The Fed Pivot

FED PIVOT MINIMIZES THE MAIN STREET-WALL STREET DICHOTOMY

In our last newsletter we wrote, “although the Federal Reserve will pause and continue to be data dependent, unlike some of his predecessors, Jay Powell will continue to formulate policy based on the goings-on of Main Street. The liquidity flow from Wall Street to Main Street will continue, and as a result, the Fed will continue with QT and be more hawkish than the market will like.” While future Fed action is never certain, the statements and musings from Fed governors since the beginning of the year have been considerably more dovish than we expected and force us to reconsider Powell and his monetary doctrine.

There is a real possibility that the Federal Reserve will pare back its Quantitative Tightening (QT) program by the end of the year. Structurally, we think this is a mistake since the Fed’s balance sheet has very little impact on overall economic activity. The pivot in policy is a retrenchment back to the decade-long precedent of formulating monetary policy based on asset prices. We have always viewed the “third mandate” of the Fed as a structural mistake. Look no further than the health of the Eurozone and Japanese economies to illustrate the negative effects of bloated Central Bank balance sheets. They restrict capital market function, hurt bank profitability, and incentivize risky corporate and consumer behavior. Nevertheless, it is not our job to formulate solid monetary policy. It is our job to invest given the structural forces that are in place and fighting the Fed has never been a recipe for success.

The willingness of the Federal Reserve to turn tail and reverse their QT program in the face of a 20% decline in equity values, reveals that they still view their balance sheet as a viable monetary tool. Despite there being no concrete evidence that Quantitative Easing (QE) does anything to help the underlying economy, it seems the Fed is still open to using it. As such, the dichotomy between Main Street and Wall Street we referenced in our last newsletter is considerably less pronounced given the Fed pivot. Multiple contractions is less of a risk in 2019 than we had assumed. The pivot does not make us bullish risk assets, but it does reveal a “Powell Put” that is much higher than we had originally opined. The performance of equity markets since the beginning of 2019 has no doubt incorporated this notion - the consternation that Powell would not protect asset prices has been eliminated. It is very plausible that when the Fed is finally confronted with a choice between stimulating asset prices and fighting inflation, they will opt for the former.

IMPLICATIONS OF A SPINELESS FED

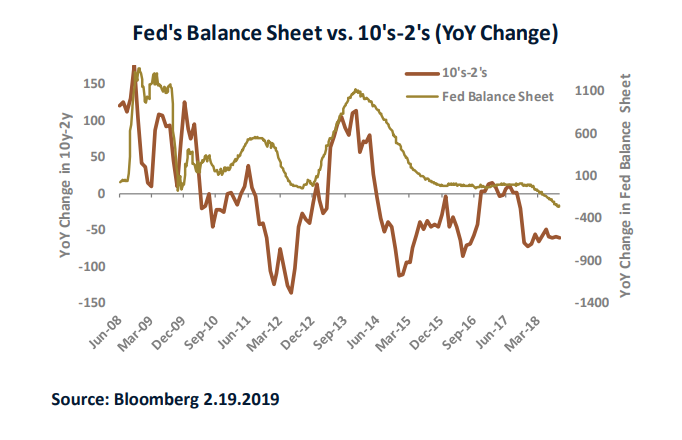

The Fed pivot has many implications for markets. First, it removes one of the pillars supporting dollar strength. Global interest rate differentials have been a major driver for the dollar, and this is the first step in removing support. Second, we believe the Fed’s implicit choice of promoting growth instead of preventing inflation will steepen the yield curve. The rate-hike pause already allowed for marginal steepening. Meanwhile, the end of QT exacerbates this potential. Balance sheet expansion (or removing contraction in this case) have been steepening catalysts over the past decade as is illustrated in the chart below.

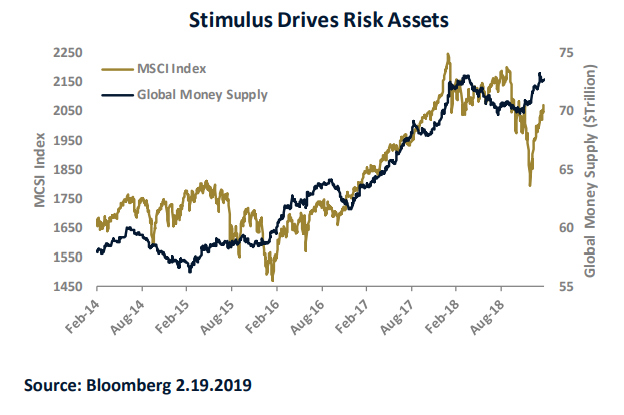

Meanwhile, risk asset performance over the last couple of months can be directly attributed to global stimulus – particularly China. Global money supply started expanding in mid-December and is currently at all-time highs. It is no coincidence that the surge in risk assets has been accompanied by stimulus. The chart below shows the MSCI world index versus global money supply.

As the Federal Reserve joins other Central Banks with a more dovish approach, Gold and other hard assets should do well as real interest rates remain low. The wild card is nominal interest rates, as we believe the market is prematurely celebrating a victory over inflation. Oil has experienced a strong recovery in 2019, and core inflation in the United States is running close to the Fed’s 2% target. Anecdotally, many companies have indicated their intent to raise prices over the next 12 months. This theme has been a fixture in earnings reports over the past month. We believe that the data will merit another interest rate hike this year. However, for the first time since Powell took the helm, we question the Fed’s resolve. It is also possible that an additional hike will be accompanied with removal of their QT program. If they choose to ignore stronger inflation data over the next twelve months, curve steepening could be even more severe. The only thing we are certain of is the treasury market will continue to have to absorb supply, as the Federal government continues to operate at a $1 Trillion annual deficit. Given the risks of inflation and the influx of supply, we continue to favor the short-end of the yield curve from a risk-reward perspective.

TIME TO BE DEFENSIVE

The narrative that the Fed will protect asset prices is not an old one – it has been pervasive for the duration of this expansion. The risk is that monetary stimulus fails to help the underlying economy. This is particularly troublesome since there is zero evidence that balance sheet expansion promotes real growth. We are concerned that the recent Fed pivot, while it has been short-term bullish for risk assets, indicates a weakened resolve on the part of the Fed to keep inflation in check. Structurally, this could be a real problem down the road. Higher longer-term rates increase the cost of-capital for consumers and corporations – the latter is already battling increased input costs and rising wages. And if they succeed in passing through these costs to the consumer, it could cause an inflationary feedback loop that further squeezes margins. Can monetary stimulus (or the lack of tightening) drive risk-assets higher? Of course. But the seeds of a Fed reversal are becoming increasingly evident. The 3m – 2y portion of the yield curve is threatening an inversion, and historically risk assets perform terribly during a Fed easing cycle. Given the risks of a steepening yield curve, the pivot in Fed policy, and a near-term end to the economic expansion, we think that it is an ideal time to shorten duration and increase credit quality.

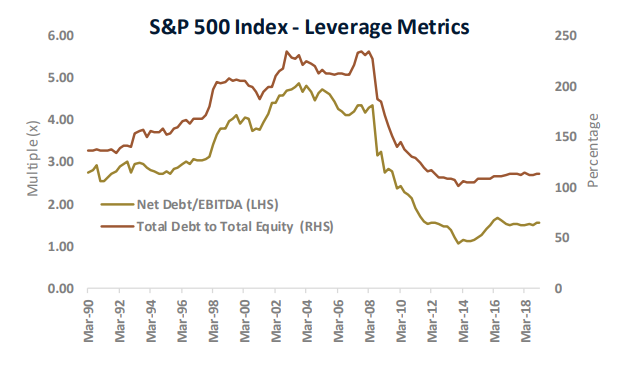

It’s important to make the differentiation between being defensive and outright bearish. Mainstream media continues to proliferate the message that corporations and consumers are overly-leveraged and that there is a considerable systemic risk. We disagree. Debt service as a percentage of disposable income and debt-to-net-worth are at 40-year lows for the consumer. And although an increasing percentage of IG credits are flirting with junk status, overall credit metrics are strong. The chart below shows that leverage metrics for the overall S&P 500 are much healthier than they were prior to the last two recessions.

We are preparing for a recession, but the lack of systemic risk and consumer and corporate credit health lead us to believe that the next recession might be a shallow one.

Disclosure: This article is distributed for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. ...

more