The Rocky Path Towards A US Economic Recovery

The outlook for a satisfactory US economic recovery over the medium term remains quite uncertain.

Uncertainty exists because future economic growth will depend upon whether there is a successful development and distribution of a corona vaccine to the American public.

Also, there is the reality that the government stimulus measures that helped shore up consumer spending earlier this year have run dry. It is not at all clear whether an adequate new stimulus bill will emerge out of a divided Congress in 2021.

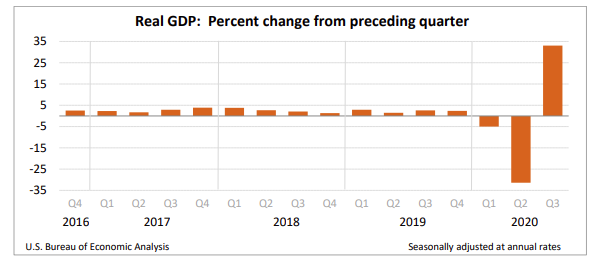

Nonetheless, the US economy grew at a record 33.1% annual rate in the third quarter. US economic output expanded at its fastest pace on record in the last quarter as businesses began to reopen and customers returned to stores.

But the American economy only climbed partway out of its pandemic-induced hole, and unfortunately, corona cases are rising again, and economic progress is also slowing once more.

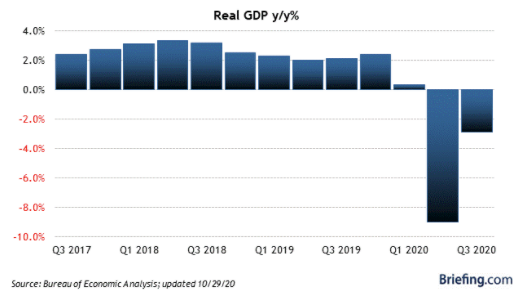

In fact, the deceivingly rapid bounce-back in Q3 followed an enormous GDP drop in Q2 which still left the economy much smaller than it was before the pandemic. In the second quarter of 2020, real GDP decreased at a 31.4% annual rate.

The increase in third-quarter GDP (which now sounds like history) reflected continued efforts to reopen businesses and resume activities that were postponed or restricted due to COVID-19.

Indeed, it should be obvious to everyone that the strong economic growth performance in the third quarter gives a false impression of the economy's true health.

After all, the economy in the third quarter was 3.5% tinier than at the end of 2019, before the pandemic began. By comparison, American GDP shrank 4% over the entire 18 months of the Great Recession that occurred a decade ago.

Moreover, the US economy appears to be weakening again and facing renewed problems since the number of confirmed viral cases are surging again.

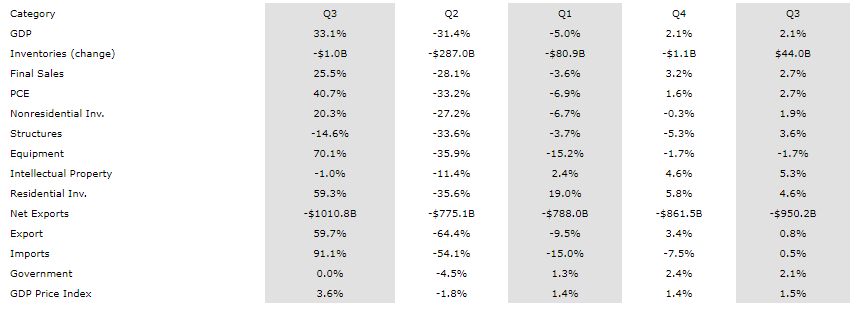

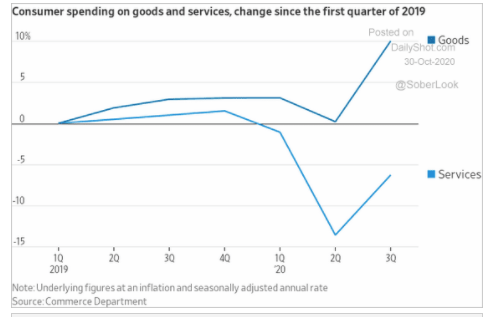

Third-quarter GDP growth was powered by a record 40.7% annual increase in consumer spending, with the demand for goods expanding faster than the demand for services.

Consumer spending contributed over 25 percentage points to the total 33.1% annual change in Q3 GDP. As the table below indicates, Americans stepped up their shopping after the spring shutdown, which had sent consumer spending sinking by a record 40% annual rate. Consumer spending normally accounts for roughly two-thirds of economic activity.

Already, there are signs that the recovery is losing steam. Industrial production declined in September, job growth slowed in recent months, and a growing list of large corporations have announced new rounds of layoffs and furloughs.

Most economists expect the slowdown to worsen in the final three months of the year as virus cases rise and federal aid to households and businesses fades.

In closing, The US economy desperately needs another large fiscal stimulus package.

Prior to the recent election, a $2 trillion stimulus package was almost negotiated. Hopefully, a new fiscal stimulus package will emerge early in the new year.

(Click on images to enlarge)

Hi William

Bravo. I couldn't agree more.

As a Canadian who has studied and worked in the US, I have always admired your country, particularly its dynamic economy and the interesting and a bit bewildering political system. However, with all of its warts, I always took US democracy for granted.

Now, like many others, my admiration has sharply diminished. Particularly, I am also appalled by the selfishness of the 1%.

I am relieved that I am not the only one so very snowed by the glowing reports of how great the recovery has been, reports that used the bottom of the valley as a reference point instead of using a similar time a year earlier. using selected data is what gave statistics that poor reputation a while back.

The terrible reality is that serious damage has been done, and will continue to be done, not only to those businesses that lacked resources to slide through this problem, but also to all of those families suffering financial pain, not only from loss if income but also from he deadly effects of inflation.

And it is proving to the populace, although probably not realized yet, that the federal banking gang is not concerned very much about the majority of the population neary as much as about the wealth of that 1%, or probably the 3% of the people on top.