The Worst For Stocks Is Not Over, It's About To Start

The below numbers confirm a bullish change in trend from a price, volume, and sentiment is not imminent.

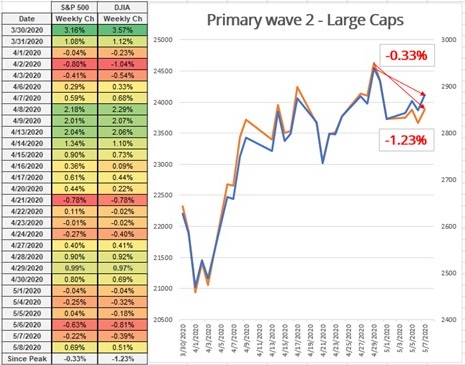

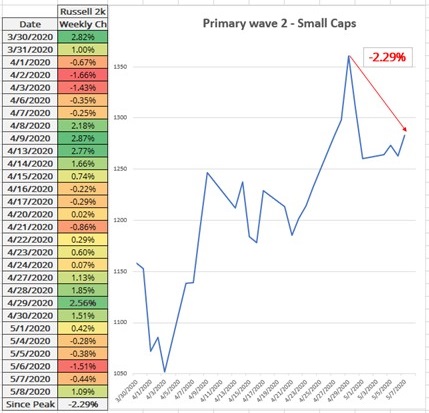

Price

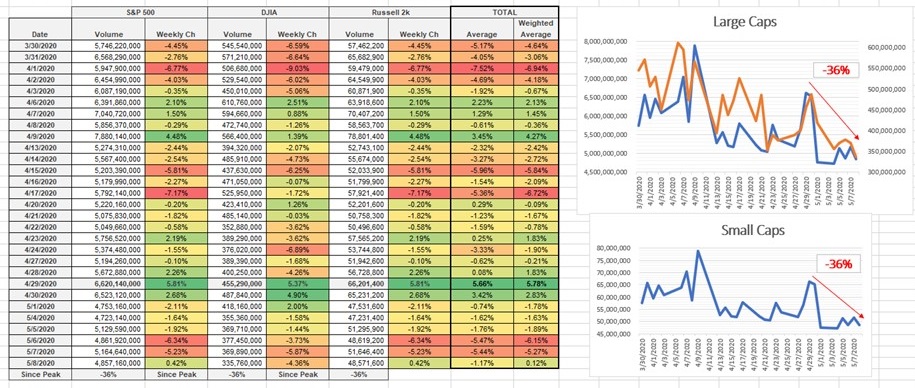

Volume

(Click on image to enlarge)

NYSE Advance-Decline Ratio

The NYSE advance/decline ratio has been trending down with lower highs well before the end of the Primary wave 2 bear market rally. If we see a bullish reversal in trend, expect an increase in volume accompanied by greater advance-decline ratios.

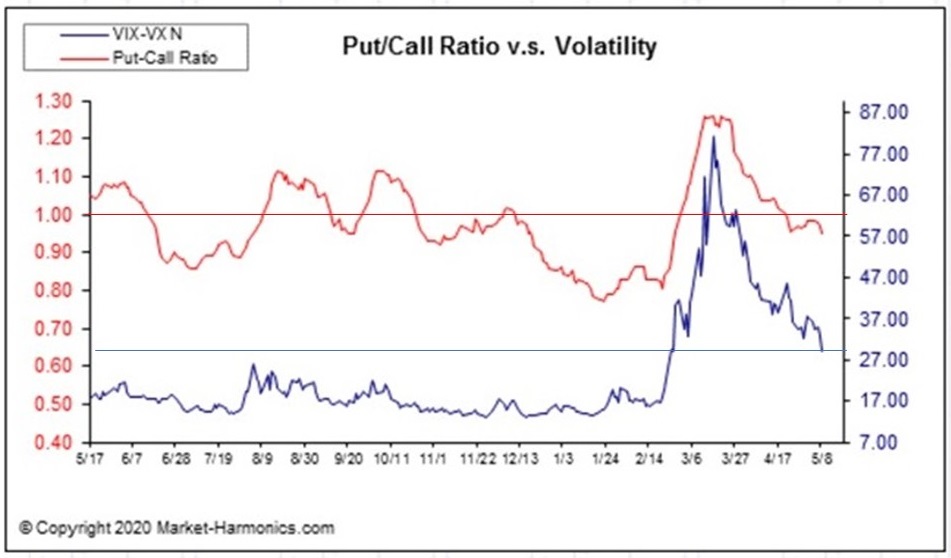

Sentiment

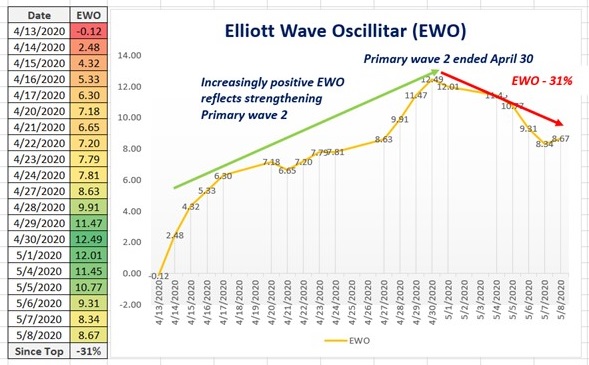

Elliott Wave Oscillator

Conclusion

There are no definitive signs that the overall character of stocks is turning bullish. All technical indicators point to the next wave down in stocks that will soon start. Expect Primary wave 3 down to begin in earnest with a material pick-up in volume.

Disclosure: None.

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!