Trade Hope Rally Fizzles In Europe After China Soars To Four Month High

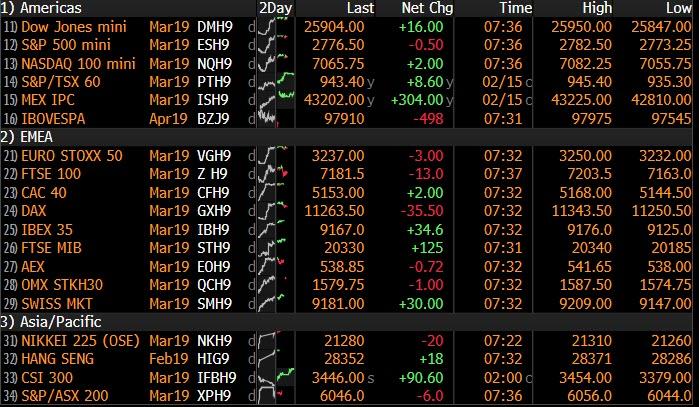

The latest "trade hope" rally which sent the Dow Jones up 444 points on Friday, fizzled overnight as stocks in Europe and U.S. futures drifted in thin trading (US exchanges are closed for Presidents’ Day) even after a rally in Asia boosted shares to their highest level since October on delayed catch up to the US.

The Stoxx Europe 600 was flat, with the Stoxx 50 little changed on the session, with the Dax declining while peripheral indexes IBEX 35 and FTSE MIB outperformed, as gains in telecommunications companies offset declines in carmakers, after President Donald Trump received a report that may be a preliminary step to raising tariffs on auto imports. The autos index, a bellwether for Europe’s economy, fell 0.65%, also pressured by data showing Chinese car sales fell 16% in January, their seventh straight month of decline, and the biggest one month drop in seven years.

Trump has 90 days to decide whether to act upon the recommendations.

“The optimism on trade has been strong, but the underlying economic data has been a lot of weaker - so you have some push and pull factors,” said David Vickers, senior portfolio manager at Russell Investments, adding much focus was now on flash PMI data due out this week. “As the bounce-back from the December lows fades...the fundamentals now reassert (themselves),” Vickers added.

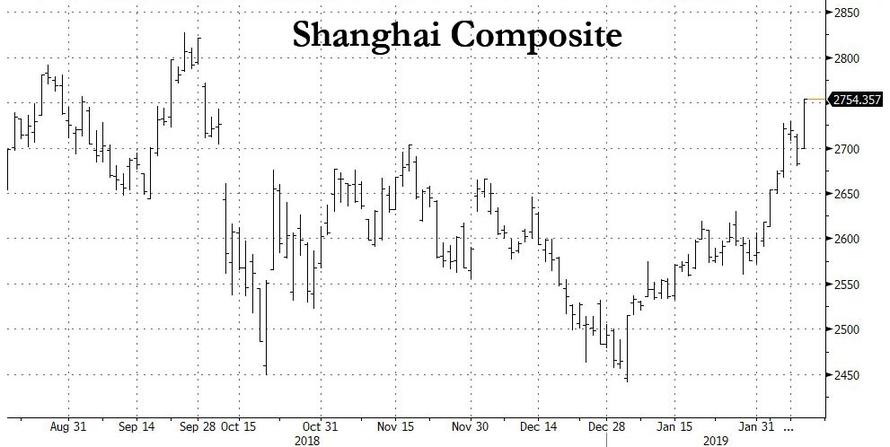

Earlier in the session, the "US-China trade hope" trade boosted Asian sentiment, lifting the MSCI All-Country World Index rose 0.3% to a two and a half month high, after Japan’s Nikkei closed up 1.8% at its highest level of the year thanks to a weaker yen and MSCI’s index of Asian equities rose almost 1%. China's Shanghai Composite soared 2.7% to its highest finish in more than four months...

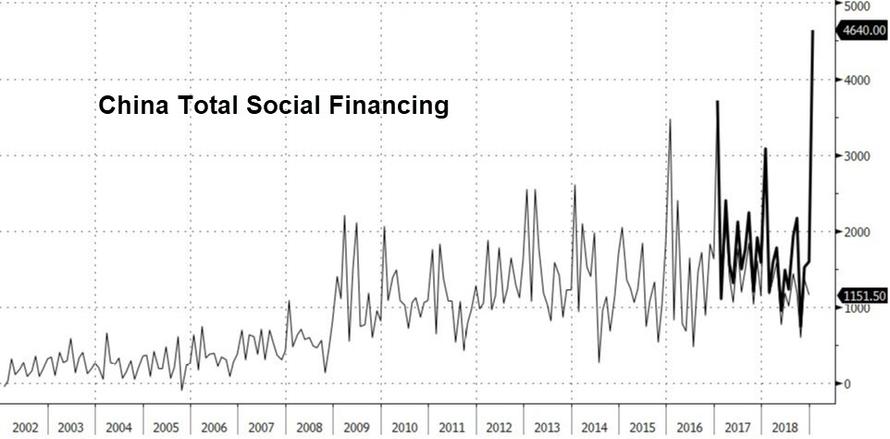

... while the Chinext and Shenzhen Composite both surged by over 4% after China reported a Total Social Financing credit injection on Friday that was the same size as the GDP of Saudi Arabia, at just under $700 billion.

“The market has a view that there will be an extension or a deal along the way,” Erik Nielsen, chief economist at UniCredit Group, told Bloomberg TV. Overall, “the Americans don’t believe in multilateralism any more. So we are moving constantly towards a less-good scenario, and global trade is suffering.”

U.S. equity-index futures drifted although were modestly in the green, suggesting that U.S. stocks would hold onto last week’s gains when trading resumed on Tuesday. The Dow and the Nasdaq boasted their eighth consecutive week of "trader optimism" the world’s two largest economies would hammer out an agreement resolving their protracted trade dispute.

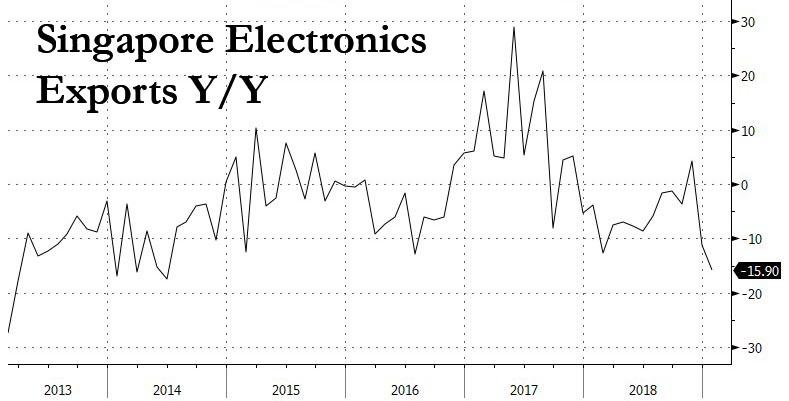

In addition to trade, bullishness has been encouraged by a continued soft economic data which has fueled expectations that the world’s most powerful central banks could deliver on reflationary policies and provide support for markets. The need for stimulus was highlighted by data showing a sharp slide in Singapore exports and a big drop in foreign orders for Japanese machinery goods.

Meanwhile, trade negotiations - whose favorable outcome has already been pried in by the market - will resume this week, with U.S. President Donald Trump saying he may extend a March 1 deadline for a deal. Both sides reported progress at last week’s talks in Beijing.

In rate, core European bonds were little changed across the curve, BTPs outperform, with 10-yr Italy/Germany spread 3bps tighter at 266bps. US Treasury cash markets are closed for the holiday.

In FX, the dollar was steady on the yen at 110.52, having backed away from a two-month top of 111.12. The yen slipped with the dollar, while the euro strengthened despite dovish comments from a European Central Bank governing council member. The pound strengthened after seven members of the U.K. Parliament said they’ll stand as independents after quitting the main opposition Labour Party over issues including Brexit and antisemitism. Emerging-market assets climbed.

British Prime Minister Theresa May plans to speak to every EU leader and the European Commission chief to seek changes to her EU withdrawal agreement, after another defeat from her own lawmakers last week.

Commodities from oil to copper climbed, sending an index of commodities to the highest since December, with oil prices reaching their highest for the year, buoyed by OPEC-led supply cuts and U.S. sanctions on Iran and Venezuela.

Looking ahead, the latest Fed minutes are due on Wednesday and should provide more guidance on the likelihood of rate hikes this year. There is also talk the bank will keep a much larger balance sheet than previously planned.

“Given the range of speakers since the January meeting who support “patience,” the Fed minutes should reiterate a dovish message overall,” analysts at TD Securities said in a note.

Overnight News

- The slowdown of the European economy is “significant” and the European Central Bank could change its interest-rates guidance if it becomes clear the situation isn’t temporary, Governing Council member Francois Villeroy de Galhau said

- Trump has received the findings of a probe into whether imported vehicles pose a national security threat, which could lead the U.S. to impose tariffs

- Theresa May said she’s planning to meet with European Commission President Jean-Claude Juncker and speak to the leader of every EU member state in the days ahead over Brexit

- Iron ore futures extended gains amid uncertainty over production losses after the Vale SA dam disaster, even as inventory of Brazilian ore at China’s ports surged to a record

- Trump wanted the Russia investigation cited in the memo firing FBI Director James Comey and believed Russia’s president over his own intelligence agencies about North Korea’s missile capability, former Acting FBI Director Andrew McCabe said

- The krona, the worst-performing major currency this year, faces volatility on Swedish inflation data Tuesday as markets may be underestimating the risk for a surprise

- The Bank of Japan’s offer to buy bonds due in more than 25 years drew the strongest response in over four years, with traders’ willingness to part with the super-long securities signaling bets that the central bank will scale back purchases further

Asian stocks kick-started the week on the front foot as the region followed suit to last Friday’s gains on Wall St. where sentiment was buoyed by US-China trade talks, which were said to have made progress and are to continue in Washington this week. ASX 200 (+0.4%) was led by higher by outperformance in the energy sector as oil prices hit fresh YTD highs but with upside in the index contained as financials and industrials lagged, while the Nikkei 225 (+1.8%) was among the biggest gainers with exporters boosted by a weaker currency. Elsewhere, Hang Seng (+1.7%) and Shanghai Comp. (+2.4%) benefitted from the trade-related optimism after US-China trade talks were extended into this week, while the latest lending data also provided encouragement as both Aggregate Financing and New Yuan Loans topped estimates in which the latter rose by the most on record.

In European markets, equities are mixed [Euro Stoxx 50 +0.1%], in spite of the positive gains seen in Asia overnight on US-China trade optimism as talks are scheduled to continue this week in Washington. The DAX (-0.1%) is mildly underperforming weighed on by auto names, Volkswagen (-1.1%) and Daimler (-0.7%), following China car sales falling 17.7% Y/Y; alongside the US Commerce Department submitting the ‘Section 232’ report to US President Trump yesterday. The report is expected to include some tariffs on fully assembled vehicles, with the President having 90 days to act upon its recommendations; although ING have downplayed the potential impact of tariffs as the car industry adds at most 4% to German GDP, with an eighth of this depending on exports to the US. Subsequently, sectors are mixed with underperformance in the auto sector. Other notable movers include Wirecard (+12.5%) who are leading the Stoxx 600 after German financial regulator Bafin has issued a ban on establishing/increasing short positions on the Co. until April 18th. Separately, Reckitt Benckiser (+5.0%) are in the green following their earnings. At the bottom of the Stoxx 600 after being downgraded are Casino (-2.7%), who were downgraded to hold at Deutsche Bank.

In FX, we start with the GBP/EUR which is pegging at the top of the G10 leaderboard, as Sterling and the single currency glean most from a broader Dollar pull-back with the DXY retreating a bit further from 97.000 and last Friday’s new 2019 high just shy of 97.400. The Pound has also benefited to a limited extent from reports that certain EU countries, including France, may be willing to provide legally binding assurances over the Irish backstop amidst speculation that pro-Brexiters may accept a 5 year limit on the contingency arrangement. Cable is back above 1.2900, but may find a more pronounced rebound tough to achieve without confirmation of any such olive branch and with almost 1 bn option expiries running off at the big figure. Similarly, Eur/Usd looks top heavy on the 1.1300 handle having faded at 1.1325 and now testing a Fib level around 1.1313.

- CHF/AUD/NZD - The next best majors, with the Franc paring more losses from last week’s ‘flash crash’ lows vs the aforementioned softer Greenback, but still pivoting 1.1350 against the Eur, while the antipodeans are relishing latest updates from China and the US as both sides declare progress on key trade issues. Aud/Usd and Nzd/Usd are both off overnight highs, but the former is holding closer to its peak circa 0.7160 vs the latter that waned just ahead of 0.6900, as the cross trade back over 1.0400.

- CAD/JPY - Firm oil prices still underpinning the Loonie that is pivoting 1.3250 in holiday-thinned trade (US and Canadian markets closed, latter for Family Day), while Usd/Jpy has firmed off recent lows on US-China tariff optimism and ahead of mega option expiry interest at the 110.00 strike (2.5 bn) within a relatively restricted 110.40-60 range.

- EM - The Lira is markedly underperforming after the CBRT’s 100 bp RRR reduction over the weekend, as concerns about a more formal shift in policy via benchmark rates to an easier stance build. Usd/Try climbed from the low 5.2700s to 5.3150+ at one stage compared to regional counterparts that are treading water vs the Usd.

In commodities, WTI (+0.8%) and Brent (+0.1%) futures are consolidating following Friday’s advances after the benchmarks printed fresh YTD highs. Prices are supported by the OPEC-led supply curbs, US sanctions on Venezuela and Iran and optimism surrounding a US-Sino trade deal, while US President Trump also acknowledged progress and productivity in talks over the weekend. Furthermore, US National Security Advisor Bolton, on twitter, warned the international oil company to not deal with Venezuelan state-owned PDVSA due to sanctions, calling the company “Maduro’s corrupt oil slush fund”. Elsewhere on the radar, Nigerian elections have been rescheduled to the 23rd February as the INEC said it had deemed holding the poll “no longer feasible”. In terms of potential market impact, a group of militants from the Delta region threatened to resume attacks against oil pipelines and facilities if the trial against Chief Justice of Nigeria, Walter Onnoghen (whose role includes overseeing potential election disputes) proceeds, due to corruption allegations. Oil traders will recall the 2016 attacks from the Niger Delta militants which significantly disrupted Nigerian output, which was running at a rate of 1.89mln BPD in December. PMV analysts said that the latest provides "a timely reminder that Nigerian authorities have yet to conclusively eliminate the threat posed by armed militants". Looking at production, the country’s crude output declined to 1.66mln BPD in December from 1.78mln in December; according to the oil ministry. Finally, as a reminder, WTI will not settle tonight due to US President’s Day holiday so prices may diverge from the global benchmark come tomorrow.

US Event Calendar:

- No events scheduled due to the Presidents' Day holiday

DB's Jim Reid concludes the overnight wrap

Hope you all had a nice weekend? We had a brief taste of summer on Sunday in the south of England with the sun “blazing” out. We were at a friend's house and they had a sandpit outside which attracted all the kids. As such though, when we returned home we spent most of the evening finding dollops of sand scattered around the house. It gets everywhere. The bath also ended up with a big dirt ring round its circumference. At this stage, it feels like there is more chance of winter being gone for good than there is getting our deposit back on our rental accommodation when we move out in 9 weeks. Just hope the landlord doesn’t work in the city and doesn’t read this.

So on to a new week. However, today is Presidents Day in the US with bond and equity markets closed so don’t expect the most exciting start to proceedings. After that, we have enough to watch though, with the flash PMIs around the world on Thursday the most interesting, especially for Europe given its current flirtation with recession.

A reminder that last month we saw the composite reading for the Euro Area fall slightly to 51.0 (flash February consensus 51.1) and the lowest in five and a half years. It was also the fifth consecutive monthly decline and the tenth in the last twelve months. The manufacturing print, which is expected to slide 0.2pts to 50.3 (50.5 in last month), has declined for six consecutive months and twelve in the last thirteen. Given rising concerns about a possible recession in Germany, there will be plenty of focus on whether or not the manufacturing print can rise above 50.0 again following a decline to 49.7 in January. Currently, the consensus print for Germany's manufacturing PMI is 49.9. For the US, the manufacturing print is expected to broadly hold steady at 55.0.

Also important for growth, yesterday was the deadline for the US Department of Commerce to decide on whether or not there is a national security case to impose auto tariffs following a long-awaited report. The findings of the probe along with recommendations from commerce secretary Wilbur Ross have been submitted to President Trump overnight, without the contents being made public yet. The findings and reaction are of crucial importance given where the world is going in trade terms and where Europe currently is in its recessionary orbit. An aggressive response from the US will create huge tensions, especially in their relationships with the EU, Japan, and South Korea. President Trump will have up to 90 days to decide on whether or not to take action, in part or in full. The FT reported that trade lobbyists expect Trump to take most of the 90 days to make his decision but will he really not tweet any of the findings, especially if they suggest a security risk? So watch this space! The potential economic impact is not to be underestimated. Our economists in Europe have previously estimated that the cost, excluding secondary confidence or financial conditions effects, of the trade measures implemented at that point in time (August 2018) plus a second round of US-China tariffs and an extension to auto tariffs to be equivalent to 0.4-0.5% of euro area GDP with auto tariffs accounting for around half. So with growth flirting with recession in Q3-Q4 this would be very bad news for those hoping and expecting a slow bounce back. Add a hard Brexit on top of this and Europe has a few binary risks at the moment.

If you’re looking for more positives then if a lot of the slowdown in Europe is actually export and maybe China-related then Friday’s Chinese credit growth surprised to the upside and augured well for the months ahead. Aggregate social financing rose 4.64 trillion yuan, versus consensus estimates for a 3.31 trillion rise. This pushed the credit impulse into positive territory, which has been a good lead indicator of Chinese PMIs. As we’ll see below this kicked started a rally on Friday that got supercharged by more positive trade headlines and positive TLTRO talk.

Before we look back on that, we’ll finish off the highlights of the week ahead. In Germany on Friday we'll see the final Q4 GDP revisions. A reminder that the preliminary print was much softer than expected at just +0.02% qoq (vs. +0.2% expected), and therefore technically avoiding a recession by the slimmest of margins. The smallest of downward revisions could, therefore, see Germany tip into a second consecutive quarter of negative growth. See here for our economists latest forecasts for growth in Germany, which they downgraded to just 0.5% for 2019 this week. It'll also be worth keeping an eye on survey readings in Germany next week with the February ZEW survey due on Tuesday and February IFO survey on Friday.

Meanwhile, on Wednesday we'll get the FOMC minutes from the January 29-30 meeting. A reminder that the meeting broadly reaffirmed the Fed's intent to be patient in assessing further adjustments to its policy as it awaits the resolution of various "crosscurrents" that have lifted uncertainty and raised downside risks to the outlook. Expect the balance sheet run-off topic to also be a potential talking point. All other data and Central Bank speakers are in the day ahead.

This Morning in Asia markets are largely heading higher following Wall Street’s lead from Friday with the Nikkei (+1.84%), Hang Seng (+1.57%), Shanghai Comp (+1.79%) and Kospi (+0.45%) all up. Elsewhere, all G10 currencies are up (+0.1% to +0.3%) against the greenback except for the Japanese yen (c. -0.1%) while futures on S&P 500 are trading flat (+0.03%) ahead of today’s holiday.

Over the weekend, the UK PM May penned a letter to her party’s lawmakers asking them to unite behind her Brexit withdrawal plan saying she’s planning to meet with European Commission President Jean-Claude Juncker and speak to the leader of every EU member state in the days ahead but added that gaining headway in Brussels will depend largely on whether she can show a united front at home. In the meantime, the Sunday Times reported that Steve Baker, the deputy chairman of the ERG, told his colleagues that Brussels and London were pretending to negotiate while running down the clock so May’s Brexit deal can be forced through parliament. This was rejected by the Brexit Minister Chris Heaton-Harris in an interview with Sky News where he said that there’s a “huge amount” of activity from the government in trying to secure a deal, citing trips to Brussels by May and other senior ministers over the coming days. So a week of bubbling Brexit tensions likely ahead of the next big vote in the middle of next week.

Turning to last Friday now before reviewing the rest of the last week. It ended up being an eventful session after the China data first boosted risk, Italy then dampened it before TLTRO and positive trade talk reenergized the bulls. The China data helped commodities and related asset prices to rally on Friday, with oil up +2.63%, the Australian dollar +0.51%, and the Stoxx basic materials sector gaining +1.94%.

Italian assets saw a wild roundtrip, with 10-year BTP yields rising as much as +10.5bps to over 2.90% as media outlets reported that Claudio Borghi, a top Northern League politician, suggested that he was in favor of leaving the European Union if upcoming elections do not meet his expectations. Admittedly, Borghi is a known euro-skeptic and his comments were not especially new, but they still moved the market as he described the European project as “disastrous and toxic.” The sharp move completely reversed by the end of the session, however, after ECB Executive Board member Benoit Coeure said that “we are discussing” a new TLTRO. He also said that the slowdown has been “clearly strong and broader” than the ECB expected. The TLTRO talk helped BTPs rally back to flat on the day, and boosted Italian bank equities (+4.05% Friday) and broader European banks (+3.63%). In the meantime, the ECB Governing Council member Francois Villeroy de Galhau has said that the slowdown in the European economy is “significant” while adding that the main problem which Euro-area is facing is global political uncertainty.

Elsewhere, the drumbeat of positive rhetoric on US-China trade talks continued, with Treasury Secretary Mnuchin saying the meetings last week were “productive,” President Xi saying the parties “achieved important progress,” and President Trump saying “it’s going extremely well.” The talks are set to continue in DC this week, and the positive momentum helped the S&P 500 to a gain of +2.50% on the week (+1.09% on Friday). The NASDAQ and DOW posted similar gains, advancing +2.39% and +3.09% on the week (+0.61% and +1.74% Friday) respectively. In Europe, the STOXX 600 gained +3.04% (+1.41% Friday) with the FTSEMIB outperforming, up +4.45% (+1.90% Friday). The dollar strengthened a touch, up +0.29% on the week (-0.06% Friday), while EMs sold off -0.53% (+0.33% Friday). In fixed income, Treasury yields rose +2.9bps (+0.9bps Friday), with a similar move in Bunds, up +2.2bps (-0.3bps Friday). Credit continued its strong start to the year, with US HY cash tightening -13.5bps (-5.1bps Friday).