Time To Take Profits In These 3 Dividend Stocks

Slowing growth in these three stocks could cause a brutal sell-off that drops prices by 15% to 20% over the next six months. With recent total returns for this sector ranging from 30% to 50% on solid growth, now is the time to take profits.

Since the stock market correction that occurred in the early fall of 2015, REITs have been very good to investors. Over the 10 month stretch, REITs represented by the Vanguard REIT Index Fund (NYSE:VNQ) have gained close to 20% including dividends. In contrast, the overall market, using the SPDR S&P 500 ETF Trust (NYSE:SPY) as a benchmark, has gained just 7%. While I expect REITs to continue to outperform the overall market, it’s time to take some profits in the overheated residential REIT subsector.

Since the housing market crash, many Americans have changed how they view their housing needs. Home ownership is no longer a driving goal for a larger number of people. As a result, new home construction since the housing crisis has remained at well below historical levels. With more and more people renting instead of buying, apartment builders, owners, and operators have been in a strong bull market. The residential, apartment owning REITs have been able to build apartment complexes with more amenities and higher rents, fill those new apartments quickly and increase the rental rates across their property portfolios. The result has been growing revenues and FFO for the apartment REITs. Three-year total returns from the larger companies in the group have ranged from low 30% range to over 50%.

However, in the hotter rental markets the signs of apartment over-building are starting to appear. A recent Wall Street Journal article noted that national apartment vacancy rates had increased for three consecutive quarters and in the hottest markets, rental rate growth is slowing. Looking forward, we can expect to see flat to slower revenue growth profiles from the apartment REITs.

While slower growth may not seem like a big deal, there is a tendency for Wall Street money to jump out of formerly hot sectors when they start to see any sort of slowing. It happened to the hotel REITs last year. The hotels went from mid-teens revenue per room growth to high single digits, and the hotel REIT share prices as a group declined by over 30%.

It is possible that the same thing will happen to the apartment REITs when the Street starts to perceive slower growth rates. While these REITs will continue as well run and growing companies, if you have made some nice profits it is time to sell and lock them in. It is likely that you will be able to buy the same shares later in the year at much lower share prices.

Here are three apartment REITs that have done very well over the last several years that you should consider selling.

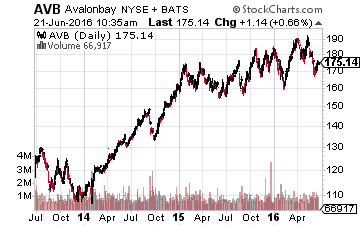

Over the last three years,AvalonBay Communities Inc. (NYSE:AVB) has generated a 41.6% total return for investors. With a $24 billion market cap, AvalonBay is one of the largest apartment REITs and one of the largest companies in the entire REIT universe. Over the last five years, the AVB dividend has been increased by 7% per year. The stock now yields 3.0%, so you are not getting paid much yield to hold on in a slowing growth market.

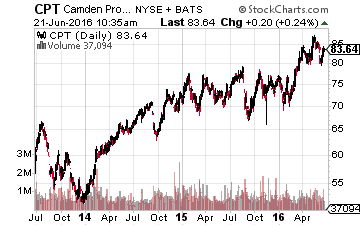

Camden Property Trust (NYSE:CPT) has returned 40.5% to investors over the last three years. The CPT dividend has grown by 9.25% per year for the last five years and the stock currently yields 3.6%. Camden Property Trust is a mid-cap company with a $7.2 billion market cap.

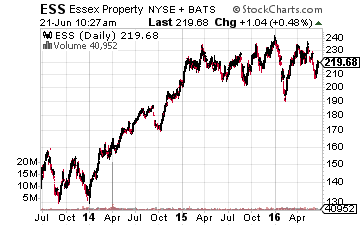

With its portfolio of properties located in California and Washington, Essex Property Trust Inc. (NYSE:ESS) has generated some of the best returns in the residential REIT sector. Investors have earned 51.4% over the last three years. The ESS five-year annual dividend growth rate has been about 7% per year. The stock yields 2.9%.

Again, these are not bad companies and they should continue to grow their businesses and dividends. The danger is that when the market perceives a slowing growth rate the shares could sell off, possibly by a lot. If you own and like these stocks, you can sell now and be ready to buy back in when prices drop by 15% or 20%.

If you like high REIT total returns, the self-storage REITs are an attractive alternative to the apartment REITs. Growth remains strong for the self-storage companies and dividends are still increasing at impressive rates. Here are a few stocks to consider: Sovran Self Storage Inc (NYSE:SSS), CubeSmart (NYSE:CUBE), or Extra Space Storage, Inc. (NYSE:EXR).

Finding stable companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and regular dividend growth is what has given me the most consistent gains out of any strategy that I have tried over my decades-long investing career.

Disclosure: There are currently over twenty of these stocks to choose from in my Monthly Paycheck Dividend Calendar, ...

more