Three Negatives And One Ginormous Positive

The State of the Market: Executive Summary

Three negatives and one ginormous positive. From my seat, this defines the current stock market environment. The negatives can more accurately be described as uncertainties and all are well worn: (1) The breathtaking surge in coronavirus cases, (2) the election, and (3) the state of/outlook for economic recovery. IMO, this combination is enough to warrant a sloppy period and even some downside volatility. However, the good news is there appears to be an offset - and it's a whopper. Stimulus. Both monetary and fiscal. In short, my take is the bulls have got perhaps the friendliest Fed in history on their side as well as another stimulus package coming from the government, which many analysts believe will help support economic growth going forward.

From my seat, the positives appear to outweigh the negatives as Wall Street is a place that loves easy money. And with the Fed clearly set to keep rates "lower for longer" and another trillion dollars or so coming from Washington at some point in the coming months, it is hard for me to get overly negative here.

Sure, the part of the economy impacted by social distancing (restaurants, cruises, airlines, movies, concerts, professional sports, etc.) will continue to struggle mightily given the surge in coronavirus cases. However, the good news is the rest of the economy appears to be doing just fine, thank you. And some areas (think homebuilders and online shopping) are growing even faster now than they were before the pandemic began. For me, this represents a pretty sturdy floor to economic activity. And in turn, a limit to how much damage the bears might be able to justify at this time.

So... My plan remains the same. Stay patient and use weakness to put dry powder to work.

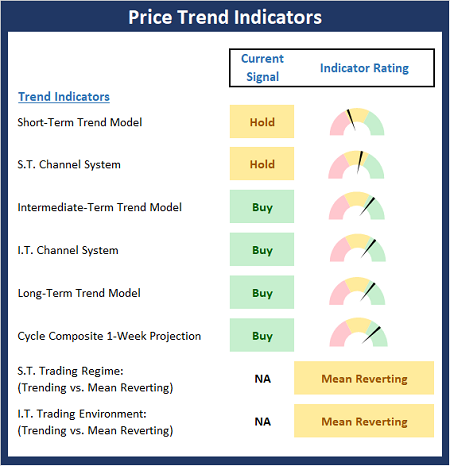

The State of the Trend Indicators

Although the price action turned ugly to start the week, the Trend Board remains in decent shape. So, until/unless the bears can start to inflict some real technical damage, we should probably view the action as a continuation of the consolidation phase that has been in place since late August.

My Take on the State of the Charts...

Looking at a chart of the S&P 500, it is clear to me that we're still in the midst of a consolidation phase. During these "sloppy periods," the daily price action can and certainly has been, quite volatile. And with a VIX reading above 32 this morning, it is reasonable to expect the recent volatile to continue. But from a bigger picture standpoint, index movements remain inside the recent range - and as such, aren't terribly meaningful. Yet, at the same time, it is interesting to note that price is currently sitting at a fairly important technical juncture (near-term support and the 50-day). The bulls would prefer to see this area hold without any further downside testing - and a move higher from here could qualify as a "cup with a handle" formation. However, any further selling could easily lead to a test of the lower end of the range. But for me, the key is the fact that this remains a rangebound environment.

S&P 500 - Daily

(Click on image to enlarge)

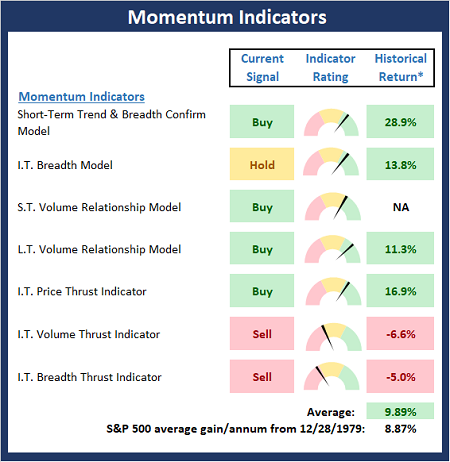

Next, let's check in on the state of the market's internal momentum indicators.

The Momentum board has faltered a bit since our last report as two of our thrust indicators flipped to negative. Both our intermediate-term volume and breadth thrust indicators issued sell signals at the start of the week. However, the readings of both indicators are not overly negative at this time. As such, the board continues to give a slight edge to the bulls at this time.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

Thought For The Day:

No one can make you feel inferior without your consent. -Eleanor Roosevelt

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should ...

more