Three Trillion Dollar Tuesday – A Little Inflow Goes A Long Way

Happy $62.1 Trillion!

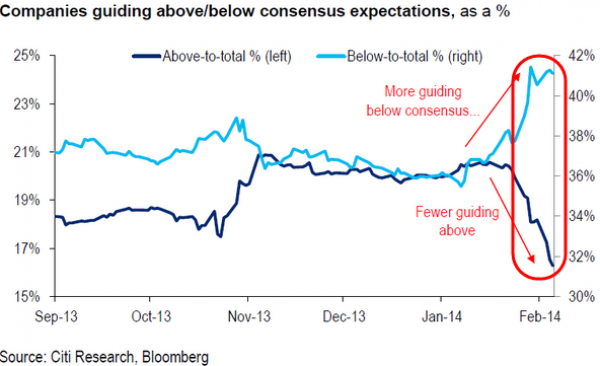

That was the market capitalization of Global Equities at Friday's close. That's up $3.1Tn since February 4th as $11Bn flowed back into Equity Funds last week. Sure, $3.1Tn is 281 TIMES $11Bn but NFLX trades at 235 times earnings and TSLA will be lucky to have earned 63 cents per $198 shares this year and that's 314 times earnings so what's the big deal if Global Equities move a mere 281 times faster than actual inflows? What could possibly go wrong with the implied assumption that $11Bn will continue to flow in for 281 more consecutive sessions?

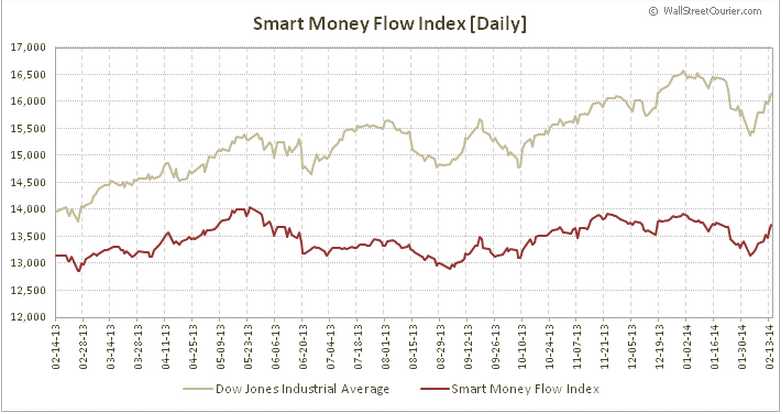

Notice, in the Money Flow chart above, that we're repeating a pattern we made back in September, when the S&P ran up 100 points, back to 1,750, just before giving it all back again into early October. It's simple physics – until as much money flows back in as flowed out, you're not going to have a sustainable recovery!

How many times over the years have I warned you about chasing low-volume rallies? The average volume on SPY was 98.5M/day last week, vs 174M/day the week before and 162M the week before that – WHEN WE WERE SELLING OFF. Can that really all be reversed by 7 sessions of light buying? It certainly didn't work out in late December and early January, when light volume led us up to a cliff.

I guess we're going to see this week, with options expiring on Friday and oil contracts rolling over on Thursday (/CLJ4 will be the new front-month and we're already using it for our oil trading – currently short at $100.90 with a stop at $101.01).

We'll also get a bit of data this week with the Empire State (NY) Manufacturing Survey this morning along with Housing data that we expect to be disappointing and E-Commerce Retail Sales that will probably be excused by the weather – even though that would make no sense at all. Tomorrow we get the FOMC Minutes and Bullard (hawk) and Williams (dove) speak on each side of it. Also more housing data and the PPI.

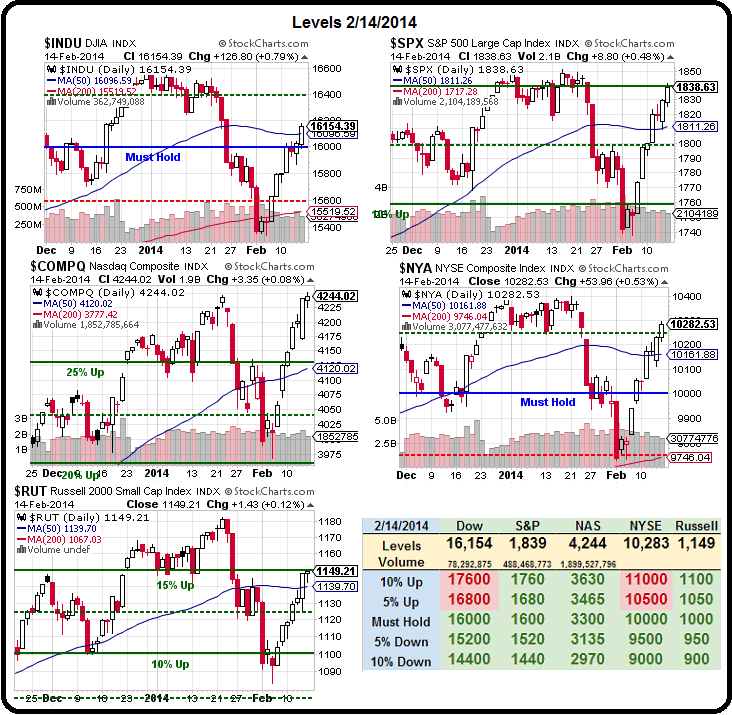

CPI is Thursday and PMI with the Philly Fed and Leading Indicators and Friday is Home Sales and Bullard gets the last word at 1pm. In summary, it's going to be an exciting week and we have no reason to be bearish UNLESS one of our indexes fails their 50% lines, which would be:

- Dow 16,500 to 15,400 (we round) is 1,100 points, so 15,950 is the 50% line but we'll round that up to 16,000, since that's our normal "Must Hold" line on the Big Chart.

- S&P 1,850 to 1,750 is 100 points so 1,800 is also the 12.5% line.

- Nasdaq 4,250 to 4,000 is 250 points so 4,125 is also the 25% line.

- NYSE 10,400 to 9,750 is 650 points so 10,100(ish) and 10,000 is our Must Hold line.

- Russell 1,180 to 1,090 is 90 points so 1,135 needs to hold, but we'd be concerned if 1,150 (15% line) looks like resistance.

Keep in mind that those 10% lines (S&P 1,760, for example) are where we think the S&P would be without stimulus (SPX chart from Dave Fry). There is, of course, still plenty of stimulus and the BOJ just INCREASED their insane money-printing program this morning. If the market aren't going up on that news – maybe we'd better wait for more inflows!

As you can see from Dave Fry's Dollar chart, Dollar weakness is the story of the "bull" market move this month. That's boosting oil, gold, silver, agrigculture – as well as the equities – all of which are priced in Dollars. You simply need more Dollars to buy the same stuff (ie Inflation), which is also what's leading to "better than expected" sales numbers on the S&P. Just like Japan, our worthless currency makes earnings seem better as International Sales convert for more Dollars.

It's OK – as long as YOU are willing to believe in the rally, the rally can continue. Just don't look too closely under the hood…

The material presented in this commentary is provided for informational purposes only and is based upon information that is considered to be reliable. However, neither Philstockworld, LLC (PSW) nor ...

more