Time Series On Term Spreads, Yield Curve Snapshots

Part of the yield curve is already inverted.

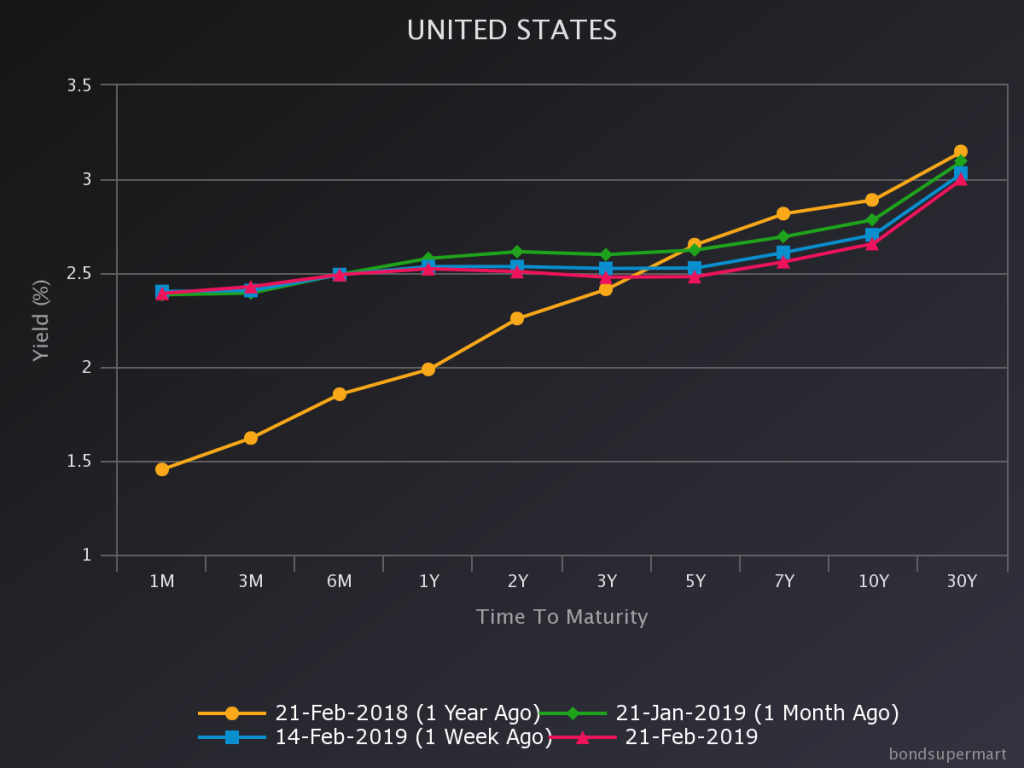

Figure 1: Yield curves as described. Source: Bondsupermarket.com.

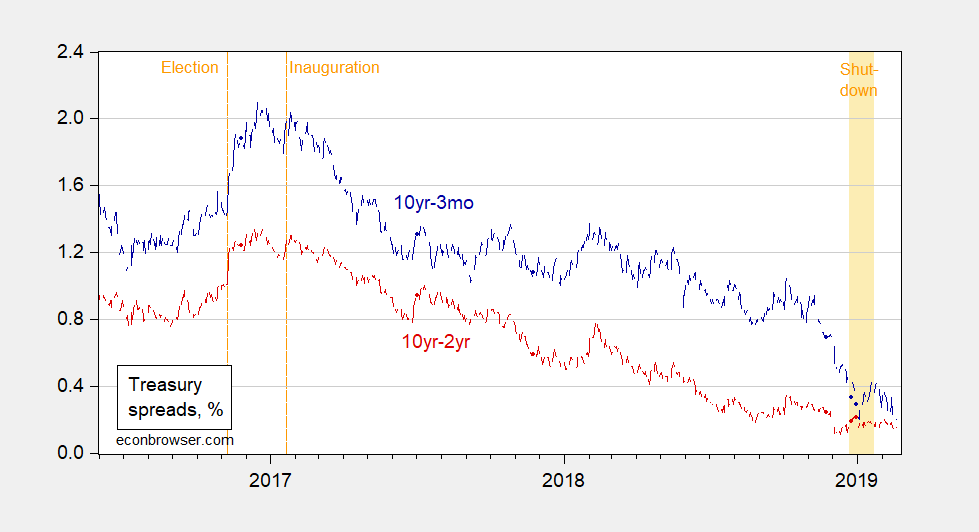

Notice that inversion occurs at the 2-3 year maturities; the key 10yr-3mo spread continues to decline, while the 10yr-2yr spread has stalled.

Figure 2: Ten year-3 month Treasury spread (blue), and ten year-two year Treasury spread (red). Source: Federal Reserve via FRED, Treasury Department, author’s calculations.

The inversion at the 2-3 year maturities suggests lower short rates in the near future.

Disclosure: None.

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!