The Message From The Models: The Bulls Are In Charge, But...

It was a busy weekend of birthday celebrations (we had 2) and important family events in my household (our youngest is moving into her first apartment!) and as such, I didn't take the opportunity to spend a couple of hours of quality time at the keyboard.

While I've got a good start on a missive entitled "Twelve Charts Tell The Story", this piece will have to wait, as there just wasn't time to do the idea justice. Hopefully, I'll be able to knock the remainder out by mid-week.

So, to start the week, I'll let the indicator boards do the majority of the talking. In short, while the trend and momentum indicators continue to sport an awful lot of green and the Fundamental Factors remain constructive, the Early Warning and "Primary Cycle" boards both continue to give me pause.

In a perfect world, with stocks overbought and sentiment becoming extreme, the market would pull back a bit to relieve some of the extreme overbought/sentiment conditions and provide an entry point for those under-invested folks who were silly enough to think that a big decline in the stock market might be meaningful. I know, I know, such thoughts are sheer folly, right!

But so far at least, the bulls have not been accommodative and all dips - which have largely been limited to intraday affairs - have been bought on a consistent basis this year. However, with the S&P currently sitting at an important technical juncture and the table "set" for at least some sort of pause/pullback, it will be interesting to see if the bears can get up off the mat and get something going - if even for a few days.

But for now, let's dispense with the objective musings and get to the indicators and market models.

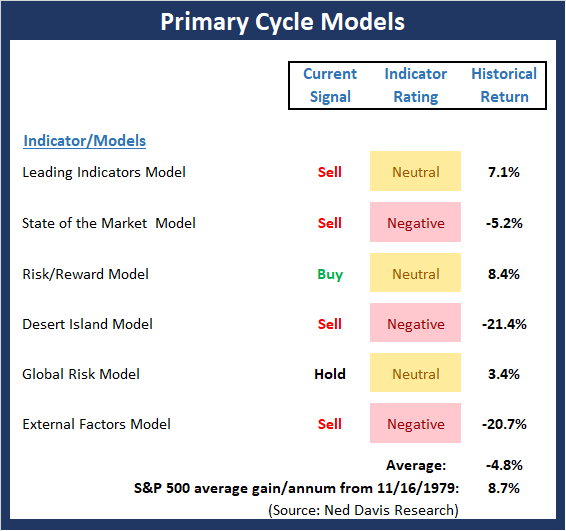

The State of the Big-Picture Market Models

I like to start each week with a review of the state of my favorite big-picture market models, which are designed to help me determine which team is in control of the primary trend.

The Bottom Line:

- While the "Primary Cycle" board continues to give me pause, at least there is some improvement to report this week. The Global Risk Model upticked in a meaningful way to a reading of 50% (from 15.5%), putting the model into the neutral zone. I find this meaningful due to the fact that the global markets entered a bearish environment early last year - well ahead of the U.S. So, the fact that the tide appears to be turning (likely on the hopes that a trade deal will spur future growth), means the potential for further upside in the U.S. is improving. Now if we could just get some of my favorite big-picture models to perk up, we'd be cookin'!

This week's mean percentage score of my 6 favorite models improved to 45.4% from 40.3% last week (2 weeks ago: 44.2%, 3 weeks ago: 48.9%, 4 weeks ago: 48.9%) while the median upticked again to 46.3% from 42.5% last week (2 weeks ago: 40%, 3 weeks ago: 46.7%, 4 weeks ago: 46.7%).

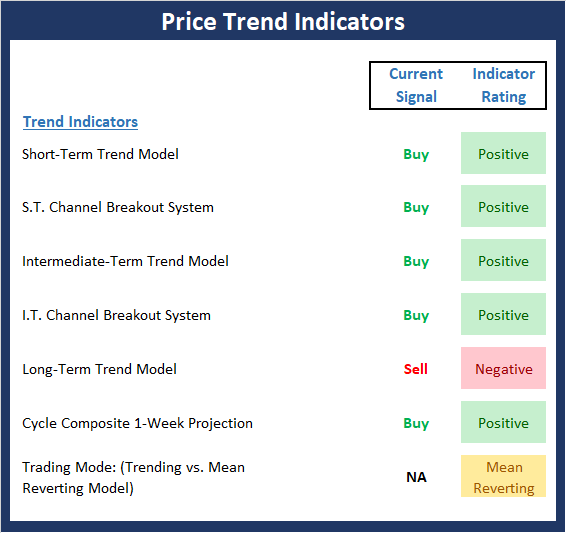

The State of the Trend

Once I've reviewed the big picture, I then turn to the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

The Bottom Line:

- With all but one of the Trend board indicators sporting a green hue, it appears that the "trend is your friend." Two other points here. First, the S&P 500 appears to be struggling with, or at the very least, pausing at a key resistance zone that everyone on the planet is aware of. Second, we are quickly approaching the average length of time that "bounces" from waterfall declines last. As such, the near-term price action takes on added importance. A break above 2815 would embolden the bulls and argue for new highs whereas a failure at resistance would likely usher in an overdue pause in the rally.

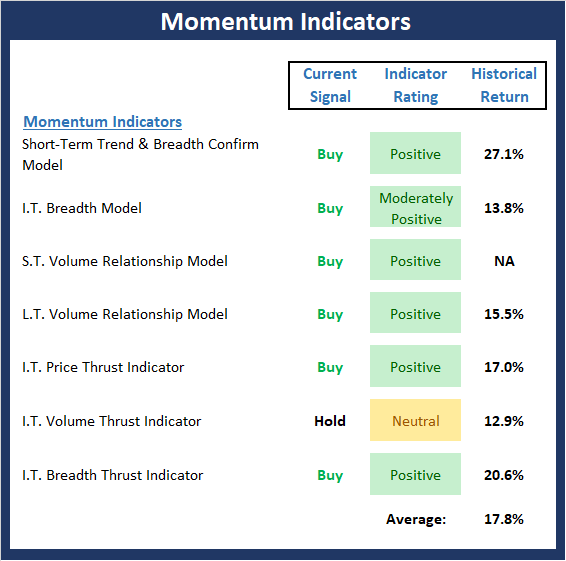

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend.

The Bottom Line:

- The dominant color of the Momentum board remains green. However, a small degree of weakness can be seen creeping in. For example, the I.T. Breadth Model downticked just enough to fall from an outright positive reading and our I.T. Volume Thrust indicators pulled back into the neutral zone. However, neither is enough to change the view that momentum remains strong and a buy-the-dip approach remains appropriate (assuming there will be a dip at some point - ha!).

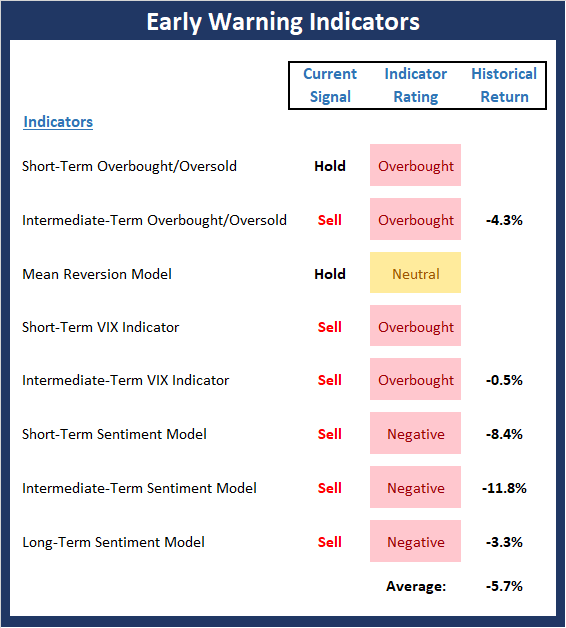

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders might start to "go the other way" -- for a trade.

The Bottom Line:

- The Early Warning board continues to suggest that the potential for either a counter-trend move or an outright trend reversal is high. While our overbought/sold indicators show that the table is set for the bears, I also note that the longer-term sentiment indicators are not at extreme readings. So, given that the trend and momentum boards are positive, one can argue that any decline in the near-term would likely be short and shallow.

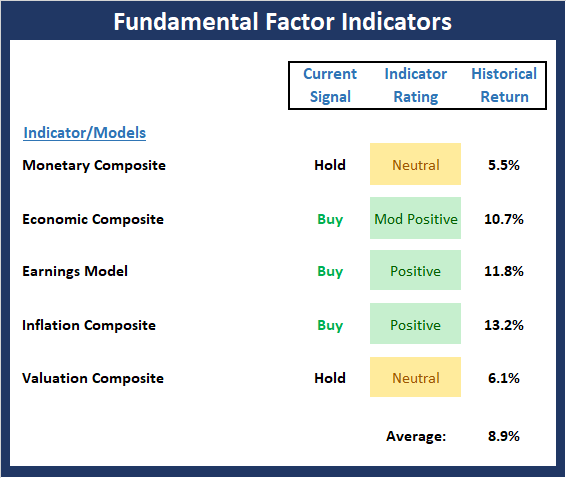

The State of the Macro Picture

Now let's move on to the market's fundamental factors - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

The Bottom Line:

- While the Fundamental Factors board suggests the backdrop for equities remains constructive, it is worth noting that some of our economic models have slipped recently. For example, our model designed to predict economic growth fell into the "moderate growth" mode and our model using the index of Coincident Economic Indicators produced a sell signal. So, while the bulls should be given the benefit of any doubt from a near-term perspective, we need to recognize that the #GrowthSlowing theme is real.

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more