These Alt ETPs Are Proven Diversifiers

We’re often told that there’s no free lunch in investing, that there’s a price to be paid for every benefit. There seems to be a carve-out, however, for diversification. Advisors often tell their clients that, done properly, diversifying a portfolio’s risk can tamp down volatility without reducing expected returns.

There’s been no greater source of diversification than alternative investments, or “alts”. Defined broadly, these are exposures that promise little or no correlation to portfolio mainstays such as equities and, perhaps, conventional fixed-income securities. Hedge funds were once the only avenue through which investors could access alts, but that’s no longer the case. Numerous exchange-traded portfolios (ETPs) now wade in the alternative waters.

It’s no secret that these strategies have been pretty much a bust, while equities were screaming to the upside over the past few years. But now that the wheels on the stock market bus are starting to wobble, alts are getting a renewed look.

So, which alt ETP is likely to provide the greatest degree of diversification?

To answer that question, we have to first look to the past. We started by surveying the field to find funds with track records. Aiming for ETPs with two-year histories, we filtered out volatility-index-tracking funds as being purely tactical, rather than long-term, holdings. With that, nearly three dozen alternative ETPs came into view.

Next, we had to come up with a measure of diversification. For that, we reasoned that a well-diversified portfolio is one that exhibits less overall risk than the summed weighted risks of its components. A ratio, therefore, greater than one (1.00), with the portfolio components’ aggregated risks in the numerator and the portfolio’s overall risk in the denominator, demonstrates a diversification benefit.

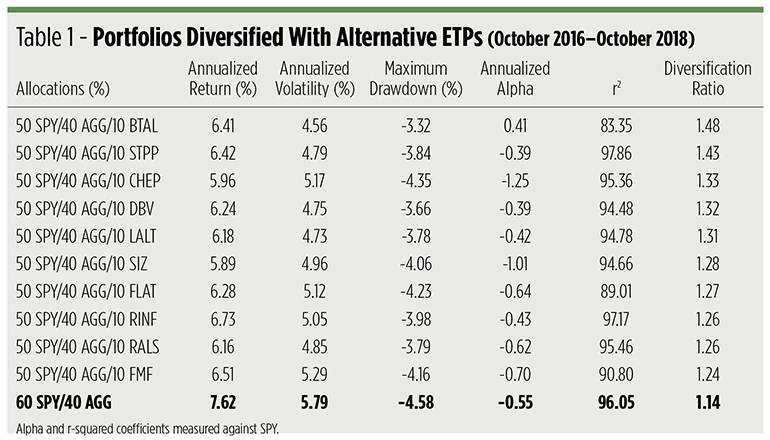

A simple benchmark portfolio illustrates how the diversification effect is measured. A classic 60/40 mix can be constructed by allocating 60 percent of our hypothetical capital to the SPDR S&P 500 ETF (NYSE Arca: SPY) and 40 percent to the iShares Core U.S. Aggregate Bond ETF (NYSE Arca: AGG). The standard deviation of the SPY portfolio’s returns over the past two years is 9.19 percent; that of AGG is 2.80 percent. The weighted sum of these two components’ volatilities is 6.62 percent, but when combined, they produce a portfolio with a standard deviation of just 5.79 percent. The result? A 1.14 diversification ratio.

That 1.14 ratio is our bright line. Any attempt to build a more diverse portfolio by weaving in an alternative ETP into a SPY/AGG mix will show some measure of success if it results in a diversification ratio exceeding 1.14.

If we make room for a 10 percent alternative exposure by reducing the SPY allocation to 50 percent, all 34 of the resulting portfolios earn diversification ratios better than 1.14. Twenty-three, or about two-thirds, are within one standard deviation of the benchmark. It’s the top 10 portfolios— the ones with the highest diversification ratios— that deserve our immediate attention, however. Table 1 contains these asset mixes set against the benchmark 60/40 portfolio.

(Click on image to enlarge)

At the top of the table, with a 1.48 diversification ratio— four standard deviations above the benchmark—is the portfolio constructed with the AGFiQ U.S. Market Neutral Anti-Beta ETF (NYSE Arca: BTAL), a fund that takes long positions in low-beta stocks while shorting high-beta issues. This portfolio has the distinction of having the lowest r-squared coefficient against SPY and is the only one that earns positive alpha, in great part owing to BTAL’s volatility dampening.

The second-place portfolio is built around the iPath U.S. Treasury Steepener ETN (Nasdaq: STPP), a note that tracks nominal futures spread: long two-year versus short 10-year T-note contracts. The STPP strategy aims to produce gains as yields on longer-term paper rise relative to short-term debt. The ETN’s neutral beta stance has an ameliorative effect on the benchmark alpha even as it gooses up the r-squared coefficient.

Third place belongs to a portfolio that includes the AGFiQ U.S. Market Neutral Value ETF (NYSE Arca: CHEP), a fund that pits long positions in value stocks against shorts in growth names. Over the past two years, value’s been mostly a drag on portfolio performance.

In the fourth position, the portfolio fashioned with the Invesco DB G10 Currency Harvest (NYSE Arca: DBV) obtains the benefit of currency carry trade strategy, along with the attendant foreign exchange risk. Using forward contracts, the DBV fund takes long positions in currencies supported by high-interest rates while shorting low-rate currencies.

The actively managed Invesco Multi-Strategy Alternative Portfolio Fund (Nasdaq: LALT) is the linchpin of our fifth-place asset mix and relies on a combination of hedged equity and volatility strategies, currency forward plays and outright debt futures to keep correlations to a minimum.

In the table’s sixth slot is a portfolio constructed with the AGFiQ U.S. Market Neutral Size ETF (NYSE Arca: SIZ), a fund that buys small stocks and shorts large-cap names. Over the past two years, owning SIZ would have ratcheted down overall alpha to the greatest extent among the most-diversified portfolios.

Yet another long/short equity fund anchors the seventh-place portfolio, but the offsetting positions in the ProShares RAFI Long/Short ETF (NYSE Arca: RALS) include individual stocks that make up the RAFI 1000 Index and short exposure to the Russell 1000 Index. Essentially RALS is a bet on the outperformance of fundamentally weighted names over cap-weighted issues.

Sitting on our table’s eighth tier is a portfolio that includes the iPath U.S. Treasury Flattener ETN (Nasdaq: FLAT), a note that tracks the inverse strategy plied by STPP. FLAT’s objective is capital appreciation when the Treasury 2- to 10-year yield curve flattens.

The diversifying element for our ninth-place portfolio is the ProShares Inflation Expectations ETF (NYSE Arca: RINF), which tracks an index that sets long exposure to Treasury Inflation-Protected Securities (TIPS) against short positions in conventional T-notes of the same maturity. RINF tries to capture gains as inflationary expectations rise.

Last on our table is the only portfolio with primarily futures exposure. The First Trust Morningstar Managed Futures Strategy (NYSE Arca: FMF) is actively traded and allocates long and short positions among commodity, currency and equity futures.

What’s it all mean?

One thing is clear from our top-10 table: Diversification has NOT resulted in better gross returns. Not over the past two years anyway. The best three-asset portfolio’s average annual return lagged the benchmark’s by 89 basis points. Adding alternative exposures did, however, reduce portfolio volatility across the board and improve portfolio alpha half the time.

Those with glass-half-empty mentalities will be quick to say that you can’t eat reduced volatility. That’s certainly true. But market volatility has a way of eating YOUR lunch if you’re not careful. Reducing volatility means you’re less vulnerable to drawdowns and more likely to keep what you’ve earned in upcycles.

The markets are clearly signaling change ahead. Volatility spikes have beleaguered the equity market twice this year, and there’s little evidence that we’re through with such tremors. That seems to make a case for diversifying with a fund like BTAL going forward.

Not necessarily a free lunch. Just not a lost lunch.

Disclosure: None.