The Purge Of QE

As I wondered yesterday, what good would opening up the Federal Reserve do for us? What you would find is already out on the table. We would be treated to hidden insight that already exists in public, such as that delivered by FRBSF President (and CEO) John Williams just today (thanks to T. Tateo for pointing it out). He pronounced the Fed an “amazingly nerdy group of people who pore over data, computer models, and statistical analysis.” There is, of course, absolutely nothing wrong with that, except in the case where that is all you are, and doing only that leads nowhere good.

So the point of Williams speech was to try to claim that being this way has led to good things, presumably for more than just nerds and statistical obsessives.

Like you, I’ve attended many gatherings such as this in the years since the onset of the Great Recession. Sometime after the coffee is poured and the conversation begins, it invariably turns to where things stand with the recovery. Today, I’d like to propose we do something a little different…

With an economy at full employment, inflation nearing the Fed’s 2 percent goal, and the expansion now in its eighth year, the data have spoken and the message is clear: We’ve largely attained the hard-sought recovery we’ve been after for the past nine years.

What he says is technically true; the Fed has achieved a recovery according to its own definitions. They see cyclicality through the output gap exclusively, so if their output gap is closed then recovery can be righteously declared. Where it becomes so contentious is in the words “we’ve been after for the past nine years.”

Again, if you define recovery solely through the output gap, William’s statement is precisely true. But go back and review anything over the past nine years and you will fail to find any pronouncements from the Fed nerds and their models that describes the world we have now – and Williams knows it. Almost immediately after stating what I quoted above, he delivers the grand contradiction of this “recovery.”

I’d like to focus my remarks today on this topic of sustainable growth and to address a related question: “What will it take to improve the trend line on GDP growth from the historically low pace we experienced during the recovery?” [emphasis added]

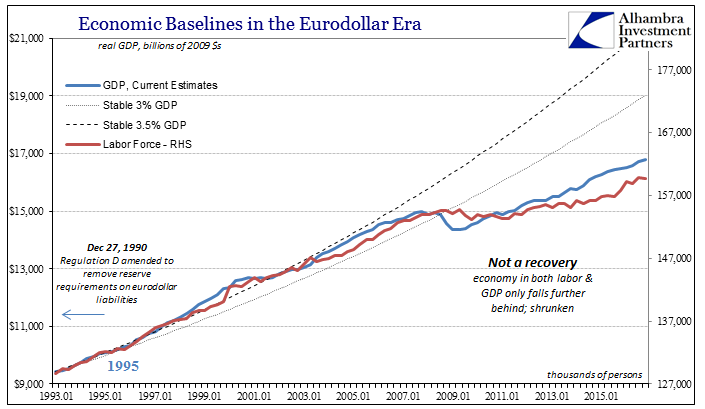

Most Americans would surely stop Mr. Williams and make him explain how the Fed could claim to have delivered that recovery while at a “historically low pace.” To the layperson, the inconsistency is blinding to the point of anger, particularly given the lack of symmetry that has resulted. There was an enormous collapse that rather than lead, as it always had in the postwar past, to a rise of similar depth and speed was rendered instead this “historically low pace.”

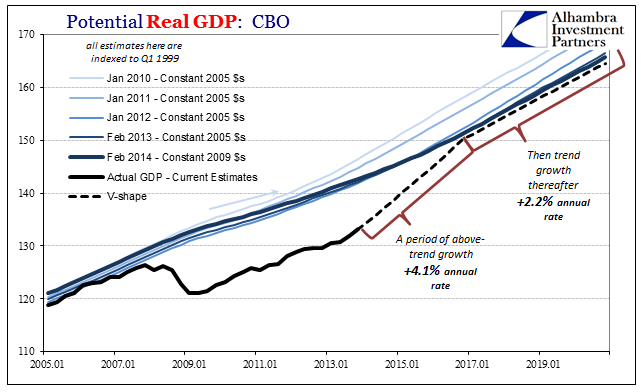

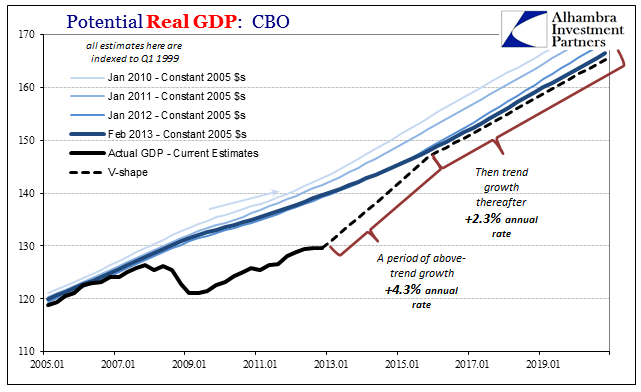

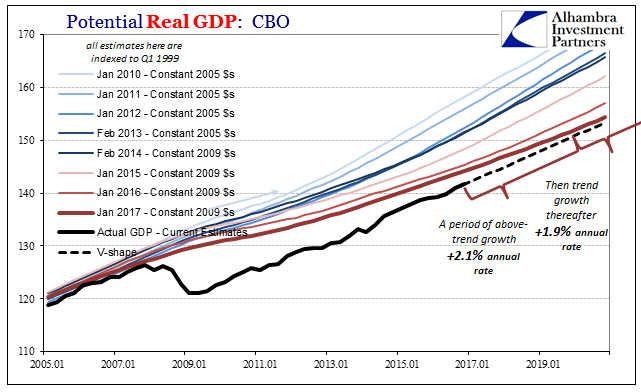

To Economists, it is the escape hatch through which they intend to disinvite themselves from the reckoning already underway at least unofficially. What Williams is saying is that the Fed was successful in that the output gap is gone, and so what is left is what there is and was all along. He does not note how none of his or the Fed’s models predicted this outcome, for as late as just two years ago they were still expecting, and speaking about, a full(er) recovery in the conventional sense that would have made sense to everyday Americans.

It is a strategy where the US and global economy is left to languish but where also economists like John Williams and Janet Yellen can plausibly (they think) declare “it’s not our fault”, for that is all this is. With QE having been finally, mercifully proved the greatest dud in history, it is CYA time at the central bank.

In October 2014, Williams told an audience of business and community leaders in Nevada:

I’ll be honest: These speeches get more and more enjoyable as time goes by because the economic outlook keeps getting better and better. Instead of gloom and doom with a scattering of hopeful notes, things are now pretty upbeat, with only a couple of standard economist’s caveats thrown in.

No mention at that time of “historically low pace” because in late 2014 he and the rest of his statistical robots were thinking and dreaming of overheating, the idea of recovery where the economy picks up sharply for some period of above-trend growth. Even though oil prices had by then started their crash, and the bond and eurodollar futures curves collapsing for nearly and over a year, respectively, John Williams quite confidently professed there was no more doom and gloom.

I wrote in September 2014 the following contrary assessment:

However, there is no hiding from context. For anyone declaring a full rebound, the behavior of US demand toward Chinese imports is an “unexpected” disappointment. Whatever you think transpired in Q1, there is nothing like a rebound in the months since the snow melted.

The pace of US imports from China is still about where it was at the worst of the dot-com recession, and about the same as the first two-thirds of the Great Recession. Global growth is a fantasy, only one that is more apparent now in Europe and Japan. The FOMC can make all the statements and proclamations it wants, but China and the rest of the world strongly beg to differ. Some “decoupling.”

The difference between Williams’ interpretation and mine was solely QE. Somehow he saw the introduction of a third (and then fourth) QE as powerful “stimulus” that just had to work because they all assumed right from the start that it would. I saw additional QE’s as instead powerful wastes of time that did more to obscure and obfuscate the disastrous truth, because if you have to do it more than once it didn’t work (at all) the first time. In November 2012, just after the start of QE3, Williams said in still another optimistic speech:

Thanks in part to the policy actions I’ve described, I anticipate the economy will gain momentum over the next few years. I expect real gross domestic product, that is, the nation’s total output of goods and services, to expand at a modest pace of about 2 percent this year, but improve to about 2½ percent next year and about 3½ percent in 2014. I see the unemployment rate remaining above 7 percent through at least the end of 2014. I expect inflation to remain slightly below 2 percent for the next few years as labor costs and import prices remain subdued.

Four and a half years later he now claims the recovery is complete, though further deceleration rather than gaining momentum was the eventual condition. Auditing the Fed is a waste of all our time, for it suggests that there is something valuable still to be discovered in more openness and transparency, and therefore Fed officials aren’t as yet fully disqualified from all future discussions. As I stated yesterday, that just isn’t the case; we already know without any doubt they really have no idea what they are doing.

Now, instead, as Fed officials scramble to deflect blame for getting a whole decade so very wrong from the very start, what is demanded is a more serious and potentially effective remedy. Janet Yellen, as John Williams and Ben Bernanke, needs to be hauled before Congress and made to reconcile her estimations with how things actually turned out – the two bear no resemblance to each other. We know that she can’t because she is left with retirees and drug addicts as the only specific explanations she might put forth.

That’s what’s missing from all this. They did four QE’s well into the trillions and now they act as if they never happened. In John Williams’ entire speech today, one given on the very topic of recovery, he mentions QE exactly zero times. Zero. That alone demands far more than an audit; it demands full accountability for which is it absolutely clear Fed officials want no part of. The only real question is whether we let them get away with it. But because their BS still flies in the media and in DC, it is sad to say that it looks like they will, meaning we will all be stuck at the “historically low pace” until they don’t.

Disclosure: This material has been distributed fo or informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more