The US Goldilocks Scenario Was Supported By Strong GDP Growth In The First Quarter

Worries about a slowing US economic expansion this year seem a bit premature considering that real GDP rose at a 3.2% annual rate in the first quarter.

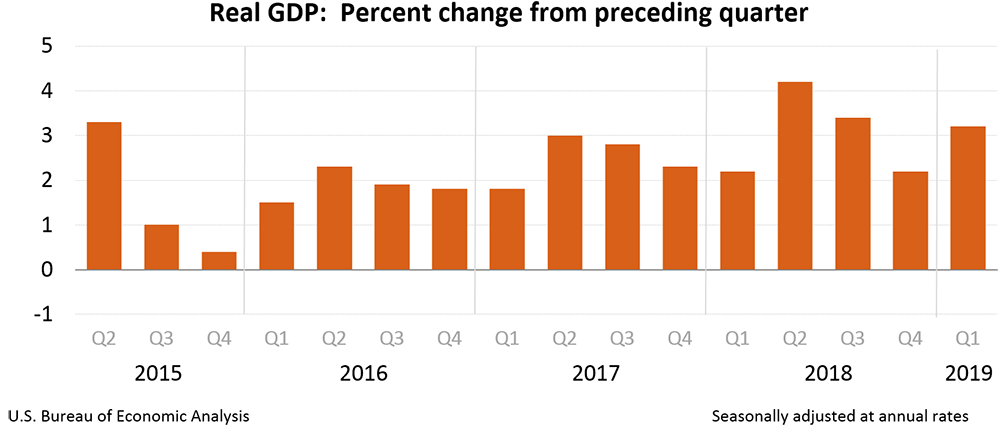

As the first chart below indicates, the US economy was decelerating from the end of the first quarter of 2018 through to the end of last year. Thus, the sharp acceleration in first quarter growth in 2019 indicates that the somewhat soft growth patch from last year may be over.

Nonetheless, the sharp rebound in US GDP growth from the slower 2.2% pace in the fourth quarter was due to special factors which are not expected to be sustaining.

The acceleration in the economy in the first quarter was centered in major boosts from two normally volatile sectors of the economy, inventories, and trade. It is rather unlikely that further large gains from these two sectors can be counted on going forward.

Indeed, the large growth of inventories in the first quarter may well be reversed as early as the second quarter.

In other words, these special factors inflated growth in the first quarter and clearly overstate the true underlying pace of growth.

As the following figures indicate, the GDP growth rebound in Q1 was helped by a shrinkage in the net trade deficit (exports jumped while imports contracted sharply) and the inventories bulge, which together contributed to more than one half of the economic gain in the quarter.

As Briefing. Com points out, the largest contributor to the total expansion in Q1 was net exports, which added 1.03 percentage points, followed by gross private domestic investment, which added 0.92 percentage points, and then personal consumption expenditures, which contributed 0.82 percentage points.

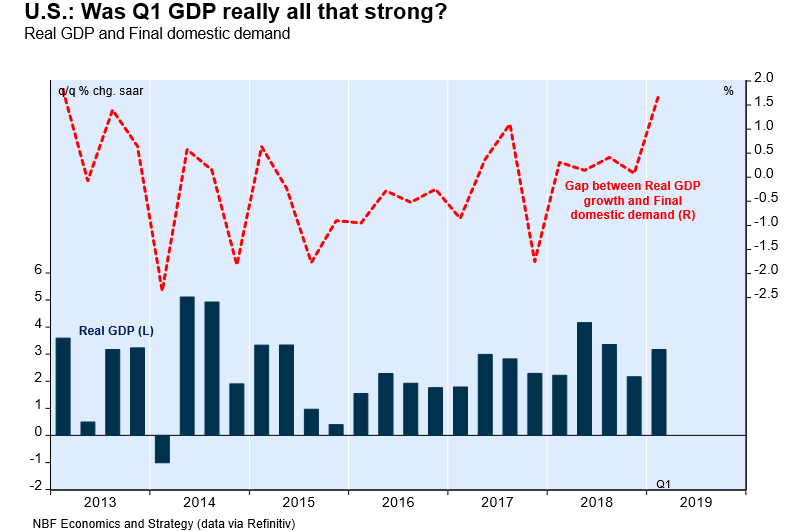

Another way of probing the sustained growth implications from the first quarter data is to compare actual GDP growth against final domestic demand.

Final domestic demand (i.e. GDP excluding trade and inventories) expanded just 1.5% annualized in the first quarter, the weakest growth rate since 2015.

In other words, the annualized growth gap between real GDP (3.2%) and final domestic demand (1.5%) in Q1 was the largest in six years. The last time there was such a large gap was in 2013/Q1, a quarter that was then followed by a slump in economic growth.

The sluggishness of the US housing sector was also prominent in the first quarter, as residential construction contracted at a 2.8% annual rate, its fifth straight quarterly contraction.

Even though Trump’s promise of 3% growth this year will likely not be realized, nonetheless the expansion should continue with the help of the Fed vacating the possibility of any interest rate hikes this year. We are projecting only 2.2% real growth in 2019 and in 2020.

Finally, on the negative side, the impact of the huge tax cut in 2017 will fade further this year, and the global growth seems to be slowing virtually everywhere.