The Sell-Off In Equities Should Find A Bottom

Cycles warn that the sell-off in equities during the last two weeks should find a bottom this week – temporarily. The Bradley model does not hold much hope for those who hope to trade the bounce as it points an upwards-to-sideways move until mid-September when it drops precipitously into mid-October.

The Decennial pattern warns of a nasty sell-off in equities during years ending in the number 7 (i.e. 2017).Since 1907 each of these years (with the exception of 1947 which suffered a mere 6.2% drop) has seen a double-digit decline beginning somewhere between June and October.

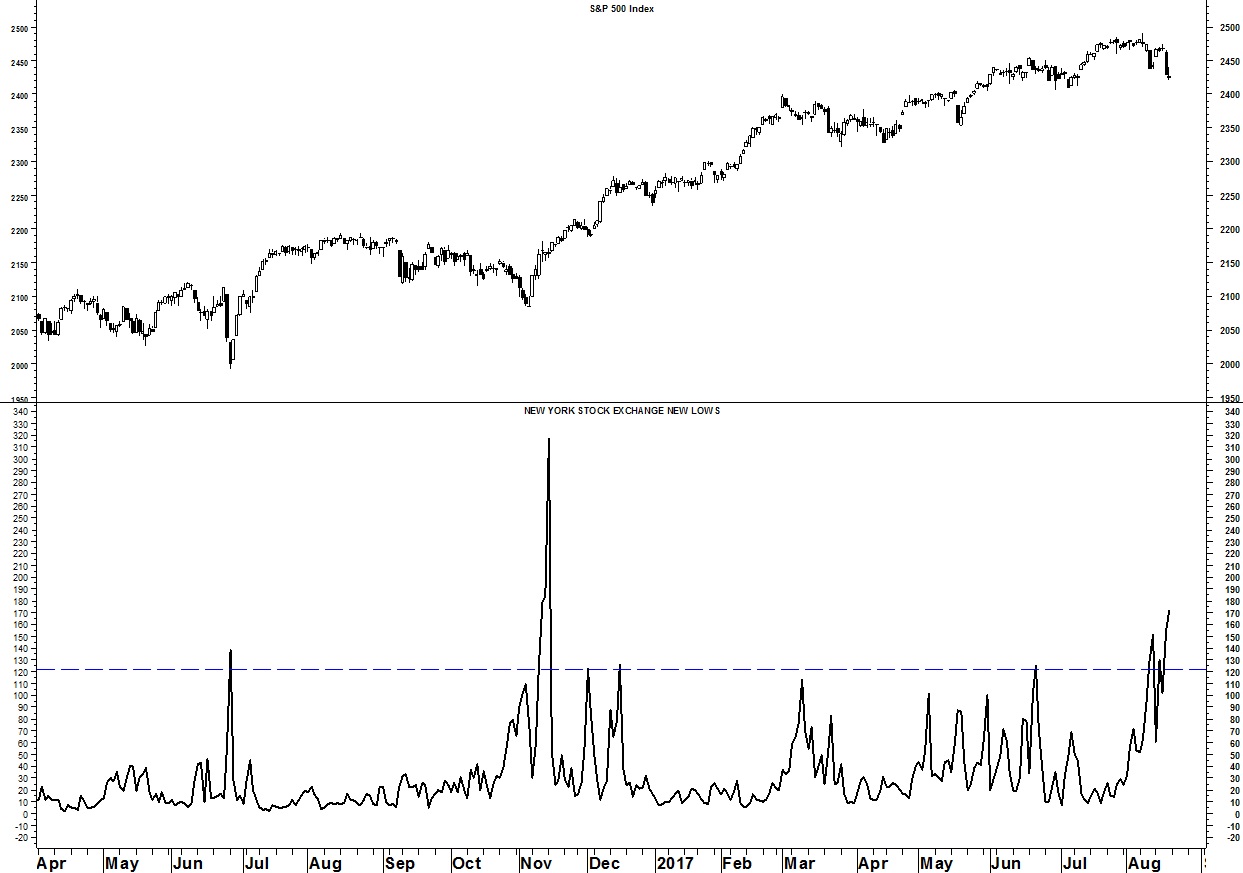

One non-cyclical indicator warning of a low is NYSE new 52-week lows (chart). They have reached a high enough level to indicate that market participants have thrown in the towel (the selling is over for now).

(Click on image to enlarge)

Click here for a sneak-peek at Seattle Technical Advisors.com. Take a trial subscription at more