The US Stock Market’s Epic Recovery Is A Sight To Behold

Economic recoveries routinely fuel bull markets in stocks, but almost no one expected this.

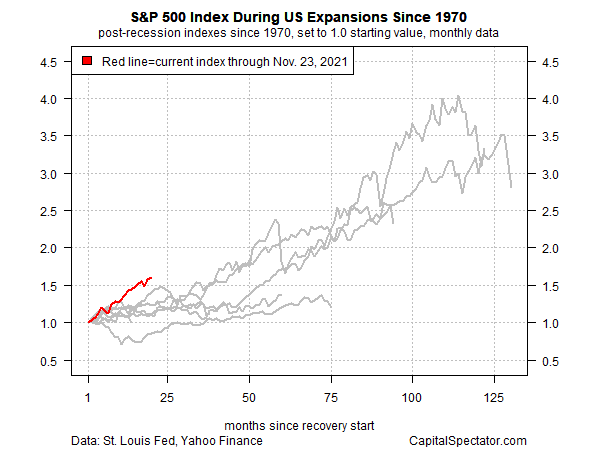

The S&P 500 Index’s rebound since the economy began to emerge from recession in May 2020 has been, well, epic. To be precise, the current bounce has so far outpaced the previous seven market recoveries during economic expansions since 1970.

It’s anyone’s guess how long this bull can run, but at the moment it’s unusually strong. Equities are up more than 61% in the current expansion. The next-strongest rise at this stage in the recovery (19 months and counting) is a distant 39.9% (posted during the recovery following the 2008-2009 recession).

The astonishing gain to date in the stock market is an upside outlier in the extreme, but it’s not unusual relative to gains in employment, retail sales and industrial production to date in the current expansion. As noted previously, the recoveries in these three key slices of economic activity have been unusually potent relative to previous rebounds following recessions. Personal income, on the other hand, has been unusually weak, which may be a sign of trouble if it doesn’t soon recover.

In any case, the bulls certainly can point to a (mostly) strong macro backdrop to rationalize bidding up prices. If history’s a guide, there may be a long way to go before the current bull run exhausts itself.

But having come so far, so fast, a question lurks: Have economic cycles and bull markets become compressed time-wise into shorter but far more dramatic events? Unclear, but at least one aspect of this analysis will likely remain the same: a close link between economic growth and higher stock prices. Ergo, the first (and last) question: Is there a recession on the horizon?

No, although saying so with a high level of confidence restricts us to look only a few months into the future, at most. Beyond that, we’re flying blind, as always. For what it’s worth, Mr. Market isn’t worried, at least not as of yesterday’s close.

Disclosures: None.