'Tis The Season

While we all know ‘tis the season to be jolly, markets are not in the mood yet. The spectrum of interest in trading markets rather than enjoying the holidays drives today as the TGIF risk-reduction mood meets the bad-news-means-good policy reflexivity hope that competes for investor positioning into the last two week for 2018. Holiday trading rules are different than normal, as illiquidity and illogic dominate and beat out other factors of value, momentum and carry. This is a day where news flows matter in the longer-term but not in the short-term. The reason we are in a panic rests with the central bank put on risk asset hope. There are some notable negative surprises to consider for that faith –

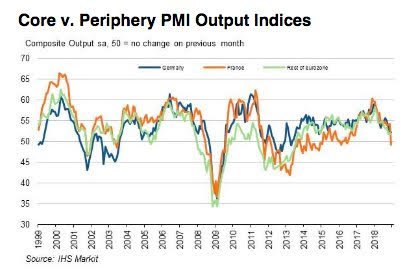

- European flash PMI show growth weakest in 4-years and that French business has been badly hurt by the yellow vest crisis with PMI contracting for the first time in 2 ½ years – all of which puts ECB policy of ending QE in question;

- Russia’s central bank raised rates 25bps to 7.75% surprising the market, reflecting the need to contain RUB weakness.

- Chinese retail sales and industrial production are much weaker than expected, raising prospects for PBOC easing action and more fiscal stimulus from Beijing;

Not all news is negative – Japan Tankan was better than feared, but outlooks are worse. The Japan flash PMI was better as well. WPI fell in India and leaves some hope that RBI is on the right path regardless of Modi pressures. The net result is that we are going back to a US growth divergence world – unless the retail sales today disprove some of that – the US rate moves and oil drops have left room for FOMC pausing and ongoing 2019 growth above potential. The USD is king still – while the EUR suffers. If you want to trade global risk just focus there. EUR 1.1180 is the next target.

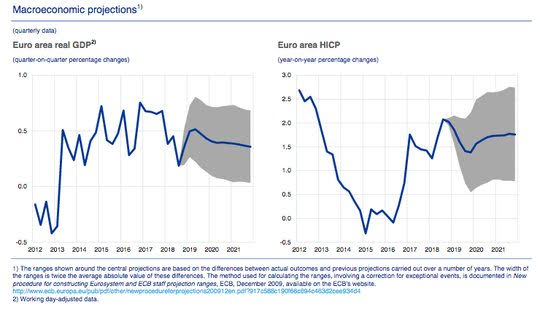

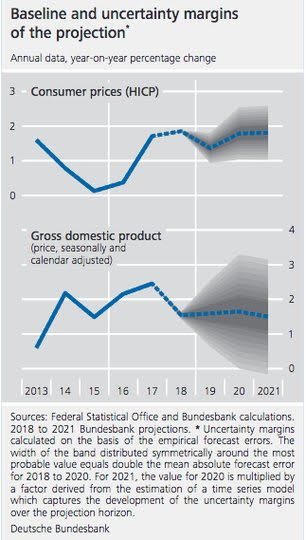

Question for the Day: Is the ECB and others wrong about the soft-patch? Markets are going to focus on growth outlooks for 2019 and the risk of a recession globally as trade fears and political messes drive down confidence everywhere. Yesterday brought the ECB and the Draghi news conference where the central bank set forth the expected end of QE and lowered its growth and inflation forecasts. Draghi argued that the slowing growth was normal after a year of over-potential gains.

Today the German Bundesbank released their own forecasts and this is how they put it: “Germany's economy looks set to continue booming for the time being, and it will ride out the recent setback in the third quarter of 2018, which was largely down to temporary supply-side difficulties in the automotive sector. In their latest projection, the Bundesbank’s economists expect the economy to quickly overcome the dip in growth these problems caused.” The problem for markets is that the forward-looking data from the flash PMI reports today and other indicators of late all suggest that 4Q growth in Germany and in Europe as a whole is weaker than expected and 1Q is setting up for further trouble. The soft-patch risks turning into quick-sand should there be other shocks to the economy.

What Happened?

- New Zealand November Business NZ PMI off 0.2 to 53.5– better than 53 expected and above 53.4 long-term average. Positive comments rose 1.8 to 60.1 with seasonal factors driving but also some customer demand and sales. BNZ Senior Economist, Craig Ebert said that "the improvement in the PMI since July has been underpinned by a pick-up in new orders, which achieved 56.3 in November. This level is usually a good portent that production will expand relatively well in the near term".

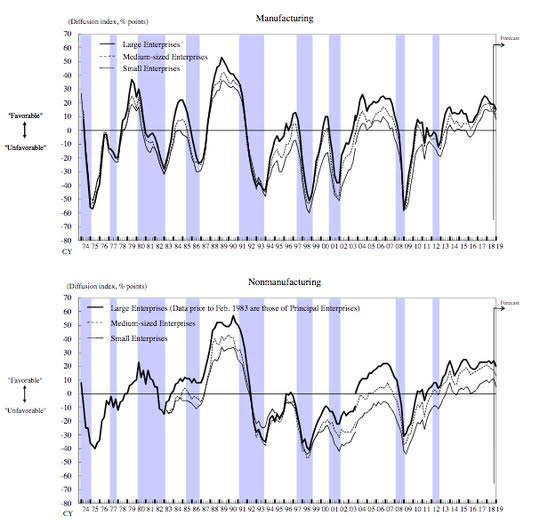

- Japan 4Q Tankan large manufacturing 19 unchanged – better than 17 expected – but the forecast for 1Q drops to 15 while large services 24 from 22 – also better than 20 expected with forecast dropping to 20 in 1Q. The medium-sized manufacturing index 17 from 15, small was 14 unchanged; while for services medium fell to 17 from 18 and rose to 11 from 10 for small – forecasts for both are lower. Large Capex all industry plans rose to 14.3% from 13.4% - also better than 12.7% expected. The JPY rate expected was 109.26.

- Japan December flash manufacturing PMI 52.4 from 52.2 0 more than 52 expected– best rate since April. Price pressures eased somewhat and employment growth slowed while domestic orders rose but export orders fell.

- Japan October industrial production unrevised +2.9% m/m, 4.2% y/y after -0.4% m/m, -2.5% y/y – as expected. Shipments rose 3.5% m/m, inventories fell 1.3% m/m pulling the inventory ratio down 0.5% to 104.7.

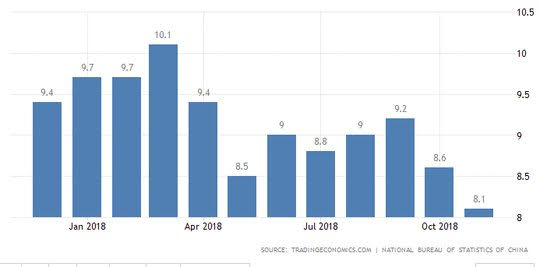

- China November retail sales slow -0.5% m/m, +8.1% y/y from 8.6% y/y – weaker than 8.8% expected – worst since May 2003. Total sales touch CNY3,526bn with urban sales up 7.9% y/y and rural up 9.3% y/y. From January to November, the online retail sales reached CNY 8,068.9bn up by 24.1%. Of the total, the online retail sales of physical goods rose by 25.4%, accounting for 18.2% of the total retail sales of consumer goods, up 3.4% from last year. The online retail sales of non-physical goods were CNY1,797.8bn up by 19.7%. By type, sales drops were notable in furniture 8% from 9.5%; and oil, oil products 8.5% from 17.1%. In addition, vehicle sales plunged 10% after -6.4%, alongside a decline in sales of telecoms -5.9% from+ 7.1% and office supplies -0.4% from -3.3%. By contrast, sales rose for clothing 5.5% from 4.7%; jewelry 5.6% from 4.7%; personal care 16% from 10.2%; home appliances 12.5% from 4.8%; and building materials 9.8% from 8.5%.

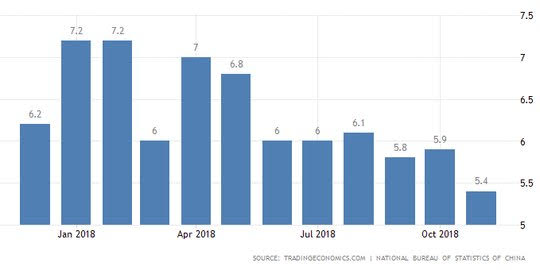

- China November industrial production slips to 5.4% y/y from 5.9% y/y – weaker than 5.9% y/y expected. In terms of sectors, mining increased by 2.3% y/y, the manufacturing grew by 5.6% and electricity, thermal power, gas and water grew by 9.8%.

- China Jan-Nov fixed asset investment rises to 5.9% y/y from 5.7% y/y more than the 5.8% y/y expected. From January to November, the total investment in real estate development was CNY11,008.3bn up 9.7%. The floor space of commercial buildings sold reached 1,486.04 million square meters, up 1.4% y/y. The total sales of commercial buildings were CNY12,950.8bn up 12.1% y/y.

- India November WPI drops to 4.64% y/y from 5.28% y/y – better than the 4.7% y/y expected. Fuel inflation fell to 16.28% from 18.44% while food drops to -3.31% from -1.49% while manufacturing WPI moderated to 4.21% from 4.49%.

- German November wholesale prices rise 0.2% m/m, 3.5% y/y after 0.3% m/m, 4% y/y – reflecting energy prices.

- Spain November final HICP unrevised at -0.2% m/m, 1.7% y/y after 0.7% m/m, 2.3% y/y – as expected. The national rate -0.1% m/m, 1.7% y/y after 2.3% y/y – also as expected.

- Italy November final HICP -0.3% m/m, 1.6% y/y after 0.2% m/m, 1.7% y/y – revised from preliminary -0.2% m/m, 1.7% y/y expected. The national CPI also lower -0.2% m/m, 1.6% y/y after 0% m/m, 1.6% y/y – revised from 1.7% y/y preliminary.

- Eurozone December flash manufacturing PMI 51.4 from 51.8 0 weaker than 51.9 expected and 34-month low; services 51.4 from 53.4- weaker than 53.5 expected and 49-month lows - composite 51.3 from 52.7 – also weaker than 52.8 expected and 49-month lows. One bright spot was manufacturing output PMI rose to 51 from 50.7 – 2-month highs, however, overall business activity is at 4-year lows. New export orders fell for the 3rd month and had the steepest decline in 4-years.

- France flash manufacturing PMI 49.7 from 50.8 – weaker than 50.7 expected and 27-month lows; services PMI 49.6 from 55.1 – also weaker than 54.7 expected and 34-month lows – brings the composite to 49.3 from 54.2 – weaker than 54 expected ad 30-month lows.

- German flash manufacturing PMI 51.5 from 51.8 – weaker than 52 expected and 33-month lows; services PMI 52.5 from 53.3 – also weaker than 53.4 expected and 7 month lows –bringing the composite PMI 52.2 fro 52.3 – weaker than 52.5 expected and 48-month lows.

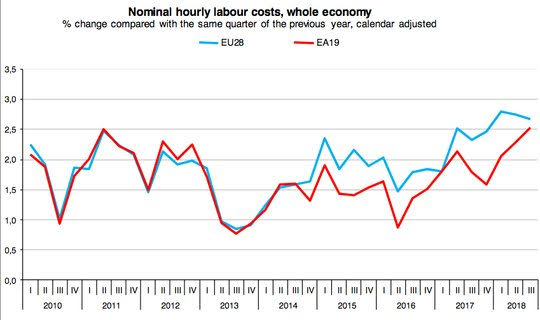

- Eurozone 3Q labor cost index rises to 2.5% y/y from 2.3% y/y revised – more than the 2.3% y/y expected. 2Q revised up from 2.2% y/y. The wages sub-index rose 2.4% y/y after revised 2.1% y/y from preliminary 1.9% y/y – also more than the 2% expected. The lowest labor costs increases were in Belgium up 1.2% and Portugal 1.5%.

Market Recap:

Equities: The US S&P500 futures are off 0.85% after a 0.02% drop yesterday.

- Japan Nikkei off 2.02% to 21,374.83

- Korea Kospi off 1.25% to 2,069.38

- Hong Kong Hang Seng off 1.62% to 26,094.79

- China Shanghai Composite off 1.53% to 2,593.74

- Australia ASX off 0.99% to 5,678.80

- India NSE50 up 0.13% to 10,805.45

- UK FTSE so far off 0.70% to 6,829

- German DAX so far off 0.85% to 10,834

- French CAC40 so far off 1.00% to 4,848

- Italian FTSE so far

Fixed Income: The risk-off mood drives bonds bid globally. Europe watching weaker data and ECB hangovers. German 10Y Bund yields off 2bps to 0.26%, France off 2bps to 0.71%, UK Gilts off 3bps to 1.27% while periphery suffers with Italy up 1bps to 2.98%, Spain off 2bps to 1.41%, Portugal off 2bps to 1.66% and Greece up 3bps to 4.25%. Worth noting Russia hike surprise 10Y rates up 2bps to 8.70% there.

- US Bonds bull curve flattening returns with weaker equities– 2Y off 3bps to 2.73%, 5Y off 3bps to 2.72%, 10Y off 3bps to 2.89%, 30Y off 1bps to 3.15%.

- Japan JGBs rally but BOJ Rinban shows limits– 2Y off 1bps to -0.15%, 5Y off 2bps to -0.13%, 10Y off 2bps to 0.04%, 30Y off 1bps to 0.79%.

- Australian bonds are bid with focus on China growth. 3Y off 3bps to 1.97%, 10Y off 3bps to 2.45%.

- China bonds are lower with PBOC doubts– 2Y off 1bps to 2.76%, 5Y up 2bps to 3.07%, 10Y up 2bps to 3.37%.

Foreign Exchange: The US dollar index up 0.5% to 97.58

- EUR: 1.1290 off 0.6%.Range 1.1282-1.1365. Reversal on weaker PMI with 1.13 break opening 1.12 next with 1.1340 resistance.

- JPY: 113.60 flat.Range 113.42-1113.67 with equities driving. 112.80-114 keys.

- GBP: 1.2565 off 0.7%. Range 1.2554-1.2662 with EUR/GBP .8985 up 0.1% - all about politics and Brexit with 1.24 base for 1.2650.

- AUD: .7165 off 0.85%.Range .7154-.7228 with China driving the show and commodities focus - .7050-.7250 back as keys. NZD off 0.9% to .6795 despite better PMI.

- CAD: 1.3375 up 0.2%. Range 1.3346-1.3402 with 1.3450 and 1.36 new targets. Oil and rates keys.

- CHF: .9975 up 0.35%.Range .9929-.9977 back as safe-haven with ECB and data driving 1.00 pivot with 1.0080 next.

- CNY: $6.9020 up 0.35%.Range 6.8943-6.9074 with focus on 6.92 and 6.95 next with US rates/China growth driving.

Commodities: Oil lower, Gold lower, Copper off 0.45% to $2.7870.

- Oil: $52.19 off 0.75%.Range $52.11-$52.95 – modest give back after 3% yesterday but focus is on growth/equities and USD with $52 pivot and $50-$55 keys. Brent off 0.9% to $60.85 with $60 pivot.

- Gold: $1238 off 0.4%.Range $1237-$1242 with focus on USD and risk elsewhere - $1236 key support for $1225 or $1250 next. Silver off 1.2% to $14.58 with $14.20 next focus. Platinum off 0.25% to $735.40 and Palladium off 1.5% to $1173.

Economic Calendar:

- 0830 am US Nov retail sales (m/m) 0.8%p 0.2%e / ex autos 0.7%p 0.3%e / control 0.3%p 0.4%e

- 0915 am US Nov industrial production (m/m) 0.1%p 0.3%e / cap utils 78.4%p 78.5%e

- 0945 am US Dec flash manufacturing PMI 55.3p 55.2e / services 54.7p 55e/ composite 54.7e 54.5e

- 1000 am US Oct business inventories 0.3%p 0.5%e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.