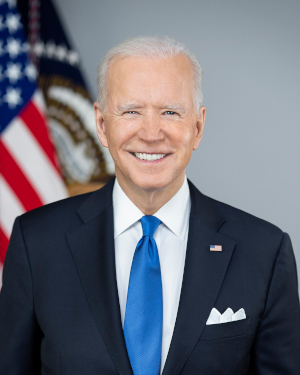

Three Reasons Why The Biden Tax Increase Makes No Sense

Anyone who believes the “rich” and large corporations will pay for $28 trillion in debt or the $2 trillion in new deficit has a real problem with maths.

Biden’s announcement of a massive tax increase on businesses and wealthier segments of the population simply makes no sense. The tax hikes will have a significant impact on economic growth, investment, and job creation and do not even scratch the surface of the structural deficit. Even if we believe the Gross Domestic Product growth and revenue estimates announced by the Biden administration, the impact on debt and deficit is negligible. So, what is their response? That debt and deficits do not matter because the key now is to spur growth and the cost of borrowing is low despite the rising debt.

Furthermore, the Biden administration has been inundated by MMT (Modern Monetary Theory) proponents who passionately believe that deficits are good because they attend to the rising global demand for US dollars. Additionally, the Biden administration argues that the deficit increase is not a problem because the Federal Reserve continues to purchase government bonds, keeping yields low and debt costs stable.

Nice, so why the tax hikes then? If debt and deficits do not matter and growth and jobs is what we need to focus on, then why increase taxes?

The entire tax increase argument crumbles. There is absolutely no rationale for such massive hikes either from the revenue perspective or the growth objective. If growth will take care of the rising deficit, the Biden administration should use all the tools to support growth.

There are five main reasons why the tax increases make no sense:

First, the estimated real revenue impact is negligible. In 2018, the federal capital gains tax revenue was $158.4 billion. A five-percentage point increase in the current regime would provide an additional $18 to $30 billion according to Princeton University estimates in an optimistic scenario where there would be no negative impact of the tax increase. The estimates of revenues of the corporate and personal tax increase assume $691 billion from corporate taxes, $495 billion from global minimum tax, and $271 billion from so-called “repeal tax loopholes”, end fossil fuel tax breaks and anti-inversion deals. Obviously, these estimates are optimistic and in many cases science fiction as they consider a perfect world where these taxes will not have any negative impact on the economy and a GDP growth that will not be affected at all. Even if we accept the estimates, these revenues are spread throughout a decade (yes, ten years), so the net-present-value impact is even worse.

These do not even start to address the rise in mandatory spending that drives the structural deficit above 2.5% of GDP.

Second, the impact on the economy will be larger than what the Biden administration estimates. These tax increases do not affect only “the rich”. Such high capital gains tax stifles innovation and reduces capital flow into private equity which is essential to boost start-ups and new high-productivity businesses. This is the reason why Europe has reduced capital gains taxes and even eliminated them. Belgium, Luxembourg, Switzerland do not have capital gains tax. Of the countries that do levy a capital gains tax, Greece and Hungary have the lowest rates, at 15 percent. European countries average is 19.3 percent. The same happens with the corporate tax rate. The United States would have the highest corporate tax rate in the OECD under Biden’s plan (28%). Many argue that effective corporate tax rates are lower and that in other countries firms pay VAT, and the arguments are only partially correct. The European Commission showed that the effective average tax rate of United States companies was 36.5% compared to 21.1% in the average of the European Union. When comparing effective rates, many United States analyses play the trick of adding loss-making companies or averaging what a Tech giant pays in the U.S. with the rest of the sectors. However, none of these arguments matter if you look at the Tax wedge that United States companies pay relative to other OECD companies. According to PWC, the total tax wedge and contribution of United States businesses was 43.8% (profit, labor, and other taxes) compared with a region average of 38.9%

The risk of outflow of capital from the United States to other countries with more competitive taxation is evident to anyone that has run a business or a financial firm. These tax increase may have little impact on multinational corporations, but they do have an exceptionally large negative effect on medium-sized businesses. That is why these measures are regressive.

Even Yellen knows this tax increase is damaging. That is why she wants a global tax. If she saw no negative impact, she would let other countries manage their taxes as they wish.

Third, the problem of mandatory spending is not even addressed. Mandatory spending in the United States has ballooned to $2.9 trillion in 2020 from $1.8 in 2008 and estimated to rise another trillion in the next ten years. The main cause of the United States deficit comes from the rise in mandatory spending as receipts cannot match the unstoppable increase in spending that no government can touch. Economies grow and enter recessions. It is impossible to cut the deficit via tax increases when the pace of growth of the expense side exceeds the economic output and receipts even in growth periods.

No serious economist can believe that tax increases will generate sustained annual revenues in any economic cycle, be it growth, stagnation, or recession to cover more than $200 billion every year in spending increases over a trillion deficit.

So why does Biden do it? To please the most socialist part of his administration and voter base, who do not worry about the economic implications, they only want to make the rich poorer.

If making money in capital markets is so easy, why don’t the politicians facilitate things to allow everyone to do it? Furthermore, if they believe making money in capital markets or in a business is so easy, why don’t they do it themselves?

Biden’s tax increase plan does not make sense from a growth, revenue, or deficit perspective. Furthermore, it does not make sense from a Republican or Democrat perspective. It simply does not add up and does not address the United States problem: Ballooning mandatory spending.

Disclosure: None