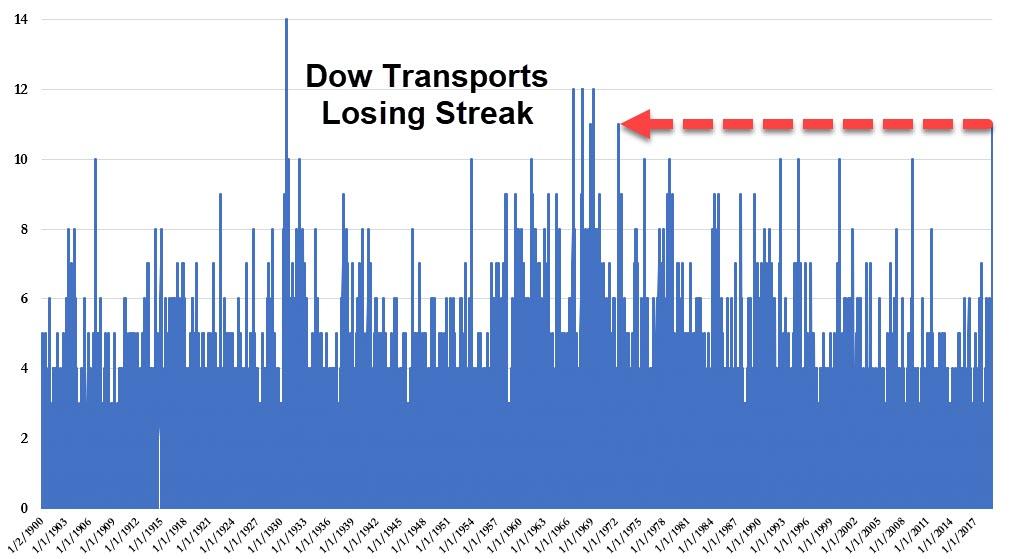

Dow, S&P, Nasdaq and Small Caps are down 5 days in a row but The Dow Transports is now down 11 days in a row - the longest losing streak since Nixon in 1972...

(Click on image to enlarge)

This week was the first down week for US stocks since 2018... Small Caps were the biggest laggards.

(Click on image to enlarge)

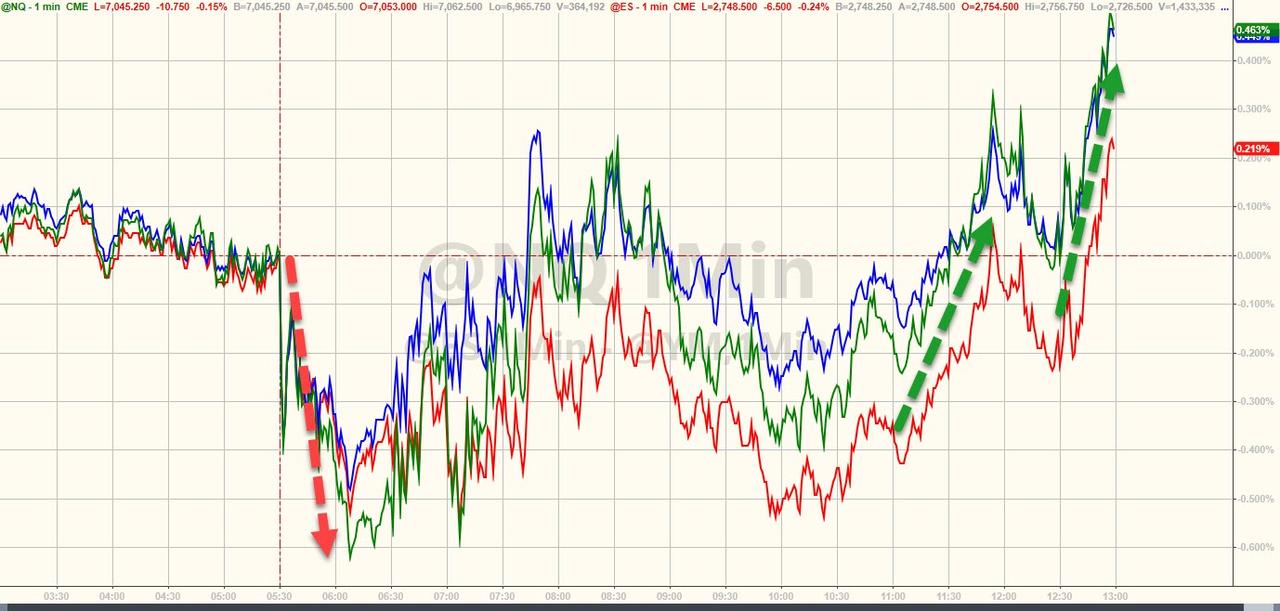

The machines went wild as always, desperate to get stocks green on the day...

(Click on image to enlarge)

Everything green from the shitty payrolls print...

(Click on image to enlarge)

Stocks tried twice to accelerate and ignite momentum for a green push but China trade headlines in the last hour spoiled the party briefly before the panic bid ensued, pushing the market above the pre-payrolls levels...

(Click on image to enlarge)

"Most Shorted" Stocks are down 7 days in a row (first down week of the year).

(Click on image to enlarge)

Buyback-related stocks are also down 8 of the last 9 days...

(Click on image to enlarge)

The S&P and Nasdaq both broke back below their 200DMA this week...

(Click on image to enlarge)

(Click on image to enlarge)

FANG Stocks suffered their biggest loss of 2019 this week...notably breaking back below its 200DMA

(Click on image to enlarge)

Semis were slaughtered - worst week of the year...

(Click on image to enlarge)

About two-thirds of its members are down, led by Marvell Tech after disappointing earnings. There was also a Nikkei report that the global semiconductor market contracted in January for the first time in 30 months. Momentum on the SOX is negative, as measured by the MACD. Falling below the 200-DMA could be an excuse for a broader selloff in stocks, I pointed out yesterday.

Credit spreads have widened 5 days in a row (and VIX is up 5 days in a row), blowing out by the most since Dec 21st...

(Click on image to enlarge)

The VIX term structure has re-inverted...

(Click on image to enlarge)

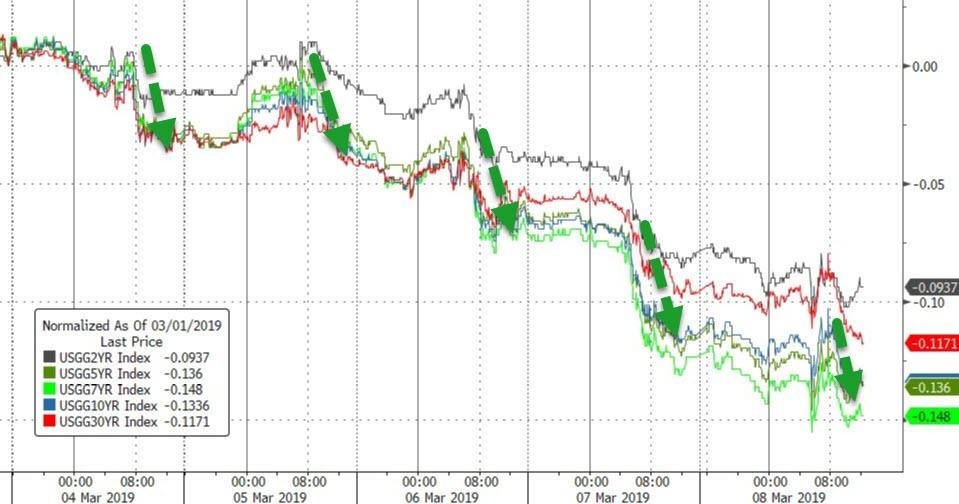

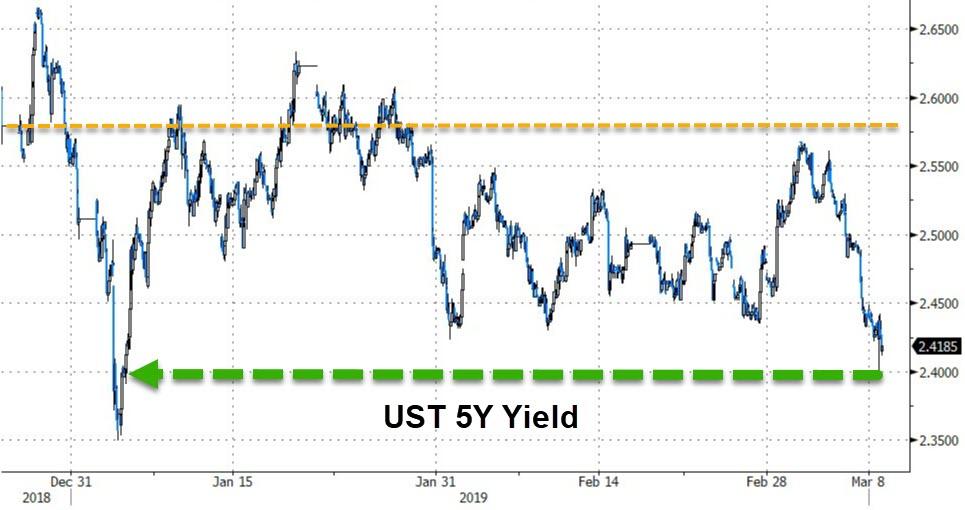

Treasury yields tumbled all week, with the belly outperforming...

(Click on image to enlarge)

The long-end dropped back to a 3.01 handle - erasing last week's losses...

(Click on image to enlarge)

And the belly reached down to its lowest since the first day of the year...

(Click on image to enlarge)

In fact the belly is the richest it has been in years (5Y lowest relative to the 2s10s curve) as bond traders are no longer so concerned about a policy error, but still seem to be pricing in a major growth slowdown in the next few years.

(Click on image to enlarge)

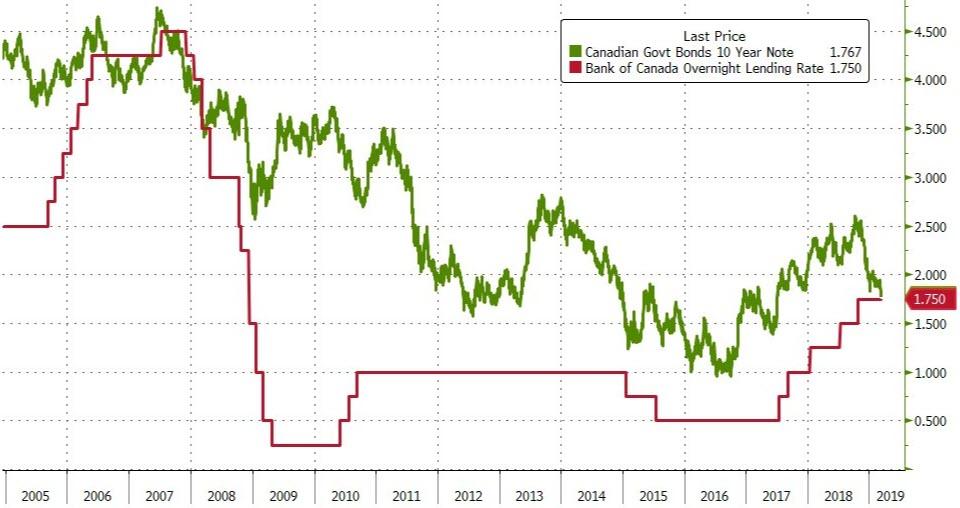

And before we leave bond land, we note that 10Y CAD yields are now less than 2bps above the BOC policy rate!!!

(Click on image to enlarge)

After rising for 7 days straight, the dollar index tumbled today but remains above the key 97.00 level...

(Click on image to enlarge)

Yuan weakened - as you'd expect with USD gains - but closed at the lows of the week after Xi headlines...

(Click on image to enlarge)

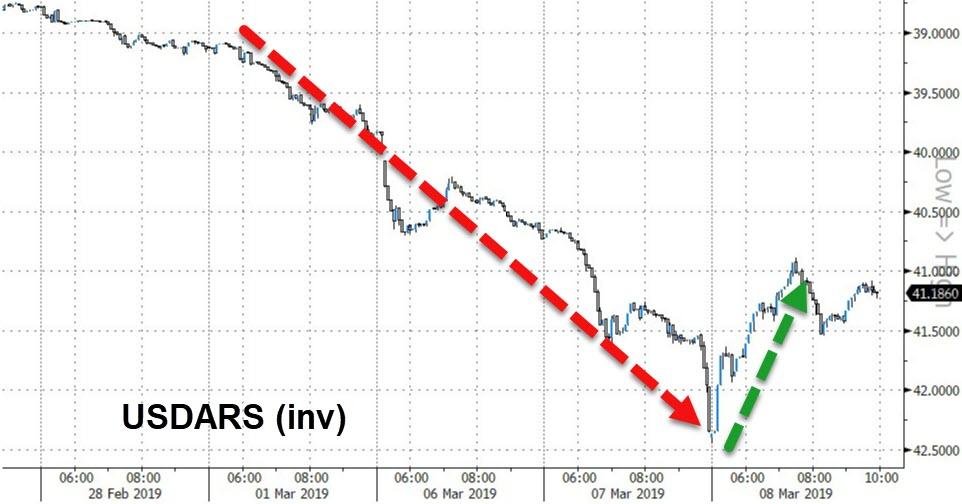

After yesterday's bloodbath to a new record low, Argentina's Peso rebounded notably as BCRA raised its benchmark rate by 500bps to 56.76%!!

(Click on image to enlarge)

Litecoin had a big week but the rest of Crypto was practically flat...

(Click on image to enlarge)

Despite the dollar surge on the week, PMs and oil gained on the week - rallying after the dismal jobs data...

(Click on image to enlarge)

WTI dropped off $57 and bounce back off $55...

(Click on image to enlarge)

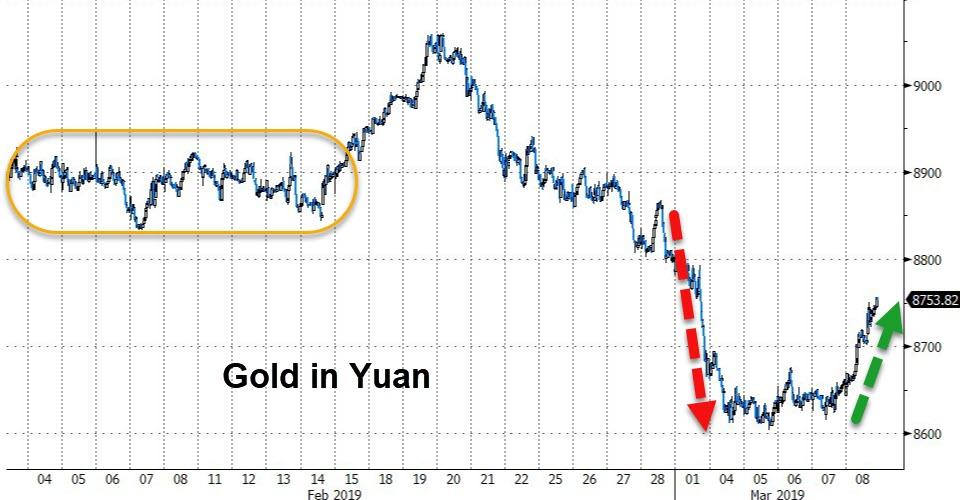

Today's dismal jobs data sparked a revival in gold - bouncing off unchanged for 2019...

(Click on image to enlarge)

And Gold rebounded notably against the Yuan...

(Click on image to enlarge)

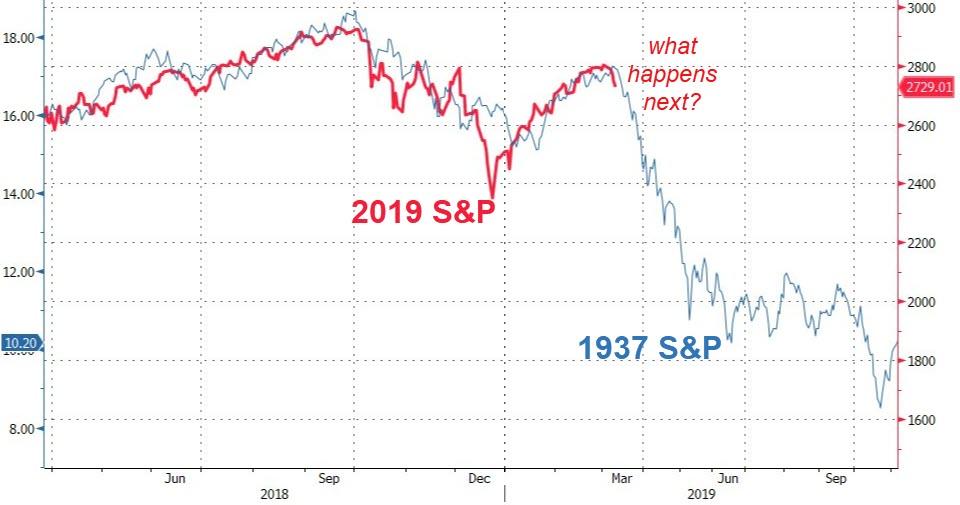

Finally, deja vu all over again?

(Click on image to enlarge)

Because the gap to reality is wide...

(Click on image to enlarge)

Everyone should read this.