This Uniquely Positioned Net Lease REIT Pays 5.9%, But Wait For Pullback

Last week I wrote about Hannon Armstrong (NYSE:HASI), a "clean energy" REIT that invests in a wide range of energy-based assets. It was my first article on HASI and the comments generated substantial interest and curiosity.

I'm not sure if the interest in the article had more to with yield (around 7%) or growth potential (the company has a significant pipeline of deal flow), or maybe both.

Collectively, I think many readers are perplexed as to how HASI trades and how to compare the underlying assets. It's quite clear that HASI's assets are much different than most other REIT assets, and while the company does quality as a REIT, the asset base is out of the ordinary.

Forgetting about the assets for a minute, HASI's primary source of repayment is perhaps the strongest differentiator overall. I cannot think of another REIT that has 97% investment-grade rated contracts and based on credit alone, HASI has a very low probability of default. Of course, there is a chance for default and I don't know about you, but I would not know how to repo a fiber optic cable that is under the ocean and attached to the Reagan Defense Center.

For that reason, many believe HASI acts more like a BDC or an MLP, than a REIT.

However, I intend to analyze HASI as a Net Lease REIT. I think that's the best peer group based on the fact that the business model is tenant credit-based and this sector has higher payout ratios (compared with other asset classes). There is no perfect bucket (peer group) for HASI but it works for me.

A REIT Less Focused on Underlying Tenant Credit

As stated, HASI invests (or more accurately finances) in real estate in which around 97% of the portfolio is investment-grade rated. Most Net Lease REITs strive for higher investment-grade tenants, since there is a much lower probability for lease defaults. Although owning a high percentage ofinvestment-grade leases is no guarantee for success, most Net Lease REITs underwrite a lessee's source of repayment as a measure of risk management.

As we enter a period of rising interest rates, that's even more important. Companies with better balance sheets are able to secure more favorable debt terms than below investment-grade companies. As rates begin to rise, financing costs for weaker tenants will be at higher risk and that could squeeze profitability margins.

Of course, that also plays out favorably well for REITs that invest in non-investment-grade companies. As rates rise, more companies will look to monetize assets and lock-in long-term lease contracts (i.e. sale/leaseback) to avoid higher debt costs in years ahead. One company that focuses on that lower quality credit profile is EPR Properties (NYSE:EPR).

EPR Properties Has a Differentiated Focus

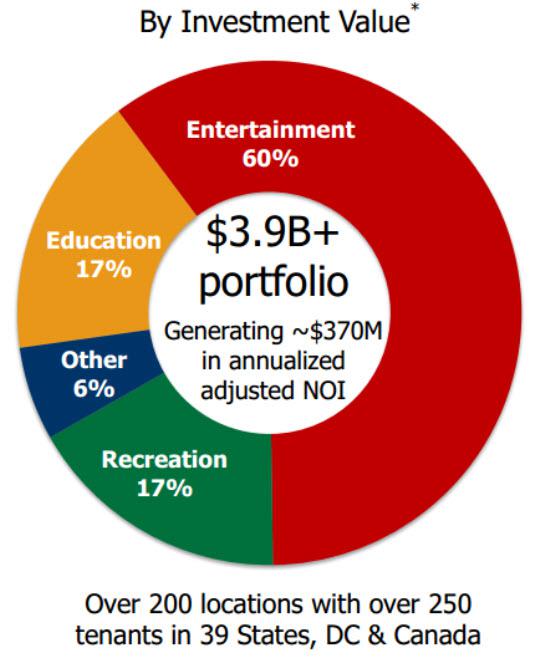

EPR Properties - formerly known as Entertainment Properties Trust - went public in November 1997 and is a ~$5.84 billion REIT (based on Total Capitalization), based in Kansas City. With gross assets of around $3.68 billion (as of Q3-14), EPR is the largest owner of entertainment-related real estate, with a large concentration in the entertainment category, comprising 60% of its total portfolio (based on income), as well as education (17%), recreation (17%), and a growing list of related business lines.

EPR is a specialty REIT that invests in properties in select categories which require unique industry knowledge, while offering the potential for stable and attractive returns.

Continue reading this article here.

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor ...

more