The “Fly Like An Eagle” Stock Market

Following Chair Powell’s press conference yesterday, the song that appropriately captures market sentiment this week is the Steve Miller Band’s “Fly Like an Eagle.” It hit #2 on the Billboard Hot 100 chart in March 1977 (four months before I was born!):

I want to fly like an eagle

To the sea

Fly like an eagle

Let my spirit carry me…

Steve Miller Band - Fly Like an Eagle

Chair Powell’s commitment to “full employment” and ensuring no structural long-term unemployment – as we had following the Great Financial crisis (post 2009) – is clear. He will keep the pedal to the metal with low short rates and $120B/month of bond purchases until everyone that wants a job, has a job.

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well-anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved.”

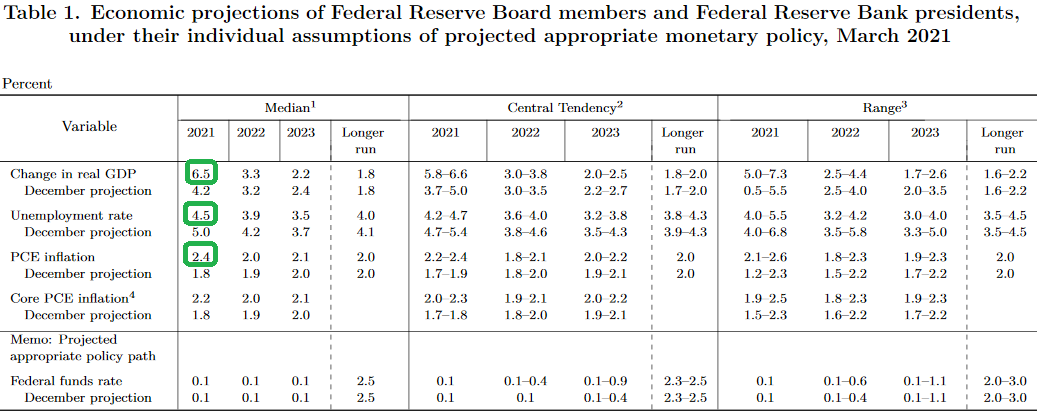

The three numbers in yesterday’s statement that stood out were:

- Their 2021 GDP projections finally caught up with the Street at ~6.5% (up from 4.2% in December).

- Their 2021 unemployment rate expectation of just 4.5%.

- The fact that they now see PCE inflation at 2.4% (up from 1.8%).

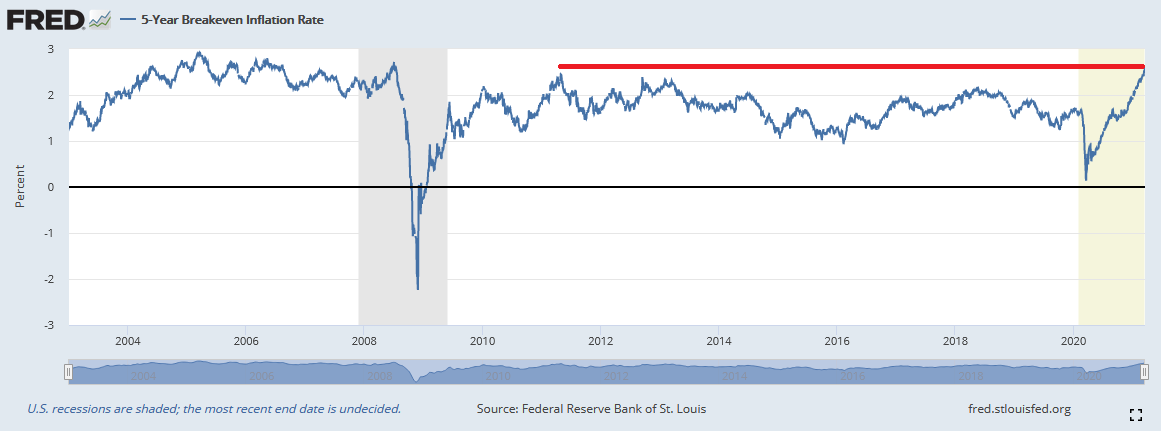

This is in-line with the spike in 5-year inflation breakevens (now trading up to 2.58%):

FRED, “The breakeven inflation rate represents a measure of expected inflation derived from 5-Year Treasury Constant Maturity Securities and 5-Year Treasury Inflation-Indexed Constant Maturity Securities.. The latest value implies what market participants expect inflation to be in the next 5 years, on average.”

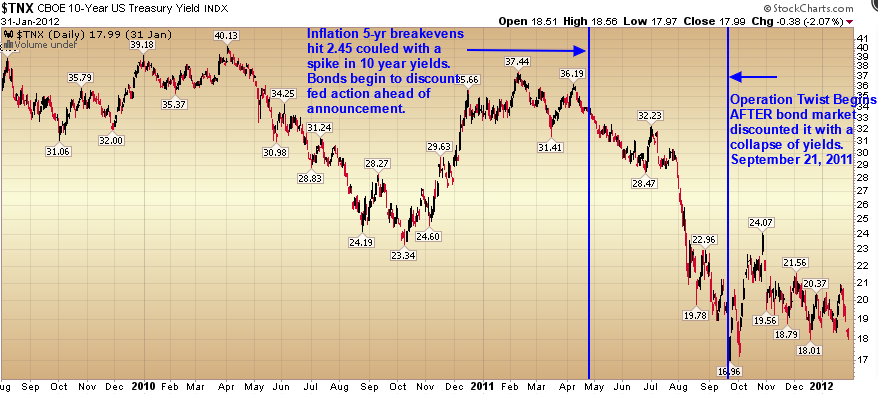

When 5 yr inflation breakevens hit 2.45% in late April 2011, the Fed started putting out trial balloons for “Operation Twist” (the Fed uses the proceeds of its sales from short-term Treasury bills to buy long-term Treasury notes). Several months later – on September 21, 2011 – they implemented the program with $400B. Bond yields compressed IN ANTICIPATION of this change of policy (from April through September) and BOTTOMED when the program was ACTUALLY IMPLEMENTED.

Compare that to today:

While the knee-jerk reaction yesterday was stocks up, dollar down, yields elevated – the question now becomes, “what does the market begin to discount moving forward?” It is KNOWN that Chair Powell is dovish, but he also will not want to lose control of the long end of the curve. Powell has stated that he is “data dependent” and the market will take any inflationary data in coming weeks as a signal that his hand will be forced sooner than anticipated. The key will be how far do “bond vigilantes” have to push him before he blinks? My guess is he doesn’t let the 10-year yield get to 2% before they start jawboning.

Whether they begin to “trial balloon” it (Operation Twist) in coming weeks/months if yields continue upward – or if the market sniffs it out, the “uncrowded trade” is yields moderating (the exact opposite of what is expected after yesterday’s meeting).

Are we expecting a repeat of 2011 (rally in bonds, collapse in yields)? No. We do not anticipate a collapse in yields, but a moderation or short-term correction in yields is currently not expected – and in our view more probable than not. The question becomes, “how much more do yields have to move first before this reversal/moderation?”

While Hedge Funds are piling into the crowded trade (short bonds) AFTER a 25% drop in bonds, Commercials (who are often ahead of the curve, early, AND RIGHT) are buying (like they did before every major bounce in bonds in the past). Commercials are the green line at the bottom, large traders are red:

When this change happens, bonds will get a short-term bid – as will stocks with dividend yields above the 10yr (as they will become more competitive relative to bond yields). Utilities, Staples, and Big Pharma should benefit the most and continue their recent bounces – as this change gathers traction. Expect fits and starts in the interim (despite the big move in Utilities in the past two weeks).

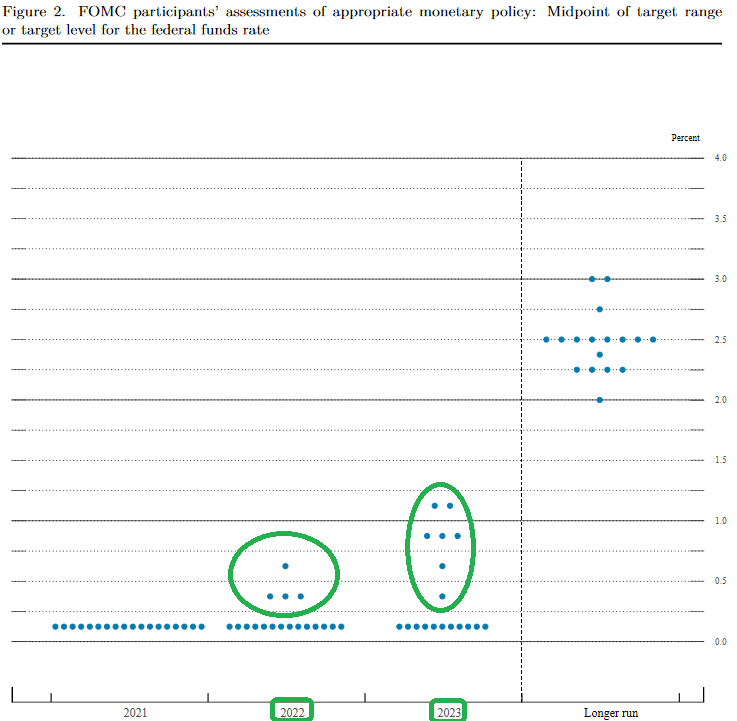

It was also notable that 4 members see rate raises as a possibility in 2022, and 7 members see raises in 2023 (versus the newly “promised” 2024 target):

Are Bonds Really “Stupid?”

On Tuesday, I was on Fox Business with Liz Claman on the Claman Countdown. Thanks to Liz and Ellie Terrett for having me on.

In this segment, we discussed Ray Dalio’s statement that “Bonds are Stupid” and what to buy moving forward: Watch Fox Business Segment Here

I agree with Ray Dalio that investment in bonds makes less sense than equities today, but I have always felt that way – as history unequivocally proves that out over the past 200 years.

I prefer certain pockets of US equities over Chinese equities (Mr. Dalio’s preference) for the following three reasons:

- Due to China’s “one-child” policy (which lasted from 1979-2015), their demographics are less favorable for growth moving forward – as they have an aging population.

- In the US, Millenials (72M) now outnumber Baby Boomers (71M) – and are at the age that drives growth/housing formation (25-40 years old). They are now in the same stage of their spending cycle that the Boomers were in the early/mid-1980’s – which drove economic growth for a decade and a half. China does not have this advantage.

- China did not extend stimulus to the same magnitude as the US to weather the pandemic. They are also withdrawing stimulus in recent months – as we have been adding another $2.8T. I think China will see tightening conditions that simply won’t be present in the US in the coming year or two.

In the last couple of weeks, we mentioned Utilities, Staples, and Big Pharma as a way to play this environment. Many Utilities and Staples are up 5-10%+ since. Pharma has been the laggard and looks ready to move in the coming weeks.

Not only will it work if the Fed eventually talks down rates, but the Healthcare sector has also proven to better hedge against inflation than Gold (and other sectors) – since 1926. It is the best inflation hedge because demand stays firm – even as pricing power increases.

We continue to like PFE, NVS, and MRK over the next 6-12 months.

Institutional Survey

This week, Bank of America published its monthly “Global Fund Managers” survey (~200 managers with ~$600B AUM). I posted a summary here: March Bank of America Global Fund Manager Survey Results (Summary)

My three key takeaways were:

- 43% of Managers said that a 10-year yield of 2% could spark a 10% correction in the S&P 500. (this probably means it will take longer to get to 2% than most people are anticipating)

- Managers dumping tech stocks at the fastest pace in fifteen years. (this probably means some parts of tech are due for a bounce)

- Exposure to commodities now sits at an all-time high. (this probably means big movers in the space are due for a short-term rest after being up 75-100%+ in a matter of months).

Now onto the shorter-term view for General Market:

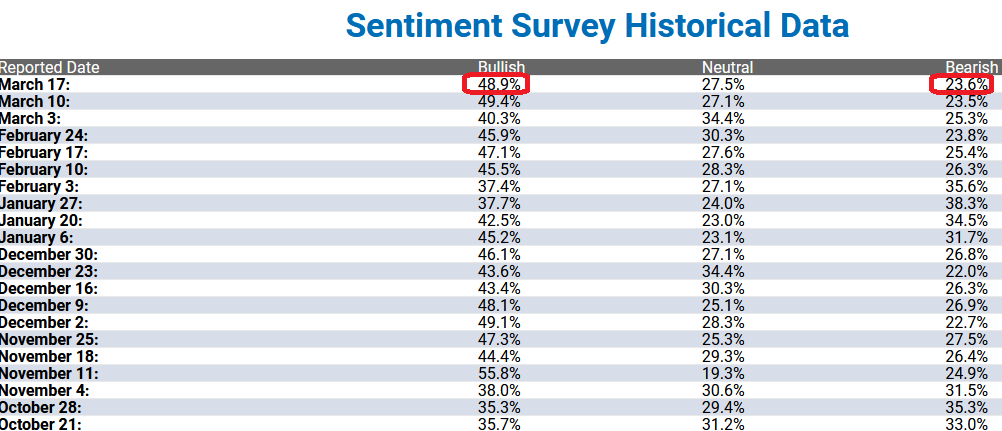

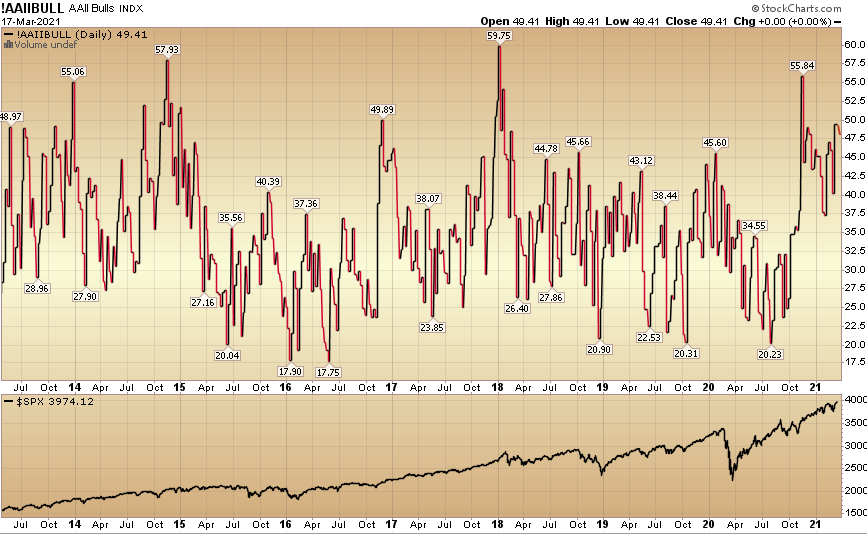

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked down to 48.9% from 49.4% last week. Bearish Percent flat-lined to 23.6% from 23.5% last week. Retail exuberance is persisting.

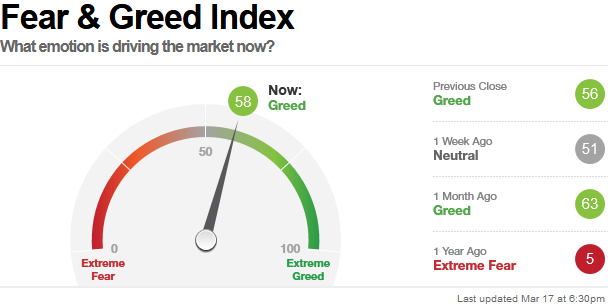

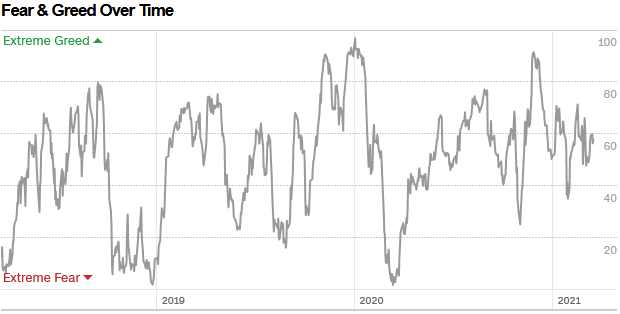

The CNN “Fear and Greed” index moved up from 51 last week to 58 this week. This is a neutral reading. You can learn how this indicator is calculated and how it works here: (Video Explanation)

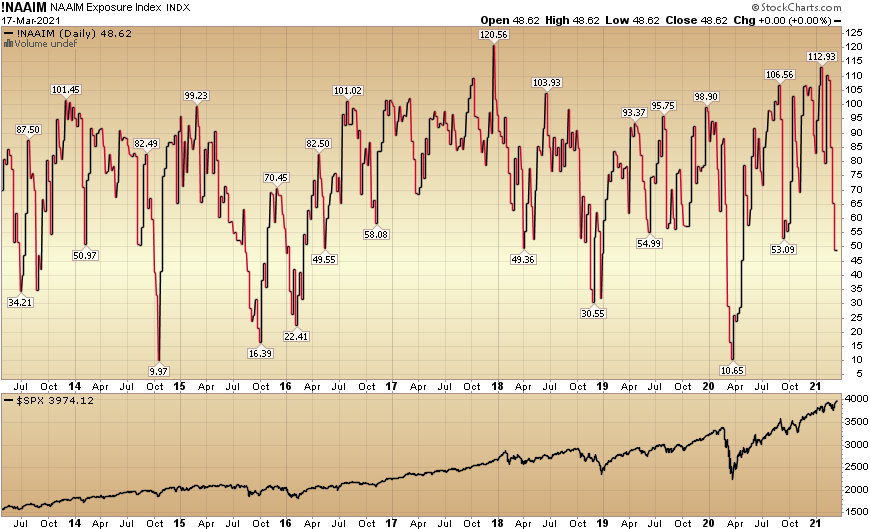

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 48.62% this week from 65.37% equity exposure last week. Active managers are more pessimistic than retail.

Our message for this week:

We built up selective positions in Utilities, Consumer Staples, and Big Pharma since we first mentioned it at the end of last month. We think the rebound in this group should continue in the coming months (even if we have a few fits and starts – after a nice jump in the past 2 weeks).

We continue to hold our banks, energy and defense/aerospace stocks from much lower levels last year and would not be surprised if they take a breather – before resuming their uptrend.

Reminder: Pay less attention to the general indices – as there are many crosswinds at present – and more attention to take advantage of the “rallies under the surface” through sector rotation.

Disclaimer: Not investment advice. For educational purposes only: Learn more at more