Toys R Us And Government Hurt Great Jobs Report

Great July Jobs Report Despite Consensus Miss

With the ADP report showing 219,000 jobs created and the BLS survey occurring during a week that had low jobless claims, I was anticipating job growth in the BLS report to beat expectations. Usually, the ADP report doesn’t elicit a big stock market reaction, but since it had recently been pessimistic, its beat pushed stocks higher last Wednesday. These two indicators implied over 250,000 jobs could be created in July. That didn’t happen as the report only showed 157,000 jobs were created which missed estimates for 190,000 jobs created. Even though this looks bad, the details show us that it was a great report.

There are two obvious details in the headline report. The first is that there were 170,000 private sector jobs added, which only missed estimates for 184,000. In other words, the consensus expected the government to add 6,000 jobs, but instead, it subtracted 13,000 jobs. Local governments lost the most jobs. It’s possible the jobs were subtracted because school isn’t in session in the summer, meaning teachers aren’t working. As you can see, the 33,000 miss instantly becomes a 14,000 miss, which is very small.

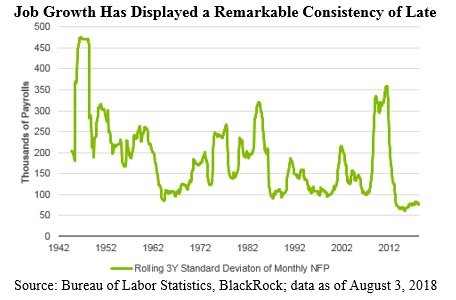

These employment reports usually are very volatile and hard to predict, but lately, they have been consistent. As you can see from the chart below, the rolling 3-year standard deviation of the monthly payrolls report is near its lowest level since 1942. The standard deviation has been low for a few years. We had gotten used to discounting monthly reports like regional Fed reports which have excessive noise. Without the noise, the employment reports are becoming reliable indicators of the economy. To be clear, I follow every report, but I would discount one if it was wildly inconsistent with the trend.

(Click on image to enlarge)

The second reason this was a good report is because the May and June jobs reports were revised to show an additional 59,000 jobs were added. It’s easy to just focus on the last report because it’s the most recent one. However, you need to look at all three holistically. The older reports are more reliable than the newest one. The June report was revised up from 213,000 to 248,000 and the May report was revised up from 244,000 to 268,000 jobs. These are spectacular reports. If you are worried about hitting full employment, you might fear they are too good. Adding 258,000 jobs per month will get the labor market to full employment quickly even if all the workers on the sidelines start looking for work again.

Is The Labor Market At Full Employment?

Economists have been way too early in their pronouncement that the labor market is at full employment because they look at the jobless claims and the unemployment rate. The July unemployment rate fell from 4% to 3.9%, but that doesn’t mean there isn’t slack left in the labor market. The labor force participation rate was stagnant at 62.9% which beat estimates for 62.8%. The prime age labor force participation rate increased 0.1% to 82.1%. It peaked at 83.4% in the last cycle and 84.6% in the prior cycle. A 1.3% difference between the last cycle and the current rate doesn’t sound like much, but it’s huge. From September 2015 until now the rate has gone up 1.5%. That means it took 2 years and 10 months.

Increasing at that speed would get us to the prior cycle’s peak in about two and a half years. That is a lot different from the consensus projection for a recession in about 18 months since the economy doesn’t immediately fall into a recession after the prime age participation rate peaks. To be clear, there isn’t a magic rate which causes a recession. This is a guide to measure how much slack there is in the labor market.

As you can see from the chart below, the prime age employment to population ratio increased from 79.3% to 79.5% in July. The rate peaked at 80.3% in the prior cycle and 81.9% in the cycle before that. This reading of the slack in the labor market shows the labor market is slightly tighter than the previous one I reviewed as it only needs to go up 0.8% to reach the prior cycle’s peak. In the past year, the rate is up 0.9% which implies it will take about one year to get to the previous cycle’s peak.

(Click on image to enlarge)

Toys R Us Bankruptcy Makes Report Look Bad

There are many other details which show this report was better than the headline number suggests. The most prominent one-time negative impact was the Toys R Us bankruptcy which caused the sporting goods, hobby, book, and music store category to lose 31,800 jobs. If that category would have added 1,200 jobs, the headline number wouldn’t have missed estimates. Private sector job growth would have beaten estimates without this bankruptcy. On the other hand, there was a one-time positive event which made the headline number look better than it was. Auto manufacturers skipped their summer retooling which means there weren’t the usual job losses.

Housing Job Creation Continues

There have been a few weak data points on the housing market recently. For example, seasonally adjusted week over week housing purchase applications were down 3% in the report last Wednesday. That was the 3rdweekly decline in a row. We will get an update on that stat this Wednesday. Even though there has been some weakness in the housing market, housing jobs showed strong growth in July. The chart below shows the year over year change in payrolls for real estate, construction, and architectural and engineering services. As you can see, each of the 3 industries had year over year growth with construction growing the quickest growth. There is a shortage of skilled workers.

(Click on image to enlarge)

Conclusion

This is an overview of the July employment report. I still have more topics to discuss such as wage growth. As you can see, this was a great report which shouldn’t make investors question if the economy will maintain its growth rate.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more