The Tax Cut Sharply Reduced Government Revenues, Even Though Supporters Claimed No Revenue Shortfall

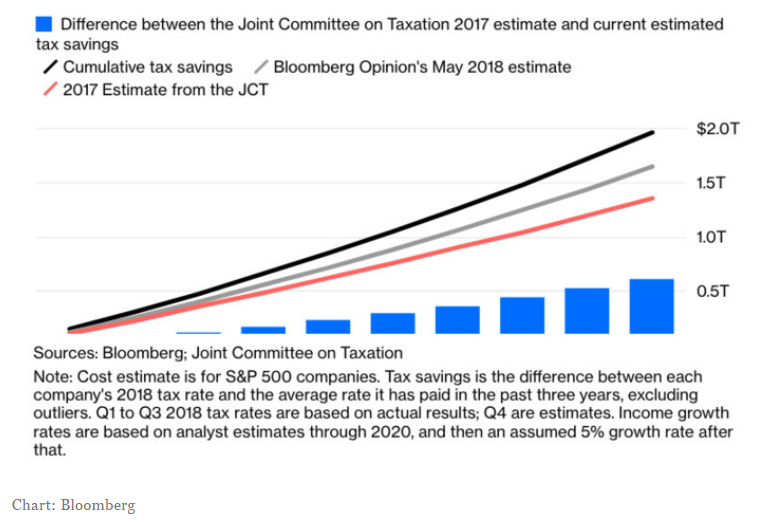

“The Joint Committee on Taxation, Congress’s official revenue forecaster, projected that the law would reduce tax receipts by $1.5 trillion over the next decade. Republicans insisted that this projection reflected “static analysis,” which failed to account for all the extra growth that would be stimulated by lower tax rates. They have spent years browbeating the committee to adopt their pet ideological assumptions, and in response to the pressure, it dutifully produced a complementary “dynamic” analysis that predicted, with the additional growth, the tax cuts would lose just $1 trillion dollars.” (Justin Fox, Bloomberg News, September 14, 2018)

“The Tax Policy Center has released distributional estimates of the conference agreement for the Tax Cuts and Jobs Act as filed on December 15, 2017. We find the bill would reduce taxes on average for all income groups in both 2018 and 2025. In general, higher income households receive larger average tax cuts as a percentage of after-tax income, with the largest cuts as a share of income going to taxpayers in the 95th to 99th percentiles of the income distribution.” (The Tax Policy Center, Analysis of the Tax Cuts and Jobs Act)

The Tax Cuts and Jobs Act was passed in December 2017 and has been in effect for about a year.

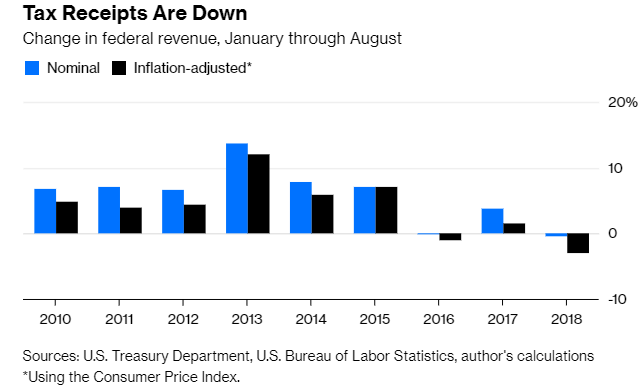

Unfortunately, as its critics had expected, the introduction of the massive tax cut was followed by a significant decrease in US federal tax receipts.

As predicted by many economists, overall tax revenues and corporate tax revenues, have declined sharply. On its own, this is a very unusual impact for an economy at full capacity and with record low unemployment.

Over the first 11 months of the fiscal year 2018, the US government has run a deficit of $895 billion, up from $674 billion during the same 11-month period from a year ago.

Although it is still quite early in the assessment game, it is nonetheless clear that the tax cut resulted in a significant increase in federal borrowing which has not been paying for itself.

The Trump administration also claimed that its economic policies would boost economic growth into the 3% to 4% range in the coming years. It is interesting to note that most forecasting groups expect the US economy to grow at a medium-term annual rate of 2% or less.

Even if growth in a fully employed economy was able to accelerate to the 3% or 4% range, it is highly doubtful that the trickle-down effect from such regressive tax policies would pay for itself.

(Click on image to enlarge)

(Click on image to enlarge)

Disclosure: None.