The ETF Portfolio Strategist: Sunday, Feb. 14

In this text:

- Stocks rise as Treasury yields tick higher.

- Is the tide finally turning in favor of global asset allocation?

Equities Rally as the Reflation Trade Starts to Pinch Bonds

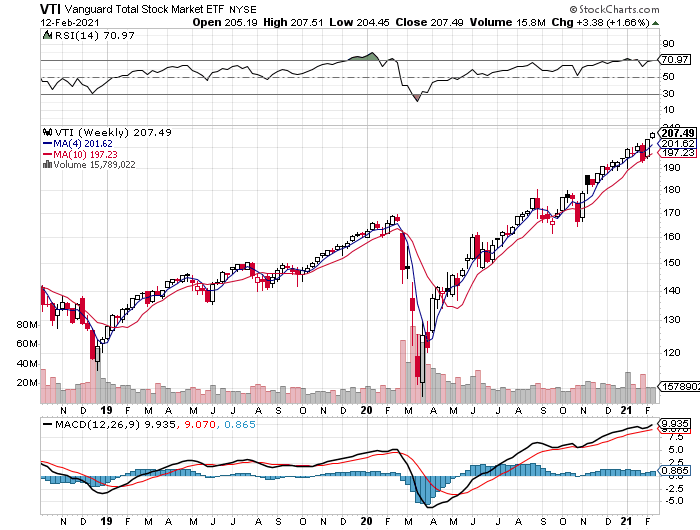

US equities rose for a second week, based on Vanguard Total US Stock Market (VTI). The fund gained 1.7% at Friday’s close (Feb. 12), marking the first back-to-back weekly gain this year and propelling VTI to a new record high.

Presumably, this week’s optimism is related to hints that the pandemic is peaking and the vaccine rollout is finally starting to make a meaningful dent in the spread of the disease. Incoming data could change the analysis in a heartbeat, of course, but for now the crowd is paying attention to falling infection and hospitalization rates (and minimizing the still-high fatalities trend).

Bulls can also point to the rising likelihood that the Biden administration’s $1.9 trillion coronavirus relief package will, in some form or another, soon become law and provide the economy with a fresh boost.

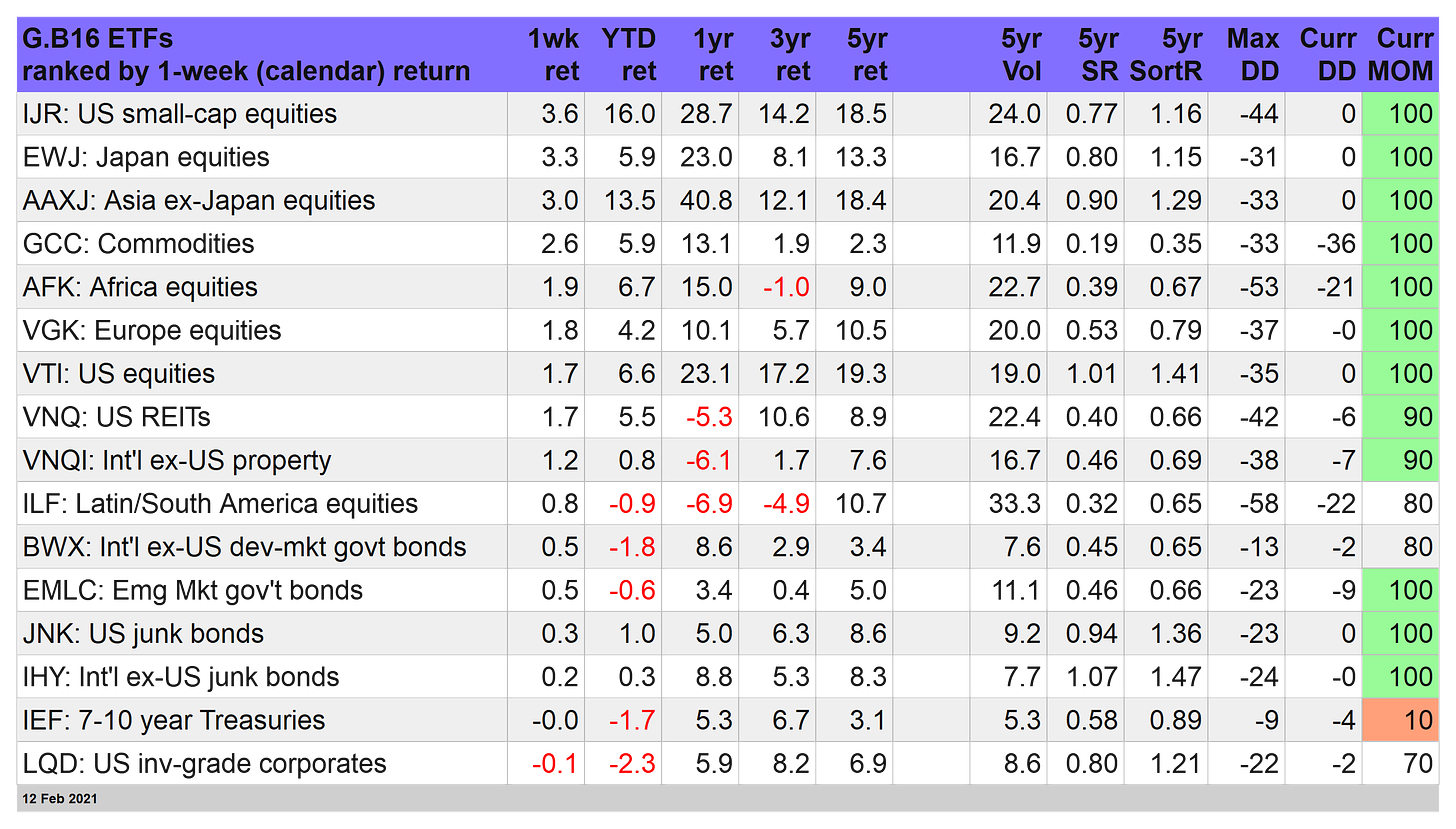

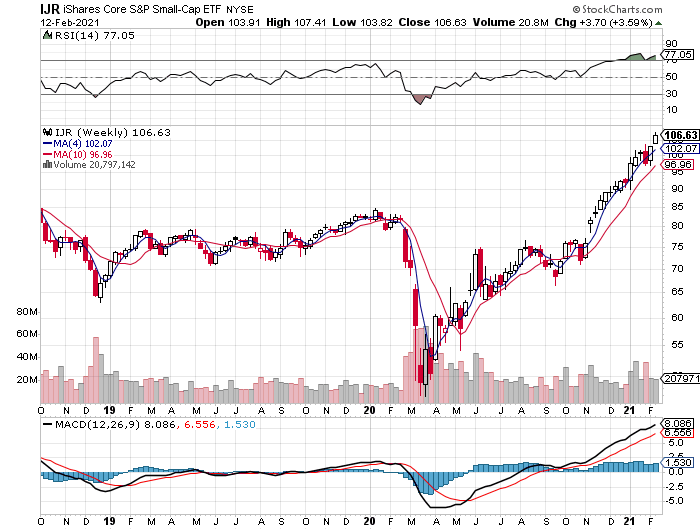

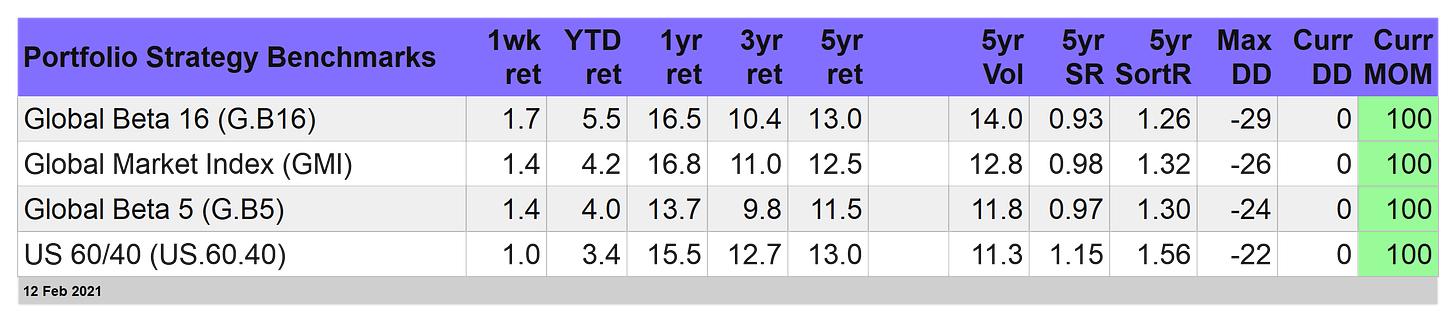

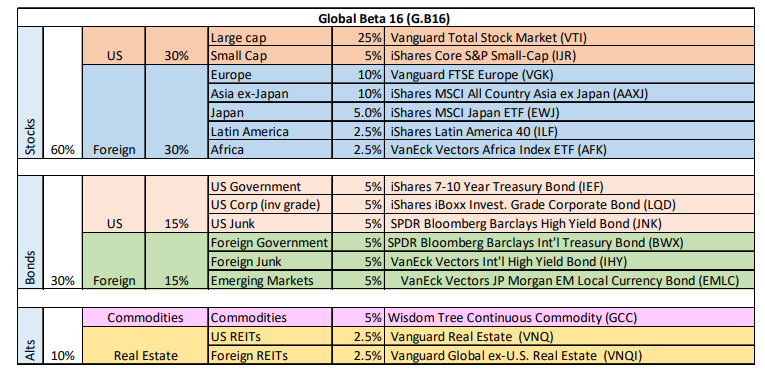

US small-cap stocks certainly picked up on the growth theme. The iShares Core S&P Small-Cap ETF (IJR) surged 3.6% this week -- the strongest gain for our list of major asset classes that comprise the Global Beta 16 (G.B16) strategy benchmark. (For details on all the risk metrics and benchmarks, see this summary.)

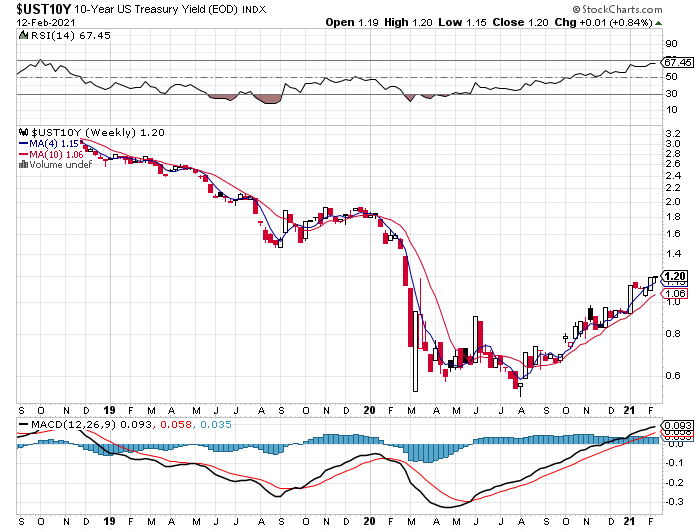

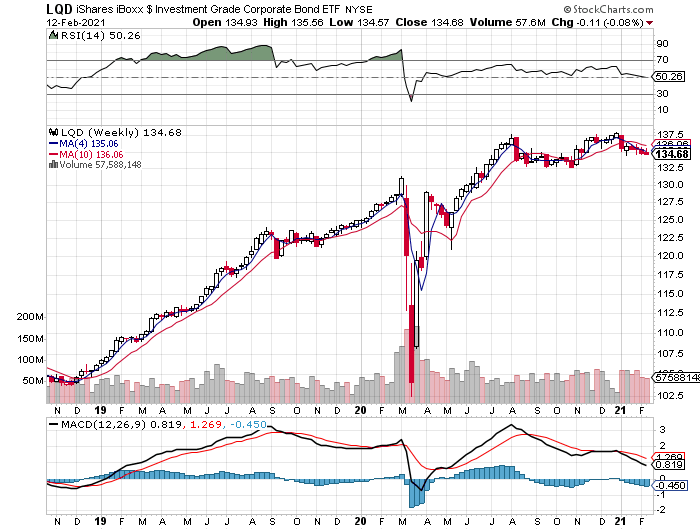

US investment-grade bonds were the only losers this week for our set of fund proxies. Driving the losses were rising interest rates, albeit gently so. The 10-year Treasury yield inched up to 1.20% today for the first time in nearly a year.

The continued rise in rates pinched bonds this week, although just barely. The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) slipped 0.1%, the worst performance for the G.B16 opportunity set. A mild setback, although the decline marks the fifth straight decline in the past six weeks.

The only other loss for our proxy funds this week: iShares 7-10 Year Treasury Bond (IEF), although you’ll have to squint to see the decline – a mere 3 basis points. Nonetheless, the weak trend for IEF is conspicuous, and more of the same is expected for the foreseeable future.

The main takeaway is that the upside bias for most flavors of equities rolls on. Ditto for the mild but persistent slippage in investment-grade fixed income.

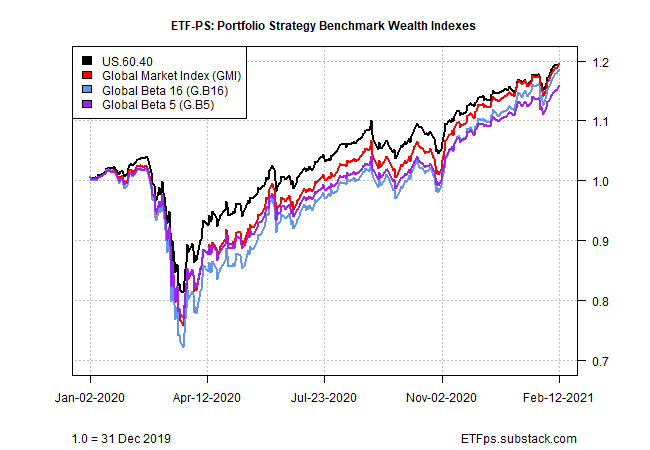

Another Good Week for Portfolio Strategy Benchmarks

Rising yields so far aren’t taking much of a toll on our indexes for multi-asset-class portfolios. Extending the previous week’s gains, Global Beta 16 (G.B16) rallied 1.7% this week and is now up a strong 5.7% year-to-date.

Helping drive G.B16’s rally this week were solid increases in foreign equities. Notably, Asia stocks posted 3%-plus gains this week. That includes a 3.3% jump in iShares MSCI Japan, which gapped higher and delivered the second-best gain in G.B16’s portfolio. Note: all the funds listed in the first table above are held by G.B16, with year-end target rebalancing weights as follow:

Notably, the US 60/40 stock/bond benchmark (US.60.40), which has dominated returns relative to global multi-asset-class portfolios in recent years, seems to be losing its edge, if only slightly and gradually. It’s premature to write off leadership of American-focused portfolios, but G.B16’s advantage over US.60.40 so far this year suggests that the tide may finally be turning in favor of diversifying into global assets ex-US.

Programming note: Starting with this issue, ETF-PS will separate reporting on our portfolio strategy benchmarks from the proprietary strategies, which will be updated in an upcoming ...

more