The Mystery Of The Miniscule

The Federal budget has just had a big hole blown in it, thanks to the Tax Cuts and Jobs Act and the last omnibus spending bill, the both the Fed and foreigners (including central banks) are no longer adding to their holdings of Treasurys.

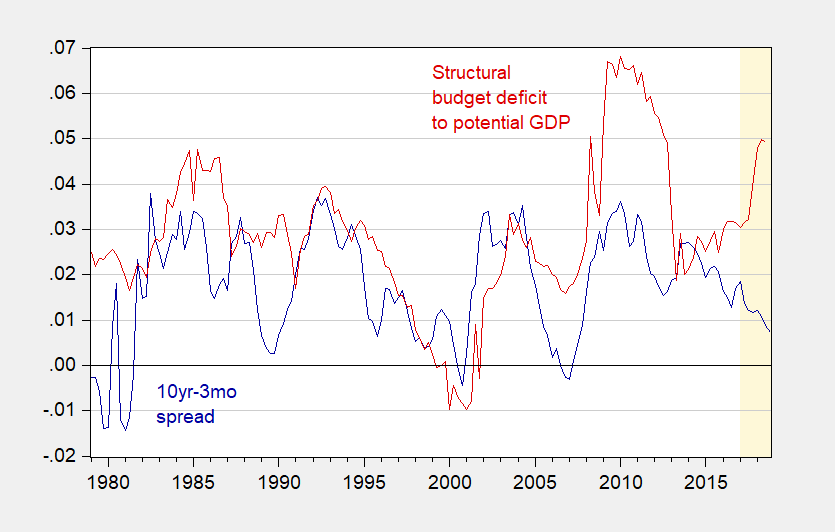

First, consider that when structural (cyclically adjusted) budget deficits rise, often spreads rise. But not this time around.

Figure 1: 10 year-3 month Treasury spread (blue), structural budget deficit as a share of potential GDP (red). Orange shading denotes Trump administration. Source: Federal Reserve, CBO, Budget and Economic Outlook, and author’s calculations.

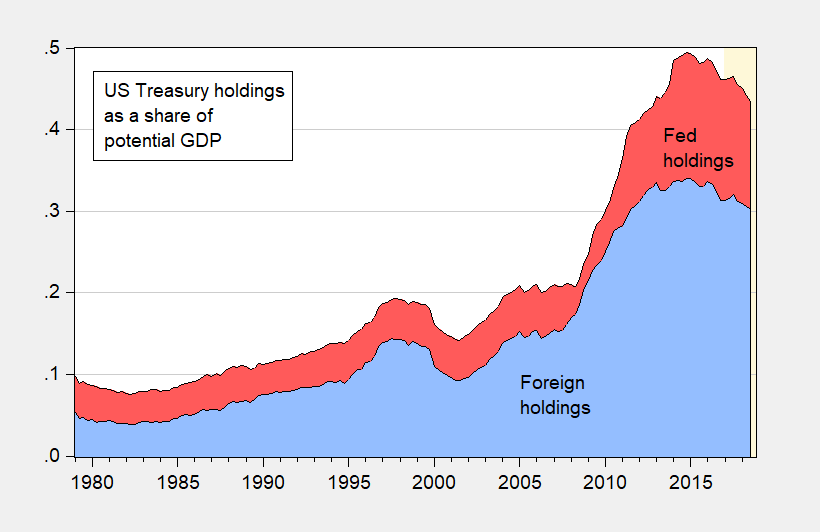

Not only is emission of government bonds rising, demand for government bonds is apparently tailing off.

Figure 2: Foreign and international holdings of US Treasurys (blue) and Federal Reserve holdings (red), both as a share of potential GDP. Source: BEA, CBO, and author’s calculations.

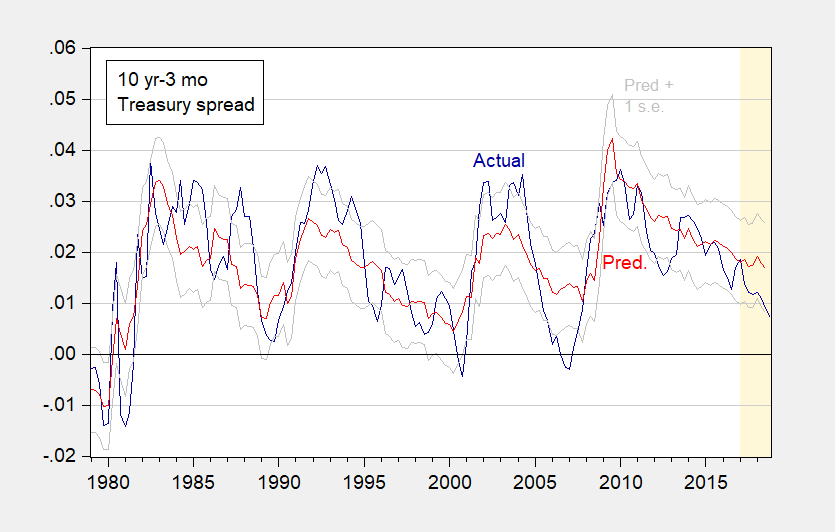

Running a Kitchen-Chinn (2012) specification augmented with expected annual growth from the Survey of Professional Forecasters (to account for the expectations hypothesis), yields:

Spread = 0.003 – 0.278(y-yn) – 0.197(inflgap) – 0.148(BuS) – 0.014(FedHold+FornHold) + 0.297(ExpGrowth)

Adj-R2 = 0.57, SER = 0.008, DW = 0.57, Bold denotes significance at 10% msl using HAC robust standard errors.

I find that the spread is over-predicted, by about half a percentage point.

Figure 3: 10 year-3 month Treasury spread (blue), predicted spread (red), spread plus/minus one standard error. Orange shading denotes Trump administration. Source: Federal Reserve and author’s calculations.

Could be just estimation error. Or the spread is falling because of factors not otherwise included in the regression (structural budget deficit, output gap, inflation gap, Fed and foreign Treasury holdings, and expected one year growth rates).

If the SPF median expectations signaled faster growth than market expectations, for instance, that might be one possibility.

Disclosure: None.