The EUR/USD Effect: It Ain't An April Fool's Joke

There are three factors that have really started to influence the EUR/USD pair: France’s lockdown situation can only deepen economic woes, investors have lowered their expectations, and the euro is going to be printed into oblivion.

In the face of mounting EUR/USD and USDX pressure, what tricks will gold come up with? Is the yellow metal up to the challenge?

As you well know (if you’ve been reading the analyses), we’ve covered the subject of the EUR/USD pair quite extensively in the Gold Trading Alerts. The world’s most traded currency pair is extremely important to consider, as it accounts for nearly 58% of the movement in the USD Index.

Anytime that Europe’s economy underperforms that of the U.S. (which is what it’s currently doing), it’s a negative for the euro and bonus points for the dollar. Because the precious metals have a strong negative correlation with the USD Index, a rise in the dollar in the very near future will further serve as downward pressure on the precious metals. Yep, we’re looking at you, gold.

As the screams of hope attempt to drown out the whispers of reality, on Mar.31, the EUR/USD and the PMs enjoyed a short-term reprieve. However, with fundamental weight continuously being added to the EUR/USD’s barbell, the currency pair’s demise alongside the USD Index’s rise will likely elongate the PMs’ downside.

Let’s have a look at the three factors that are currently weighing on the EUR/USD:

1. France in Lockdown = France in Trouble

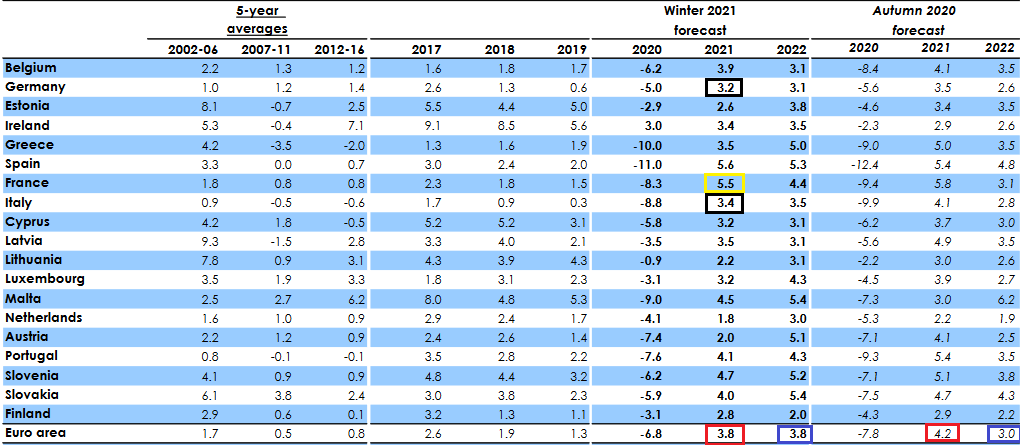

On Feb. 17, I highlighted that The European Commission’s Winter 2021 Economic Forecast (released on Feb. 11) predicted that the Eurozone GDP growth (3.8%) would be headlined by France’s outperformance in 2021.

I wrote:

The report forecasts that France (the yellow box below) will deliver 5.5% GDP growth in 2021. With ambitious being an understatement, it was less than two weeks ago (Feb. 4) that IHS Markit’s Eurozone Productivity PMI fell for a third-straight month (to 47.4 in January) and declined at its fastest pace since June. More importantly though, the report cited France and Italy’s service sectors as the main weak spots.

Source: European Commission Winter 2021 Economic Forecast

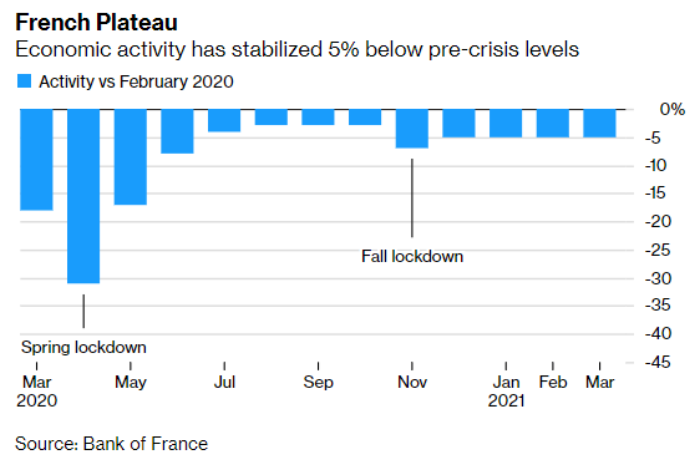

And after closing out the first quarter of 2021, Europe’s projected bellwether of GDP growth has made relatively little economic progress since November.

Please see below:

Adding insult to injury, despite the EUR/USD shrugging off the revelation on Mar. 31, Europe’s second-largest economy is now back in full lockdown. Addressing the nation, French President Emmanuel Macron said that "it is the best solution to slow down the virus.” We could “lose control if we do not move now."

Source: Sky News

Thus, can we finally stick a fork in France’s economic renaissance?

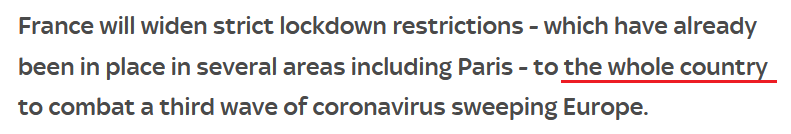

2. EUR/USD Sentiment Index Doesn’t Look Too Good

Adding to the EUR/USD’s bearish outlook, the currency pair’s sentix Sentiment Index – which is derived from a weekly survey of more than 5,000 private and institutional investors and reflects their expectations over the next month – has moved sharply lower.

Please see below:

To explain, the blue line above tracks changes in the EUR/USD’s sentix Sentiment Index, while the gray line above tracks changes in the EUR/USD. If you analyze the right side of the chart, notice the large gap between EUR/USD sentiment and the underlying exchange rate?

Can you see one other time when the index was at similarly low levels while the EUR/USD was only after a relatively small decline? It was in the first half of 2018, so the above chart further validates the self-similarity in the USD Index between now and 2018. Since the USD Index soared in 2018, the same is also likely to take place this year.

With the performance of the EUR/USD often rising and falling with the sentix Sentiment Index, the divergence implies that there is still plenty of room for the EUR/USD to move lower.

3. Printing the Euro Like Crazy

Third on the docket, I warned on Jan. 22 that the European Central Bank’s (ECB) bond-buying program was likely to accelerate.

I wrote:

The ECB decreased its bond purchases toward the end of December (2020), Then, once January hit (2021), it was back to business as usual. As a result, the ECB’s attempt to scale back its asset purchases was (and will be) short-lived. And as the economic conditions worsen, the money printer will be working overtime for the foreseeable future.

And with projections of prosperity now morphing into resignations of reality, the ECB’s money printer is working days, nights and weekends.

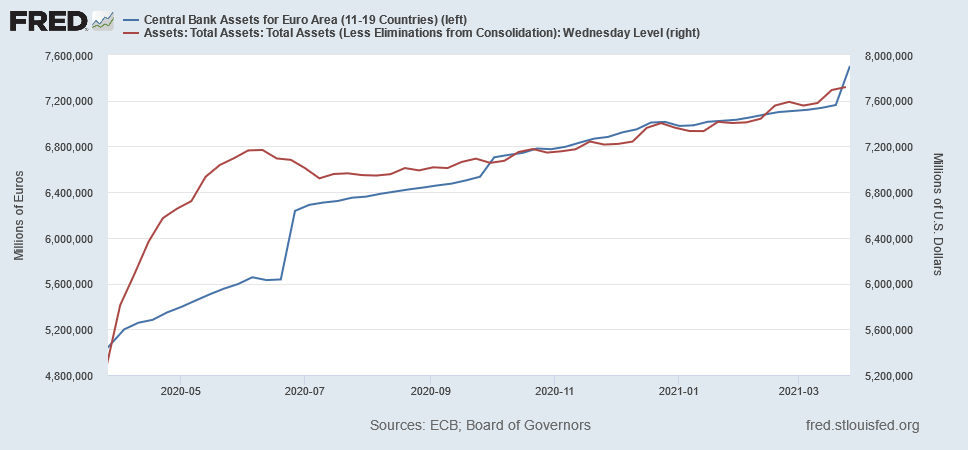

Please see below:

To explain, the blue line above tracks the ECB’s balance sheet, while the red line above tracks the U.S. Federal Reserve’s (Fed) balance sheet. Moving at relatively similar speeds over the last year, if you analyze the right side of the above chart, you can see that the ECB went on a manic shopping spree over the last two weeks. Case in point: last week’s bond purchases (€343 billion) were the highest since June 2020 and the ECB’s balance sheet now equals 75% of Eurozone GDP (which is more than double the FED’s).

But what about mean reversion?

Well, it’s possible that the ECB decreases its future PEPP purchases. However, on Mar. 31, when asked about unrest in the European bond market and the modest uptick in interest rates, ECB President Christine Lagarde had an interesting response:

Source: Bloomberg

Translation?

Because Europe can’t handle rising interest rates if increasing the ECB’s bond-buying program means printing the euro into oblivion … then so be it.

Also worth mentioning, an extreme decoupling has occurred between the EUR/USD and the German DAX (the benchmark equity index of Europe’s largest economy).

Please see below:

To explain, the performance of the EUR/USD often mirrors the performance of the DAX 30 (and vice versa). However, if you analyze the right side of the chart, you can see that equity optimism has completely run away from currency realism. As a result, if the DAX 30 rolls over, it could put even more downward pressure on the EUR/USD.

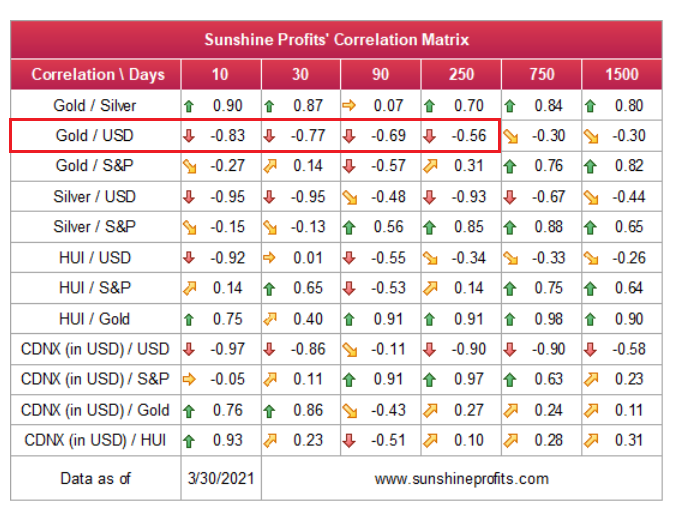

Piecing together the puzzle, because the EUR/USD accounts for nearly 58% of the movement of the USD Index and gold has a strong negative correlation with the U.S. dollar, the euro’s plight is profoundly bearish for the yellow metal.

Please see below:

To that point, amid the surge in U.S. Treasury yields and the recent follow-through by the USD Index, gold has delivered its worst YTD performance since 1982.

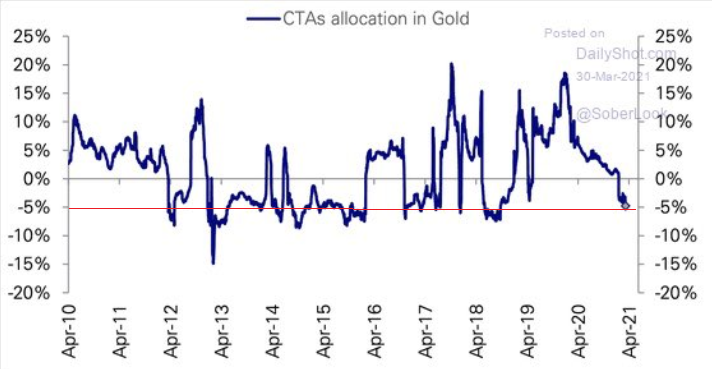

If that wasn’t enough, Commodity Trading Advisors (CTAs) continue to reduce their exposure to the yellow metal. For context, CTAs manage professional futures portfolios and often employ computer-driven (quant) strategies in their attempts to deliver alpha. And while the latest reading is relatively stretched, history implies that CTA’s allocation still has room to move lower.

Source: The Daily Shot

Source: The Daily Shot

In conclusion, the PMs’ strength on Mar. 31 was likely a mirage. Wrapping optimistic equities, subdued Treasury yields, and a dormant USD Index into the perfect package, the daily price action was gold’s version of paradise. However, with the tranquility unlikely to last, the yellow metal will soon have to test its mettle against its fiercest opponents. And for the time being, gold is likely ill-equipped to handle the forthcoming challenge.

Disclaimer: All essays, research, and information found above represent analyses and opinions of Matthew Levy, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be ...

more

Thank you for helping me better understand the precious metal market recently. Your perception on precious metals just shows how experienced you're in this field, unlike permabulls that only rely on headlines.