The VIX And Investment Timing

“Davidson” submits:

What is the ‘VIX – CBOE Volatility Index’

Created by the Chicago Board Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the market’s expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors’ sentiments. It is also known by other names like “Fear Gauge” or “Fear Index.” Investors, research analysts and portfolio managers look to VIX values as a way to measure market risk, fear and stress before they take investment decisions.

The VIX is a measure of very short-term market psychology. It is based on how many Puts and Options are traded and their premiums/discounts to their underlying security prices.. Options are very short-term bets on market direction executed by Momentum Investors. The higher the demand for Puts(a bet on lower prices), the higher the VIX. Every time the VIX rises, the number of media guests forecasting dire outcomes with recommendations that investors flee equities rises sharply. Does a high VIX signal a weaker equity market? What does the data say?

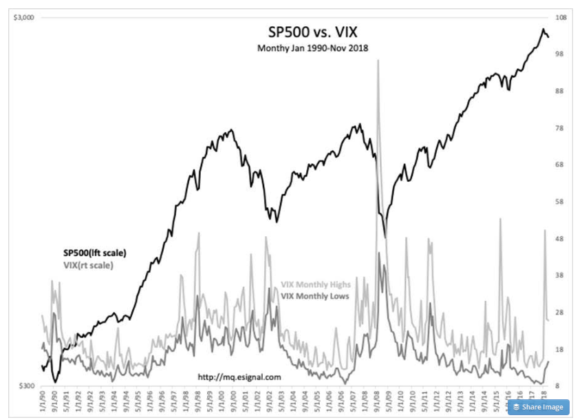

If one compares the high levels of the VIX with market prices, it should be obvious that a high VIX is always associated with lower equity prices. The media refers to high VIX levels as indicating higher risk of loss for investors. Recommendations that investors should reduce equity positions are typical. At first glance, the monthly chart of the SP500 vs. VIX from Jan 1990 to Nov 2018 seems to support this. But, looking at daily data, one comes away with the opposite perspective.

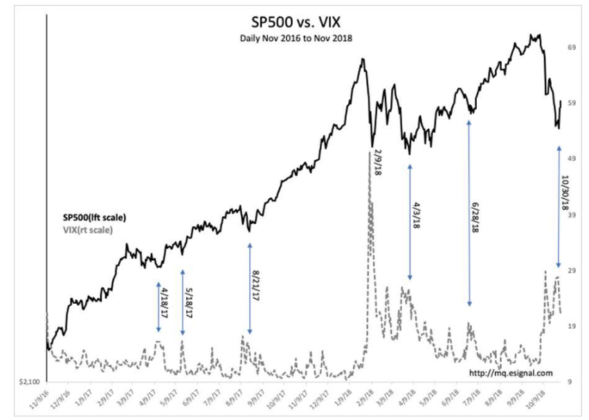

The daily SP 500 vs. VIX from Nov 2016 to Nov 2018 covers enough market history with enough detail to reveal an opposite correlation than that in the media.The data indicates that the highest levels in the VIX occur after prices are already low. The data shows that periods of elevated VIX levels correlate with short-term and opportune buying levels, i.e. lower periods of risk. This is the opposite of the consensus perspective. Traders are typically leveraged and it takes a few days before they begin to panic. When they panic, they buy puts fearing higher losses than they have already suffered. The VIX is an after-the-fact indicator and better at identifying short-term equity buying levels than anything else. The VIX is good for gaining media attention, but rises in this index indicate less not more market risk.

It should also be noted that market corrections of one level or another occur randomly and that there is no set VIX level with a particular percentage decline in the SP500. Note that the 2/2/18 SP500 correction resulted in a VIX over 50 but the steeper SP500 correction of 10/30/18 only resulted in a VIX of 28.

With shifts after-the-fact, It should be obvious that the VIX has never forecasted a market decline. It is best to think of the VIX as a short-term Momentum Investor market psychology indicator . No one has ever predicted short-term market trends! The only predictions one can make are based on long-term economic trends. If the long-term economic trends differ considerably from current market psychology, then investment opportunity exists to benefit from price changes once economic fundamentals are reported.

Summary:

If the long-term economic trends differ considerably from current market psychology, then a decent investment opportunity exists. It is always fundamental economic trends which drive future market psychology. If one knows the economic trend and the current sentiment, then one can predict which way investors are likely to be surprised.

Today, economic activity is in a strong uptrend and market psychology believes a recession is imminent. A strong investment opportunity for higher prices is present.

The high levels in the VIX indicate that today is a good time to add to portfolios.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more