Tie-Breakers

Everyone loves the entertainment of a tie-breaker with the sweaty palms of anxiety over the speculation for the winners and losers that permeates the air of this cold Tuesday for traders. We are in the 5th day of trading for 2019 and the volatility; uncertainty of policy and economic growth continues to hang over the nascent recovery in asset prices. Overnight positive comments on US/China trade continued but politics elsewhere start to matter – North Korea Kim visits Xi for their 4th summit. South Korea Moon reshuffles his cabinet as his approval ratings fell to record low 45.9%. Confidence in Japanese consumers fell again, German industrial production fell again – making clear German growth in 4Q will be near zero, while EU confidence across the economy fell more than expected. The markets maybe holding better than the news headlines today – especially in FX where the EUR and GBP are not yet reflecting the pain to the USD. The US dollar weakness in 2019 maybe about the only connection back to 2018 that rhymes as US negative outlooks on growth, rate spreads, politics and capital flows remain mired in doubt despite the clear recovery of technicals in the S&P500. The correlation of the weaker USD to better US moods might matter a bit to those looking for other tie-breaking scenarios give the bid today. The USD nascent downtrend has further to go if you believe the chart and not the economic data differentials but today looks like an important tie-breaker risk with 96 the pivot and 96.80 key break. Today’s trade and JOLTs report seem unlikely to matter much in the bigger competition for investors money and confidence but they may lead the USD and foreshadow the year ahead.

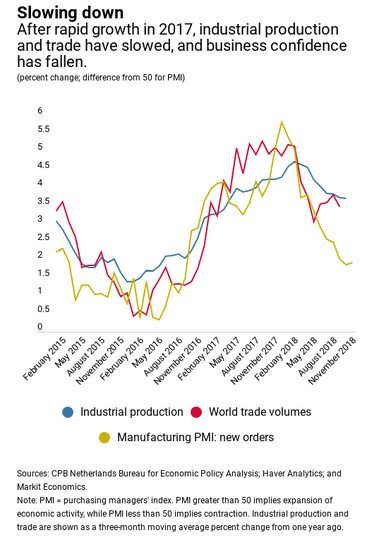

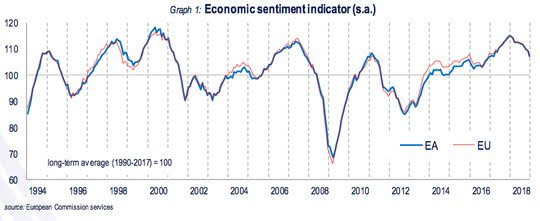

Question for the Day: Will trade data matter again? The link between global trade growth, industrial production and business confidence matters and is clearly signaling that 1Q GDP won’t be as good as last year. The IMF chart that was the most viewed in its blog is below and worth considering. The headline news of the day – Samsung warning on earnings, Ford recalling 1 million vehicles, Sears facing liquidation, WeWork cutting back its deal with Softbank– these are bottom-up stories about the business cycle hitting the tape. Confidence matters.

What Happened?

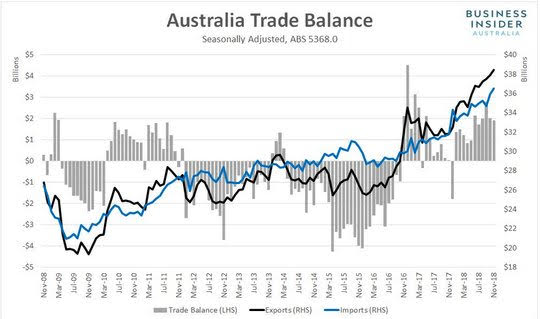

- Australia November trade surplus shrinks to A$1.925bn after A$2.013 – less than A$2.2bn expected – even with record exports and imports. Exports rose 1% to A$38.445bn while imports rose 2% to A$36.520bn. In trend terms, the surplus was A$2.259bn off just A$7m from October. Exports saw a big increase in non-monetary gold up 60%, iron ore up 4% and a modest 1% gain in services, led by travel, while rural goods fell 1% - with 9% drop in coal and products. Imports rose with capital goods up 7%, while intermediate and services fell 1%.

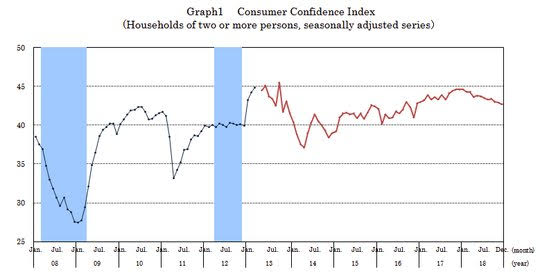

- Japan December consumer confidence 42.7 from 42.9 – better than 42.0 expected – still the lowest since Nov 2016.This was the 3rd consecutive fall. 3 out of 4 parts fell - Household livelihood fell 0.2 to 40.6, employment fell 0.8 to 45.8, income fell 01. To 41.7 but willingness to buy rose 0.4 to 42.8. Inflation expectations dropped with “go up” down 1.3% to 83.2%, “stay the same” up 1% to 10.8% and “go down” up 0.3% to 4%.

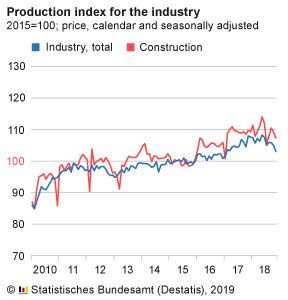

- German November industrial production fell 1.9% m/m, -4.7% y/y after revised -0.8% m/m, +0.5% y/y – worse than +0.3% m/m expected. October revised from -0.5% m/m. Ex-energy and construction, production fell 1.8% m/m. Capital goods fell 1.8%, intermediate goods fell 1% and consumer goods fell 4.1%. Energy fell 3.1% and construction fell 1.7%.

- French November trade deficit E5.1bn from E4.1bn – better than E6.0bn expected. Exports fell 4.4% m/m, while imports fell 1.8% m/m. The current account deficit widened to E2.8bn after E0.3bn revised in October – worse than the E1.5bn expected. This was mostly due to the trade balance shift ex energy and US litigation fees with SocGen. Services were unchanged. There were E1.7bn of capital inflows.

- Eurozone December economic sentiment fell to 107.3 from 109.5 – worse than the 108.4 expected. There was drops in all sectors except retail trade. The ESI fell in all five of the largest economies (Spain -3%, France -2, Germany down 1.9, Italy down 1.4 and with Netherland off just 0.3. By sector – industry fell 2.3, services -1.4, consumer confidence -2.3, retail up 0.5 and construction up-1. Overall, employment plans fell most in construction then services but held flat in industry. The business confidence fell to 0.82 from 1.04 – worse than 0.99 expected. Production outlook fell sharply along with both domestic and export orders.

Market Recap:

Equities: The S&P500 futures are up 0.6% after a 0.7% gain yesterday. The Stoxx Europe 600 is up 0.65% to 345 holding opening gains. The MSCI Asia Pacific index was up 0.2% holding gains from yesterday.

- Japan Nikkei up 0.82% to 20,204.04

- Korea Kospi off 0.58% to 2,025.27

- Hong Kong Hang Seng up 0.15% to 25,875.45

- China Shanghai Composite off 0.26% to 2,526.46

- Australia ASX up 0.68% to 5,783.30

- India NSE50 up 0.28% to 10,802.15

- UK FTSE so far up 0.6% to 6,854

- German DAX so far up 0.3% to 10,777

- French CAC40 so far up 0.8% to 4,757

- Italian FTSE so far up 0.4% to 19,027

Fixed Income: Supply and news battle it out with focus on 3Y US next and with Trump politics and FOMC speeches also in the mix. The better equities starting to show up in weaker bonds globally. German 10Y Bund yields up 1bps to 0.23%, French OATs up 1bps to 0.73%, UK Gilts up 1bps to 1.26% while periphery holds Italy up 1bps to 2.92%, Spain flat at 1.51%, Portugal flat at 1.82% and Greece off 2bps to 4.36%.

- UK DMO sold GBP2.25bn of 10Y 1% Gilts at 1.264% with 2.17 cover and 0.1bps tail.

- US Bonds lower with focus on supply and curve– 2Y up 3bps to 2.55%, 5Y up 2bps to 2.54%, 10Y up 1bps to 2.69%, 30Y up 1bps to 2.98%.

- Japan JGBs lower with equities despite good auction – 2Y up 2bps to -0.15%, 5Y up 2bps to -0.15%, 10Y up 2bps to 0%, 30Y up 1bps to 0.69%. The MOF sold Y1.769trn of 10Y 0.1% #353 JGB at 0.015% with 4.04 cover.

- Australian bonds lower again despite mixed trade story– 3Y up 4bps to 1.83%, 10Y up 4bps to 2.32%.

- China bonds rally again– 2Y off 5pbs to 2.69%, 5Y up 1bps to 2.93%, 10Y off 2bps to 3.15%.

Foreign Exchange: The US dollar index up 0.2% to 95.85. USD in EM also bid back up – INR off 0.4% to 70.06, KRW off 0.8% to 1125.50 – Samsung story – ZAR off 1% to 13.999, RUB off 0.5% to 66.968, TRY off 1.5% to 5.463

- EUR: 1.1445 off 0.25%. Range 1.1432-1.1485 with 1.13-1.15 still key and weaker data not mattering yet…

- JPY: 108.70 flat. Range 108.51-109.09 with 108-110 now settling in as key range to watch but risk is still 105. EUR/JPY 124.40 off 0.2%.

- GBP: 1.2755 off 0.15%. Range 1.2746-1.2797 with focus on EUR not GBP but Brexit and data ahead matter. EUR/GBP .8975 flat.

- AUD: .7125 off 0.3%. Range .7116-.7150 with focus on China/rates/risk mood crosses point to .70 before .73 still. NZD .6730 off 0.3%.

- CAD: 1.3280 off 0.15%. Range 1.3268-1.3303 with BOC the key for today and risk for 1.34 over 1.32 again.

- CHF: .9810 up 0.15%. Range .9788-.9827 with focus on risk mood. EUR/CHF off 0.15% to 1.1225.

- CNY: 6.8600 up 0.2%. Range 6.8425-6.8675 – USD back bid despite hopes for trade deal rising.

Commodities: Oil up, Gold down, Copper off 0.35% to $2.6640

- Oil: $49.28 up 1.55%. Range $48.31-$49.33 – watching USD/data and equities for momentum to breakout with $50 key. Brent $58.33 up 1.75%.

- Gold: $1284.70 off 0.4%. Range $1282.70-$1291.40 with focus on USD/equities and rates but $1300 capping still. Silver off 0.6% to $15.67, Platinum up 0.4% to $828 and Palladium up 0.4% to $1245.

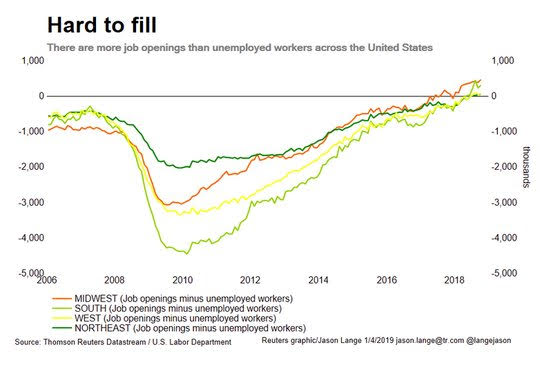

Conclusions: Will the jobs data continue to support the US market? The JOLTS report this morning maybe a tie-breaker with the trade report. The job openings from regional reports as Reuters shows beats the number of jobless. This ratio matters to companies as they try to keep margins intact and meet production. Wage inflation by any other name should follow but hasn’t.

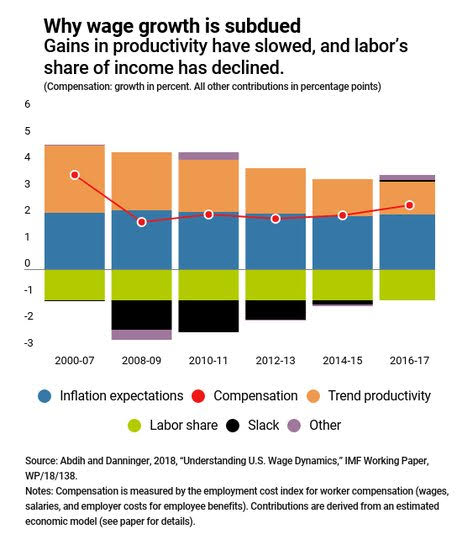

One of the other most viewed charts from IMF blog last year is worth considering in the context of the data ahead.

Economic Calendar:

- 0830 am Canada Nov trade deficit C$1.17bn p C$2.05bn e

- 0830 am US Nov trade deficit $55bn p $53bn e

- 1000 am US Nov JOLTS job openings 7.079mn p 7.1mn e

- 0100 pm US Treasury sells 3Y $38bn notes

- 0300 pm US Nov consumer credit $25.38bn p $18bn e

- 0430 pm US weekly API oil inventories -4.5mb p

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.