The FOMC's November 1st Meeting Conundrum

What Is The Conundrum?

The Federal Reserve has been very clear through its' forward policy guidance that it will slowly increase the Fed Funds Rate. "Slow" should more appropriately be described here as at a "Glacier Pace"!

Additionally, the Fed plans to gradually reduce the central banks' balance sheet at a slowly increasing rate. A rate that over 15 months totals only 10% of the $4.5T growth in the Fed's Balance Sheet since the beginning of the Fed's Quantitative Easing (QE) and ZIRP.

The general perception is that going forward the Fed will either:

- Raise Rates & Reduce Balance Sheet as is being presently signaled,

- Do Little (in reality what they are actually doing) or Marginally Nothing Further, or

- Resume another version of QE ∞, plus Negative Interest Rate Policy (NIRP) and possibly Helicopter Money.

Why Quantitative Tightening?

The expressed reasons for the requirement for "Normalization" of US Monetary Policy is that the US Economy is now over 8 years into the recovery with low unemployment rates and signs of a broad-based (though weak) recovery. It is my opinion both of these conditions are not valid, however, I will leave that for another day.

Instead, I would like to suggest what may be a few of the real reasons for the Fed's QT stance is:

- The Fed requires some much needed "firepower" to fight a possible downturn in the business cycle. A cycle that is now extended by historical benchmarks,

- Remove some of the speculation & excess leverage in the financial markets that appear to be approaching "bubble levels" in both the bond and equity markets,

- Offer some relief to an imperiled pension system before it becomes overwhelmingly and systemically underfunded.

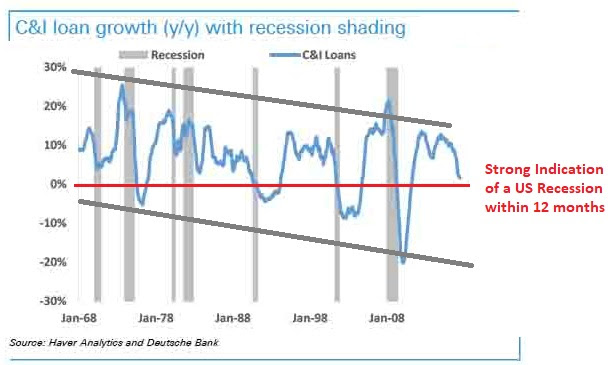

The above Fed Chart has been Extremely Accurate In Warning the Fed of Recessions (shown in grey)

What The Fed Sees

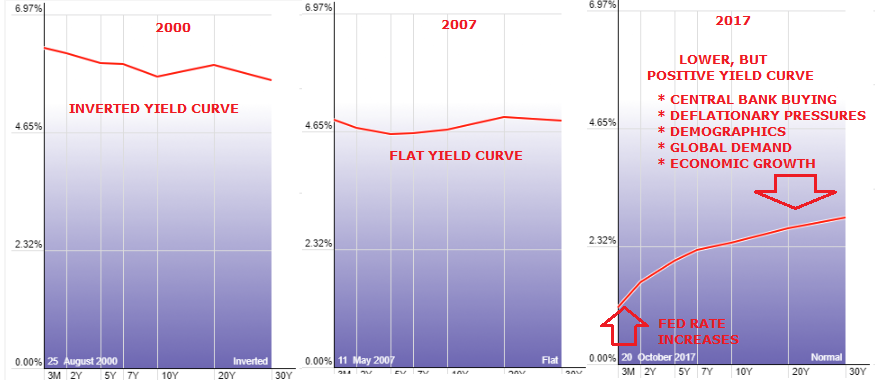

Having lived through and as an investor participated in 1987, 2000 and 2007 I learned a number of lessons. One is the importance of advanced shifts in the Currency, Credit and Yield markets prior to major reversals in the equity markets.

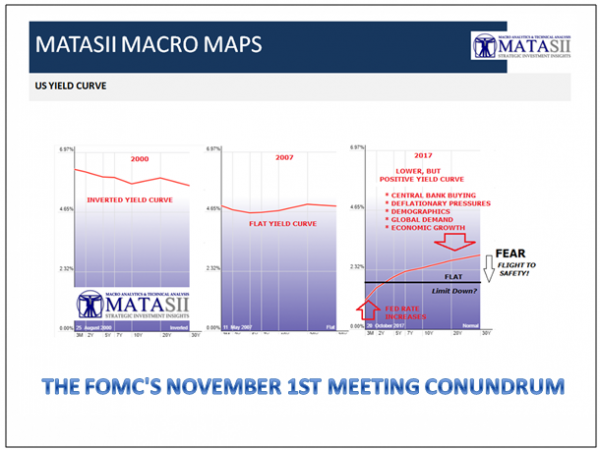

The yield curve is of particular note since it is presently almost completely ignoring the Fed and has been steadily flattening. This is problematic, especially for the Fed!

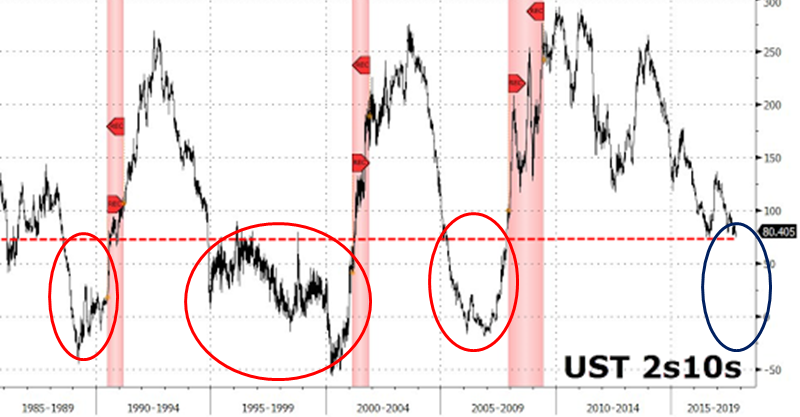

We can see that the 2-10 US Treasury spread is below the dotted red line which has always preceded a major market correction, as well as a US recession.

What I learned was that there is always a shock or surprise (shown in Blue) which comes out of "nowhere".

What that surprise is, doesn't really matter except it occurs because of hidden underlying market dislocations. Extreme valuations, low volatility, market speculation, excess leverage, etc., etc., all contribute but are not in themselves the direct cause. Together they all contribute.

The only thing you can be certain of is that market fragility will abruptly fracture. The Fed is acutely aware of this and knows it must be fully prepared!

The irony is that QT will likely contribute to this fragility and shock. Therein lies the FOMC's Conundrum!

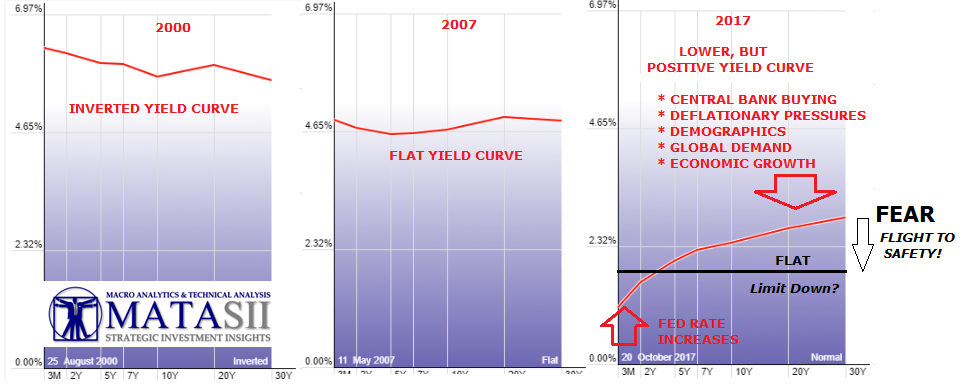

We can see the yield curve comparison prior to the 2000, 2007 tops along with today's level. Though the yield curve is not flat or inverted (yet) it is setup for exactly that to occur.

The black line shows that a couple of minor Fed rate hikes on the short end, and a shock which precipitates the normal "Flight to Safety" into the security of longer dates US Treasuries and the yield curve would be flat-to-inverted in a "New York Minute"!

Conclusions

In a recent SA article "Euphoria And Greed: The Final 5% Is Always The Most Expensive" I pointed out how the Consumer Comfort sentiment indicator is historically an important institutional tool in assisting with timing. Since posting that article "US Consumer Comfort Plunged the most in 13 months as 'Personal Finance Fears Mounted".

What may be a conundrum for the FOMC next week, need not be a conundrum for you!

Disclaimer: Information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any ...

more