The Driving Force Behind The Current Action Is...

One of the most important lessons I have learned about the business of investing is the drivers of the market action change over time. Sometimes dramatically so. It is for this reason that no one, I repeat, no one, has ever perfected the game for any length of time. You see, like golf, the conditions under which one plays the game are always changing.

Think about it. There are times when the news and/or external events drive prices to and fro. Other times the central bankers are the focus. Sometimes it's the economy, inflation, and/or interest rates that cause traders to take action. Often (but not always) it's the earnings outlook that controls the game. And every once in a while, valuations are the primary driver (think Spring 2000). Oh, and lest we forget, there are even times when pure, unadulterated fear becomes the impetus for Ms. Market's machinations.

What Are The Current Drivers?

To be sure, the current rally has been a thing of beauty for stock market investors. Yet at the same time, for anyone following the global economic data, the move has become more than a little confounding.

So, the question of the day is, what is driving the current joyride to the upside - and can it last?

As I opined with my tongue firmly implanted in cheek last week, stocks seem to be rallying on the back of two assumptions. First, that the Fed is an investor's best friend again (i.e. The Fed is on hold, the next move could be more QE, and the "Fed Put" is back). Second, it is assumed that a trade deal with China is going to get done soon, and the deal is going to fix all that ails the world's fledgling economies.

With these two big "worries" out of the way, it is not surprising that the indices have retraced a fair amount of the fear-based trade seen in December. In short, traders have "corrected the correction" because the fear turned out to be unwarranted. Makes sense.

Has #GrowthSlowing Been "Fixed?"

Yet, there is still the #GrowthSlowing issue to contend with. There can be no argument that both economic and earnings growth is slowing at the present time. Last week's economic headlines both in the U.S. and abroad made this point quite clear.

Let's see... Germany's Manufacturing PMI fell to 47.6. Since the reading is below 50, this means the manufacturing sector is contracting. Export orders saw their biggest decline in more than six years. And the Composite PMI is teetering on the verge of contraction. And with Germany's Q4 GDP came in at 0.1%, it is easy to see that Europe's biggest economy is flirting with recession.

Next up is Japan. The PMI in the Land of the Rising Sun also fell into contraction mode for the first time in two and one-half years.

Here at home, we learned last week that Existing Home Sales fell to a 3-year low. Durable Goods Orders showed weak momentum. The Philly Fed General Business Activity Index plunged 21.1 points, which was the biggest decline since August 2011, signaling contraction. And the Conference Board's LEI fell in January instead of gaining ground, as economists had expected.

Is This A Problem?

No, none of the above means that a recession is imminent in the U.S. And this is part of the reason that investors keep buying stocks without too much concern here. However, I think we need to admit that, at the very least, we've got another "soft patch" on our hands.

Below is a chart from Martin Pring (the man whose videos on technical analysis got me started in the business in the mid-1980's) showing the stock market (adjusted for inflation), the secular bull/bear cycles, and recessions (in red) versus "slowdowns" (in beige).

(Click on image to enlarge)

Image Source: Pring.com

As you can see, the stock market never fares well during/around recessions. However, slowdowns are another story.

As the chart illustrates, the bulls didn't pay much attention to the three mild slowdowns that occurred during the 1982-1999 secular bull market. Basically, stocks paused for a bit when things slowed down and then continued to power forward.

But since then, the story is a little different as stocks have struggled at the beginning of each slowdown. So, the question in my mind is whether this slowdown is just getting started or closer to an end?

Two Ways To Play

If it's the former, then a "retest" scenario is the likely outcome and a tactical, trend-following approach could come in quite handy. Remember, waterfall decline lows tend to be "tested" within a couple months of the low as the original reason for the decline usually resurfaces. So, will the bears return if the #GrowthSlowing issue isn't "fixed" by a trade deal tout suite?

On the other hand, if the current data winds up being merely confirmation of the slowdown everybody already knows about and a trade deal can reinvigorate global growth, then a move to new highs is a logical outcome. And as far as the appropriate strategy for the market driver is concerned, in a rebounding growth environment, a buy-the-dips strategy is usually a good way to play.

Another Driver to Consider

Yet, I believe there is an additional driver of market action to consider here. It's called "positioning."

According to JP Morgan's Marko Kolanovic, hedge funds and other systematic trading strategies were caught flat-footed by the recent surge in the stock market and are in the process of playing catch up on a daily basis.

In an interview on CNBC last week, Kolanovic stated that the "beta positioning" of hedge funds and systematic investors is currently "in the 20th to 30th percentile." Kolanovic noted that while the current reading is well above the December level of "close to zero," it is still below normal.

In other words, there is an entire segment of market participants that has been and remains underinvested. From my seat, this helps explain why there have been no pullbacks to speak of for the last nine weeks and why intraday dips are being bought on a consistent basis.

Kolanovic suggests that it is for this reason that the current rally can continue. The guy who has made some impressive market calls over the past couple years, says that the current pace obviously can't be sustained. But as long as a trade deal gets done, Kolanovic feels money flows will continue to sustain the market.

Summing Up...

In summary, it looks like the current rally has "corrected" the correction that was based on fears of policy mistakes by both the Fed and the administration. Now the bullish assumption seems to be that a trade deal will "fix" the #GrowthSlowing issue. And with money continuing to flow into stocks from underinvested traders, it seems the rally can just keep on keepin' on.

My take is the risks here are obvious. First, there is the risk that a trade deal doesn't get done in a timely fashion. And second, that growth, which was slowing long before the trade spat with China began, continues to falter as the global synchronized slowdown continues.

Weekly Market Model Review

Now let's turn to the weekly review of my favorite indicators and market models...

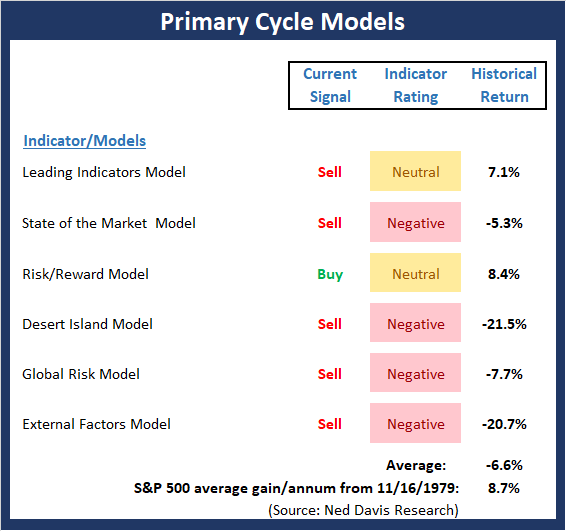

The State of the Big-Picture Market Models

I like to start each week with a review of the state of my favorite big-picture market models, which are designed to help me determine which team is in control of the primary trend.

(Click on image to enlarge)

The Bottom Line:

- While the bull case seems strong here, my "Primary Cycle" board continues to give me pause. If just one or two of my favorite longer-term "state of the market" models was negative, I think I could give it a pass. However, with five out of six on sell signals and four sporting negative readings, I'm concerned about the health of the market. At the very least, this board suggests that some caution is warranted in the near-term.

This week's mean percentage score of my 6 favorite models slipped to 40.3% from 44.2% last week (2 weeks ago: 48.9%, 3 weeks ago: 48.9%, 4 weeks ago: 47.8%) while the median improved to 42.5% from 40% last week (2 weeks ago: 46.7%, 3 weeks ago: 46.7%, 4 weeks ago: 45%).

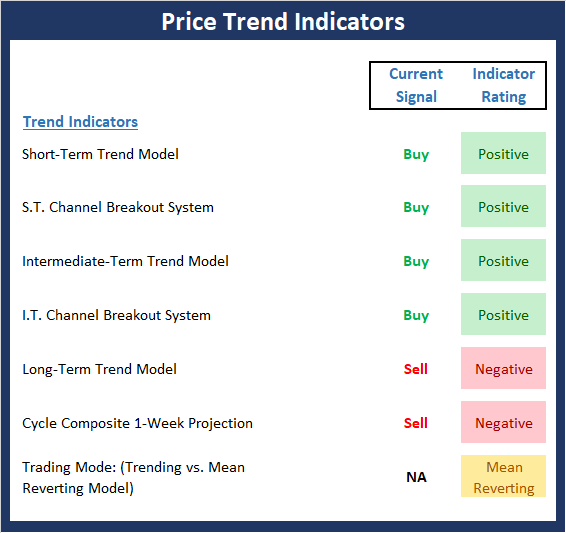

The State of the Trend

Once I've reviewed the big picture, I then turn to the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

(Click on image to enlarge)

The Bottom Line:

- With the market having retraced all of the December dive, it is easy to view the trend as being positive. And with the majority of Trend board positive, the indicators agree.

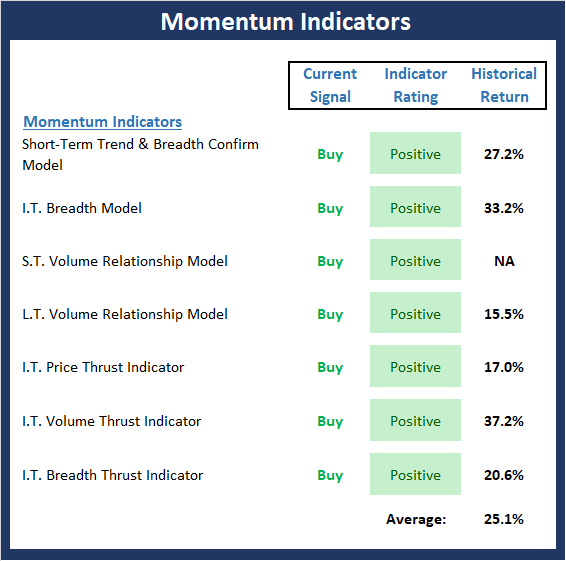

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend.

(Click on image to enlarge)

The Bottom Line:

- The Momentum board remains completely green again this week. And with every indicator currently sporting a positive rating, the advantage stays with the bulls and suggests that a buy-the-dip strategy is the way to play.

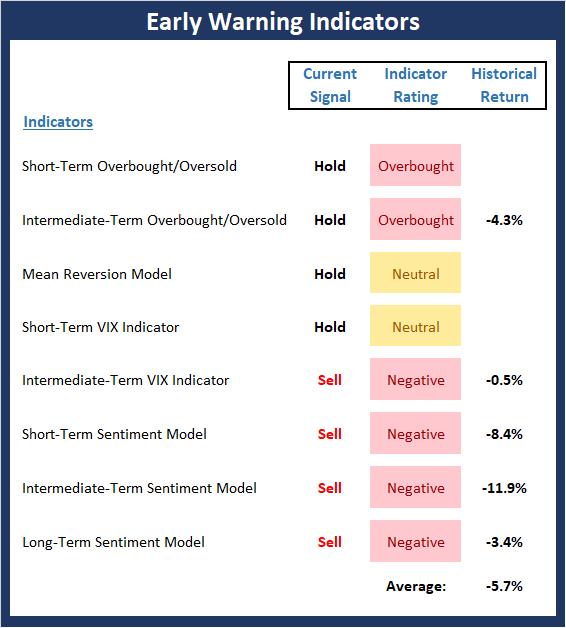

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders might start to "go the other way" -- for a trade.

(Click on image to enlarge)

The Bottom Line:

- The Early Warning board continues to warrant attention. It should be noted that the 40-period RSI is currently at one of the highest readings in history and that our Long-Term Sentiment Model flashed a sell signal last week. In short, the board suggests that the table is now set for a counter-trend move.

The State of the Macro Picture

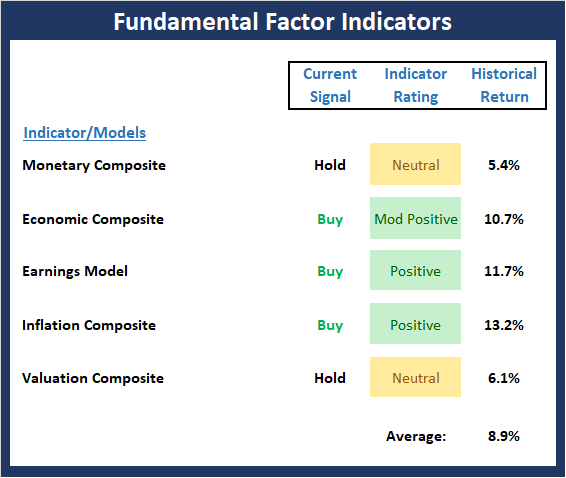

Now let's move on to the market's fundamental factors - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

(Click on image to enlarge)

The Bottom Line:

- Sorry to sound like a broken record, but the Fundamental Factors board suggests the backdrop for equities remains constructive. My take is the board tells me the bulls should be given the benefit of any doubt from near-term perspective.

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more