Thoughtless Thursday – TrumpDon’tCare Health Plan Gets A Vote

Big vote tonight.

If the TrumpDon'tCare Plan is approved (the CBO says it can no longer be called a health plan since the overall goal is to kill as many people as possible), then Trump's agenda is winning and the markets could leg higher. If, on the other hand, the GOP revolts against The Donald, all Hell could break loose so ignore the politics if you want to but we're paying very close attention!

Interestingly, the main GOP objection to TrumpDon'tCare is that it still cared about forcing Health Insurance Companies to provide minimum benefits to their customers. That has now been removed by the White House and now the Insurance Companies don't have to do anything for anyone at any time – isn't that great? As noted by Politico, however:

While altering the coverage requirements could help win over the Freedom Caucus members, it could drive away moderates — another coalition that House leaders need to build upon in the final 24 hours before the planned vote on Thursday. House leaders are still short of the 215 votes they need.

It's going to be hard to bridge the gap because the bill still is not Draconian enough for the "Freedom Caucus":

Freedom Caucus members, led by Meadows, want at least some parts of Title One of the bill removed. Included in Title One are many of the Affordable Care Act's benefits, like a prohibition on insurers denying coverage over pre-existing conditions and a prohibition on lifetime and annual limits.

That's right, your pre-existing conditions can now stop you from getting coverage and, even if you are covered, there can be a cap – so don't get too sick or you'll be on your own! Aside from leading to a great unwinding in the Health Care, Pharma and Biotech sectors, TrumpDon'tCare will put a huge burden on the bottom 99% and eat into their disposable income so prepare for yet another downgrade to our GDP forecasts if the bill passes.

We're already pretty short, of course. Our Short-Term Portfolio has rallied back on this week's small dip and we are now up $16,000 from our Jan 22nd review after hedging much more aggressively last week. We added the Tesla (TSLA) short and Amazon (AMZN) short that we discussed on Monday, which tilted us more to the bearish side with great timing. Of course, we also added some well-hedged long positions as well – just in case…

Janet Yellen will be speaking at 8am this morning so let's watch the Futures. Hopefully she'll pop us higher (so we can short again) and then super-dove, Neal Kashkari speaks this evening along with Kaplan and tomorrow morning we have more doveish chatter from Evans and THEN Bullard – one of the Fed's last remaining hawks – will speak at 8am followed by Williams at 8:30. Our shorting lines are the same as they were on Friday, when I said in the Morning PSW Report:

Our target range for the Dollar is 100 to 103 so we expect to be back at 101.50 soon and THEN we will have a better idea of what the real reaction to the Fed was. So far, as we predicted (and you are welcome if you took yesterday's index shorts for huge wins), the post-Fed rally has pulled back a bit but the Russell (/TF) still makes a good short at 1,385, especially if the Dow (/YM) is below 20,900 and the S&P (/ES) is below 2,380 and the Nasdaq (/NQ) is below 5,420 AND the Dollar is over 100.

Today is option expiration day and quarterly expirations can be very tricky so a good day to take off and come back Tuesday (Mondays are pointless) to see what's up. By the way, if you don't feel comfortable walking away from the markets for a few days – you REALLY need our help because a good portfolio should run itself – not run you!

That was great advice as we got a lovely drop Tuesday and /YM is now 20,600 (up $2,000 per contract) and /ES is now 2,347 (up $1,650 per contract) and /NQ is now 5,372 (up $1,360 per contract) and /TF is now 1,345 (up $4,000 per contract). Now wasn't that PSW Report worth $3/day? This is the last 8 days of free trade ideas before we go dark for earnings on April 1st but we'll be back with more free trade idea in May – hope you've enjoyed the free samples!

Remember, I can only tell you what the market is going to do and how to make money trading it – the rest is up to you!

Let's do a quick review of our FREE March Trade Ideas, that were published in our PSW Morning Report and distributed for your reading pleasure. Members get all trades pre-market but, unfortunately, other sites don't always post our articles right away but you can follow our Titter Feed and always get the latest:

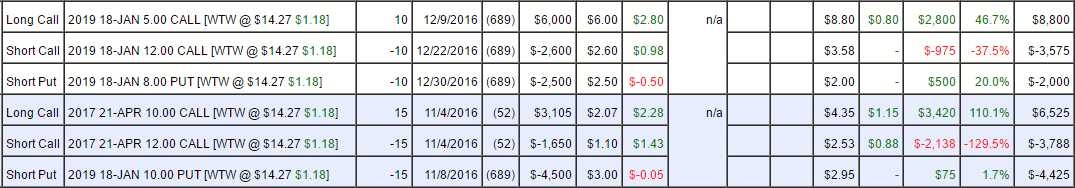

March 1st: We posted our two Weight Watchers (WTW) trades from our Options Opportunity Portfolio:

We closed out the April $10/12 spread for $2 ($3,000) and that's up $263 (12%) from where it was 3 weeks ago. The rest of the trade is still working, of course, and the 2019 $10 puts are $2.30 ($3,450, up $975 or 22%)

March 2nd: We were shorting oil Futures at $53 and the March contracts closed at $47.50 – up $5,500 per contract. That's not including the original short from the March 1st Webinar at $54.50 (we took 1/2 off at $53 and kept the rest).

March 3rd: We went long on Natural Gas (/NG) at $2.82 ($2.77 from the Webinar) and those contracts are now $3.03 for a $2,100 per contract gain but we've been in and out many times since then and we are still bullish over the $3 line with tight stops below. We also had a TZA hedge:

The primary hedge we selected in Wednesday's Webinar was using the Russell Ultra-Short (TZA) and our trade idea was:

- Buy 30 TZA Oct $15 calls for $4 ($12,000)

- Sell 30 TZA Oct $23 calls for $2 ($6,000)

- Sell 5 GILD 2019 $60 puts for $5 ($3,000)

The net cash outlay for that spread is $3,000 and the upside potential is $24,000 if the Russell falls about 10% (see replay for full explanation). Obviously, there's no payoff based on yesterday's 12-point drop in the index (0.8%) and, in fact, we still like the hedge very much going forward as TZA is at $17.84 so the spread is $2.84 in the money ($8,520) and only loses money if the market goes higher (or if GILD goes much lower). It doesn't have to be Gilead (GILD) for the offset, of course – we just happen to like them.

TZA is now $19.67 and the $15/23 spread is now $3.20 ($9,600) and the short puts are $6.80 ($3,400) so the net of the spread is $6,200, which is up $3,200 (106%) so far. Since the upside potential is $24,000 – this one is still good for a new hedge!

It was a busy day and we called for a long on Silver (/SI) at $17.77 and that those topped out at $18.50 for a very nice $3,650 per contract gain. We also called for Dow shorts at 21,025 and 500 Dow points later is $3,000 per contract on those too!

March 6th – No trades, reiterated Friday's trade ideas as still playable.

March 7th – Good notes on the correction we expected with index levels to watch but no free trades.

March 8th – No free trades, very angry about TrumpDon'tCare Plan.

March 9th – Gasoline Futures (/RB) long at $1.61 avg, went over $1.64 into the weekend as planned – up $1,260 per contract. We also like this long play for our oil and gasoline outlook:

Sunoco (SUN) is a refiner we like and they've sold off sharply with gasoline. They pay a very fat 13.5% dividend ($3.30) and you can buy the stock for $23.71 and sell Sept $22.50 calls for $2.50 and $22.50 puts for $2.30 and that nets you in for $18.91, which makes the $3.30 dividend 17.5% while you wait to see if you get called away at $22.50 for another $3.59 gain (19%) so this trade can throw off tremendous amounts of cash in short order.

If SUN goes lower then you would have to buy another round of shares at $22.50 to average $20.70, which is 12.6% less than the stock costs now and THEN you can sell more puts and calls to further reduce the basis. Now we just have to root for Team Trump to destroy our children's futures so we can make a few bucks in the present!

SUN is now $24 and the Sept $22.50 calls are $2 and the $22.50 puts are $2 so net is now net $20 is up $1.09/share or 5.7%, but don't forget – we're in it for the dividends, not the appreciation! Still good for a new trade.

March 10th: No free trade ideas.

March 13th: Gasoline (/RB) long at $1.58, now $1.60 – up $840 per contract.

March 14th: Decided TrumpDon'tCare would be good for MetLife:

MetLife (MET) is an insurance company we have our eye on. 2016 was a bad year for them but going forward we expect them to earn $5 for what are now $54 shares for a p/e of 10 and, while you wait for a p/e of 15 ($81), you collect a 3% dividend of $1.60 per year. What I really like about them though, is the way you can discount them with options, like this:

- Buy 1,000 shares of MET for $53.75 ($53,750)

- Sell 10 2019 $52.50 calls for $8 ($8,000)

- Sell 10 2019 $47.50 puts for $5.50 ($5,500)

That nets you into 1,000 shares for $40,250 or $40.25 per share, a 25% discount to the current price and, if another 1,000 shares are assigned to you (if MET is below $47.50), your average cost would be $43.875 on 2,000 shares ($87,750). Your dividend payments would be $1,600 per year (3.9% of the $40,250 cash outlay) and, if MET is over $52.50 in Jan of 2019, you will be paid back $52,500 for a $12,250 profit + $3,200 in dividends is $15,450 or 38% in less than two years.

MET has dropped to $51.77 and the $52.50 calls are now $6.50 and the $47.50 puts are $6.15 so net $39.12 is a loss of $1.13/share or $1,130 (2.8%) but I still like this one as a new trade.

March 15th: Still worried about the market, we created another TZA spread to protect your portfolio:

The other very important aspect to our portfolio strategy is HEDGING and it's surprising how many "investors" don't know how to hedge properly – including hedge fund managers! We adjusted our hedges in the OOP on March 1st, using the ultra-short Russell ETF (TZA) and the ultra-short Nasdaq ETF (SQQQ) as our primary hedges. TZA is now at $19.12 and it's a 3x ETF so a 5% drop in the Russell (to 1,294) would pop TZA 15% to $22.

$22 is, of course not a huge number but then we take that possibility and use options for leverage and then we can hedge our hedge with any stock that we'd REALLY like to buy if the market drops 20% so for example, we can set up a TZA hedge as follows:

- Buy 50 TZA April $18 calls for $1.65 ($8,250)

- Sell 50 TZA April $21 calls for 0.60 ($3,000)

- Sell 10 Taser (TASR) 2019 $20 puts for $2.90 ($2,900)

That nets you into the $15,000 spread for $2,350 in cash and the ordinary margin requirement for selling the TASR puts is $2,014, so it's a margin-efficient way to raise $2,900. You are, of course, obligated to buy 1,000 shares of Taser for $20 (now $23 so a 13% discount) if it falls below $20 but we love TASR – it's our Stock of the Decade with a $50 target for Jan 2020.

The $18 calls are now $2 ($10,000) and the $21 calls are 0.70 ($3,500) and the short TASR puts are still $2.90 ($2,900) so net $3,600 is up $1,250 (53%) but it's a drop in the bucket towards the potential $11,400 additional gain from here if TZA is over $21 so I still like it as a new trade.

I'll stop there because the others are less than a week old – we'll review the rest in early April. That's a pretty good 10 out of 11 winners in 11 trading days. Of course that's just a drop in the bucket compared to what we do in our Live Member Chat room but how could you justify springing for a PSW Membership when the FREE samples only made $19,684 in 3 weeks?

Since that's the case, you won't miss the trade ideas next month, right?

If you want to get into these trades before they are already up 431%, like this one is ...

more