The SPY Is Rising In Spite Of Recession Risk: Here Is Why

Over the past several months, investors have been getting increasingly worried about the possibility of a recession, and some economic indicators are in fact providing reasons for concern. In spite of this, the SPDR S&P 500 ETF (SPY) has performed very well, and it even closed at all-time highs last week.

This can sound like a major puzzle: How can it be that stocks are rising while some highly cyclical economic indicators are moving in the wrong direction?

The key point to consider is that the stock market is a forward-looking mechanism, the contraction in manufacturing has already been priced in, and there are some reasons to believe that economic activity could start to stabilize in the medium term.

Reasons For Concern

Depending on what area of the economy you focus on, you can see a very dissimilar picture. Those sectors deeply affected by the trade war, such as manufacturing and exports, are under heavy pressure. On the other hand, economic sectors related to services, the consumer, housing, and the jobs market continue showing strength.

But a key consideration is that the U.S. economic expansion, which started in June of 2009, is already the longest one in history. In this context, everybody is wondering how much room the economy has left to run going forward. On top of this, geopolitical uncertainty is through the roof and manufacturing activity is turning down.

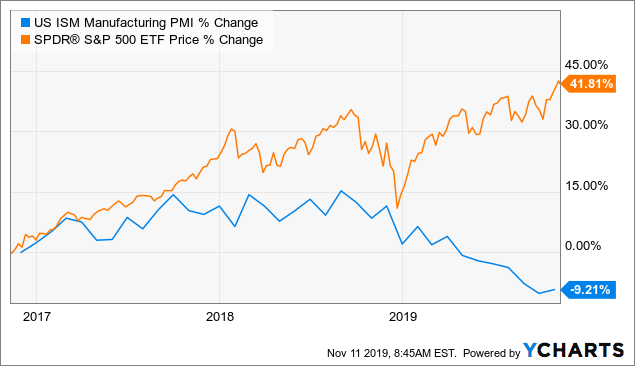

The chart below shows the percentage change in the ISM manufacturing index versus the SPDR S&P 500 in the past 3 years. Manufacturing growth and SPY tend to move in the same direction over time, but there has been a major disconnect in 2019.

Data by YCharts

So, we have the SPY at record highs, the economic expansion is the longest one in history, and manufacturing activity is turning down. It is easy to see why so many investors remain worried and even downright bearish.

Expecting The Unexpected

Broadly speaking, we could say that there are two main possible scenarios going forward. The bearish view is that the contraction in manufacturing is going to bring down the rest of the economy, and this will probably trigger a bear market in SPDR S&P 500.

The bullish view is that the stock market is acting as a leading indicator for the economy and that manufacturing activity is going to stabilize and perhaps even gain some strength in the coming months.

The future is always a matter of probabilities as opposed to certainties, and we can never know for certain how the market or the economy is going to perform. That said, monetary policy is a big piece of the puzzle that should not be ignored in this assessment.

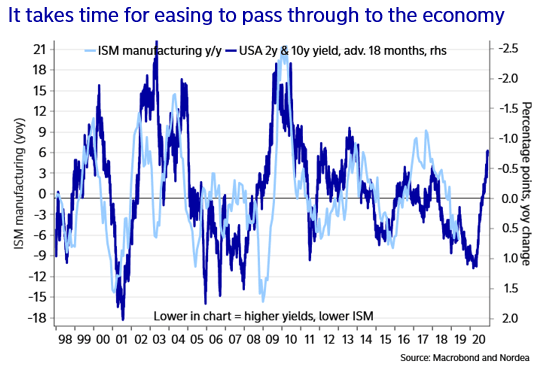

The chart below shows the evolution of the ISM index and interest rates over time. Low interest rates are a tailwind for manufacturing activity, but it takes some time for monetary easing to pass through the economy.

The Fed was too hawkish when it started raising rates in 2018, and this - in conjunction with the trade war - had a negative impact on manufacturing activity. Now the Fed has reversed its course, and this should provide a tailwind for economic activity over the medium term.

Source: Macrobond and Nordea

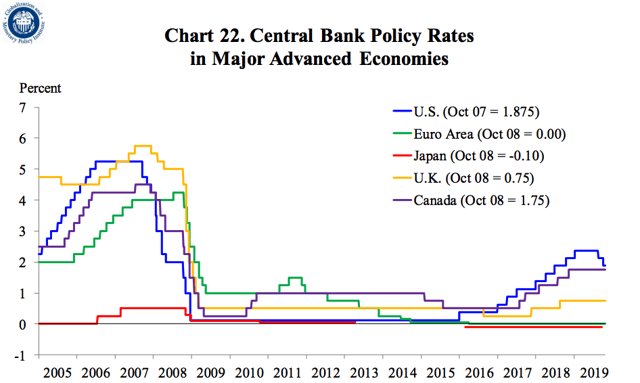

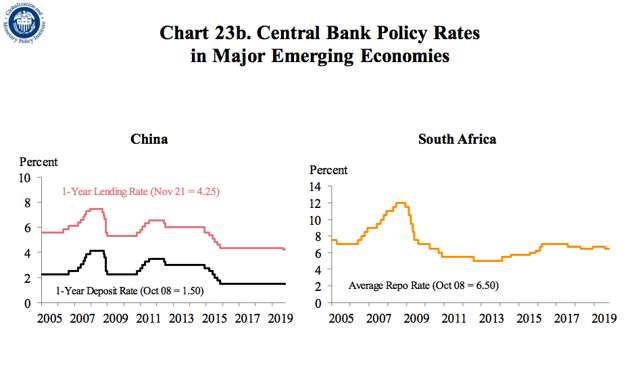

It is not just about the Fed, major central banks all over the world are moving in the same direction.

Source: Federal Reserve Bank of Dallas

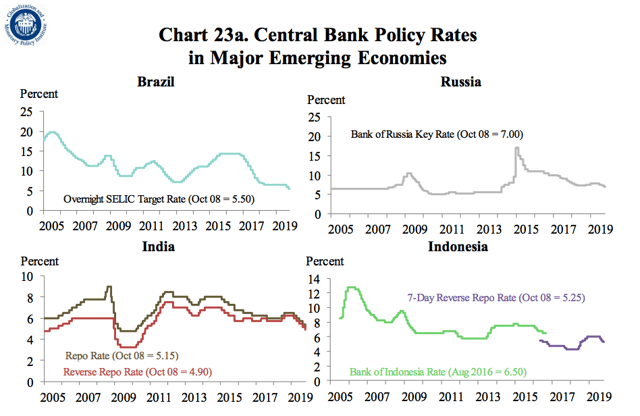

Emerging markets also being very accommodative, so we have plenty of monetary stimuli all over the world.

Source: Federal Reserve Bank of Dallas

Source: Federal Reserve Bank of Dallas

Early Signs Of Stabilization

It is one thing to have a thesis about how we could see a stabilization in manufacturing activity due to more favorable monetary conditions, and a whole different thing to see some early signs that this thesis is starting to work out as expected.

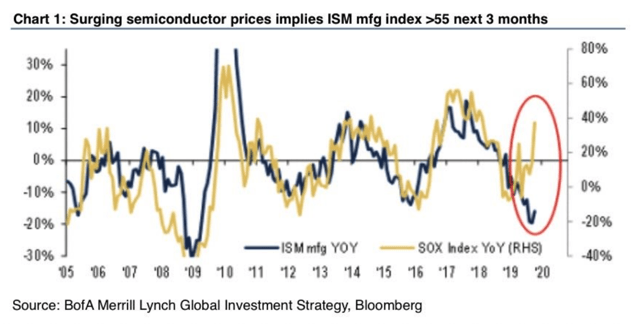

Semiconductors play a major role in the global economy nowadays, and demand for different kinds of semiconductors can say a lot about the prospects for the economy in general and the manufacturing sector in particular. Semiconductor prices have been quite strong lately, which could imply that manufacturing activity is going to rebound.

Source: MacroOps

In fact, when looking at manufacturing momentum on a global scale, the rate of change in the manufacturing PMI is starting to show some signs of improvement.

SPY Is Firing On All Cylinders

Analyzing the price action at the broad level is important, but watching what is going on under the surface can be even more relevant. Both in terms of the ETF itself and its different components, SPY is clearly looking quite solid.

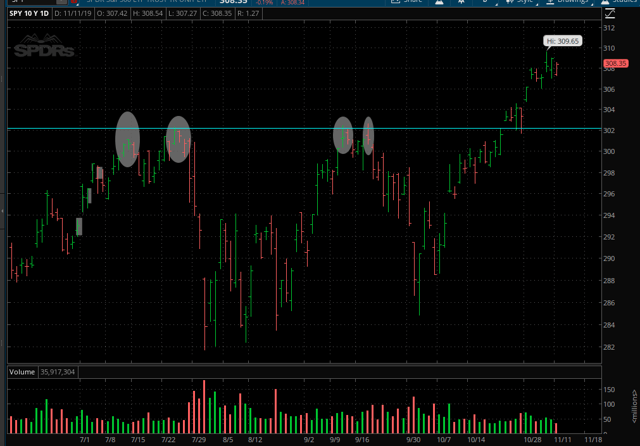

The area around $300-$303 per share has been a major resistance for the ETF over multiple months. SPY finally managed to break above such a level in the last week of October, and it has barely looked back since then.

(Click on image to enlarge)

Source TOS

With the ETF trading close to all-time highs, nobody should be surprised to see a pullback in the short term. However, as long as SPY remains above $300, the price action needs to be considered bullish until proven otherwise.

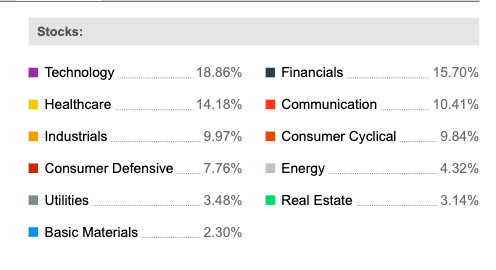

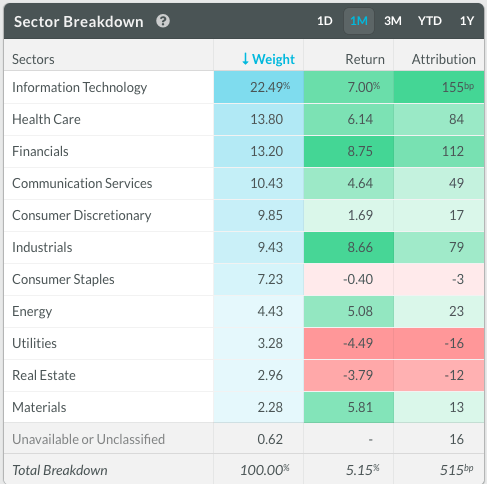

SPY replicates the S&P 500 index, so it provides exposure to large capitalization stocks in different sectors. The table shows the different sectors in the portfolio and their respective weights.

Source: Seeking Alpha Essential

The table shows the sector attribution for the SPY portfolio over the past months. In other words, it shows how much each sector weights in the portfolio, how much it returned, and how that impacted the overall return for SPY over the period.

Source: Koyfin

The bigger sectors such as technology, healthcare, and financials have delivered superior performance, so the bigger engines are carrying most of the weight. Besides, sectors such as materials and industrials are also doing well, and these sectors tend to outperform when risk appetite is rising in the market.

Conversely, the underperforming sectors are not only smaller than the outperforming sectors, but they are generally characterized as low-risk defensive sectors, such as consumer staples, utilities, and real estate.

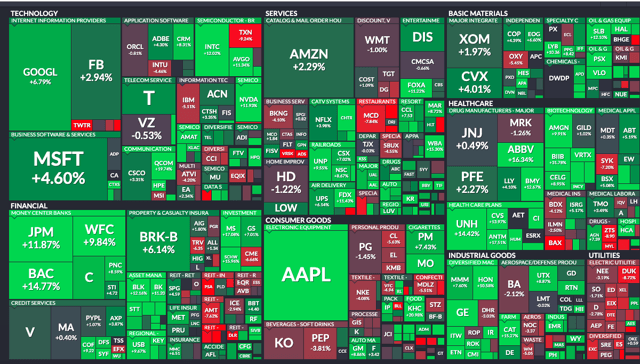

We can also see the same data at the specific company level for the SPY portfolio holdings, with the size of the square representing the weight of each of these companies. It's easy to see that there is plenty of strength among the big players in high-risk sectors, while most of the weakness is concentrated in the defensive sectors.

Source: FinViz

In other words, SPY is moving in the right direction, and it is also being pushed in that direction with broad participation among the companies in the portfolio, especially from the big names in high-risk sectors.

Moving Forward

Smart investing is not about trying to predict the future, but rather about analyzing the evidence and assessing the probabilities for different outcomes.

Most investors are concerned due to signs of slowing economic growth at times when SPY is at historical highs. However, past economic data is already well-known and incorporated into market prices.

Back in September, I published an article entitled, Recession Fears Are Creating A Buying Opportunity, which explained that all that matters is the economic data in comparison to expectations going forward, not past economic data.

From the article:

Manufacturing and exports are very important areas of the economy, but modern-day economies are enormously complex, diversified, and sophisticated, so focusing on a small group of specific data points does not paint the whole picture.

Most investors tend to get too pessimistic after the data shows signs of weakness. A low bar is relatively easy to beat, so low expectations set the stage for better than expected economic data and rising stock prices going forward.

Since then, markets have been performing well, and we could say that economic data has been better than feared. Manufacturing is still looking bad, however, when considering the impact of monetary policy and the early signs of stabilization in manufacturing activity, I would not be surprised at all to see a pickup in manufacturing activity over the coming month.

None of this changes the fact that the U.S. economic expansion is quite extended at this stage, and there are many things that could derail the economy, with the trade war and political risk being major risk factors to consider. If the evidence changes, I will change my mind, off course.

That being said, based on the evidence currently at hand, chances are that the upward move in SPDR S&P 500 still has more room to run over the medium term.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more