The Effect Of Rising Interest Rates On Dividend Stocks

On December 14, the Federal Reserve announced that they were hiking the Fed Funds rate by 0.25%. This is the rate that financial institutions lend money to each other overnight and has a trickle-down effect other interest rates in the domestic economy.

This increase is indicative of a larger trend – it comes after an equal-sized interest rate increase in December 2015. Further, the Federal Reserve indicated in the announcement to expect 3 additional hikes over the next twelve months.

If each of the 3 hikes in 2017 will be of the same magnitude, then the year will finish at a 1.5% Fed Funds rate. This presents a dramatic change to our interest rate environment given that short-term rates have been held near zero since December of 2008 to provide economic stimulus.

Investors should make themselves aware of the effects that these rate increases may have on their portfolio, as interest rates have a large effect on the price of real assets.

This article will discuss the effects of rising interest rates on dividend stocks.

Why Raise Interest Rates

As investors, it is important to understand the dynamics behind these interest rate increases. It’s beneficial to know not just when interest rates are increasing, but why.

Interest rate increases are a method to provide future economic stimulus. Note the key word future. High interest rates are not actually beneficial to the economy in a direct sense, since they increase the cost of borrowing for companies and individuals. This reduces business investment and personal consumption.

Rather, the advantage of high interest rates is that they allow for interest rates to be lowered at some point in the future. The act of lowering interest rates spurs economic growth, which is why raising interest rates is like ‘banking away’ future economic stimulus.

The 2008-2009 financial crisis provides a prime example of using interest rate cuts for economic stimulus. The Federal Reserve reduced interest rates to rock-bottom levels, where they have remained ever since.

Source: U.S. Federal Reserve

Given the current signs of strength in the U.S. economy, the Federal Reserve is hiking rates to make sure they will have economic stimulus for the next (inevitable) recession.

The Relationship Between Interest Rates and Dividend Stocks

This article will discuss the relationship between interest rates and dividend stocks in two different regards: at the security level and at the business level.

First, the business level. Generally speaking, high interest rates are bad for most companies because it increases the cost of borrowing. Companies with more debt will understandably be effected more than companies with low debt, all else being equal.

That’s why it’s important to monitor debt-related financial metrics when researching potential investments.

There are certain companies within particular industries that will actually benefit from increasing interest rates. These will be discussed in more detail later in this article.

Next I will consider the effect of rising interest rates on dividend stocks at the security level.

The most noticeable effect of interest rates is their relationship with the market’s price-to-earnings ratio. These two variables have an inverse relationship – meaning that as interest rates increase, the market’s price-to-earnings ratio (and price) will decrease.

Of all securities, rising interest rates will hurt bonds the most. This is because all of a bond’s investment returns come from interest payments and rising interest rates mean that more attractive fixed income opportunities (as measured by yield to maturity) will arise.

Non-dividend paying stocks are at the opposite end of the spectrum. Since these stocks do not pay any periodic income to investors, their returns are tied entirely to capital appreciation. Theoretically, these stocks should be the most insulated from changing interest rates.

Dividend-paying stocks fall somewhere in between bonds and non-dividend-paying stocks. This is because their returns are not entirely dependent on either capital appreciation or interest payments but rather a combination of both.

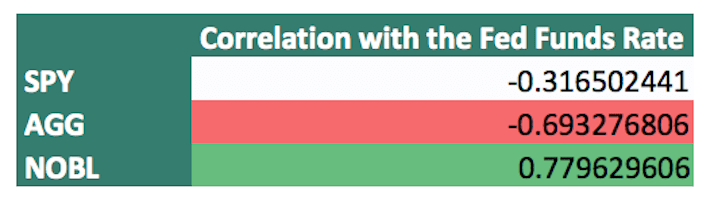

To estimate the effect of rising interest rates on dividend paying stocks, I’ve created the following diagram which examines the long-term correlations of three ETFs with the Fed Funds rate. I’ve selected ETFs as proxies for the bond market, overall stock market, and dividend paying stocks as follows:

- iShares Core U.S. Aggregate Bond ETF (AGG)

- SPDR S&P 500 ETF (SPY)

- S&P 500 Dividend Aristocrats ETF (NOBL)

Here are the results. Correlations are since January 1, 2000 or fund inception, whichever came later.

Source: Yahoo! Finance, U.S. Federal Reserve

As expected, bonds have a highly negative correlation with the Fed Funds rate. This indicates that bond prices drop sharply when interest rates rise.

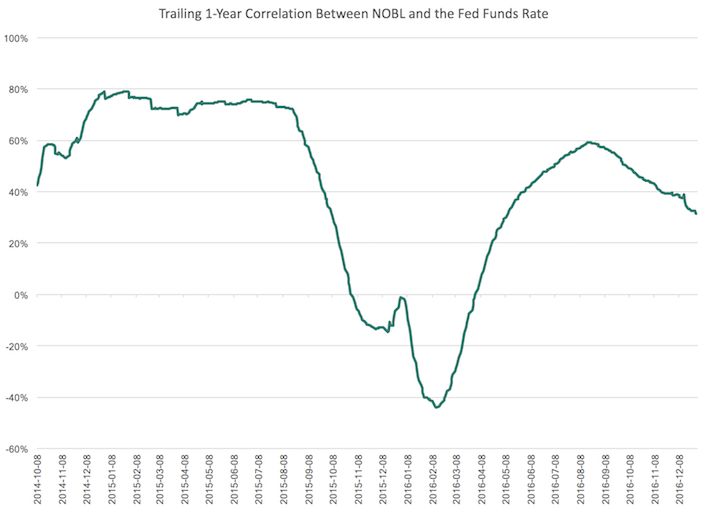

One surprising finding is that the dividend ETF NOBL actually had a positive correlation with the Fed Funds rate. This was the opposite of what would be expected. The following chart displays NOBL’s correlation with the Fed Funds rate in more detail.

Source: Yahoo! Finance, U.S. Federal Reserve

It’s difficult to say whether this positive correlation will stand up to a rapidly changing interest rate environment. The Dividend Aristocrats ETF was only created in 2013, so the sample size under investigation with these correlations is very small compared to the other two ETFs.

It might be wise to consider the correlation of another dividend-focused ETF to determine the effect of changing interest rates on bond performance.

Another popular dividend ETF is the Vanguard Dividend Appreciation ETF (VIG), which has an inception date of April 21, 2006. This is a much longer history than NOBL.

Aside from simply a larger sample size, investigating this ETF is beneficial because it has gone through one period of significant interest rate decreases – namely, the rapid rate cuts during the 2008-2009 financial crisis.

The following diagram displays the periodic rolling correlation between VIG and the Fed Funds rate over time.

Source: Yahoo! Finance, U.S. Federal Reserve

This graph has a lot of variability, so it might be more useful to compute a single correlation number for the sample under consideration. Computing the correlation since the fund’s inception gives a correlation of -0.35, which is only slightly more negative than SPY’s.

This is more in-line with the expectation that dividend stocks will be more effected by rising interest rates than stocks in general, but will not be effected as much as bonds.

To conclude, this new period of rising interest should hurt dividend stocks – however, investors can take action to minimize these effects.

How to Benefit from Rising Interest Rates

Since the Federal Reserve has publicly stated their intent to raise interest rates multiple times in 2017, this presents a predictable macroeconomic trend. Savvy investors will take advantage of predictable trends whenever possible.

The most straightforward solution is to purchase stocks that will directly benefit from the rising interest rate environment. There are three main groups of stocks who possess this characteristic: banks, insurance companies, and payroll processors.

Banks are the headline beneficiary of rising interest rates. This is because interest rates tend to rise the most in the long end of the yield curve. In other words, long-term bond yields will experience a greater change than short term bond yields over the same time period.

The business model of a bank is to collect money from depositors while paying them a rate from the short end of the yield curve while lending money to borrowers at a rate from the long end of the yield curve.

Since the long end changes more than the short end, the ‘spread’ that represents the banks profit will increase in a rising interest rate environment. This spread is called net interest margin and will boost earnings-per-share as it increases.

Insurance companies will also benefit from rising interest rates. In fact, it could be argued that they stand to benefit even more than banks do.

Insurance companies will benefit because of the way in which they invest their float – insurance premiums collected but not yet paid out as claims. Insurance companies have to be very conservative in the way they invest their float, as it is uncertain when they will have to pay out large claims to policyholders.

As a result, the vast majority of insurance float is invested in fixed income securities, or bonds, since they possess less inherent risk than stocks. As interest rates rise, new insurance premiums will be invested in higher yielding bonds at higher rates of returns.

This will boost the earnings of insurance companies in the long run, which is why I’m quite bullish on insurance stocks.

Another reason is the track record of insurance companies. They have generally performed quite well – Warren Buffett’s Berkshire Hathaway (BRK-A) is one notable example, but there are plenty more. A man (and legendary investor) named Shelby Davis averaged 23.2% annual returns by investing in undervalued insurance companies.

The third group of companies that will benefit from rising interest rates are the payroll processors. These companies hold large sums of money from businesses before paying it out to the businesses’ employees.

While the payroll processor typically holds this capital for only a short period of time, they wisely invest this cash into short-term fixed income securities. When interest rates rise, the return on these short-term deposits will rise as well, which will translate positively to their bottom line.

Three Specific Companies That Will Benefit from Rising Interest Rates

There are currently three Dividend Aristocrats that will benefit from rising interest rates. One operates in the payroll processing industry and the other two are insurance companies.

Unfortunately, there are no large banks that are Dividend Aristocrats as most slashed their dividends during the 2008-2009 financial crisis.

Aflac (AFL) is a giant in the insurance industry, providing insurance products to more than 50 million policyholders worldwide. The company has delivered solid financial performance, compounding earnings-per-share at 8% annually over the past decade.

Within the insurance industry, Aflac specializes in supplemental insurance. This insurance provides coverage such that if a policyholder gets injured and can no longer work, Aflac provides claims to help them meet typical expenses associated with a typical lifestyle.

For investors seeking geographic diversification, Aflac will be appealing. The company collects 75% of its premium income from Japan, and enjoys large market share in the country with one in four Japanese households insured by Aflac.

Aflac currently ranks very well using The 8 Rules of Dividend Investing because of its low payout ratio (26%), low price-to-earnings ratio (10.4), and above-average dividend yield (2.5%).

Aflac also offers a no-fee dividend reinvestment plan.

Automatic Data Processing (ADP) is a payroll processing company that provides services such as payroll execution, benefits administration, and human resource management to all sizes of companies. ADP is highly diversified with no single customer representing more than 2% of revenues.

The burden of increasing regulations means that more and more businesses are outsourcing their financial services to ADP. This will be a driver of growth for the company.

As well, ADP operates a very recession-resistant business model. Regardless of global economic conditions, employers will still need the services of ADP, insulating the company from the effect of downturns in the economy.

ADP currently has a relatively high price-to-earnings ratio of 29.9, which is above the valuation of the overall stock market. The S&P 500 currently has a price-to-earnings ratio of 25.8.

While ADP is a quality company, it is trading at a high valuation right now. Investors looking to take advantage of current interest rate trends by buying ADP should wait to buy on the dips.

Cincinnati Financial (CINF) is a diversified insurance company operating under four distinct business lines: life, personal, commercial, and Excess & Surplus.

The company is a well-known dividend growth stock, having raised their dividend for 57 consecutive years, one of the longest streaks of any U.S. businesses.

This qualifies Cincinnati Financial to be a Dividend King – a group of elite businesses with 50+ consecutive years of dividend increases.

You can see all 18 Dividend Kings here.

Cincinnati Financial is different from most insurers in two regards.

First, they do not avoid low-margin products. While many insurers focus on the highest margin policies, Cincinnati Financial targets their low-margin counterparts, hoping that the increase market share and policy volume will make up for slightly lower profitability.

Secondly, a substantial proportion of Cincinnati’s investment portfolio is invested in a manner different from most insurers. The company invests 35% of their insurance float in blue-chip stocks, which is in stark contrast with most insurers fixed income-only investment portfolios.

While this introduces volatility to their investment portfolio, it will also produce excess returns in the long run.

Final Thoughts

As investors, we are witnessing a dramatic shift in the macroeconomic landscape as we change from near-zero domestic interest rates to a period of consecutive rate hikes.

Through these changes, the goal remains the same. Target high-quality, dividend-paying stocks with a long-term systematic investment strategy. This will allow investors to sleep well at night regardless of the movements of interest rates.

Disclosure:

Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers ...

more