This Week’s Economic Indicators – Monday, Dec. 17

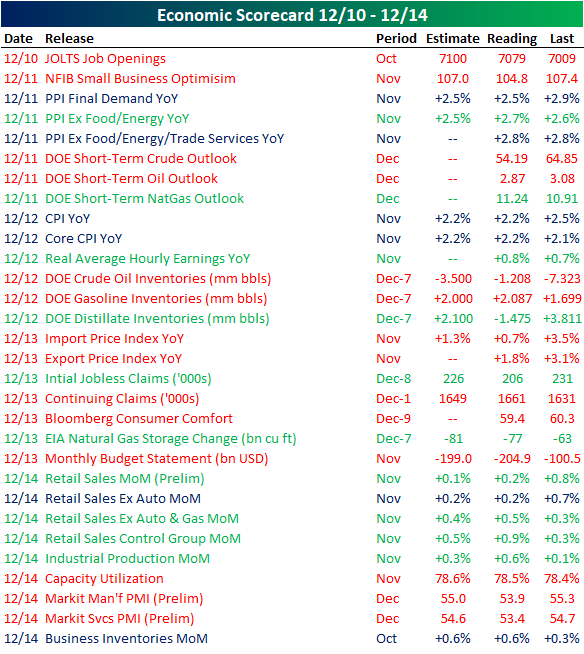

Last week’s economic data came in somewhat disappointing with a little less than half of the 30 releases below estimates or the previous period’s reading. JOLTS kicked off the week still strong and higher than the September reading, but below estimates. Small business optimism saw a decline for November. Inflation data through PPI and CPI both came in mostly in line with forecasts with core PPI being the only measure to release above estimates. However, export and import price indices both came in well below October’s levels. Jobless claims saw a substantial beat. Despite a strong Industrial Production reading, preliminary Markit PMIs for manufacturing as well as services pointed to a weaker release for December.

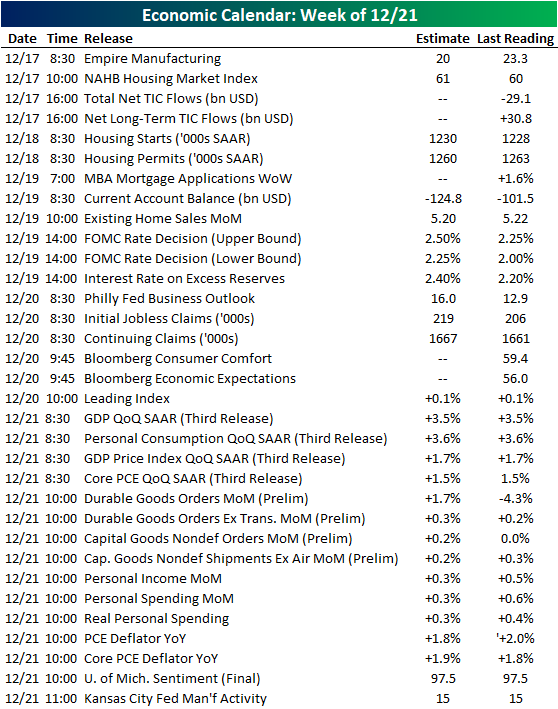

This week will see a heavy slate of data. Empire manufacturing didn’t start the week off on the best note with the index cutting nearly in half. Homebuilder sentiment and TIC flows report later today. Housing starts and permits are the only releases Tuesday, but Wednesday through the end of the week will be busy. On Wednesday, the FOMC will have their rate decision where interest rates are expected to rise a quarter of a percent. This will by far be the most talked about event of the week. Thursday we will get the Philly Fed’s business outlook and the leading index. There will be many releases to finish the week on Friday with The third GDP release, goods orders, personal income and spending, PCE inflation data, and the Kansas City Fed’s manufacturing activity.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more