Third Estimate 3Q2018 GDP Lowered To 3.4%. Corporate Profits Up

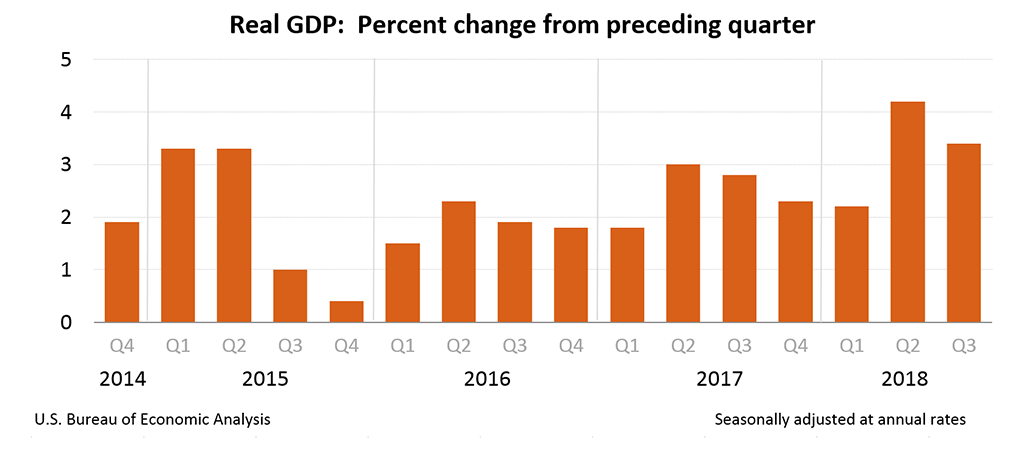

The third estimate of third quarter 2018 Real Gross Domestic Product (GDP) was 3.4 % (down from 3.5%).

Analyst Opinion of GDP

Over 2 % of this 3.4% growth number is attributable to inventory growth (materials manufactured but not yet sold). I consider this a very weak report on GDP. The main reason for the marginally reduced GDP growth figure this estimate was due to higher inflation than was calculated in the previous estimates.

I am not a fan of quarter-over-quarter exaggerated method of measuring GDP - but my year-over-year preferred method showed moderate acceleration from last quarter.

The market expected (from Econoday):

| Seasonally Adjusted Quarter-over-Quarter Change at annual rate | Consensus Range | Consensus |

Advance Actual |

Second Actual |

Third Actual |

| Real GDP | 3.3 % to 3.6 % | 3.5 % | +3.5 % | +3.5 % | +3.4 % |

| GDP price index | 1.7 % to 1.7 % | 1.7 % | +1.7 % | +1.7 % | +1.8 % |

| Real Consumer Spending - Q/Q change | 3.5 % to 3.6 % | 3.6 % | +4.0 % | +3.6 % | +3.5 % |

- Headline GDP is calculated by annualizing one quarter's data against the previous quarters data. A better method would be to look at growth compared to the same quarter one year ago. For 3Q2018, the year-over-year growth is now 3.0 % - up from 2Q2018's 2.9 % year-over-year. So one might say that the rate of GDP growth improved 0.1 % from the previous quarter.

Real GDP Expressed As Year-over-Year Change

The same report also provides Gross Domestic Income which in theory should equal Gross Domestic Product. Some have argued the discrepancy is due to misclassification of capital gains as ordinary income - but whatever the reason, there are differences.

Real GDP (blue line) Vs. Real GDI (red line) Expressed As Year-over-Year Change

This third estimate released today is based on more complete source data. (See caveats below.)

Real GDP per Capita

The table below compares the previous quarter estimate of GDP (Table 1.1.2) with the current estimate this quarter which shows:

- consumption for goods and services adding 2.4 % to GDP growth.

- trade balance worsened deducting 2.0 % from GDP growth inventory change added 2.3 % to GDP growth (inventory change is part of domestic investment)

- private domestic investment added 2.5 % to GDP growth

- federal spending added 0.4 % to GDP growth

The following is Table 1.1.2 before the annual revision: [click to enlarge]

What the BEA says about the third estimate of GDP:

In the second estimate, the increase in real GDP was 3.5 percent. With this third estimate for the third quarter, personal consumption expenditures (PCE) and exports were revised down, and private inventory investment was revised up; the general picture of economic growth remains the same

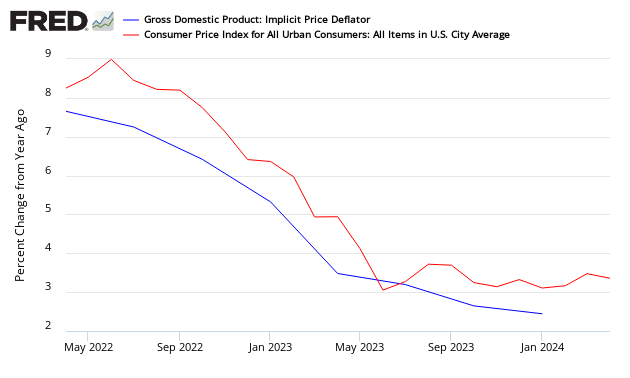

Inflation continues to moderate as the "deflator" which adjusts the current value GDP to a "real" comparable value continues to moderate. The following compares the GDP implicit price deflator year-over-year growth to the Consumer Price Index [this puts both on the same basis for comparision]:

What the BLS says about the revision from the second to the third estimate:

The third-quarter percent change in real GDP was revised down 0.1 percentage point from the second estimate, reflecting downward revisions to PCE and exports that were partly offset by an upward revision to private inventory investment.

In the same release, corporate profits data was released showing improving growth.

Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) increased $78.2 billion in the third quarter, compared with an increase of $65.0 billion in the second quarter. Profits of domestic financial corporations decreased $6.1 billion in the third quarter, in contrast to an increase of $16.5 billion in the second quarter. Profits of domestic nonfinancial corporations increased $83.0 billion, compared with an increase of $53.0 billion. Rest-of-the-world profits increased $1.3 billion, in contrast to a decrease of $4.5 billion. In the third quarter, receipts decreased $9.5 billion, and payments decreased $10.8 billion.

Caveats on the Use of Gross Domestic Product (GDP)

GDP is market value of all final goods and services produced within the USA where money is used in the transaction - and it is expressed as an annualized number. GDP = private consumption + gross investment + government spending + (exports − imports), or GDP = C + I + G + (X - M). GDP counts monetary expenditures. It is designed to count value added so that goods are not counted over and over as they move through the manufacture - wholesale - retail chain.

The vernacular relating to the different GDP releases:

"Advance" estimates, based on source data that are incomplete or subject to further revision by the source agency, are released near the end of the first month after the end of the quarter; as more detailed and more comprehensive data become available, "second" and "third" estimates are released near the end of the second and third months, respectively. The "latest" estimates reflect the results of both annual and comprehensive revisions.

Consider that GDP includes the costs of suing your neighbor or McDonald's for hot coffee spilled in your crotch, plastic surgery or cancer treatment, buying a new aircraft carrier for the military, or even the replacement of your house if it burns down - yet little of these activities is real economic growth.

GDP does not include home costs (other than the new home purchase price even though mortgaged up the kazoo), interest rates, bank charges, or the money spent buying anything used.

It does not measure wealth, disposable income, or employment.

In short, GDP does not measure the change of the economic environment for Joe Sixpack, and Joe Sixpack's kid, yet pundits continuously compare GDP across time periods.

Although there always will be some correlation between all economic pulse points, GDP does not measure the economic elements that directly impact the quality of life of its citizens.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more