The U.S. Treasury Sell-Off Needs To Be Confirmed By Inflationary Pressures

As bond yields worldwide surged last week, the bond bears were out in full force to announce that the 35-year bull market has ended. Although these claims have been made numerous times over these past three decades, this ‘time could be different’ or so it seems. Of course, we cannot declare the demise of this long trend until more years have passed into the history books. At this point, we should examine what is behind the recent run-up in yields and whether these conditions are likely to continue unabated.

For starters, the U.S. bond market has been under pressure for most of 2018 as low unemployment and solid growth supported the Fed in its moves to raise the Fed Funds rate. It went on to signal that it will continue to raise rates into 2019 and possibly into 2020. In addition to rate increases, the Fed continues to shed bonds upon maturity from its balance sheet, a technique often referred to as quantitative tightening’.

A batch of economic data gave the market its impetus. The ISM survey reached a post-2008 high, the unemployment rate for September was the lowest since 1969. Moreover, Chairman Powell referred to the ‘remarkably positive’ U.S. economy. Powell went on to say that the Fed is a long way from reaching the ‘neutral ‘rate, at a rate that allows the economy to grow without inflation. Naturally, long bond globally sold off as yields were re-aligned to maintain previous spreads between the U.S and Canadian, European, U.K and Australian markets.

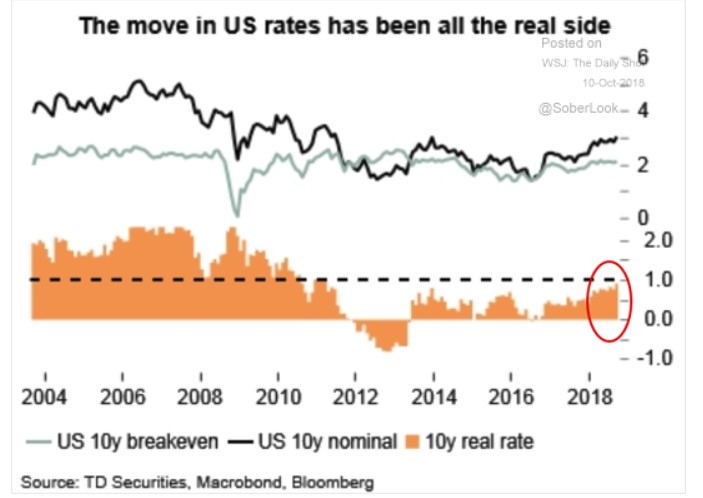

What was missing in the economic data was any solid evidence that inflationary expectations were at work. Strong economic data should generate rising prices and higher wages, but both these measures were not apparent in the recent data. As the accompanying chart reveals, TIPS or inflation-protected bonds rose while ‘break-even’ [1] rates (which measure inflationary expectations) remain very steady. In other words, investors bid up yields, not because of any expectation that inflation is accelerating. Rather, real yields were bid up slightly, but not significantly beyond their range this year.

Viewed differently, the jump in bond yields are basically a reflection that the Fed is on a determined path to raise rates, not a reflection of investors fears of inflation. This begs the question: can the Fed continue to raise rates without creating a recession? The bond market is notorious for its fear of inflation. If inflation is not driving these yields up, then is it reasonable for investors to anticipate that bond prices will remain this low or even go lower?

[1] The break-even rate is derived by comparing nominal rates to inflation-protected rates.

While the Fed may be jumping the gun, it is Trump's fault. Massive spending preceded by tax cuts and inflationary tariffs have boosted Powell's plans. But the argument could be made that the tax cuts will pass, having gone to the wrong people, the wealthy. The argument could be made that tariffs are ultimately recessionary, not inflationary. The argument could be made that regular people do not buy many houses anyway in the USA. That all seems deflationary to me.

Ultimately it will be deflationary as a 25% tariff hits consumers

Surprisingly Fed members do not voice this concern.