The Threat And Risk Of Rising Interest Rates: Separating Fact From Fiction

Introduction

The threat of rising interest rates is all the rage in financial circles today. However, the seminal question is: How real is the threat, and how much impact will rising rates have on stock prices and investor performance? This article will present my personal perspectives on interest rates and their potential impact on stock prices longer term.

Wall Street Climbs a Wall of Worry

There are many clichés in the world of Wall Street and many of them are trite.However, the best clichés often convey important and profound messages. A case in point is the old adage “Wall Street climbs a wall of worry.” The important message contained in this saying is that for the most part the market climbs.

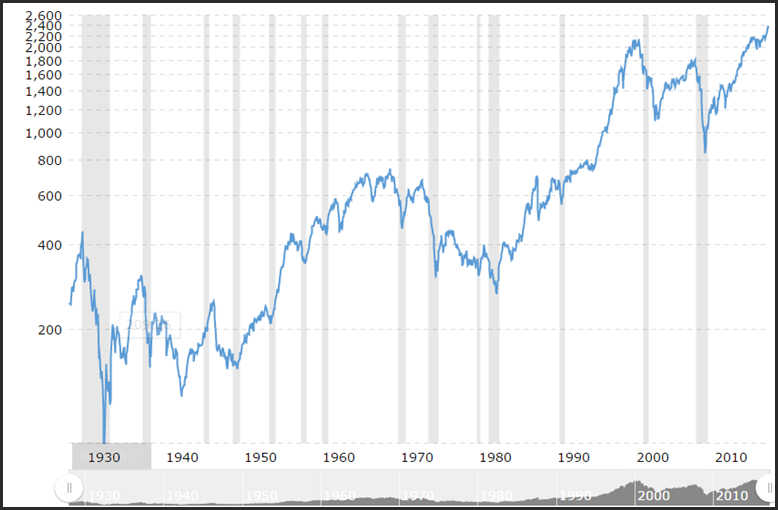

Of course, there are always exceptions. Since the mid-1920s, we have had three periods of extended price drops spanning years rather than months. The timeframe spanning the mid-1920s up to the late 1940s was a real humdinger. However, within this timeframe there were also years of strong price performance interspersed. Another bear market spans the market peak in the mid-1960s which ended after the recession in the mid-1980s. And finally, the so-called “lost decade” that followed the peak of prices in calendar year 2000. Otherwise, the general direction of the stock market has been up. The following graph courtesy of Macrotrends illustrates the above:

S&P 500 Index – 90 Year Historical Chart

But with that said, the primary focus of this article is to address what the market worries about. In truth, there is always something that engenders worry in the minds of investors. If the market is behaving well as it has in recent years, investors worry that the end is near. When the market is behaving badly, investors worry that Armageddon is upon us. In truth, things are rarely as good or bad as people fear or expect.

Interest rates: Economic and Stock Value Impact

I would like to start my discussion about the impact of interest rates on our economy and stock values by pointing out an important reality. The economy does not work like a light switch. In other words, economic activity does not respond instantly to interest rate changes or political policy. It takes time for any widespread economic impact to occur or be felt. On the other hand, investor psychology can be instantaneous or at least more immediate. Consequently, I believe it’s important to make a distinction between long-term impacts versus short-term reactions.

Perhaps of equal importance is the understanding that interest rates are but one factor among many that can have an impact on stock prices in general, and even more importantly, on the prospects and fortunes of any individual company or stock. Therefore, I believe it is erroneous to think that stock prices and values are directly correlated to the level of interest rates. In truth, they can be a factor, and under certain circumstances – a major factor. However, there are many other factors that are also at play. As I will elaborate on later, the relative valuation at the time when interest rates change can either negate or accentuate the effect of a rate change.

Interest Rates and Stock Valuations: An Inverse Relationship?

When I was young, I bought into the notion that there was an inverse relationship between interest rates and stock valuations. The logic was straightforward, and it seemed to make sense. When interest rates are high, bonds and other fixed income instruments are more competitive against stocks. Conversely, when interest rates are low stocks, especially dividend paying stocks, are more competitive versus fixed income.

I have always found that the best lessons can be learned with evaluating extreme situations. For example, and to illustrate this more clearly, all we have to do is think back to September of 1981 (at peak interest rates) when the yield on the 10 year Treasury was 15.84%. From 1968 to the peak in 1981, interest on the 10 year Treasury increased from 6.16% to 15.84%. This coincided almost perfectly with the S&P 500 falling from 712.69 on December, 1968 to 351.04 by December, 1982.

This was approximately a protracted 50% decline in stock prices over this 14 year time period. Therefore, the inverse relationship between stock values and interest rates was perfectly in sync. Steadily rising interest rates drove stock prices steadily lower for almost a decade and a half. As an aside, I entered the business in 1970 and consequently experienced the stock value versus interest rate relationship firsthand.

As an additional side, during this time I was also in the early stages of developing the F.A.S.T. Graphs™ fundamentals analyzer software tool for my own personal research and due diligence. Since the inverse relationship between interest rates and stock values was functioning as theory suggested, I thought it would be wise to create a graph that measured stock valuations (P/E ratios) versus interest rates on the 10 year Treasury. Therefore, I could examine and measure the impact of interest rates on stock valuations into my analysis and due diligence process.

This real world experience with this relationship over my first decade in the industry convinced me that there truly was an inverse relationship between stock values and interest rates. Furthermore, my P/E and Interest Rates graph provided prima facie evidence that the theory was sound. In addition to the timeframes mentioned above, the inverse relationship between interest rates and stock prices stayed true to form from 1980 through 2000. During this period of time, interest rates steadily declined and conversely, stock prices and P/E ratios as measured by the S&P 500 steadily rose. All was right with the universe.

However, the validity of the interest rate versus stock value theory has been greatly tested from calendar year 2000 to current time. Interest rates continued to fall to historically low extremes and P/E ratios followed suit. Consequently, the inverse theory between rates and stock values no longer was working over this timeframe. How could it be that stock valuations (S&P 500 P/E ratios) and interest rates (10 year Treasury rates) moved down in almost perfect lockstep since calendar year 2000?

It did not take me long to find the answer. Just as interest rates had reached extreme levels in the early 1980s, stock valuations reached extreme levels that peaked by calendar year 2000. Therefore, the answer was clear. The theoretical inverse relationship between stock valuations and interest rates was -and still is – real. However, as previously stated, there are also many other factors that come into play. Simply stated, extreme valuation trumped the benefit of falling interest rates. In other words, even though interest rates were dropping, the headwinds of overvaluation diluted the effect. Next, I will introduce and discuss several of these other factors that can influence stock returns.

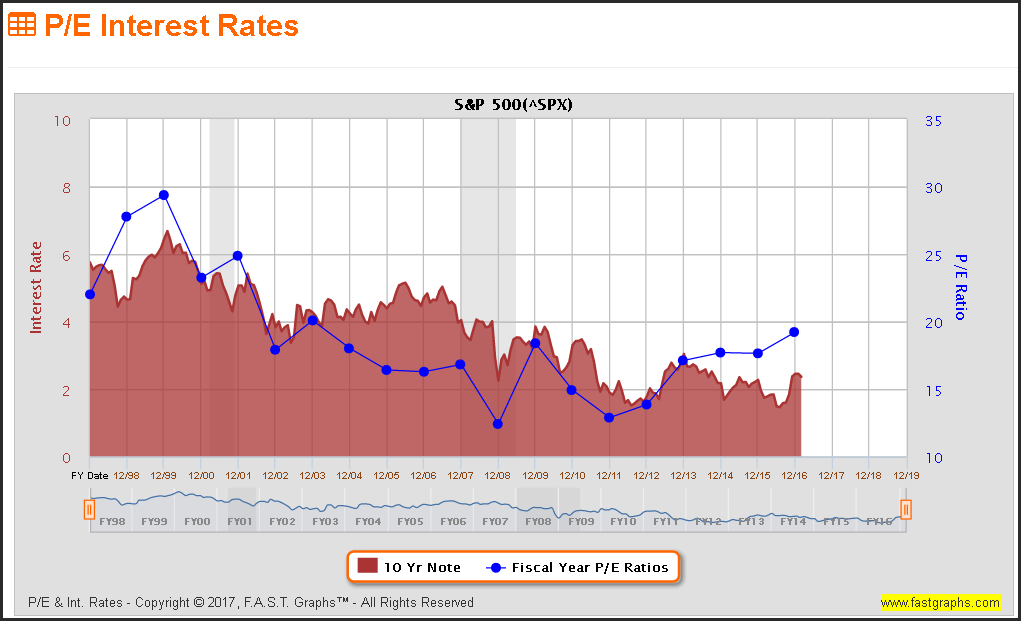

P/E Ratios and Interest Rates

The following graph correlates historical year-end P/E ratios (the dark blue line) of the S&P 500 with the historical yields of the 10 year Treasury (the red line and shaded area). As you can see, the P/E ratio of the S&P 500 steadily declined from its peak of 29.37 at year-end 1999 to its low of 12.41 by year-end 2008, the throes of the Great Depression. This occurred during the same time when the yield of the 10 year Treasury went from 6.45% by year-end 1999 to a low of 2.25% by year-end 2008.

During this timeframe, stock valuations (P/E ratios) and interest rates both declined simultaneously. Under the theory described above, P/E ratios should have been increasing as interest rates fell. As I will illustrate with the next graphic, the headwinds of extreme stock valuations were the cause. However, the expected relationship seems to be gaining traction post 2008 as P/E ratios have increased and interest rates continued to move lower.

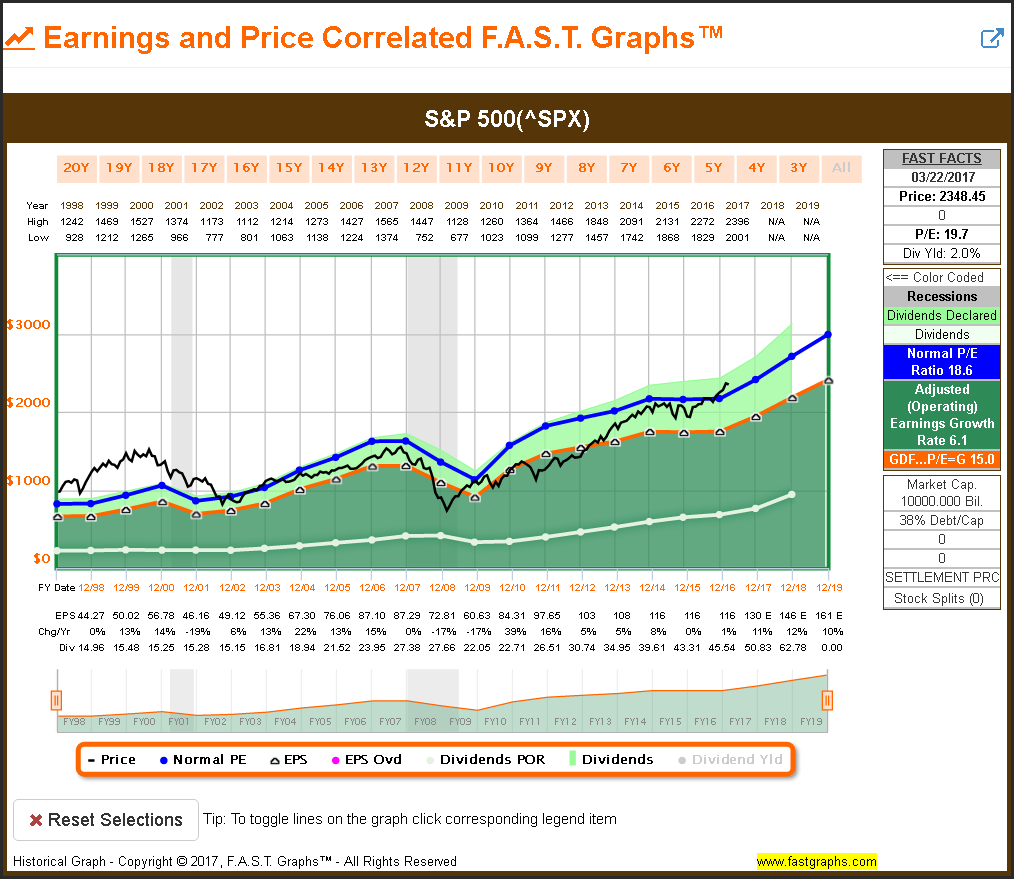

The earnings and price correlated graph of the S&P 500 below provides insights into some of the other factors affecting stock values referenced above. For starters, note extreme overvaluation from 1998 to 2000 when the S&P 500 stock price was significantly above the orange fair valuation reference line. Consequently, stock prices – and with them the P/E ratio of the S&P 500 – declined as a result.

Additionally, the other factor that should be considered in this analysis is the growth of earnings that transpired during that timeframe. Therefore, once stock prices became more in alignment with fair value, long-term growth of earnings generated positive shareholder returns in spite of lower P/E ratios for the S&P 500. Furthermore, we also see the effects of falling earnings during the Great Recession driving stock prices temporarily lower.

Johnson & Johnson (JNJ )

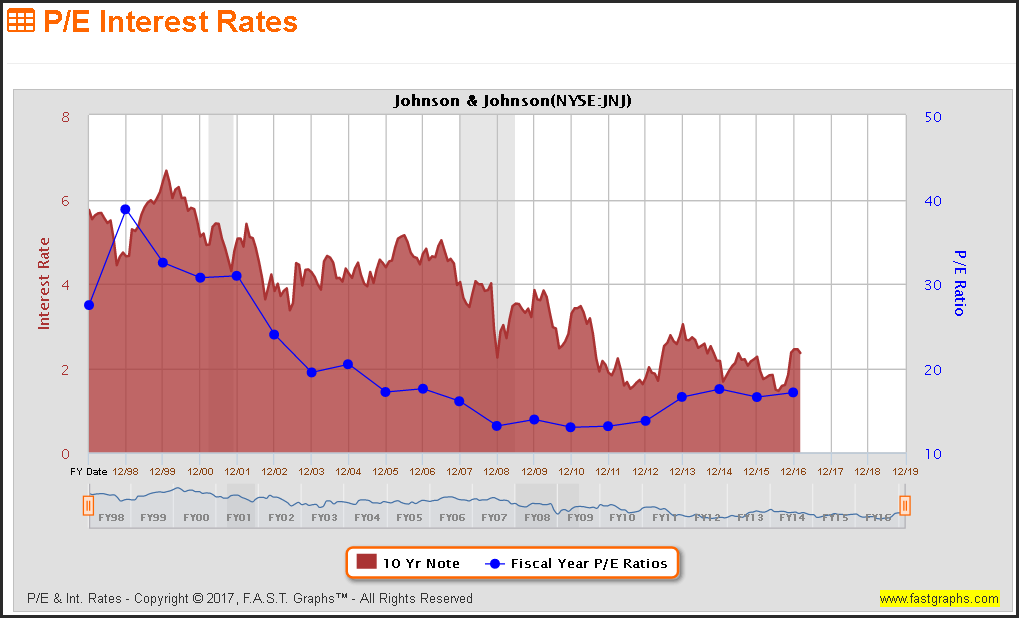

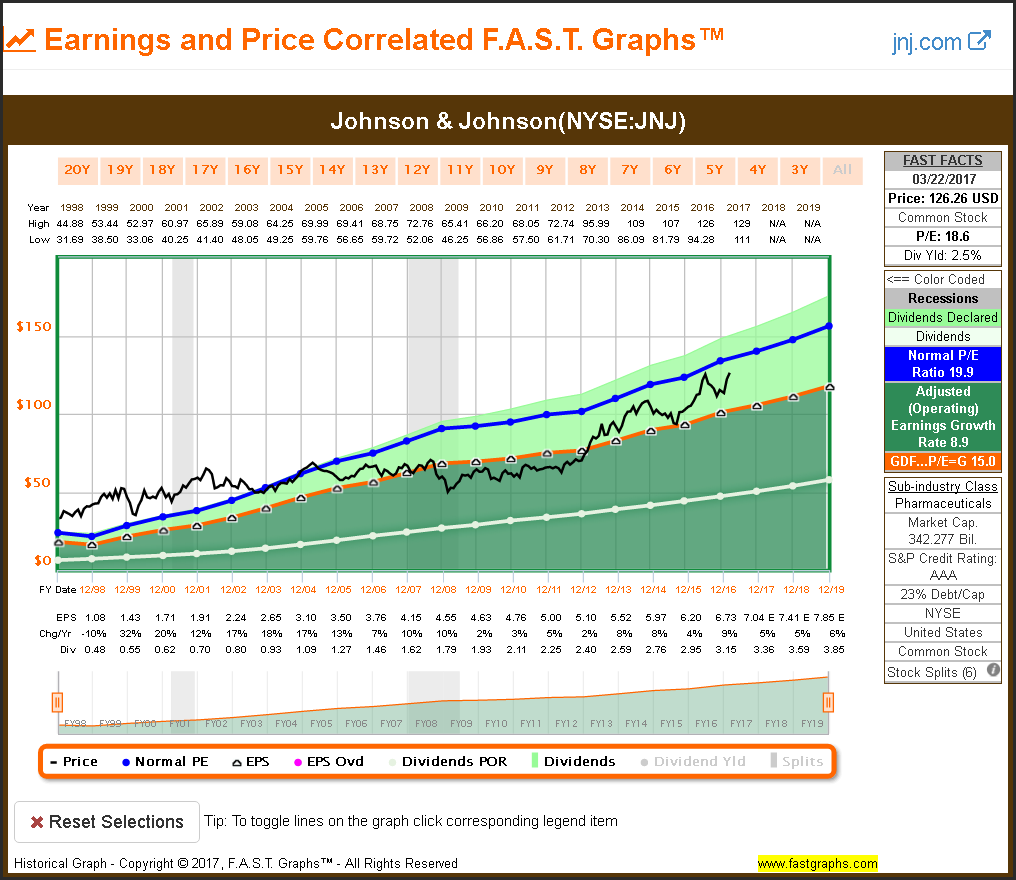

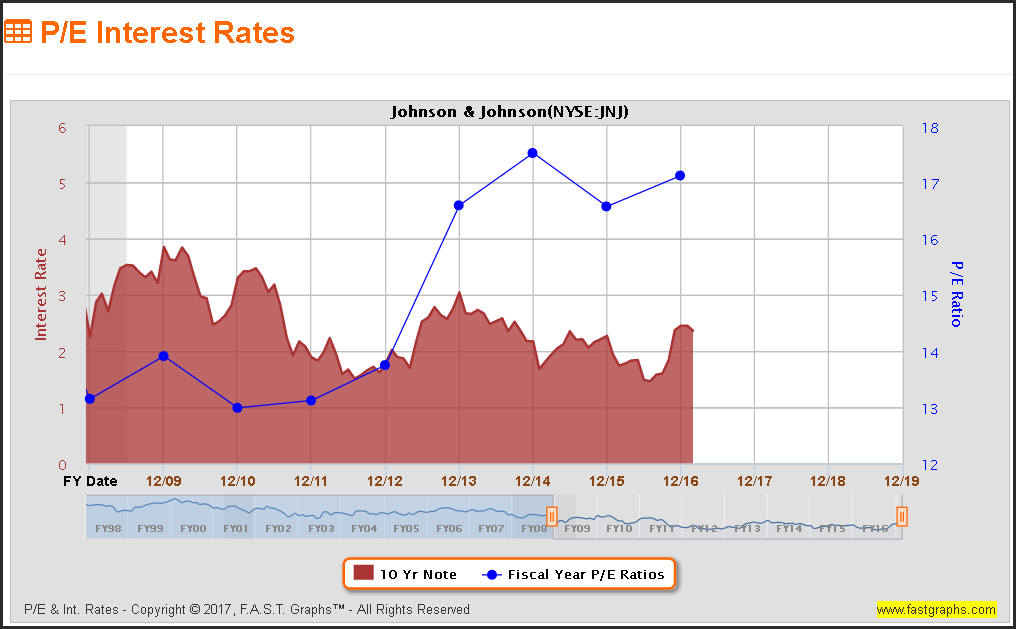

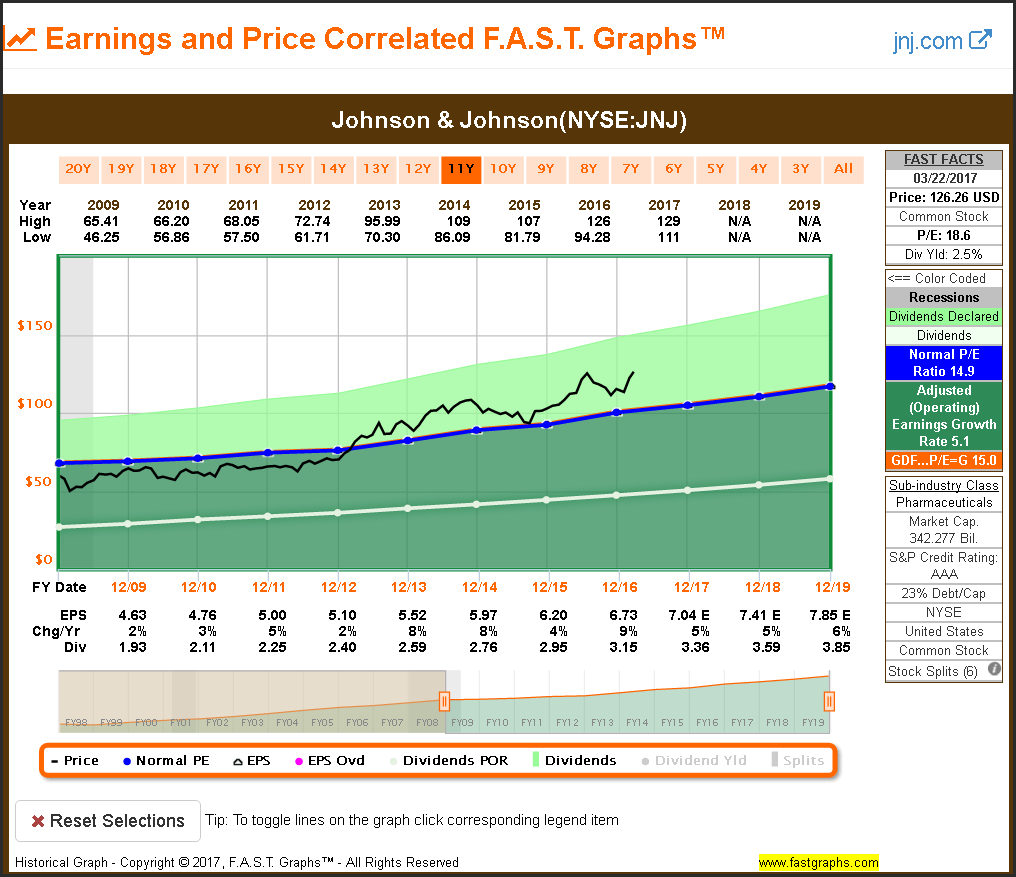

Although the factors that drive returns and affect stock valuations are interesting and useful to evaluate by looking at the overall market, I believe they are more pertinent when evaluating individual stocks. The following P/E ratio versus interest rates graph on Johnson & Johnson illustrates a similar relationship of falling stock valuations in conjunction with declining interest rates. As I will illustrate next, high valuation was once again the headwind that defied logic.

Just as we saw with the S&P 500, Johnson & Johnson was also overvalued in 2000 and stayed that way until 2007. However, the big difference between Johnson & Johnson and the S&P 500 is that Johnson & Johnson’s earnings grew much more consistently over this historical timeframe. It is important to note that Johnson & Johnson’s stock price reverted to the mean of fair value (touched the orange line) in the early spring of 2007 and then became undervalued in 2009.

In economic theory they have an important qualifying phrase “Ceteris Paribas” which loosely translates to all things being equal. What this suggests is that economic theory will typically work as planned as long as all other factors are within normal ranges. Consequently, when you examine the P/E ratio versus interest rates graph on Johnson & Johnson since the beginning of 2009, you discover that the theory of the inverse relationship is intact. As interest rates continued to fall, the P/E ratio of Johnson & Johnson -and with it its stock price – increased in contrast. All was well with the universe once again.

When we review the earnings and price relationship of Johnson & Johnson over this same timeframe, additional insights are revealed. Here we might be safe in assuming that interest rates played a role in Johnson & Johnson’s increasing P/E multiple. On the other hand, we cannot deny the role that undervaluation coupled with steadily increasing earnings (and dividend growth) played. Interest rates are an important factor, but they are just one among many important factors that drive stock prices.

Additional Individual Stock Examples

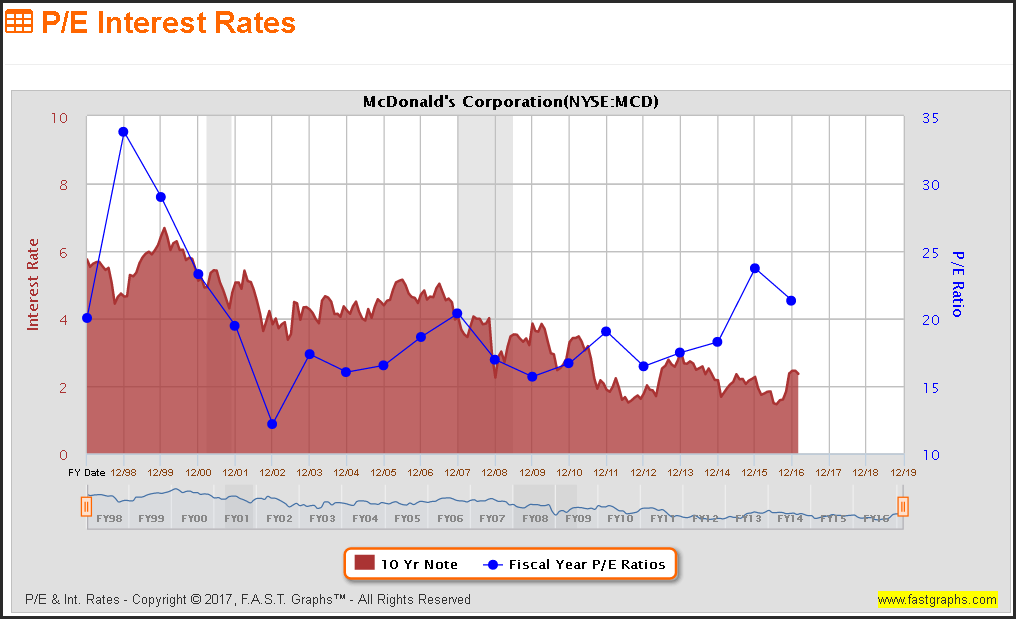

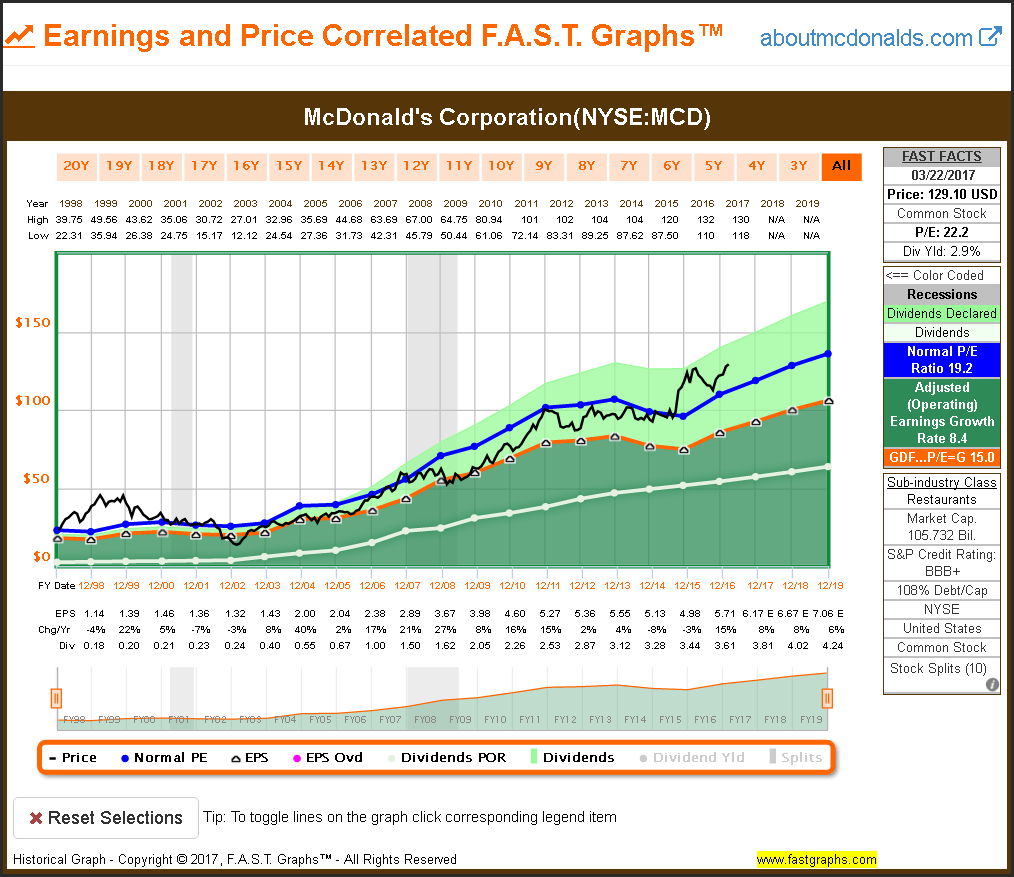

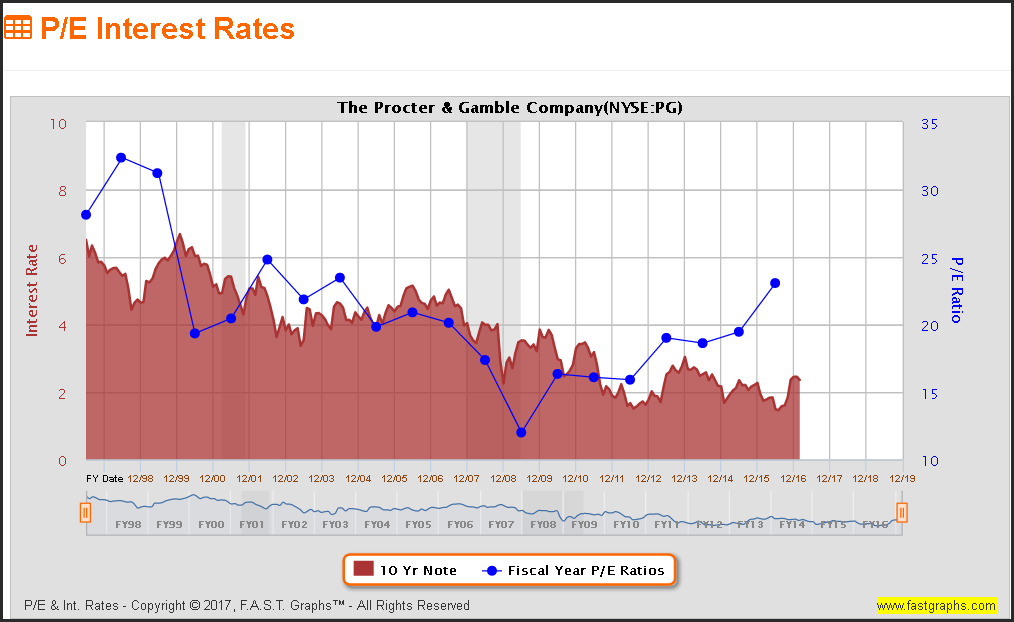

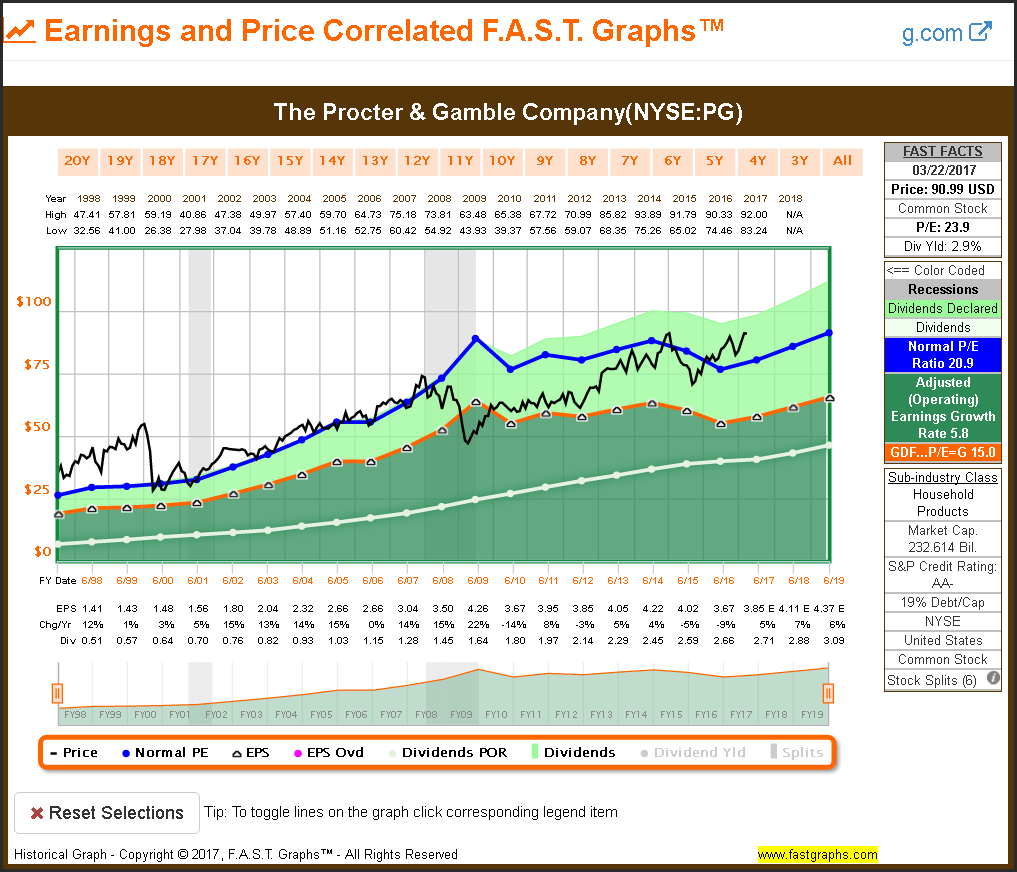

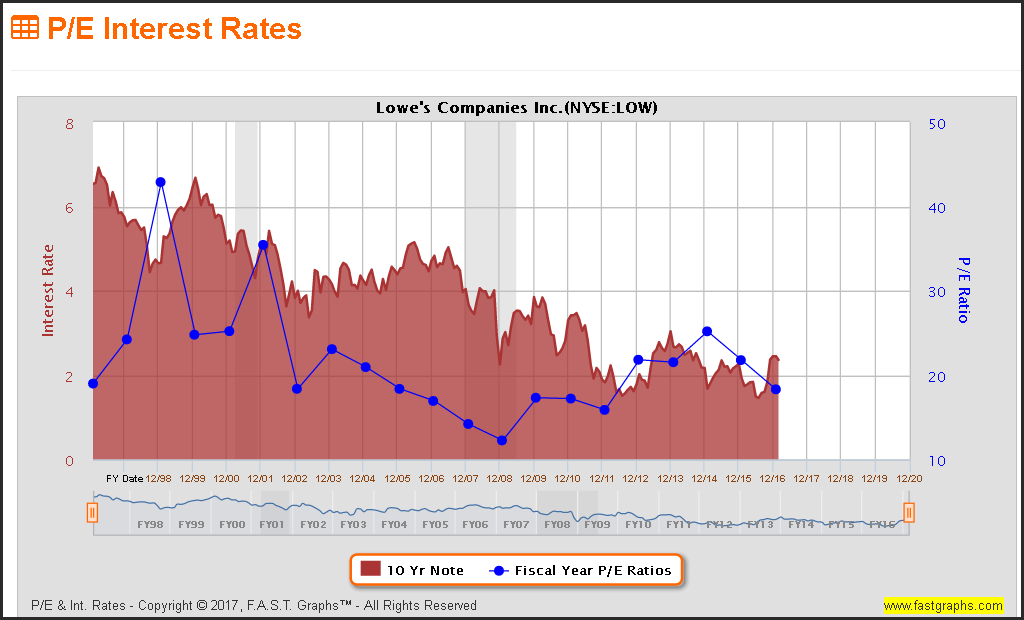

For additional insight, I offer several additional examples of blue-chip Dividend Aristocrats to illustrate that the relationship between interest rates and P/E ratios is not always neat and tidy. As you evaluate each of the examples, take note of the differences in operating results and historical valuations on each. Interest rates do play a role in every case. However, there are other factors that also come into play and at times can be the dominant factors.

Valuation levels are the critical element to be aware of. The reason I bring this up is because low interest rates have contributed to a high level of demand for blue-chip dividend paying stocks. Consequently, valuations on most of the best-of-breed dividend growth stocks have become historically high as illustrated in the examples below. Moreover, the moral of the story is that these overvalued Aristocrats might be the most sensitive to rising rates if they do manifest in the future.

McDonald’s Corporation (MCD)

The Procter & Gamble Company (PG )

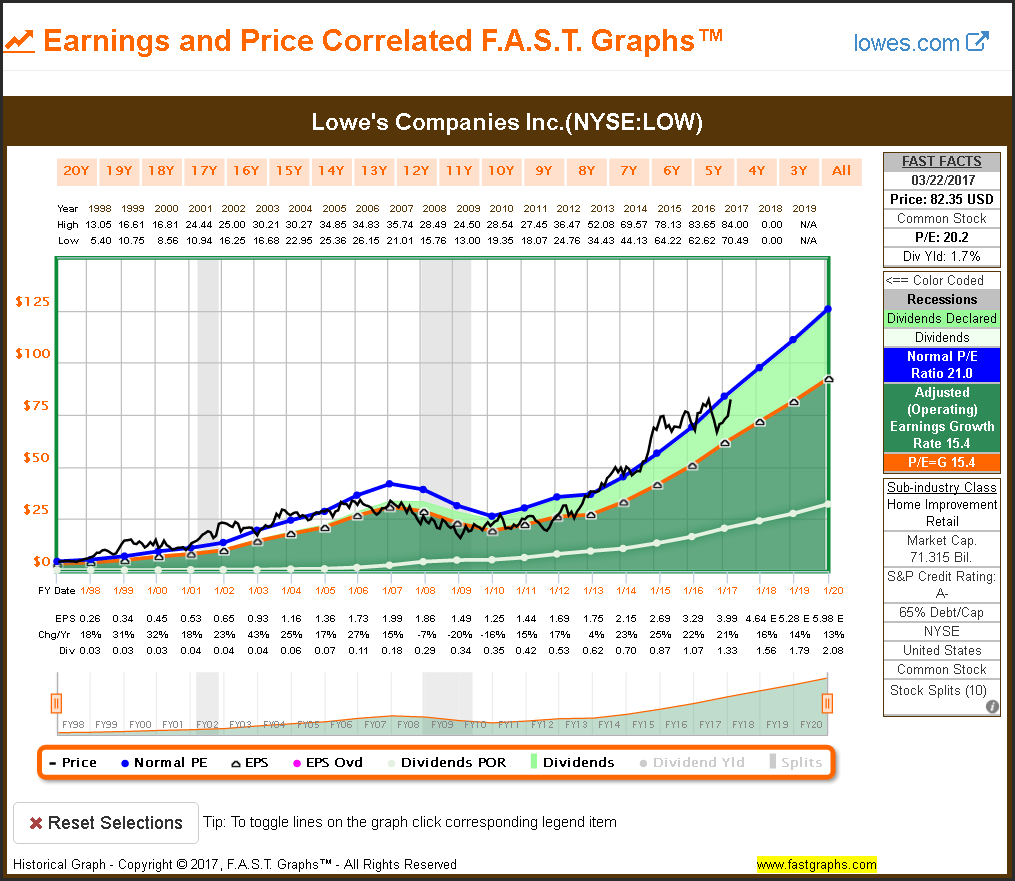

Lowe’s Companies Inc (LOW)

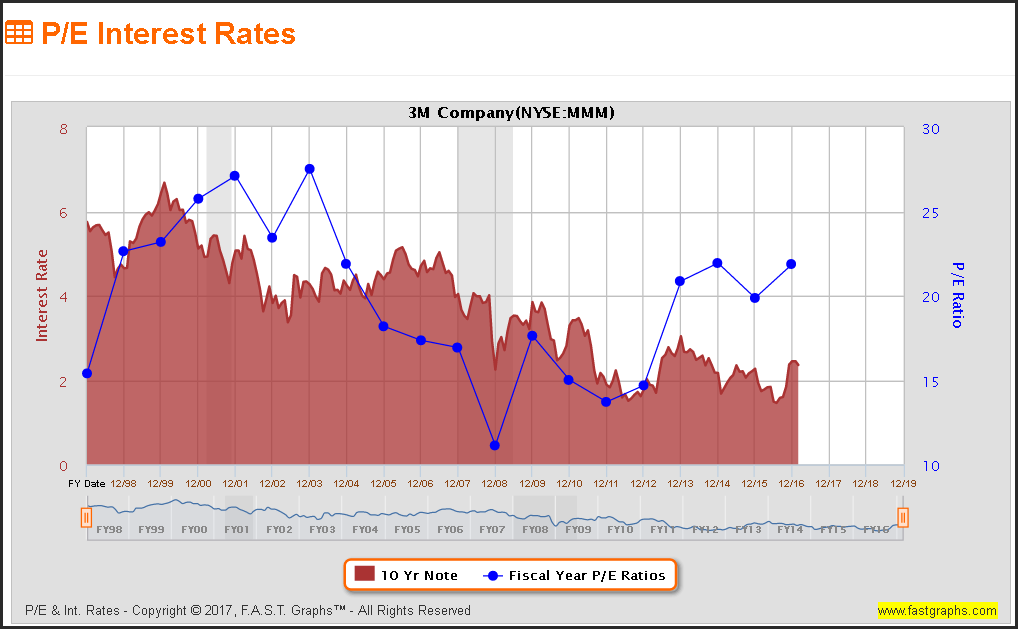

3M Company (MMM)

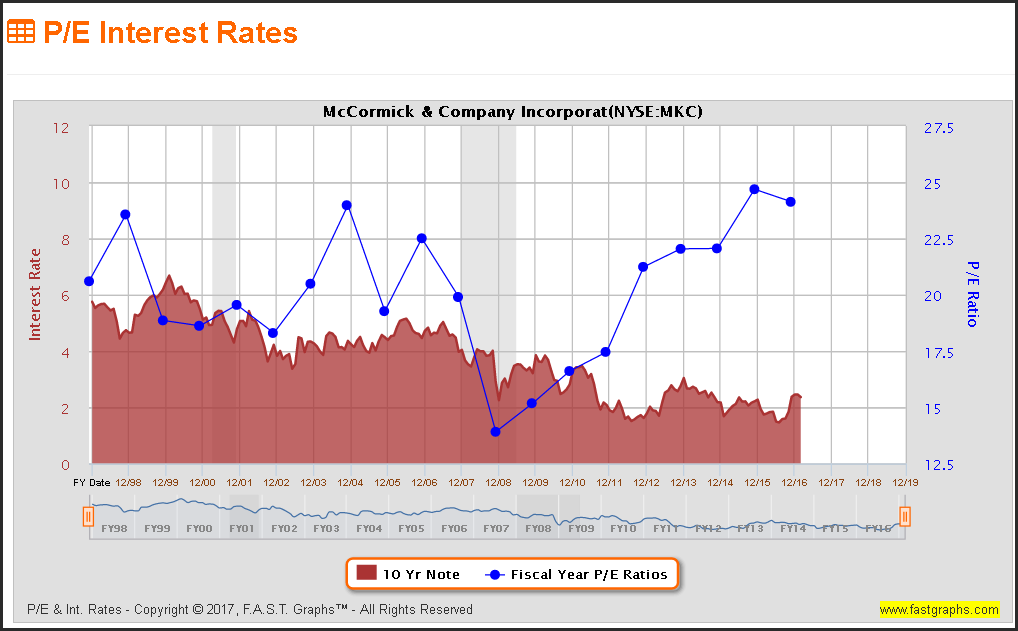

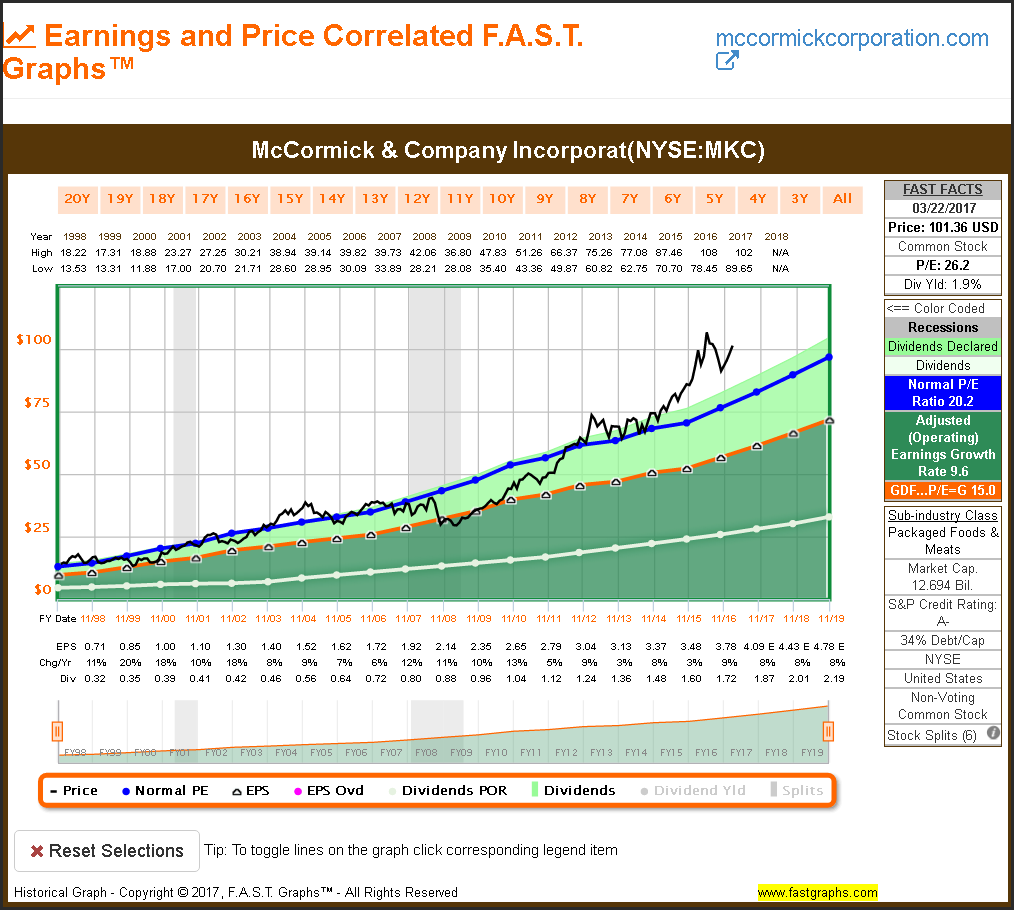

McCormick & Company Incorporated (MKC)

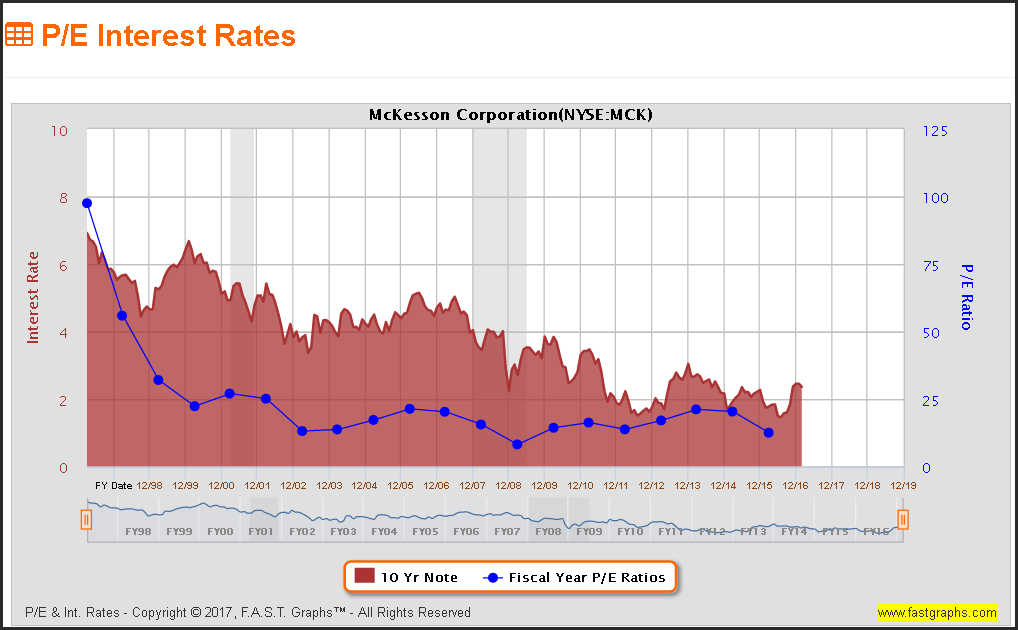

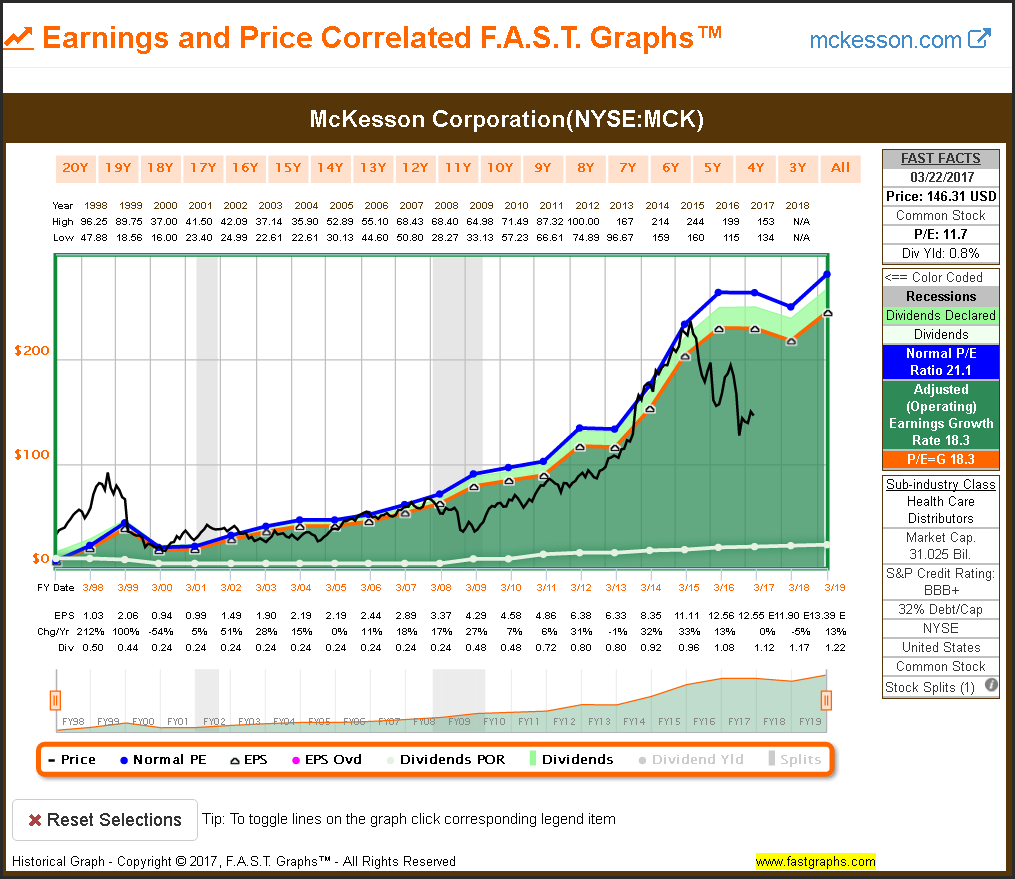

McKesson Corporation (MCK)

All of my previous examples were Dividend Aristocrats that appear currently overvalued. However, this last example presents a company in the healthcare sector that appears undervalued. The healthcare sector is generally an out-of-favor sector currently. Therefore, this illustrates another factor that comes into play. It is a market of stocks not a stock market. Moreover, generalities can provide some utility and insight. However, a deeper analysis of specific companies you might be considering is more relevant than relying on generalities. There are undervalued stocks in today’s generally overvalued market.

Summary and Conclusions

To summarize, interest rates can be an important factor that must be considered when making valuation decisions about the stocks in your portfolios. However, the level of interest rates and where they might go in the future are not the only factors that should be considered. Stock analysis and investing are much more complex than simply focusing on a single metric. Therefore, I believe that investors are best served by considering all the factors that comprise the valuation levels of their portfolios.

With that said, I believe rising interest rates, if and when they do occur, could be a critically important factor to consider, especially if the stocks in your portfolio are trading at excessive valuations. On the other hand, if your portfolio is comprised of attractively-valued stocks, I would not let the fear of a rising interest rate environment deter you. In order to add additional perspective, I offer two of my favorite Warren Buffett quotes. This first one addresses interest rates specifically, as well as other factors that Warren tends to ignore.

“If we find a company we like, the level of the market will not really impact our decisions. We will decide company by company. We spend essentially no time thinking about macroeconomic factors. In other words, if somebody handed us a prediction by the most revered intellectual on the subject, with figures for unemployment or interest rates, or whatever it might be for the next two years, we would not pay any attention to it. We simply try to focus on businesses that we think we understand and where we like the price and management.” Warren Buffett

This next quote was written in 1994. However, I believe the underlying principles remain relevant today, and I believe this quote speaks volumes about what I was attempting to convey with this article.

“We will continue to ignore political and economic forecasts which are an expensive distraction for many investors and businessmen. Thirty years ago, no one could have foreseen the huge expansion of the Vietnam War, wage and price controls, two oil shocks, the resignation of a president, the dissolution of the Soviet Union, a one day drop in the Dow of 508 points, or treasury bill yields fluctuating between 2.8% and 17.4%. But surprise – none of these blockbuster events made even the slightest dent in Ben Graham’s investment principles. Nor did they render unsound the negotiated purchases of fine businesses at sensible prices. Imagine the cost to us, if we had let a fear of unknowns cause us to defer or alter the deployment of capital. Indeed, we have usually made our best purchases when apprehensions about some macro event were at a peak. Fear is the foe of the faddist, but the friend of the fundamentalist.” Warren Buffett, Berkshire Hathaway 1994 Annual Report

In closing, I believe that investors are wise to consider all factors before making important investment decisions. Considering the high valuations of many blue-chip dividend paying stocks today, the impact of potentially rising interest rates should not go unnoticed. However, I believe it is a mistake to believe that any one factor, whether it be interest rates or political environments or any other, should be allowed to dominate your thinking. I believe in building portfolios one stock at a time. But most importantly, I believe that evaluating the specific merits of each individual holding is significantly more important than worrying about generalities. Ceteris Paribus.

Disclosure: Long PG, MCD, MCK, JNJ

Disclaimer: The opinions in this document are for informational and educational purposes only and should ...

more

Chuck:

Thanks for your interesting piece. Just a couple of points I would mention:

1. Many have noted that P/E ratios are getting high relative to historic P/E. I would mention that the US has been the place for the world to invest. And this upward shift in demand will increase the "P" in the P/E ratio. So perhaps we should expect a higher P/E ratio going forward for US stock markets.

2. I am wondering how effective the Fed can really be in raising US interest rates. There is a healthy demand now for US Federal debt, and higher debt will certainly increase the demand for US debt.