The Month Of March Should Be Good For Stocks, And These Groups In Particular

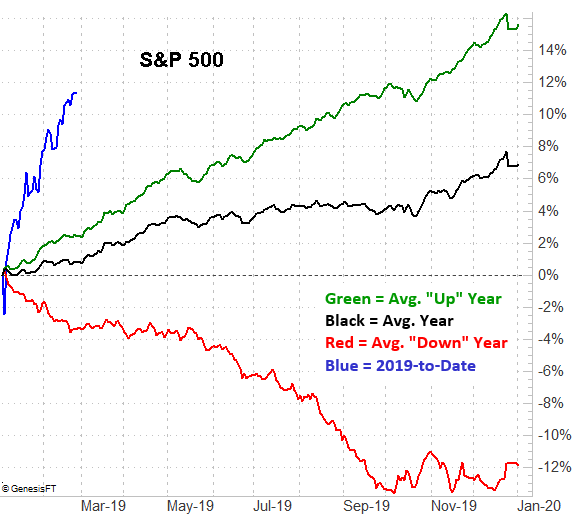

Are things ‘back to normal’ for the market? That is to say, was December’s largely unmerited drubbing put all the way into the rearview mirror by the January/February bounce?

If so, that’s good news here at the beginning of the third month of the year.

It’s an often overlooked fact, but after a usually-lethargic February, stocks tend to heat up again before running into their summertime lull. On average, the S&P 500 gains 1.1% in March and grows another 1.7% in April. May through… well, September is a slow time, forcing traders to make a point of looking for hot spots. Between now and then though, the broad tide is poised to rise, assuming the big bounce since late-December hasn’t left stocks dangerously overbought.

That’s a big ‘if,’ of course. But, tendencies are tendencies for a reason.

The bigger question is, which sectors and industries are more likely to thrive in March than others? There’s an answer. In no particular order…

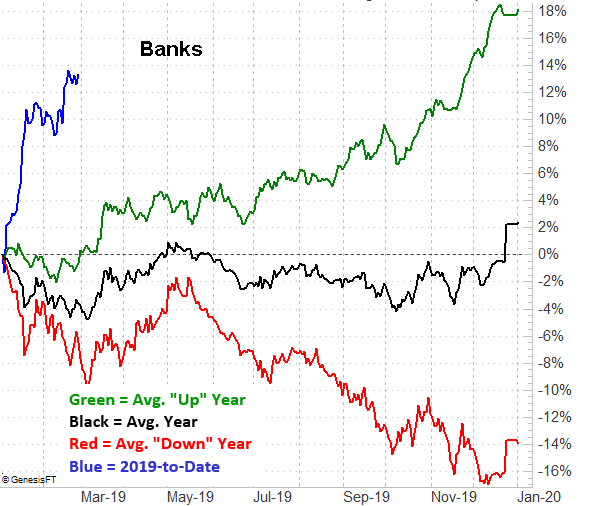

Banks

Whether they’re on a route to a winning year or a losing year, March and April tend to be great ones for bank stocks like Bank of America and Citigroup. Regional banks and thrifts? Not so much. Money-center banks generally log a gain of 2.2% in the upcoming month and add another 2.6% in March.

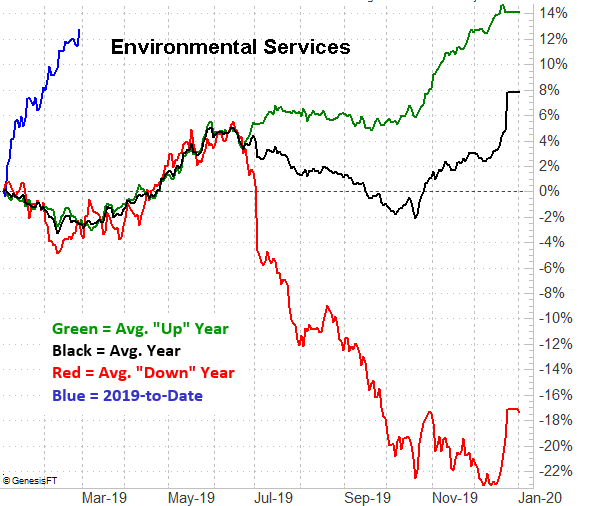

Environmental Services

It’s obscure but too reliable to ignore. Between the end of February and the end of April, environmental science names gain roughly 4.3%, but then tend to add another 3.0% in May alone. That’s the case regardless of what lies ahead the rest of the year. A couple of names here include Waste Management and Stericycle.

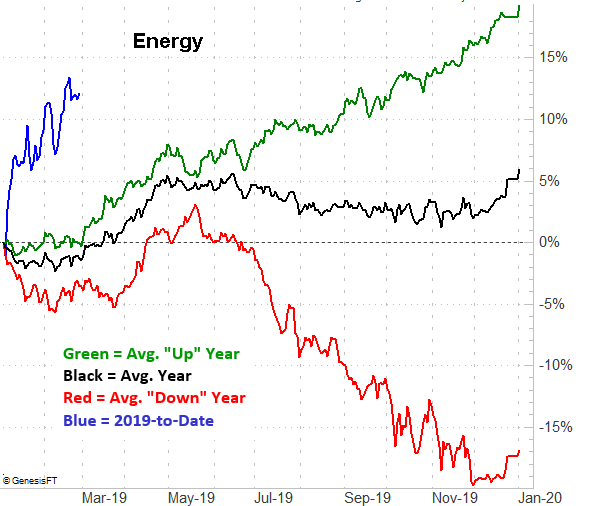

Energy

Energy stocks typically gain 6.0% for the coming two-month stretch. That’s the case no matter what lies in store for the remainder of the year. Drillers do particularly well, as do equipment and services. Refiners and storage, not so much. They all do rather well though.

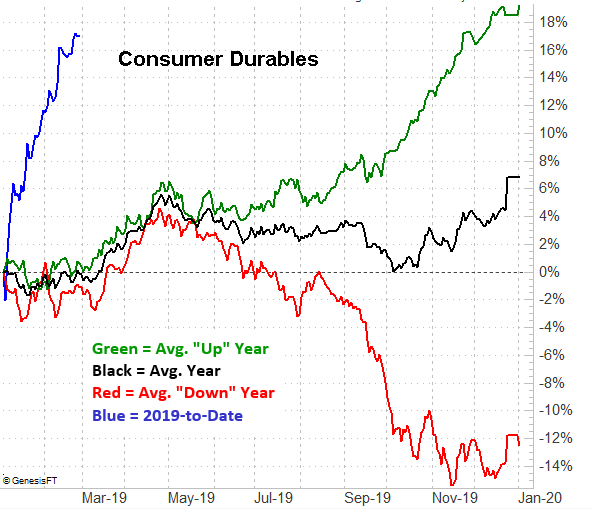

Consumer Durables

From furniture to footwear to furnishings, anything that consumer buy but don’t eat tend to make for hot stocks in March. Consumer durables stocks gain, on average, nearly 3.0% in the coming month, followed by a typical 3.1% advance in April. That said, the party tends to end pretty abruptly in May, and that weakness can linger through September.

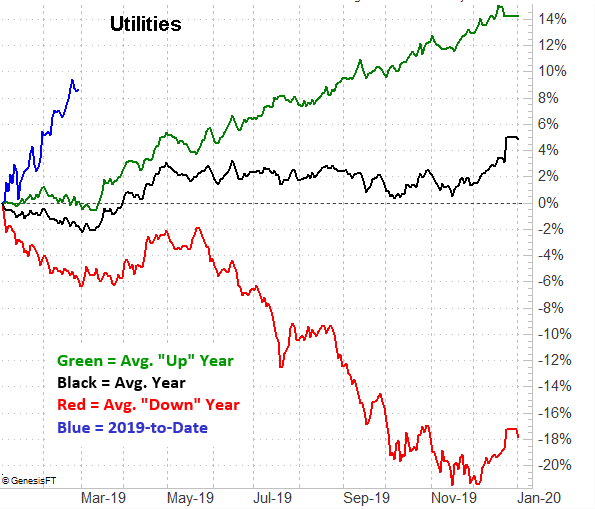

Utilities

One would think utilities stocks would thrive in the middle of winter when it’s freezing cold and people are heating their homes one way or another. That’s not the case though. In reality, utility stocks tends to be poor performers through February before moving into the usual March/April advance of 4.6%. Like the consumer durables rally though, the utilities rally tends to peter out come May.

Railroads

Finally, while most transportation stocks tend to perform well in the coming time of year – at least partially for cyclical reasons – railroad stocks perform exceedingly well. On average, this group gains 2.5% in March and gains another 4.1% in April. CSX and Norfolk Southern tend to be the most reliable.

Final Word on Seasonality

Bear in mind that seasonal tendencies are just that… tendencies that may or may not apply in any given year. On the other hand, tendencies take shape for a reason. If there’s doubt that one won’t pan out, as usual, this year, be sure there’s a specific reason to draw that conclusion.

To that end, the 2019-to-date performances of all the industries’ stocks isn’t an especially good reason to think this year will be an exception to the norm. What you’re not seeing on any of the charts is December’s (and really, October’s and November’s) oversized meltdown left the industries’ stocks sharply oversold right as last year came to a close. The new year started deeply oversold and ripe for a sharp bounce.

In other words, of all the things to worry about, don’t sweat this year’s heroic start. Technically speaking they’re overbought, but they’re not necessarily ripe for a pullback.