The World’s 10 Largest Stock Markets

(Click on image to enlarge)

The Briefing

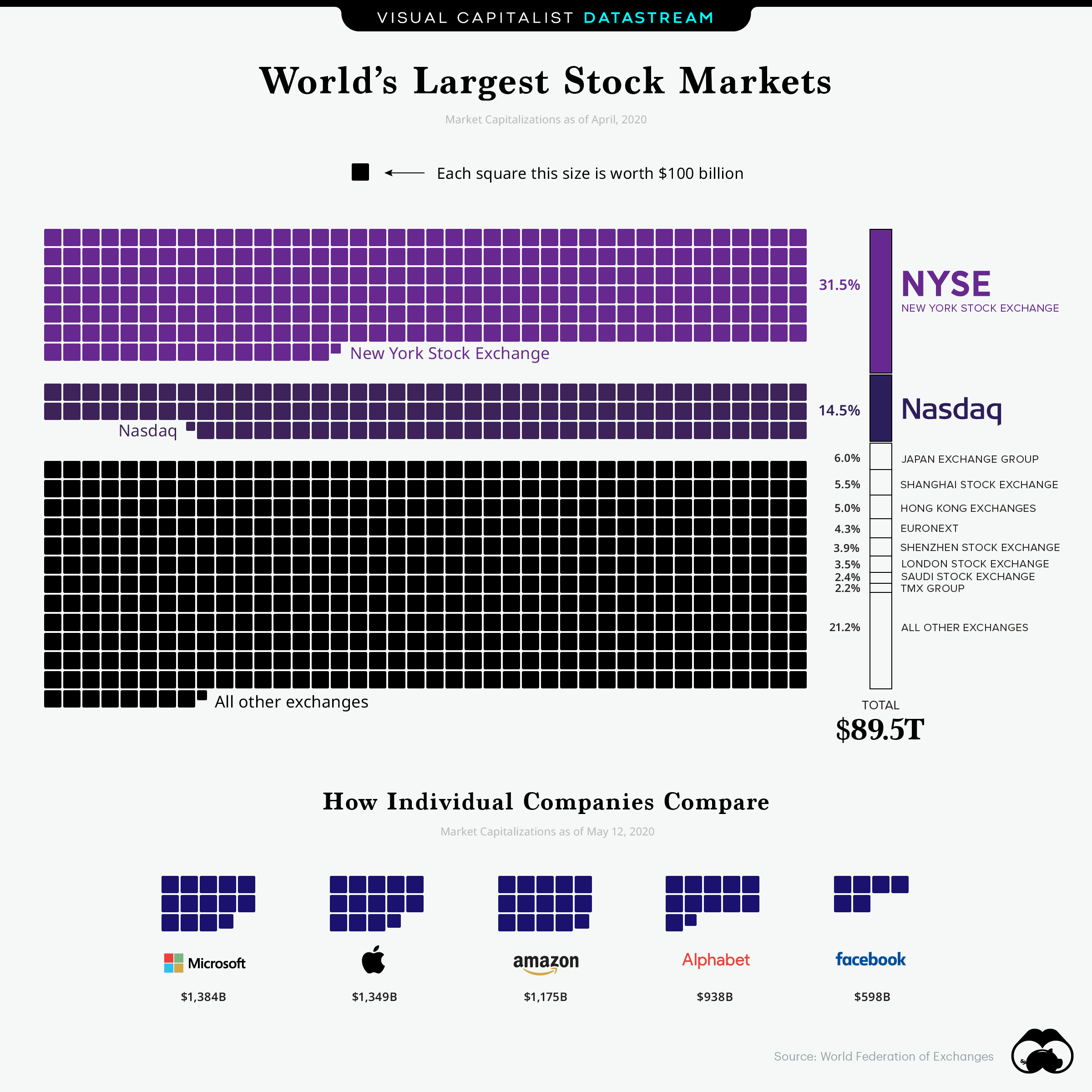

- The 10 largest stock markets represent 78.8% of the global stock market value.

- The top two—the NYSE and Nasdaq—capture 46%.

The world’s stock market exchanges have a combined market cap of $89.5 trillion. But, while their amalgamated sum is massive, there are vast discrepancies between the value of each.

Which exchanges are the world’s largest stock markets, and why?

| Rank | Exchange | Market Value |

|---|---|---|

| #1 | NYSE | $28.19T |

| #2 | Nasdaq | $12.98T |

| #3 | Japan Exchange Group | $5.37T |

| #4 | Shanghai Stock Exchange | $4.92T |

| #5 | Hong Kong Exchanges | $4.48T |

| #6 | Euronext | $3.85T |

| #7 | Shenzhen Stock Exchange | $3.49T |

| #8 | London Stock Exchange | $3.13T |

| #9 | Saudi Stock Exchange | $2.15T |

| #10 | TMX Group | $1.97T |

Market capitalizations as of April 2020

American Exceptionalism

U.S. companies dominate the global equities landscape.

This is the case for several reasons. For starters, American companies like Apple, Microsoft, and Amazon possess trillion-dollar valuations.

Another factor is prestige—U.S. stock exchanges have always carried an elevated sense of legitimacy, which ultimately provides access to the best capital and financing for companies that trade there. That’s why you’ll find non-American companies like Toyota, Sony, and Alibaba on U.S. exchanges.

On the NYSE, there are 507 non-U.S. stocks from 46 countries. Here’s a look at 10 notable ones from all over the world that bring in a combined $2.1 trillion in market cap:

| Company | Ticker | Origin | Market Cap |

|---|---|---|---|

| Taiwan Semiconductor | TSM | Taiwan | $401.9B |

| Novartis AG | NVS | Switzerland | $212.3B |

| SAP SE | SAP | Germany | $190.4B |

| Toyota Motor Corp | TM | Japan | $213.8B |

| VALE S.A. | VALE | Brazil | $59.7B |

| Anheuser-Busch InBev NV | BUD | Germany | $94.0B |

| Enbridge Inc | ENB | Canada | $59.8B |

| Alibaba | BABA | China | $838.4B |

| Honda Motor | HMC | Japan | $44.0B |

| HSBC Holdings | HSBC | United Kingdom | $80.4B |

| Total | $2,194.7B |

Trading on big American exchanges also does the job of putting some investor concerns at bay. That’s because non-U.S. companies must comply with SEC and accounting regulations, thus providing a more overall transparent process to investors.

Disclosure: None