"The Yields Are Too Low": America's 'Bond Kings' Embrace Same Strategy, Shun Corporate Debt

Amid one of the most stunning bond rallies in recent memory, all three of the most widely regarded American bond managers - Jeffrey Gundlach (DoubleLine), Scott Minerd (Guggenheim) and Dan Ivascyn (PIMCO) - are underperforming their benchmarks this year largely for the same reasons: ultra-low and negative yields are making them uneasy.

And while demand for corporate bonds has picked up this year as investors from all over the world search for yield in the US, all three of these managers refuse to invest in corporate debt, believing it to be a troubled asset class with too many landmines (of which the neutron bomb is the $3 billion BBB-rated "soon to be fallen angel" bonds which we have discussed one too many times to go over again) .

Gundlach, for his part, has been warning about a blowup in US corporate debt markets for months.

But according to Reuters, all three men now have adopted roughly the same strategy, stay long government bonds and wait for the turbulence that they see ahead to pass by before buying back into corporate debt.

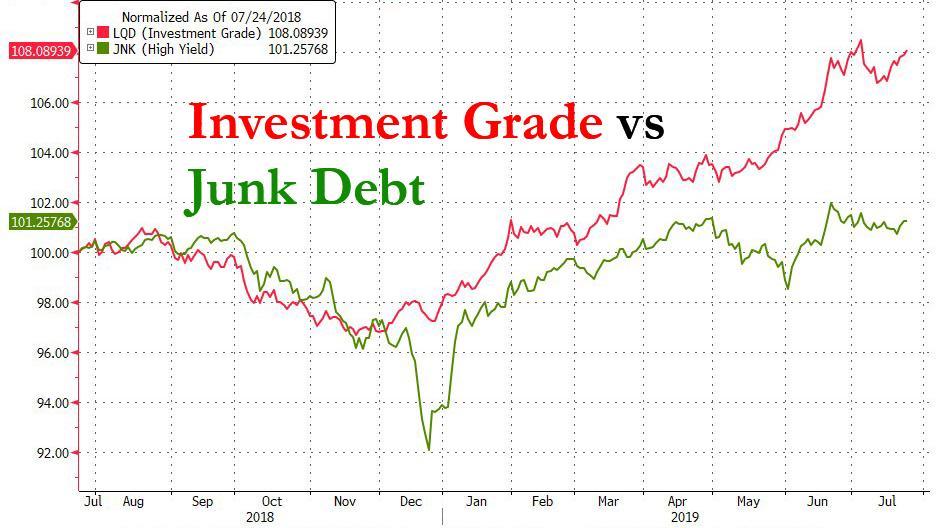

Investors had been feasting on U.S. corporate credit bonds for years, though recession fears and mounting defaults late last year put an abrupt end to that. This year, the appetite for U.S. corporate bonds picked up dramatically when investors’ views on the economy began to improve and central banks became more accommodative.

U.S. corporate bonds have posted a total return of 13.4% this year, measured by the Bank of America Merrill Lynch US Corporate Bond Index while year-to-date Treasury returns are up 8.1%, according to an index compiled by Bloomberg and Barclays.

What’s more, a lack of alternatives against the backdrop of ultra-low, even negative-yielding, debt has made U.S. corporate bonds the natural destination for many investors. Some 95% of all investment-grade corporate debt in the world that has a positive yield is in the United States, according to Bank of America Merrill Lynch.

All three investors – Gundlach, the chief executive of DoubleLine Capital; Ivascyn, group chief investment officer of Pacific Investment Management Co, known as Pimco; and Minerd, global chief investment officer of Guggenheim Partners – have been underweight corporate credit relative to their benchmarks.

All three told Reuters they can live with the underperformance for now.

"We have never owned a single corporate bond in the Total Return Strategy dating back to 1993. Look it up," Gundlach said. “When corporate bonds become very overvalued, especially when rates fall due to recession prospects increasing - well?” he added of why he has avoided the asset class.

Gundlach added that he expects there will be times when his fund is out of favor, and there will be times when it's extremely popular: Same with all of the other managers.

Ivascyn, who oversees $1.84 trillion in assets under management at Pimco as of June 30, shares Gundlach’s sentiments. “We believe that corporate credit is fundamentally weak and could overshoot to the downside if the economy deteriorates,” he said.

The Pimco Income Fund, the largest actively managed bond fund, with assets of more than $130 billion, is lagging 93 percent of its Multisector Bond category so far this year, according to Morningstar data as of Aug. 23. The Multisector category typically invests in U.S. government obligations, U.S. corporate bonds, foreign bonds and high-yield U.S. debt securities and has assets of $259 billion.

Minerd’s Guggenheim Total Return Bond Fund is lagging 95% of its Intermediate Core-Plus Bond category so far this year, for the same period.

"As the Fed begins its easing campaign to try to extend an already long-in-the-tooth expansion, credit spreads are already tight across the fixed-income spectrum," Minerd said. "Credit spreads could get tighter in this liquidity-driven rally, but history has shown that the potential for widening from here is much greater."

All three have agreed that they're keeping their duration as low as possible, and ultimately, they expect to win in the long run.

"I’ve said this a thousand times...we always run shorter duration," Gundlach said.

[...]

“We think developed government bond yields are too low and could easily reverse so we are comfortable with low rate exposure,” Ivascyn said.

When yields finally snap higher, that's the time to think about buying. The only question is when will that happen and what will be the catalyst.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more