The Next Test For U.S. Dividends

Should banks suspend dividends?

For European bank regulators, the answer is yes.

Most major European banks have suspended share buybacks and dividends since being directed by regulators to do so in March.

This coordinated decision provided cover for the weakest banks to slash payouts. It was also good PR for regulators, since the cuts are perceived as providing greater capacity for lending to struggling small businesses and households.

For U.S. regulators, the answer to this question has been “wait and see.” Federal Reserve (Fed) Chair Jerome Powell has opposed a blanket ban, saying the banks are “highly capitalized, with more high-quality capital than before the financial crisis.”

Faith in Stress Tests

Some notable differences between U.S. and European banks have influenced divergent dividend paths:

- European banks tend to pay dividends annually, in the spring, whereas U.S. banks tend to pay in quarterly increments.

- U.S. bank profitability was much higher heading into this crisis than that of European banks, which have struggled with earnings amid negative interest rates.

- U.S. banks return more of their capital via share buybacks, making dividends a much smaller portion of overall payouts.

But perhaps the biggest reason for the lack of regulatory action on U.S. dividends is the Fed’s annual stress tests that determine dividend decisions. The results of these tests will be released on June 25, giving the Fed the opportunity to make assessments that are specific to each bank’s capital distribution plans.

This approach, rather than a wholesale ban on dividends, enforces the Fed’s faith in the stress test process.

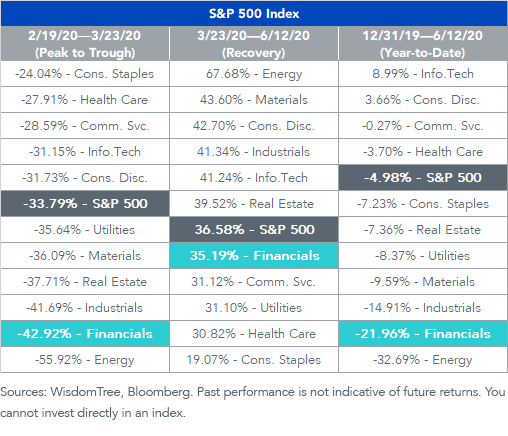

Financials Slide in 2020

Financials have been the second-worst performing sector in the S&P 500 this year. Most banks recorded billions in loan loss provisions during the first quarter, with further losses expected in the second quarter.

These losses, and a uniform suspension of share buybacks from the largest banks that was made in March, have weighed heavily on the sector’s performance.

More recently, investors have questioned if dividend cuts will follow as a result of the deteriorating economy. The list of advocates foro banks halting dividends is distinguished, including former Fed Chair Janet Yellen.1

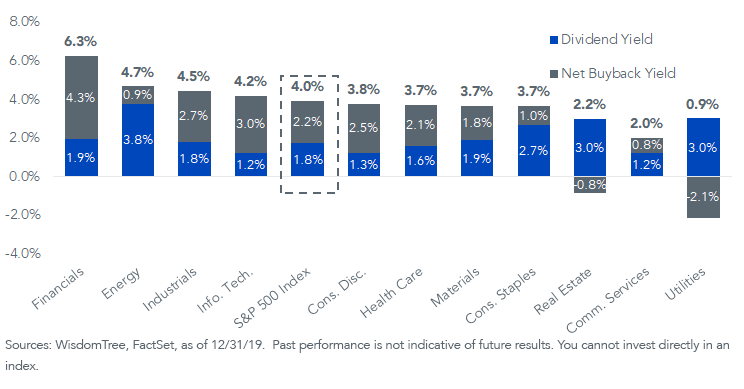

Entering 2020, Financials offered the highest total shareholder yield (dividends + net buybacks), but more than two-thirds of their payouts came from buybacks. This is why the decision by the banks to suspend buybacks in March was more important to preserving capital than slashing dividends.

S&P 500 Index - Total Shareholder Yield by Sector

Wells Fargo with Highest Payout Ratio

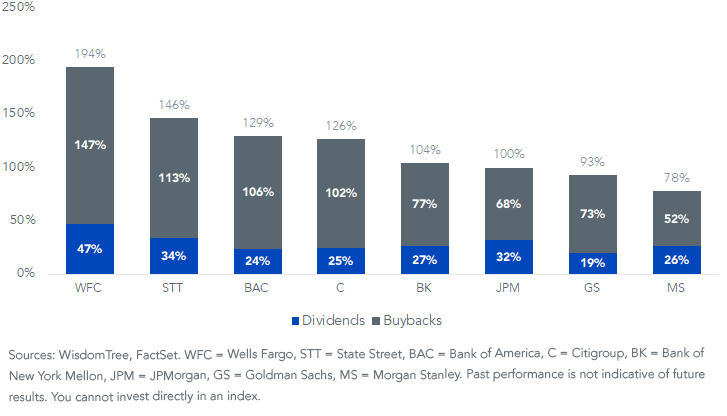

If we look at the total payout ratios for the eight U.S. global systemically important banks (G-SIBs), the average payout was 121% for 2019. That means that, on average, the banks paid out more than 100% of their earnings on dividends and share buybacks.

However, the average dividend payout ratio was only 29%, which was well below the 43% for European G-SIBs.

Wells Fargo (WFC) paid out the highest dividends and looks to be the most at risk of having its dividend cut.

2019 Payout Ratio

According to Goldman Sachs (GS), the options market implies an average dividend cut of 32% for 2021 dividends for large U.S. banks relative to the trailing 12 months—WFC had the highest cut expectation with a more than 60% implied cut.2

Based on Goldman’s own forecast, WFC will be the only bank forced to pare back its dividends from 1Q20 levels.

Potential Catalyst for Banks

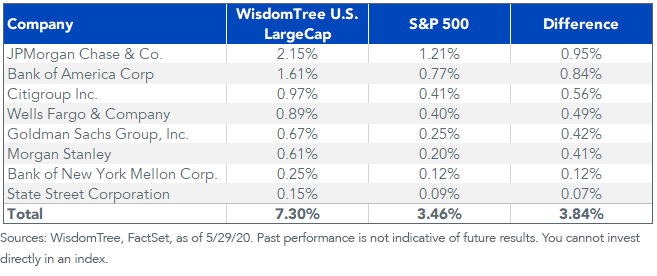

Should the Fed allow banks to maintain, or even increase, dividend payouts, it could be a positive catalyst for Financials—and for many of the value indexes that are over-weight in the sector.

The WisdomTree U.S. LargeCap Index is a value-tilted index with an over-weight of about 6% in Financials relative to the S&P 500.

The Index weights the 500 largest profitable U.S. companies by earnings. Because of the cyclicality of earnings for banks, and the currently depressed expectations for their near-term earnings, the large banks all have lower weights in the market cap-weighted benchmark than in the earnings-weighted index.

Index Weights in U.S. G-SIBs

Notes:

1. Andrew Ackerman and Nick Timiraos, “Fed Unlikely to Order Big U.S. Banks to Suspend Dividends,” The Wall Street Journal, 4/3/20.

2. “Reassessing bank profitability and dividend sustainability; we see risk only to WFC’s dividend,” Goldman Sachs Equity Research, 6/15/20.

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more