The Part Of The S&P 500 Easily Making New All-Time Highs

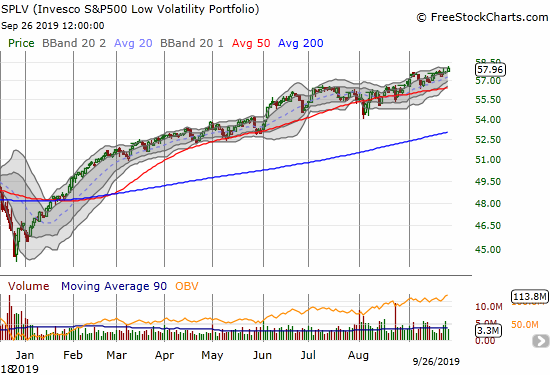

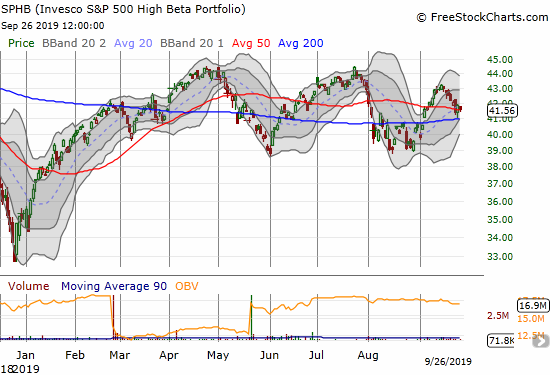

The S&P 500 Low Volatility Portfolio (SPLV) is up 2.2% month-to-date. The Invesco S&P 500 High Beta Portfolio (SPHB) is up 2.8% month-to-date. So the "risk-neutral" trade I described at the end of August is actually down slightly since that time. However, this small out-performance of SPHB has not been enough to overcome the SPLV's out-performance on new all-time highs. SPLV has hit 8 new all-time highs so far in September. SPHB is struggling in a trade range and last made an all-time high in January, 2018.

S&P 500 Low Volatility Portfolio (SPLV) has steadily churned higher and higher in 2019

Invesco S&P 500 High Beta Portfolio (SPHB) has remained stuck in a trading range for most of 2019.

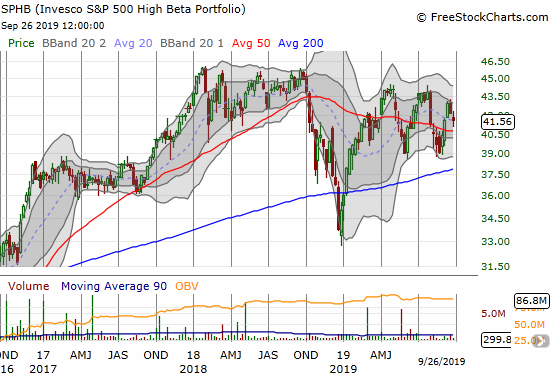

Since 2018, while SPLV has steadily churned higher, SPHB has wildly chopped lower. Both indices have certainly lived up to their namesakes. The last four peaks in SPHB since September, 2018 have created a set of lower highs. It is clear that the high beta components of SPHB are partially responsible for the bouts of poor breadth in the underlying stock market.

This weekly chart shows the overall weakness in Invesco S&P 500 High Beta Portfolio (SPHB) since it last made an all-time high in early 2018.

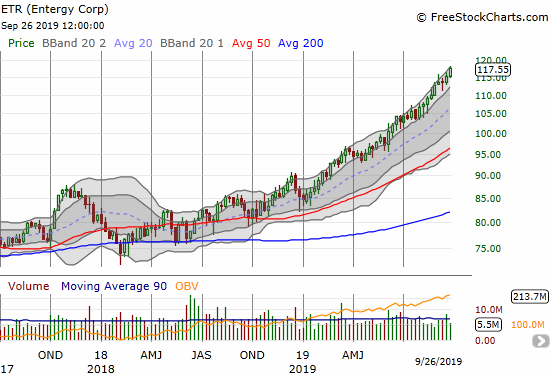

These comparisons are important because the S&P 500's periods of upward momentum have often come on the heels of a rotation back into high beta components. The stocks NVIDIA Corp (NVDA), Micron Technology Inc (MU), United Rentals Inc (URI), Advanced Micro Devices Inc (AMD), Western Digital Corp (WDC), Lam Research Corp (LRCX), Twitter Inc (TWTR), salesforce.com Inc (CRM), KLA Corp (KLAC), and Wynn Resorts Ltd (WYNN) make are currently the top 10 holdings of SPHB and make up 13.4% of the fund. The only stocks in the list at or near all-time highs are AMD, LRCX, CRM, and KLAC. The other six stocks are well off their all-time highs. The stocks Duke Energy Corp (DUK), Eversource Energy (ES), Republic Services Inc (RSG), Evergy Inc (EVRG), NextEra Energy Inc (NEE), WEC Energy Group Inc (WEC), Entergy Corp (ETR), CenterPoint Energy Inc (CNP), Exelon Corp (EXC), and American Electric Power Co Inc (AEP) are the top 10 holdings of SPLV and make up 11.8% of the fund. All but one of these stocks are energy utility stocks. All of them are at or near all-time highs; in several cases, the stocks are experiencing near relentless buying. ETR is one good example:

Entergy Corp (ETR) is on a tear upward.

Again, these data make clear that the key to the S&P 500's potential for upward momentum lies in the level of risk appetite for high volatility (aka growth) stocks. Right now, that risk appetite is at best tentative. Granted, one can argue that investors have a large appetite for risk given a willingness to pay extremely high multiples for utility stocks like the 23.1 P/E for ETR which has flat revenue growth and quarterly earnings contracting 3.7%. Investors usually flock to utility stocks for yield. ETR still pays 3.1%, so it represents a "better buy" than government bonds and even the S&P 500's (SPY) 1.8% (all data from Yahoo Finance).

I continue to watch the relationship of SPLV and SPHB for insights into the underlying health of the market. The S&P 500 still trades above its 50-day moving average (DMA), but this support will not likely last long without renewed buying interest in the components of SPHB.

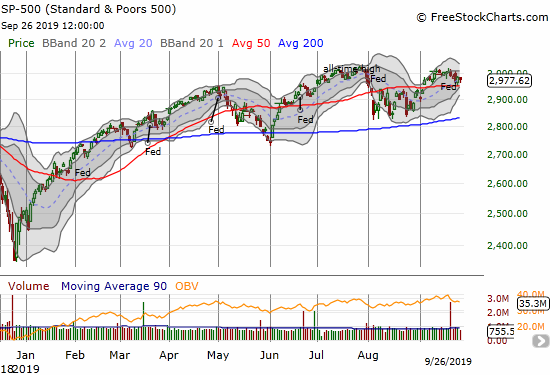

The S&P 500 (SPY) looks like it is losing steam right under its all-time high.