Time To Sell GBP/USD? Jobs Report May Have Only Been A Temporary Relief

Has the British economy turned a corner? The jobs report for November beat expectations with headline Average Earnings rising by 3.2% annually, better than 3.1% expected. Excluding bonuses, they advanced by 3.4%, meeting estimates. The unemployment rate remained unchanged at 3.8%. GBP/USD reacted positively, rising toward 1.3050.

However, these figures are insufficient in stopping a rate cut.

First, the data is outdated. The labor statistics are for November, while more recent retail sales and inflation figures for December have pointed to an ongoing downturn.

Second, the salary figures, excluding bonuses still reflect a slowdown. The core pay data is always pointing lower. And headline figures are reflecting stagnation, not an upturn.

Overall, the “better-than-expected” figures’ effect may be shortlived, and traders may soon return to shorting GBP/USD as the dust settles.

BOE still on course to cut

The Bank of England will announce its rate decision on January 30, and most market participants now expect a rate cut. Central bank watchers are already eyeing the next decision, and the question is: will the BOE reduce rates only once or kick off a cycle of cuts? Friday’s Purchasing Managers’ Indexes figures are set to provide more answers.

The World Economic Forum kicks off in Davos today, and President Donald Trump’s speech stands out. His vision about the environment and trade will be eyed. The UK aims to clinch a new trade deal with the US after Brexit. Prime Minister Boris Johnson may be encouraged by Trump’s recent signing of the trade deal with China and his agreement not to slap tariffs on France.

The House of Lords has delayed the passage of the Withdrawal Bill, but the unelected body is unable to block Brexit. The UK is set to leave the EU in ten days, and the focus is on future relations with the bloc. The recent comments by Sajid Javid, Chancellor of the Exchequer, that the UK will break away from EU rules, disappointed businesses.

Overall, speculation about Brexit, the BOE, and the global economy is set to dominate trading.

GBP/USD Technical Analysis

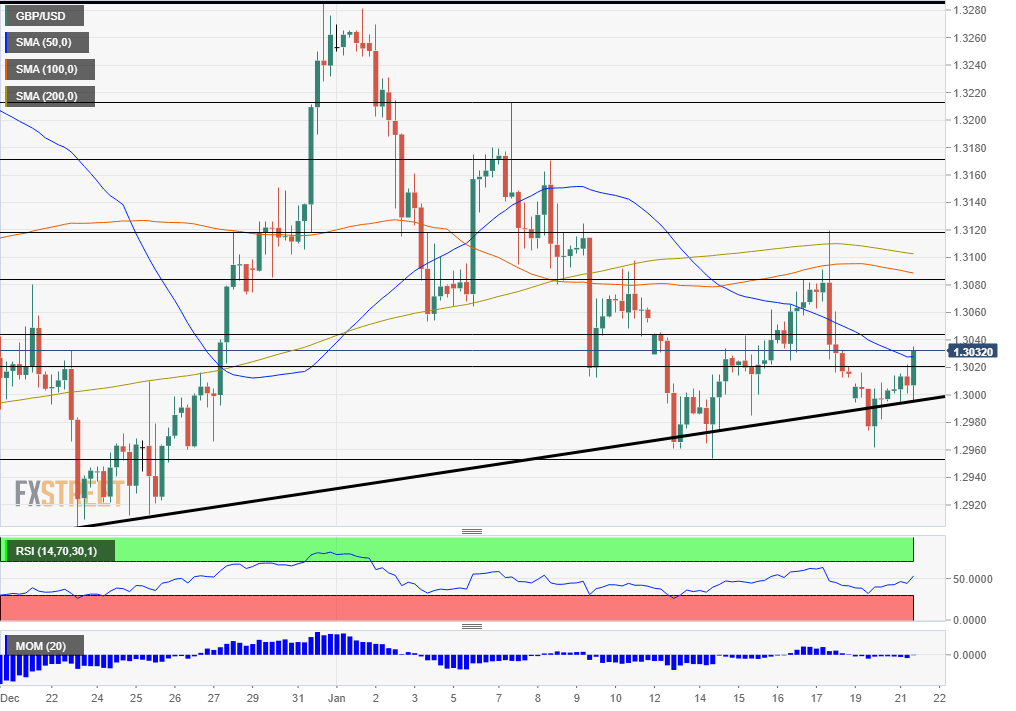

Momentum on the four-hour chart remains to the downside, and the pair is still trading below the main Simple Moving Averages. The battle with the uptrend support line – that accompanies pound/dollar since early November – continues in full force.

Support awaits at 1.2950, which is the 2020 low. It is followed by 1.29, the Christmas trough. Next, we find 1.2885, a cushion from early December, and 1.2775, where uptrend support began.

Resistance awaits at 1.3020, the daily high, and then by 1.3040, a separator of ranges from last week. 1.3080 was a support line in early January and is where the 100 SMA meets the price. 1.3120 is next.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and ...

more