The Punchbowl Just Got Refilled

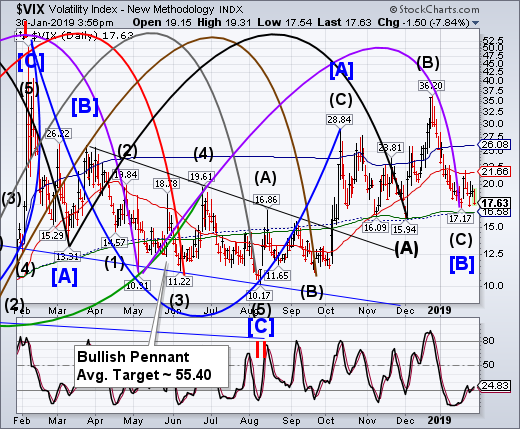

VIX has been treading water between its 200-day support at 16.58 and 50-day resistance at 21.66 since January 18. ZeroHedge observes, “Traders are becoming increasingly jittery about a potential risk spike in the coming days.

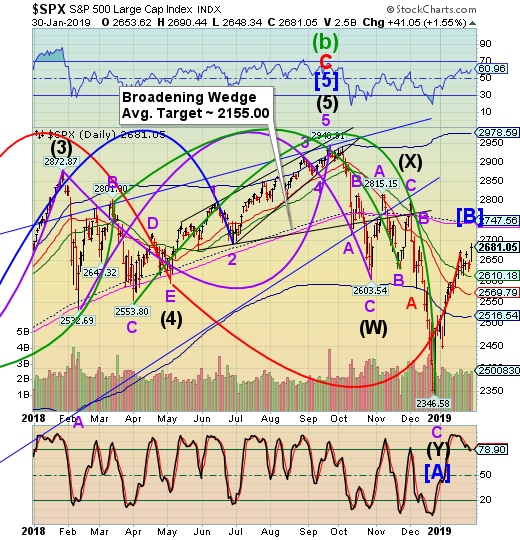

-- The NYSE Hi-Lo Index made an inverted Master Cycle high not seen since last July today as the SPX rally grows long in the tooth. The Cycles Model suggests that it is overdue for a strong reversal.

(ZeroHedge) From the Mnuchin Massacre lows on Xmas Eve, the US equity market soared on the back of the greatest short-squeeze ('Most Shorted' stocks up a stunning 22%) since the March 2009 lows...

However, the last two weeks have seen 'most shorted' stocks suddenly treading water - providing no underlying lift for stocks which have traded rangebound over the same period...

So did the bulls run out of short-squeeze ammo?

-- The SPX rally surged on Wednesday in a final show of strength. After seven market days of indecision, stocks put in their melt-up rally after the Federal Reserve capitulated to investor demands. A high of 2700.00 may put a stop to the rally if not already complete. Are the equities markets that fragile?

(Bloomberg) U.S. stocks surged and the dollar tumbled after the Federal Reserve signaled a stark dovish turn in its latest policy statement.

The S&P 500 Index rallied to an eight-week high, the Dow Jones Industrial Average jumped 400 points and the Nasdaq 100 Index added more than 2.5 percent after the Fed said it will be “patient” on future interest-rate moves and signaled flexibility on the path for reducing its balance sheet. Major gauges were already higher on the day as technology shares rallied after Apple Inc.’s results beat estimates and Boeing Co. helped boost industrial stocks.

-- NDX rallied to close just above its 50% retracement value at 6799.00 today. It may go as high as 6880.00, short-term, to complete the Wave structure. Should it reverse at any time, it will have completed the right shoulder of a new Head & Shoulders formation. If valid, new downside lows may be made. I will publish the target at the break of the neckline.

(Bloomberg) Technology stocks rallied as investors took solace in a forecast from Apple Inc. that suggested the iPhone maker’s sales woes aren’t getting worse.

An exchange traded fund tracking the Nasdaq 100 Index rose almost a percent in extended trading after Apple reported earnings. Semiconductor suppliers such as Micron Technology Inc. and Broadcom Inc. were among the biggest gainers, while tech heavyweights Amazon.com Inc., Facebook Inc. and Microsoft Corp. also rose. Apple jumped 5.9 percent, trading back above where it did earlier this month before warning on weak China sales.

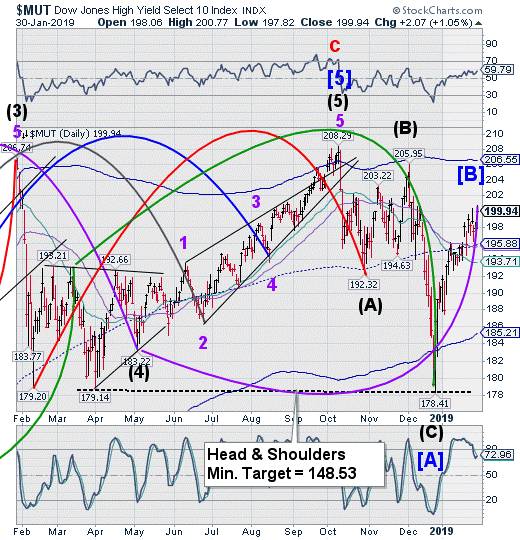

The High Yield Bond Index briefly challenged round number resistance at 200.00 today. The Cycles Model called for a final burst of strength yesterday in the High Yield Index that appears to have shown up today, instead. The new retracement high was not technically confirmed today.

(ChicagoTribune) Famished and desperate bond bears, starved for what they consider an overdue feast and riled by yet another rally in long-term Treasuries, have lately sniffed out an unfamiliar target: U.S. corporate bonds.

Bond-return tables confirm a dismal year for investment-grade corporate debt. The slice of the market rated BBB by Standard & Poor's trailed junk, municipal and government bond returns in 2018, with a total loss of about 3 percent through early December. Only dollar-denominated emerging-markets bonds did worse.

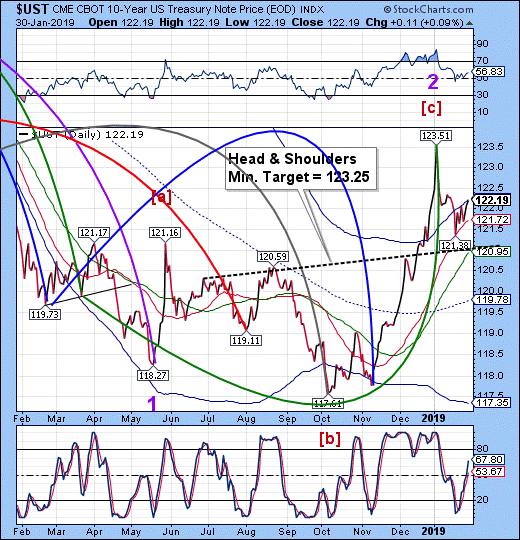

10-Year Treasury Notes tested Cycle Top resistance at 122.22 today. The Cycles Model calls for potential rally over the next week or longer which, in all probability, may exceed the prior high.

(Bloomberg) The U.S. Treasury Department announced plans to issue another record-breaking amount of debt, giving President Donald Trump’s re-election opponents more ammunition as they question whether his tax cuts will pay for themselves.

The federal budget shortfall is set to swell, driven by tax cuts, spending increases and an aging American population. As a result, the Treasury is raising its long-term debt issuance at its quarterly refunding auctions to $84 billion, the department said Wednesday, $1 billion more than three months ago. Such elevated levels of borrowing will finance the widening deficit, with Wall Street strategists projecting new debt issuance will top $1 trillion for a second straight year.

The ballooning national debt is already being drawn into the 2020 presidential election campaign. Former Starbucks Corp. CEO Howard Schultz, who is considering running as an independent, earlier this week said the debt is an example of both Republicans’ and Democrats’ “reckless failure of their constitutional responsibility.”

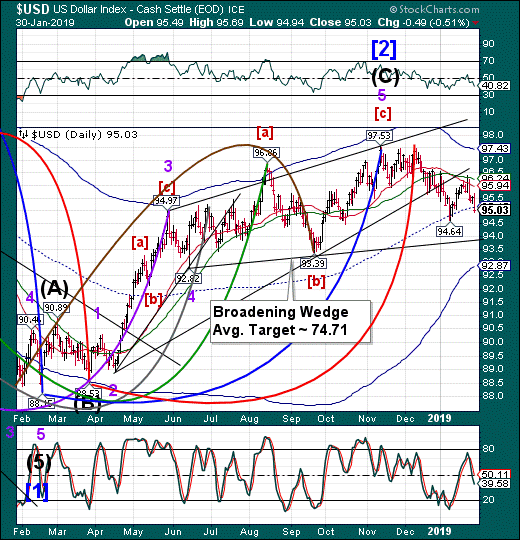

The U.S. Dollar fell beneath mid-Cycle support at 95.15 on Chairman Powell’s remarks. It remains on a confirmed sell signal. The Cycles Model suggests the decline may continue through mid-February. The Ending Diagonal formation is triggered, allowing the USD to decline to its 2018 lows.

(Bloomberg) U.S. stocks surged and the dollar tumbled after the Federal Reserve signaled a stark dovish turn in its latest policy statement.

The S&P 500 Index rallied to an eight-week high, the Dow Jones Industrial Average jumped 400 points and the Nasdaq 100 Index added more than 2.5 percent after the Fed said it will be “patient” on future interest-rate moves and signaled flexibility on the path for reducing its balance sheet. Major gauges were already higher on the day as technology shares rallied after Apple Inc.’s results beat estimates and Boeing Co. helped boost industrial stocks.

The dollar weakened to a four-month low. The Treasury yield curve steepened as the two-year rate crashed while the 10-year level fell less sharply.

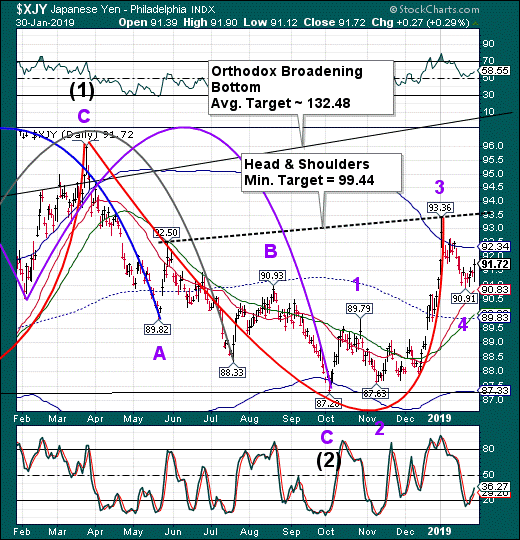

--The Yen rose toward its Cycle Top resistance at 92.34. The Cycles Model implies a continued rally to the top trendline of the Broadening formation. A Master Cycle high is anticipated in the next week or longer, in case of an extension.

FinancialTimes opines, “Rising volatility may boost yen but hit dollar”

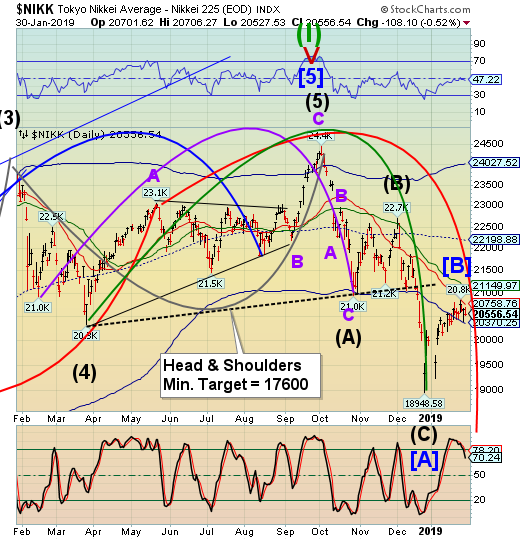

The Nikkei appears to have completed its retracement on Friday and has tested its Cycle Bottom support at 20370.25 on Tuesday. A breakdown beneath that level puts the Nikkei on a sell signal. The Cycles Model calls for the decline to continue for the next week or longer.

(Reuters) - Japan’s Nikkei fell on Wednesday, with index component Dainippon Sumitomo Pharma plunging after a clinical trial for a new drug failed to complete, offsetting optimism over a spurt in Apple’s shares.

The Nikkei share average declined 0.5 percent to 20,556.54, after opening a tad higher. Though sentiment is weak, the index has managed to stay above its 25-day moving average of 20,325.

Investors initially took heart from Apple Inc’s share price jump after the bell as the iPhone maker reported sharp growth in its services business. That followed its warning earlier this month that revenue would be less than previously expected due to softness in China.

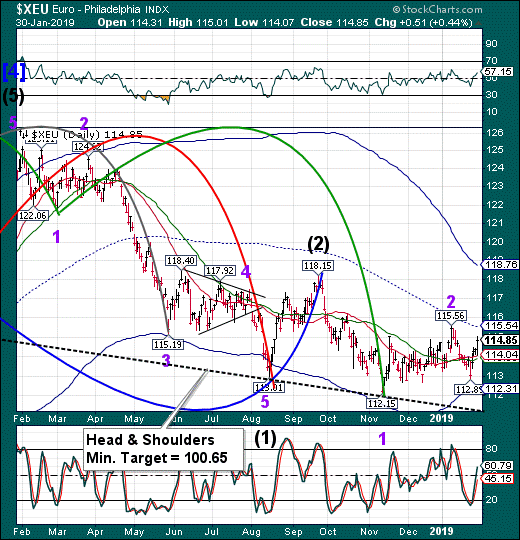

The Euro appears to have bounced off its Cycle Bottom support last Thursday and may have completed its retracement. The Cycles Model suggests another 2 weeks of decline ahead. A sell signal is triggered beneath the 50-day.

(Express) THE EU’s “biggest flaw” is too much debt across the bloc and it is bringing instability for the eurozone, Finland’s Prime Minister said.

Juha Sipila said the euro was still feeling the after effects of the 2008 financial crash, and countries with huge debts, such as Italy and Greece, are threatening the entire eurozone’s prosperity. Mr Sipila said “unpopular austerity measures and reform programs” led to widespread discomfort across EU member states, and may have given rise to social unrest leading to a rise in populist politics. But Mr Sipila blamed “unsustainable levels of Government debt” as the underlying cause of instability in the eurozone.

EuroStoxx 50 Index appears to have made its inverted Master Cycle high last Friday. While it was about a week early, it appears to be complete. In the meantime, this week it seems to be consolidating. The Cycles Model is short-term neutral, but intermediate-term bearish with a Master Cycle low due in March.

(Reuters) - European equities may be close to a bottom as bearish investors price in a sharp economic slowdown and a flurry of political risks such as Brexit, asset manager BlackRock said in a note on Wednesday.

“Given the significantly bearish sentiment and positioning towards European equities, we could be nearing the point of maximum pain for the European market, particularly if fundamentals stabilize and improve from here,” wrote Nigel Bolton, who heads the BlackRock European Equity Team.

While Bolton saw “opportunity” for a “gentle increase” in European growth this year, he warned that company results could nevertheless disappoint, flagging risks of earnings downgrades across the market, particularly in leveraged companies.

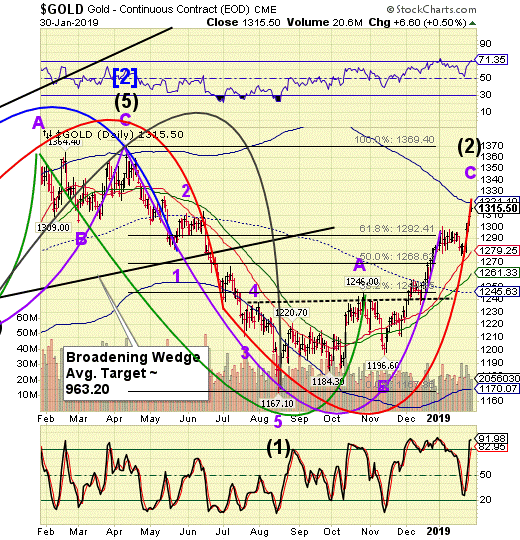

-- Gold challenged its Cycle Top at 1321.10 today, closing beneath it. It may have made an inverted Master Cycle high today, about a week earlier than the Model proposes, but within an acceptable time frame. If correct, a reversal may be imminent.

(KitcoNews) - Although off its daily peak, gold prices are holding near fresh eight-month highs as Federal Reserve Chair Jerome Powell signaled that he is in no rush to raise interest rates anytime soon.

At one point, gold prices were up nearly 1% on the day, reacting to Powell’s relatively dovish comments. Although Powell kicked off the central bank’s first press conference of the year by saying that the economy is in a good place, he soon added that the growth is slower than last year.

April gold futures last traded at $1,324.70 an ounce, up 0.72% on the day.

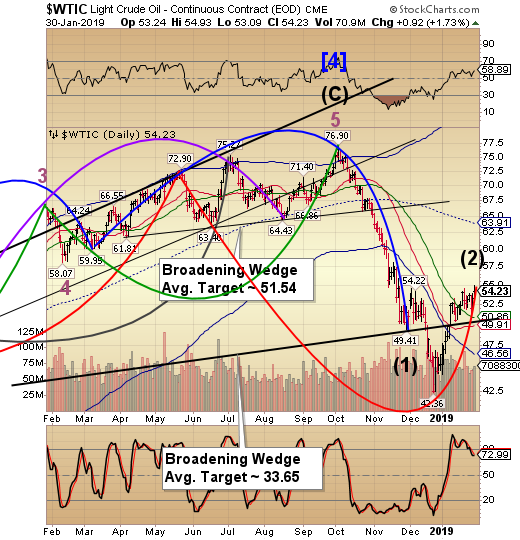

West Texas Intermediate Crude surged to a new retracement high today, making a probable inverted master Cycle high on the Fed comments. This suggests that a reversal may be imminent. A decline beneath the trendline at 50.00 may produce a sell signal.

(CNBC) Oil prices rose on Wednesday, boosted by U.S. government data that showed signs of tightening supply, as investors remained concerned about supply disruptions following U.S. sanctions on Venezuela’s oil industry.

U.S. West Texas Intermediate crude futures ended Wednesday’s session up 92 cents, or 1.7 percent, at $54.23 per barrel, its best closing prices since late November.

International Brent crude oil futures were up 43 cents at $61.75 per barrel around 2:30 p.m. ET.

Prices extended gains after government data showed U.S. crude oil stockpiles rose less than expected last week due to a drop in imports, while gasoline inventories fell from record highs as refiners slowed down production.

The Shanghai Index appears to have made its retracement high on Monday and is testing Intermediate-term support at 2555.24. It closed just under the 50-day Moving Average at 2577.55, leaving it on a potential sell signal. The Cycles Model indicates weakness may resume, lasting through mid-March.

(SouthChinaMorningPost) China’s benchmark share index dropped Wednesday to the lowest level in two weeks, down for a third day in a row, after more than 90 Chinese companies warned of annual profit losses in the past three days, fuelling concerns the economic slowdown is biting into corporate earnings.

The Shanghai Composite Index closed down 0.7 per cent at 2,575.58. The large-cap CSI300 dropped 0.8 per cent to 3,168.48. On the Shenzhen Stock Exchange, the Component Index and the Composite Index fell 1.1 per cent and 1.3 per cent to 7,470.47 and 1,283.71 respectively. The start-up board ChiNext lost 1 per cent to 1,230.82.

More than 60 companies fell by the maximum-allowed 10 per cent. Many of them warned of massive profit losses in 2018 due to the impairment of goodwill, which was triggered by the economic downturn and an expected change in China’s accounting standards in the near future.

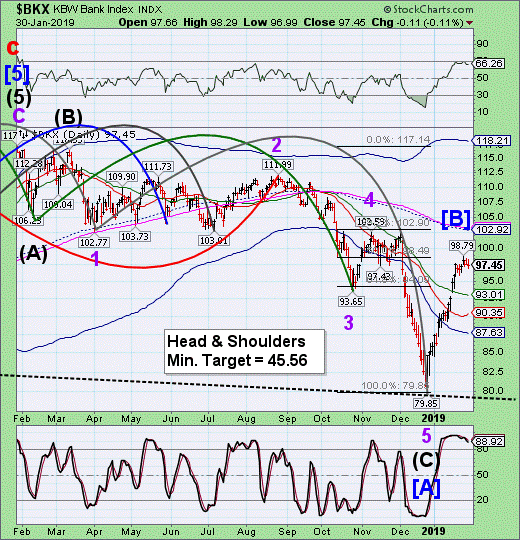

-- BKX probed its 50% retracement level on Monday, then pulled back in a possible reversal. Interestingly enough, the Cyclical strength showing up in other domestic equity indexes today did not appear in the BKX. The Cycles Model suggests a decline to develop through mid-February.

(Forbes) After the credit binge of the last decade, China’s banks are suffering from a bad case of indigestion. They are over-leveraged, under-capitalized, and so stuffed with non-performing loans that they are struggling to lend. Now, the People’s Bank of China (PBC) has decided to sort them out. Welcome to the Great Chinese Bank Bailout.

In a masterly exhibition of fudge, the PBC managed to announce the bailout on January 25 without revealing that it was, in fact, a bailout. The press release headline said “PBC Launches Central Bank Bills Swap to Support Liquidity of Banks’ Perpetual Bonds.” Ah yes, liquidity. Saying that you are providing “liquidity support” when you are in fact recapitalizing is the oldest trick in the book. And the full text of the press release shows that this is exactly what the PBC is up to (my emphasis):

To improve the liquidity of banks’ perpetual bonds (including capital bonds without fixed terms) and to encourage banks to replenish capital through perpetual bond issuance, the People’s Bank of China (PBC) decides to launch Central Bank Bills Swap (CBS). Primary dealers of open market operations can trade their perpetual bonds issued by qualified banks for central bank bills with the PBC. And banks’ perpetual bonds with ratings at no lower than AA will be included as qualified collateral for medium-term lending facility (MLF), targeted medium-term lending facility (TMLF), standing lending facility (SLF) and central bank lending.

(Bloomberg) Since buying minority stakes in Commerzbank AG and Deutsche Bank AG in 2017, Cerberus Capital Management LP's 1.7 billion-euro ($1.9 billion) investment has lost more a than a third of its value. Simply recouping that money may require more than patience and fine-tuning.

The $35 billion private equity manager’s appetite for lenders in Europe’s largest economy appears to be insatiable. Last year, a Cerberus-led consortium snapped up former state lender, HSH Nordbank. It is also bidding for a minority stake in another regional bank, NordLB, along with another fund.

(Bloomberg) The head of Deutsche Bank AG in the Nordic region says he expects a “large number” of buyouts this year, with volatility forcing quick deals in a market that’s likely to favor bidders with plenty of cash.

“In a volatile market, cash is king,” Jan Olsson, the chief executive officer of Deutsche Bank in the Nordics, said in an interview in Stockholm. He says the buyout wave will be led by bidders “with plenty of cash” who will use the current cycle to “strengthen their position in this market.”

Until next week…

Disclaimer: Nothing in this article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more