The Trending Fed

MARKETS, ECONOMIES & INSTITUTIONS ALL TREND

Everyone has heard the adage that “the trend is your friend.” It always amazes me how, despite the historical evidence supporting this principle, human nature requires that we embark on a never-ending quest to pick tops – to find divergences and indicators that support the notion that the trend is “about to change.” This speaks to two elements of human nature, I think. One, we are risk-averse, and the fear of losing money or “buying the top” drives investment strategy. And two, humanity has an inherent need to be “right” – to be the prognosticator that “called the top.” Those that have successfully called a top (even if they have spent their entire career calling a top) can typically monetize that call from an investor base that is fundamentally scared. As markets in the U.S. probe all-time highs investors should keep this in mind because typical “crash” and “top” rhetoric will accompany higher equity prices, as they always do.

Instead of picking tops, a more constructive approach for investors is to ask themselves why markets, the economy, institutions, politics, and even ideologies trend – because they all do. This speaks to another core tenet of human nature, social interaction. Trends have always been a medium by which people interact with each other, driven by a multitude of human emotion – fear, greed, popularity, the need to be part of a group etc. In general, human progression is highly cyclical, undulating between innovation, adoption, competition, and ultimately repudiation. Obviously, different eco-systems have their own peculiar time-tables and motivators, but they all have elements of this cyclicality.

The economy and markets are no different, and unlike many eco-systems, they can be leveraged, and are highly measurable. Early innovators in a market trend are usually the only ones that have capital to deploy. They see value after the proliferation of forced-selling and margin calls that always accompany market devastation. These innovators have both the capital and the foresight to act against the crowd, which is often broke and scared. Early adopters of the trend are next, followed by the mainstream, and ultimately the laggards – a cohort that is notorious for “buying tops.” The irony with laggards is that it is often the fear of buying a top that prevents their adoption of a trend, until it is too late.

The inherent difficulty of “picking tops” exists because all trends are different, with different adoption rates. But one thing to consider, as we embark on the longest expansion and bull market on record, is that size matters, and here I will make a simple physics analogy. In Newtonian mechanics, momentum is equal to mass times velocity. As the U.S. economy continues to grow it will take longer to both stimulate and slow-down via monetary and fiscal policy. The larger and faster the train, the less effective its brake system will be. Similarly, re-starting that train will require even more additional force. Nobody knows when this expansion will end but analyzing it in terms of duration is a flawed approach. It has lasted longer than any other, and for good reason, stimulus took longer to “restart the train” and tightening will likely take longer to slow it down.

THE TRENDING FED

One of my investing tenets is to assume that the Federal Reserve is behind the curve. My reasoning is twofold. One, the Federal Reserve is not in the business of formulating monetary policy based on the unknown. They review what has occurred rather than what will occur. As a result, their playbook is largely predicated on coincident and lagging indicators. Two – and this speaks to the nature of trends – when the economy is improving (or weakening) and policy is based on coincident data, the Fed will always be at least one step behind. This is not their fault. I think that it is the best system possible in an uncertain world. Basing monetary policy on projected outcomes would make the Fed no better than your typical sell-side analyst and increase the likelihood of policy mistakes. Chatter from the likes of Raphael Bostic (and others) insinuating the Fed should adjust policy to prevent yield curve inversion is troublesome. It lies outside of their dual mandate, and in effect, is a policy more designed to manage asset prices than the economy. Even if curve inversion is a reliable indicator of recession, they need to move away from the notion that recessions are entirely bad (the opposite is true), and that the Fed can prevent them.

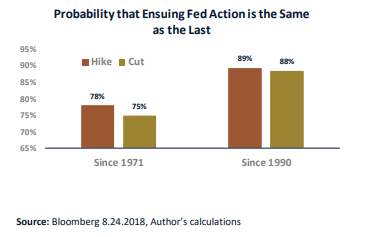

We know that the economy and markets trend. And we know the Fed is typically behind the curve. As a result, we should expect that Fed action should also trend. The below chart shows the probability that the next actionable Fed move in the Federal Funds rate will mirror the last.

Since 1991, the Federal Reserve’s next actionable change to the Federal Funds Rate after a hike, has been another hike 78% of the time. Since 1990, the probability spikes to 89%. Rate cuts follow a similar pattern. The spike in probabilities is likely related to what I mentioned earlier – larger economies trend for longer, and as a result, so does Fed policy.

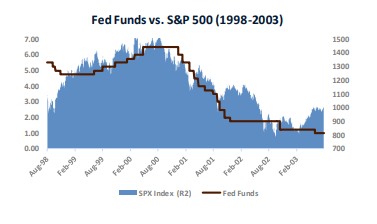

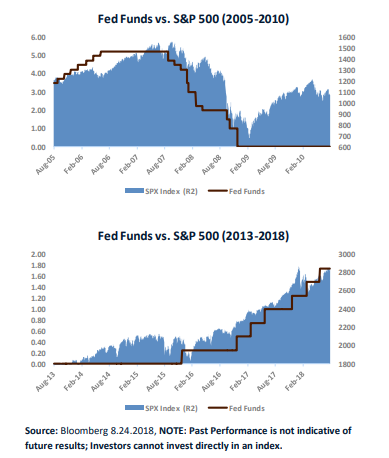

The following two charts show the Federal Funds Rate and the S&P 500 leading up to and during the last two recessions. The third chart shows the same series over the last five years.

The purpose of these charts is to illustrate the trending nature of markets and Fed policy. Caution should be taken here – correlation is not causation. There are additional variables that are moving these series in tandem, namely the economy and earnings -- and the two are inextricably linked. The point here is that a change in Fed policy is very likely related to a change in economic and earnings trends. And those trends, in a large economy, are likely to persist for an extended period. Investors should opt to respond quickly to trend changes, rather than getting whipsawed by picking tops. And although a rate cut does not guarantee a change in economic trend, it is certainly a glaring warning sign. Like any data series, there have been false positives. For example, in the late 90’s, due to the Emerging Market Crisis and LongTerm Capital Management, the Fed cut rates and then quickly resumed their hiking program. Following trend changes in Fed policy also means you will not sell “the top.” In 2001, on the day of the first rate cut, the S&P 500 was 13% off the highs. In 2007, it was 5% off the highs. But it would have limited the carnage that was to come. Just remember, a Fed rate cut is not bullish for risk-assets, especially if it marks a change in trend.

THERE ARE NO PERFECT LEADING INDICATORS – ONLY WARNING SIGNS.

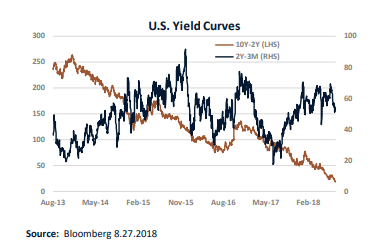

Investors who wait for all economic data and leading indicators to flash “red” will have waited too long. When everybody knows that the state of the economy is dire, it is already priced-in. It is the investors’ responsibility to follow those leading indicators they deem important – and it is an art rather than a science. With all the discussion about an inverted yield curve – specifically the spread between ten and two-year yields – I opt to follow a portion of the yield curve that is often ignored. Don’t get me wrong – I still believe that the 2-10 spread is an important leading indicator, but Central Bank intervention and negative term-premiums has called some of its legitimacy into question. Meanwhile, the spread between the two-year yield and the three-month yield embodies the difference between current Fed-policy and the market’s expectation for future Fed policy. When this curve inverts, it gives a strong signal that the “Fed trend” may indeed change. As you can see in the chart below, while the 2-10 spread has been flattening for some time, the 3M-2Y spread has been relatively stable over the past five years. There is no expectation in the near-term that the Federal Reserve is going to reverse its tightening, and corroborates the notion that economic strength, and Fed trend are intact. A 2-10 inversion, accompanied by a 3M-2Y inversion will be a powerful signal that the economic winds are changing, and I, for one, will certainly take notice.

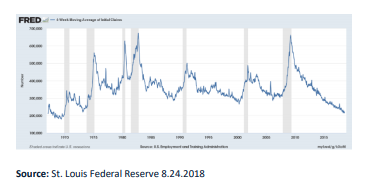

Fed trend is certainly an important indicator to follow, but there are others that can also confirm that the economic trend is changing. In late 2015 and early 2016, many leading indicators were signaling recession. Investment, capex, and industrial production were all deteriorating due to overinvestment in the energy and commodity space. We opted, at the time, to overlook these indicators, in favor of consumption-based metrics. Unemployment and Initial jobless claims continued to probe multi-decade lows, and lower commodity prices are almost never a precursor to recession – quite the opposite. The employment picture today looks very similar – unemployment is at multi-decade lows, jobless claims are probing all-time lows, and quit rates are rising. The chart below is the 4-week average of initial jobless claims. It has lost favor with pundits for no other reason than it has become boring. Nevertheless, a spike in initial jobless claims will likely accompany a trend change in the economy, like it has before every recession in the last fifty years. A spike in this series of 50k-100k would be a clear warning sign.

CONCLUSION

Trending markets and economies are not held hostage to time limits. Picking tops and recession forecasting is often a recipe for failure. However, the first rate cut by the Fed will likely NOT be the last, and it has historically indicated that the trend in the economy and earnings has changed. In this context, rate cuts by the Fed are NOT bullish for risk assets. I will continue to follow 2Y-3M steepness for signs that a trend change is imminent. If inversion is accompanied by weaker labor markets, my bullishness for the U.S. economy and risk assets will quickly wane. But right now, none of these signals are flashing red.

Disclosure: This article is distributed for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. ...

more