Topping Pattern Or Just Quick Correction Before Another Leg Up?

The U.S. stock market indexes lost 0.1-0.4% on Wednesday, retracing some of their recent advance, as investors took short-term profits off the table. The S&P 500 index broke above its short-term consolidation on Wednesday a week ago and it continued higher. The market is above the 61.8% Fibonacci retracement of its October-December downward correction of 20.2% (2,713.88). It has gained 390 points from the late December medium-term low, but it is still around 200 points below the September 21st record high of 2,940.91. The Dow Jones Industrial Average lost 0.1% and the Nasdaq Composite lost 0.4% on Wednesday.

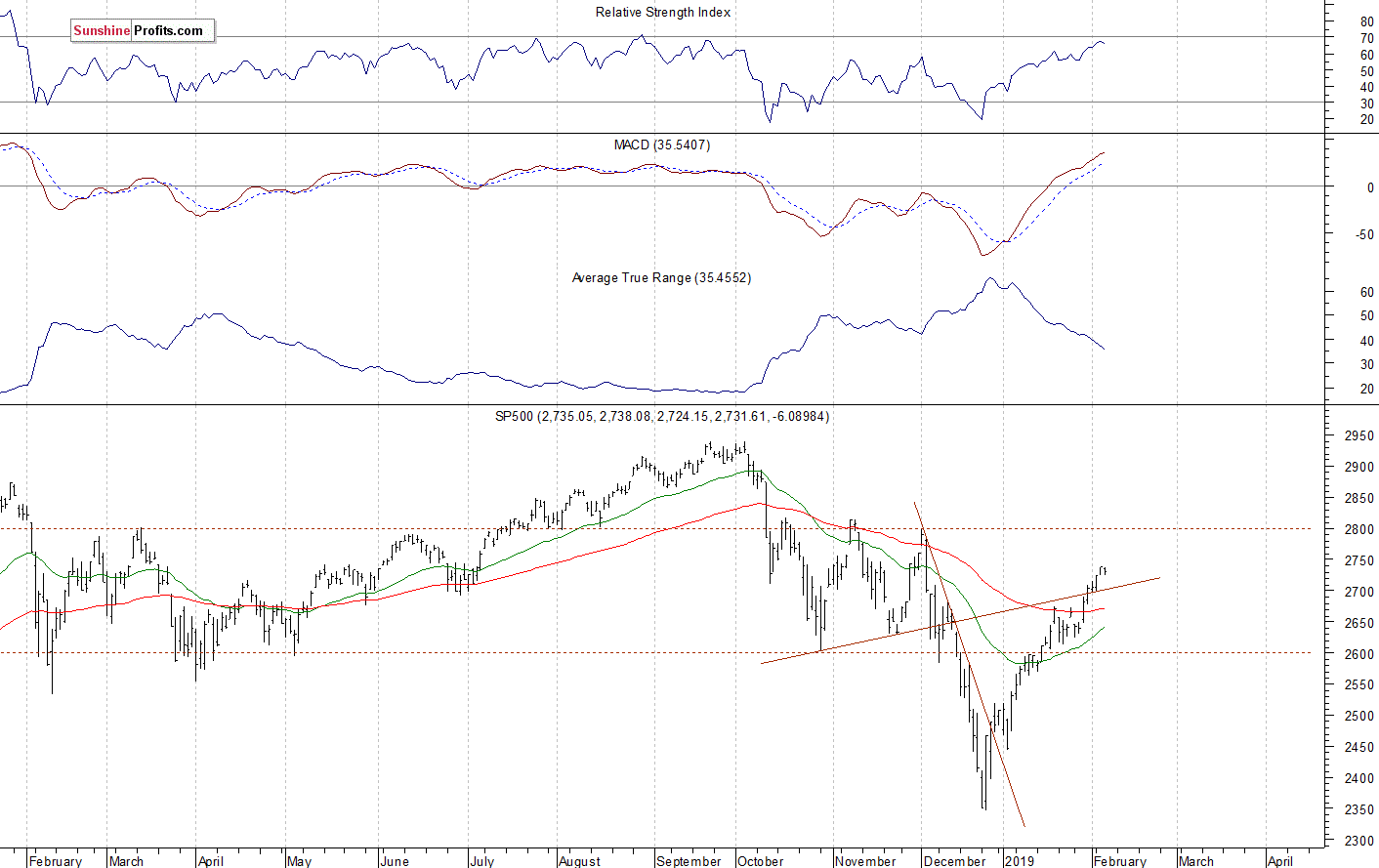

The nearest important resistance level of the S&P 500 index remains at 2,750-2,760, marked by some previous local highs. The resistance level is also at 2,800, marked by the early December local high. On the other hand, the support level is at 2,700-2,710, marked by the previous resistance level. The support level is also at 2,650.

The broad stock market broke below its two-month-long trading range in the mid-December, as the S&P 500 index fell below the level of 2,600. Then the market accelerated lower and it broke below the 2,400 mark. Since then, it has retraced more than 61.8% of the whole decline off the September high. The index gets closer to its October-November local highs and the resistance level of 2,800, as we can see on the daily chart:

Negative Expectations, Correction or a Reversal?

Expectations before the opening of today's trading session are negative, because the index futures contracts trade 0.6% below their yesterday's closing prices. The European stock market indexes have lost 0.1-1.2% so far. Investors will wait for the Initial Claims number release at 8:20 a.m. The broad stock market will likely extend its short-term downward correction and we may see some more profit-taking action.

The S&P 500 futures contract trades within an intraday downtrend, following a breakdown below the short-term trading range. as it fluctuates following yesterday's advance. The nearest important resistance level is now at around 2,720, marked by the recent local lows. The resistance level is also at 2,730-2,735. On the other hand, the support level is at 2,700-2,710, among others. The futures contract remains below the recent upward trend line, as the 15-minute chart shows:

Nasdaq Also Lower

The technology Nasdaq 100 futures contract follows a similar path, as it trades within an intraday downtrend. The market gained over 1,200 points from December the 26th local low of around 5,820 in the recent weeks. And we saw some short-term technical overbought conditions. The nearest important resistance level is now at 7,000-7,050. The support level is at 6,900-6,950, marked by the previous resistance level. The Nasdaq futures contract is back slightly below the 7,000 mark this morning, as we can see on the 15-minute chart:

Big Cap Tech Stocks Going Sideways Again

Let's take a look at the Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com). Apple released its quarterly earnings last week. Then the stock broke above its recent trading range and the resistance level of $155-160. It retraced some more of its November-December sell-off. There have been no confirmed negative signals so far:

Now let's take a look at the daily chart of Amazon.com, Inc. (AMZN). The market broke above one of its three-month-long downward trend lines recently. Since then it has been going sideways. There is a resistance level at around $1,700-1,750. On Friday it bounced off that resistance level following Thursday's quarterly earnings release:

Dow Jones - Short-Term Consolidation

The Dow Jones Industrial Average extended its short-term uptrend this week after breaking above its medium-term downward trend line. Will the blue-chip stocks' gauge continue higher and reach its record high again? Or reverse lower in the near term? There have been no confirmed negative signals so far:

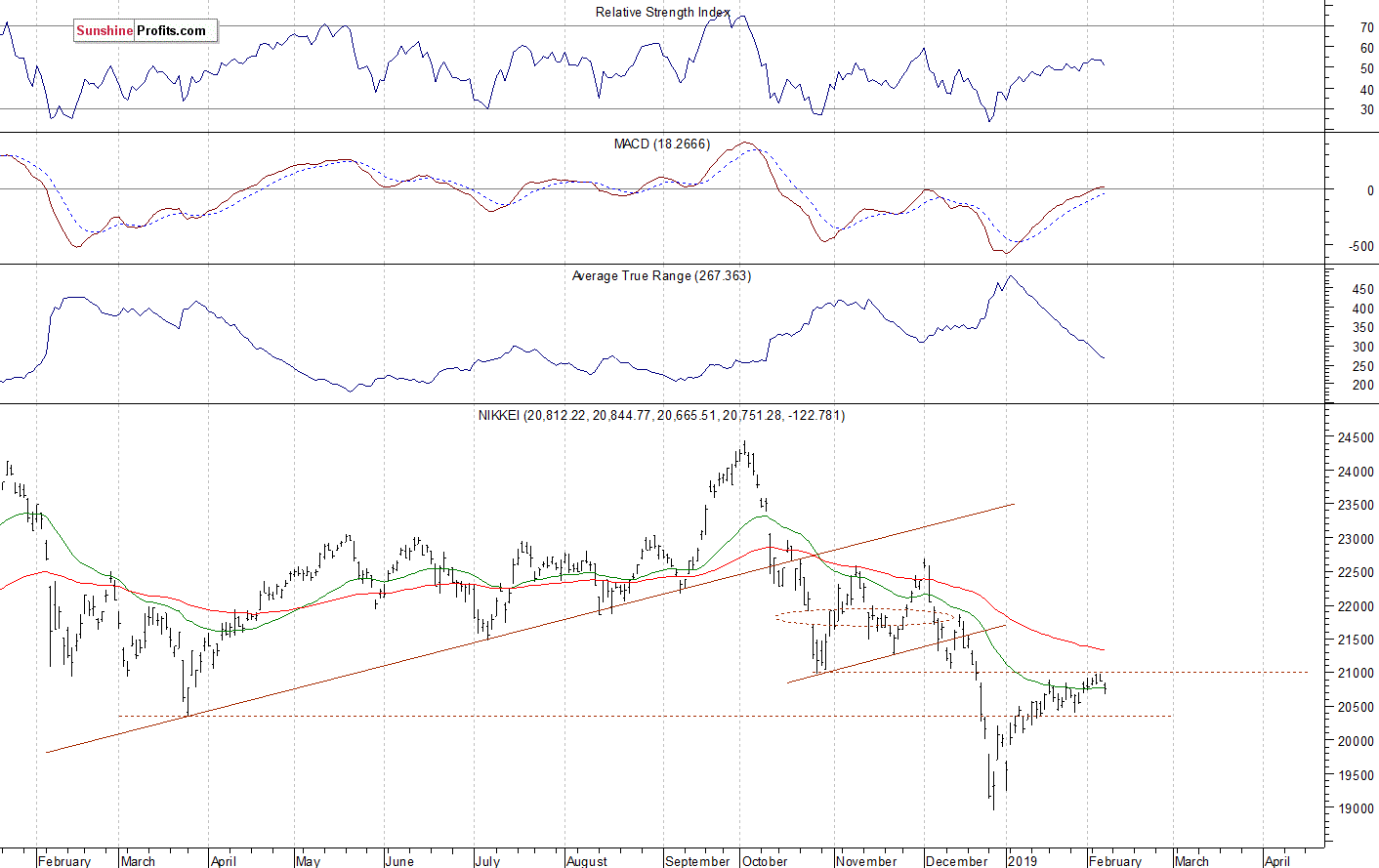

Japanese Nikkei Bounced Off 21,000 Resistance Level

Let's take a look at the Japanese Nikkei 225 index. It accelerated the downtrend in late December, as it fell slightly below the level of 19,000. Since then it has been retracing the downtrend. Recently it got close to 21,000 mark. For now, it still looks like an upward correction and the Nikkei is relatively weak, as it remains below the October - November local lows:

The S&P 500 index broke above its short-term consolidation a week ago on Wednesday, as investors reacted to the Fed's Rate Decision release. Is this a new medium-term uptrend or still just upward correction before another medium-term leg lower? The market continues to trade above the 61.8% Fibonacci retracement of the whole medium-term decline. There have been no confirmed negative signals so far. But we still can see some short-term technical overbought conditions.

Concluding, the S&P 500 index will likely open lower today. We may see some more profit-taking action in the near term. However, there have been no confirmed negative signals so far. For now, it looks like a downward correction.

Disclosure: None.