The OECD’s Latest Global Projections Are More Optimistic -- Perhaps Too Optimistic

The OECD’s Latest Global Projections Are More Optimistic, -- Perhaps Too Optimistic. The Large US Fiscal Stimulus Will Provide A Helpful Boost To Other Economies, Particularly Canada and Mexico.

“Global economic prospects have improved markedly in recent months, helped by the gradual deployment of effective vaccines, announcements of additional fiscal support in some countries, and signs that economies are coping better with measures to suppress the virus. Global GDP growth is projected to be 5½ per cent in 2021 and 4% in 2022, with global output rising above the pre-pandemic level by mid-2021. Despite the improved global outlook, output and incomes in many countries will remain below the level expected prior to the pandemic at the end of 2022. The significant fiscal stimulus in the United States, along with faster vaccination, could boost US GDP growth by over 3 percentage points this year, with welcome demand spillovers in key trading partners” (OECD, March 2015)

The world’s economic outlook has recently brightened, partly because of the successful rollout of covid-19 vaccines in some advanced economies, but as well, because of the huge $1.9 trillion fiscal boost which will be provided to the US economy.

According to the OECD, the world economy is set to rebound by 5.6% this year, and expand by 4% next year. Indeed, because of the new fiscal stimulus, US real GDP growth is projected to be 6.5% in 2021 and 4% in 2022.

And on a comparative basis, The US and Chinese economies are expected to bounce back faster than Europe and the UK, even as other regions may continue struggling until the end of 2022.

The importance of the new fiscal stimulus to the US economy and to other economies should not be overlooked since the fiscal stimulus will also boost GDP growth for the United States’ major trading partners.

That is, Canadian and Mexican GDP growth should be boosted by 0.5-1 percentage points, and the euro area and China should also experience between 0.25-0.5 ppts of extra growth this year.

Based on this improved economic outlook, global GDP is projected to return to pre-pandemic levels by the middle of this year, though the OECD projections also indicate that there will be large divergences in the speed of rebound across the globe.

Reviewing the OECD country projections, on a comparative basis, the economies of the US and China bounce back faster this year than either the economies in the Euro Area or Canada.

For example, Germany's economy is projected to grow by only 3% this year, literally half the growth recovery that France is expected to record. Among the other large economies, Japan’s economy is expected to rebound only 2.7% this year, while India is projected to post 12.6% growth and China 7.8% growth.

Despite projections of a relatively optimistic global recovery, nonetheless, significant risks continue to loom both in terms of the short-term economic outlook and in terms of some of the key components of the expected recovery.

In terms of the pandemic, there are concerns over how fast the different countries will be able to get vaccine shots to people, how soon restrictions will be lifted, and whether the new variants of the coronavirus are kept in check.

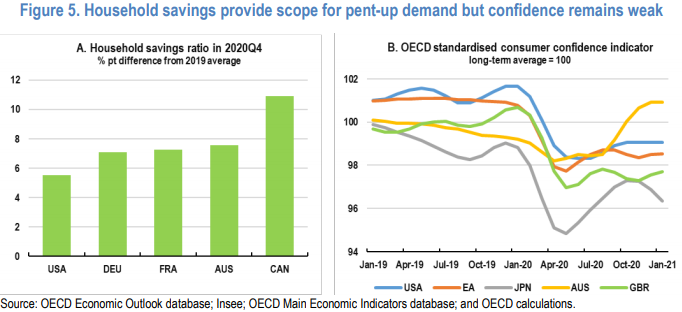

On the economic front, some of the recovery risks relate to whether the huge increase in global personal savings will quickly transfer into new consumer spending.

As OECD data indicate, in the advanced economies consumer optimism is currently quite depressed, so it is s difficult to easily detect whether there really is a huge quantity of pent-up demand waiting to be realized.

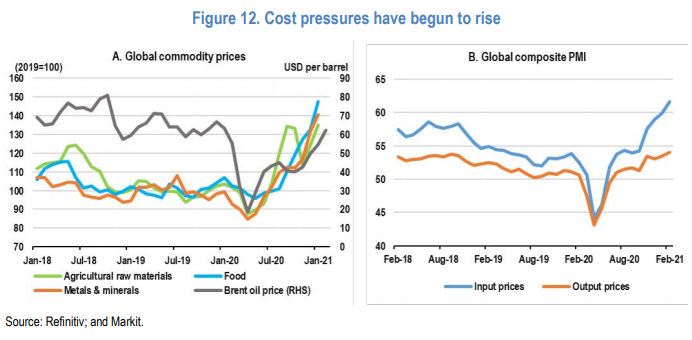

As well, despite the pandemic commodity prices have risen significantly, and this is often a harbinger of higher inflation ahead.

As the latest OECD report indicates “Headline inflation has recently risen in many advanced economies and remains high in some emerging-market economies, in part due to jumps in commodity prices and past currency depreciation. A faster-than-expected recovery in demand, especially from China, coupled with shortfalls in supply, has pushed up food and metals prices considerably, and oil prices have rebounded to their average level in 2019.”

In closing, the strong fiscal stimulus provided by the US should substantially speed up that country’s recovery from the pandemic recession. There will also be helpful spillovers of demand into other economies, particularly Canada and Mexico.

As matters currently stand, the recovery in Europe will likely be slower than in the US, reflecting continued lockdowns in the early part of 2021 as well as generally weaker fiscal supports. Early deployment of the vaccine should provide momentum, particularly in the UK economy.

The effect of that big stimulus on me is to increase my savings in preparation for the hard times approaching when the bubbles will all burst. Of course my confidence level is very far down. While certainly some folks need financial help, I am NOT one of them, nor are my neighbors in need of help. The one just bought a nice new pickup truck, because it is really cool. But he did not need that check to help pay for it.

So the stimulus checks are the wrong thing to do. The right thing would help those folks who really need it, not me. All pf the pandemic closures have been inconvenient, but they have not done any damage here. THAT DAMAGE will come from the inflation that iis still down the block and around the corner. Coming, but we don't see it just yet.