The Fed Did One Thing Right In The Great Recession. But It Wasn't Enough

The Fed actually did something right during the Great Recession. It created the Commercial Paper Funding Facility. The CPFF contributed to liquidity in the commercial paper markets. The facility was closed in 2010.

Commercial paper funded real estate loans, and with the stricter guidelines implemented after the real estate crash, commercial paper actually has slowed down significantly as a means of funding consumer debt.

So, as a result, household debt has been drastically reduced:

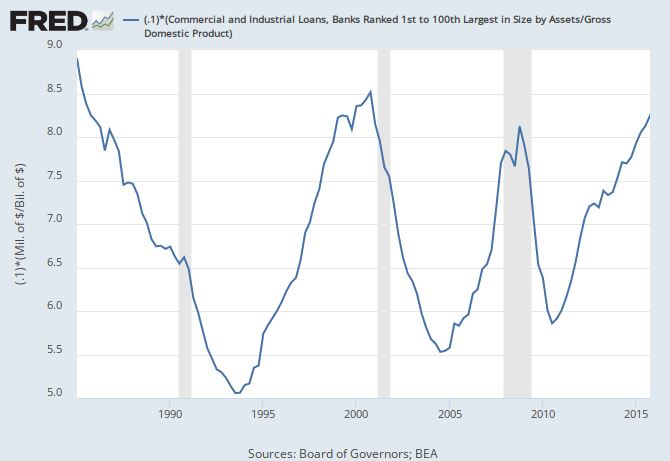

As Stephen Williamson, St Louis Fed VP, has pointed out, the decrease in consumer debt has been mainly mortgage debt reduction. Fewer people qualify for loans but C & I Loans do continue. Yet, as the chart below shows, banks continue to lend robustly to somebody, but not necessarily to the American consumer:

It has been said that this lending has partly been in ABS lending, auto loans, as opposed to MBS lending, mortgage loans. This would explain that direct lending. And also, the banks are taking up some slack in Europe. This lending is not creating inflation in the USA, as the consumer is languishing.

So, there are healthy and unhealthy aspects to this slowdown in lending. Consumers are able to strengthen their balance sheets but maybe not so much, as rent has been increasing. At least the temptation to get HELOC funding is way down, as Dr Williamson points out. The expectation of house appreciation fueled that HELOC funding, as consumers believed their house prices would go up to offset the additional credit from HELOCs. Of course, when that appreciation stopped, the entire edifice was plunged into a Great Recession.

The expectation of house price increase was fostered by the bankers, and especially by chief NAR economist, David Lereah. I watched David Lereah appear on CNBC daily for quite some time during the slow motion housing crash of the past decade, stating that house prices would bounce back, that the dip was temporary.

Was he at fault for this misplaced optimism or was he abandoned by the Federal Reserve, who, although they did offer liquidity, seemed to plan the decline of commercial paper by design? Perhaps it was a mixture of both Fed design and Lereah's misplaced optimism. Maybe we will never know for sure. Market monetarists would certainly blame the Fed for a decline in commercial paper. David Lereah did admit, according to Zero Hedge, that he lied about the housing bubble after all.

Certainly this decline of commercial banking is not something new. It was what happened in the Great Depression. And government was angry with the bankers for pulling back. The austerity was found in the Industrial lending category in the Great Depression. Banks will let you down to protect themselves. Borrowers must always remember this important lesson. The warning to all of us is in the link above and it is a disturbing revelation about the central bank and banks in general. It is really the dark side of banking at work here:

Many economists believe, however, that regardless of the extent of future business and industrial expansion, short-term commercial bank credit will constitute a progressively less important factor in American economic life. This view is predicated upon the belief that changes in the structure of business and industry have profoundly altered the relationship between banking and industrial enterprise. In the belief of Lauchlin Currie, technical advisor to the Federal Reserve Board: “If economic progress continues to be associated with the increasing importance of the larger corporations having access to the stock and bond markets, there is a strong probability that the commercial loan will continue to decline in the future.”

It is slightly different in our day. In the Great Depression, C loans, consumer loans, have been curtailed. In the Great Depression, it was much worse. In the Great Depression, I loans, Industrial Loans, were curtailed. We may be making some progress here. But this is clearly why banks are lending mostly to big business through the credit markets, and why again, in our day, commercial banking is declining, although moreso in real estate to consumers rather than loans to businesses.

However, loans to businesses have the built in evil of requiring small and medium business to take the high fixed side of the derivatives bets. That guarantees bank profitability. But it is also kind of low down and underhanded in my opinion. And it insures that the Fed will do everything in its power to keep long bond interest rates low and growth slow.

The Fed didn't do enough, although it did some crucial things to protect the financial system. It didn't do enough for the mainstream economy.

At least it is something to think about going forward.

Disclosure: I am not an investment counselor nor am I an attorney so my views are not to be considered investment advice.

It has become extravagantly clear the Fed's actions only stabilized and made TBTF banks and their executives richer while potentially purposefully killing economic growth to ensure QE and zirp rates that enable TBTF banks to prey on other banks and grow bigger. The Fed should never be given the right to create liquidity again, because they clearly can't even manage interest rates let alone distribute wealth and liquidity through QE in any way that isn't obviously corrupt in nature.

Yes, from mispricing risk, which created the bubble, which created bad bonds and resulting panic, to cutting off the money supply, making the Great Recession worse, the Fed really acted against the interests of the people of the United States, in most of what they did. It is shocking, really.