The US Economy Is Nearly Back To Pre-Covid Levels, But Still Far From Normal

“The increase in first-quarter GDP reflected the continued economic recovery, reopening of establishments, and continued government response related to the COVID-19 pandemic. In the first quarter, government assistance payments, such as direct economic impact payments, expanded unemployment benefits, and Paycheck Protection Program loans were distributed to households and businesses through the Coronavirus Response and Relief Supplemental Appropriations Act and the American Rescue Plan Act.” (US BEA, April 29, 2021)

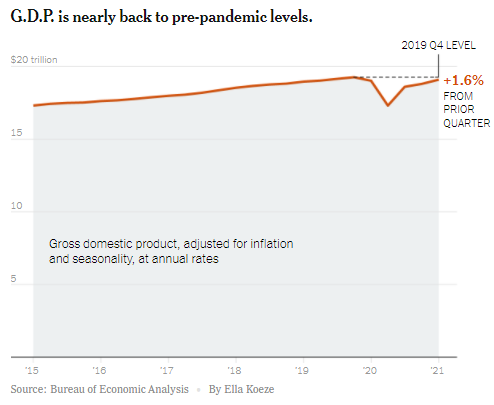

There is little doubt that the US economy is bouncing back rapidly from its Covid downturn.

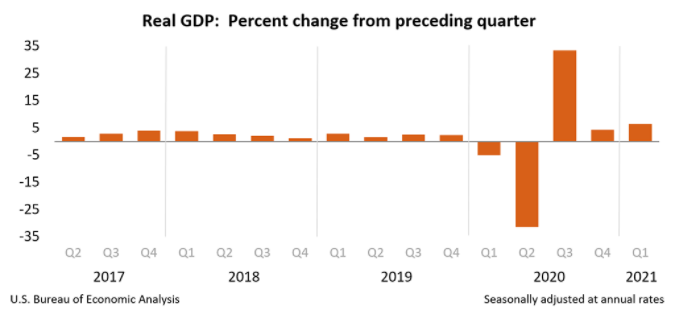

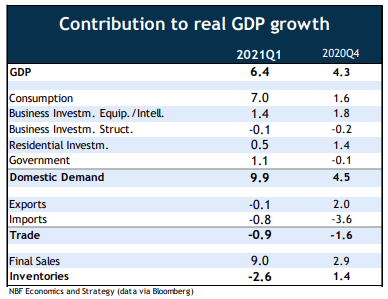

According to the advance estimate (which likely will subject to major revisions), real GDP expanded at an annual rate of 6.4% in the first quarter of 2021 following 4.3% growth in the fourth quarter of 2020.

This left the US economy in the first quarter 0.4% larger than the same GDP measure taken a year earlier. Of course, Q1, 2020 was the approximate bottom of the pandemic economy, so the recent speedy quarterly growth rate is really nothing to cheer about. Nonetheless, as vaccines continue to roll out and with infections seeming on a downtrend, the economic outlook is truly improving.

The two leading spending sectors contributing to the speedy growth in Q1 were the 10.7% increase in consumer spending and the 6.3% increase in government spending. Consumer spending on its own contributed 7 percentage points to total economic growth in the first quarter. Real final sales, which exclude changes in private inventories, also surged 9.2% in the first quarter.

The US foreign trade picture worsened sharply in the first quarter and subtracted from growth, as exports dropped and imports surged. Indeed, net exports subtracted close to a full percentage point from GDP growth in the first quarter.

Aside from a worsening foreign trade picture, the US economic outlook for the balance of this year continues to be positive as the vaccination rollout has been effective, new Covid cases seem on a decline, and the improving weather is also another positive factor.

It is obvious that the substantial economic rebound in Q1 reflects the impacts of the earlier hefty rounds of federal government support payments. After-tax personal income, adjusted for inflation, jumped 12.7% in the first quarter, with the government transfer payments accounting for most of the increase. There was a huge surge of spending on consumer goods in the first quarter that can clearly be traced to the federal relief spending.

It still remains the case that the future economic outlook depends very much upon how inflation and the monetary policy scene unfolds.

The pandemic has triggered rather unique supply disruptions that has distorted the inflation indicators and has made markets extremely uncomfortable about the possibility of inflation escalating out of control.

Indeed, both the Consumer Price Index (CPI) and Producer Price Index (PPI) recently recorded steep increases, with April’s CPI rising 0.8% from March and 4.2% year on year, and the PPI increasing 0.6% from March and 6.2% y/y.

Currently, the Fed seems steadfast in its view that the recent bout of inflation is transitory. Thus, the Fed still plans to keep interest rates near zero to support the economic recovery and to reduce unemployment from its current 6.1% level.

Indeed, there is little risk of a repeat of a 1970s style of entrenched inflation. This view is also obviously shared in the financial markets, since longer-term bond yields have been declining, despite the recent spike in inflation.

All of this suggests that the US economic outlook is rather solid and will continue to be supported by policymakers well into next year.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Almost any situation can be shown to be much better than another situation was if that reference situation was selected to be awful enough. That is what I see with all of the comparisons. How about actual numbers, not ratios? If hare prices dropped to half of the previous days value, and then the next day returnd to the higer value, That is a huge increase from the day before but no actual increase.