Trading The Rejection

(Video length 00:57:31)

We sure didn’t waste any time getting things moving in August, did we?

With the US and China going “eye-for-an-eye” in the trade war, these markets have been explosive with plenty of great set-ups to say the least…

And with big moves up/down on our favorite markets, we have plenty more set-ups coming for Tuesday’s trading session – are you ready?

Crude Oil is sideways in a range-bound market, which tells me to buy the low, sell the high, and avoid the middle of the range on Tuesday morning.

Knowing this, my plan is to wait for an attempted breakout and then look for failure set-ups to send price back into the original range once again.

E-Mini S&P is Four Legs Down, Does that Matter?

E-Mini S&P is bearish with four big legs lower today, which tells me to expect tomorrow to go sideways with a trading-range…

Knowing this, my goal is to keep looking for ways to sell as high as possible, and to do that, I’m waiting for buyers to try taking it higher, so I can sell into their failures.

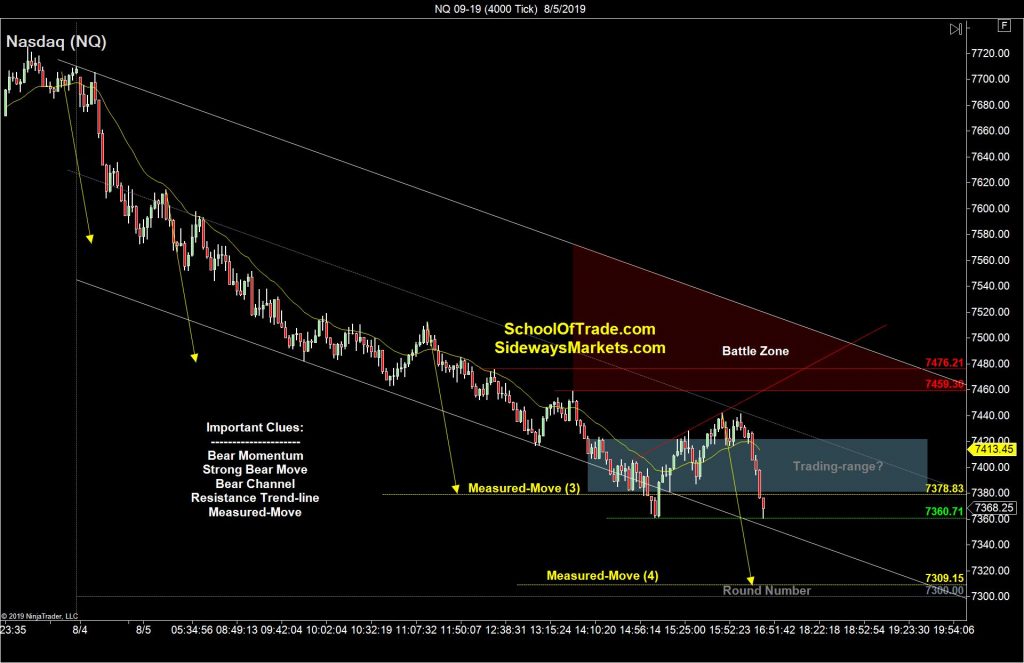

Nasdaq Is Hunting for Leg Number 4…

Nasdaq is bearish and almost four legs down, which tells me to avoid selling this market now and wait for the opportunity to sell off key resistance levels waiting overhead…

And speaking of resistance, I’m watching a Hidden Channel, drawn off the lower-lows, and waiting to be used up at the high.

Gold is Bullish, But Got Rejected at the Highs…

Gold is bullish with a Spike & Channel, which quickly pulled-back and shot back up to re-test the high – but the buyers got rejected up at the highs!

This rejection is a big clue, because it tells me to consider this market as a range, and focus on buying the low of the range using seller-failure set-ups tomorrow morning.

Euro is Waiting for the Pullback…

Euro is bullish with a Spike & Channel pattern, which tells me to mark the “buy zone” at the base of the channel and wait patiently for a pullback…

And as we open in Asia, it is easy to see this market may keep trying to push higher, and if so, I’ll just keep waiting for that pullback to give me the best risk-reward-ratio (and probabilities) as possible.

Disclaimer: Join our Free Trading Course. Joseph James, SchoolOfTrade.com and United Business Servicing, Inc. are not registered investment or ...

more