The Delusions Of MAGA, Part 2

We began Part 1 with the Donald's bogus tax day boast that the American economy has come roaring back. But that falsehood merits further debunking because it succinctly embodies the kind of context-free, anti-historical, bad money-populism that prevails on both ends of the Acela Corridor.

On this Tax Day, America is strong and roaring back. Paychecks are climbing. Tax rates are going down. Businesses are investing in our great country. And most important, the American people are winning.

Au contraire. The US economic expansion is not roaring; it's still stumbling into debt-ridden old age---fixing to be battered by another round of collapsing financial bubbles and payback for growth stolen from the future.

For example, since December 2016 paychecks have been "climbing" alright----but as a factual matter, they are up by the very same 2.8% as the CPI. That is to say, real earnings have gone exactly nowhere during the last 15 months.

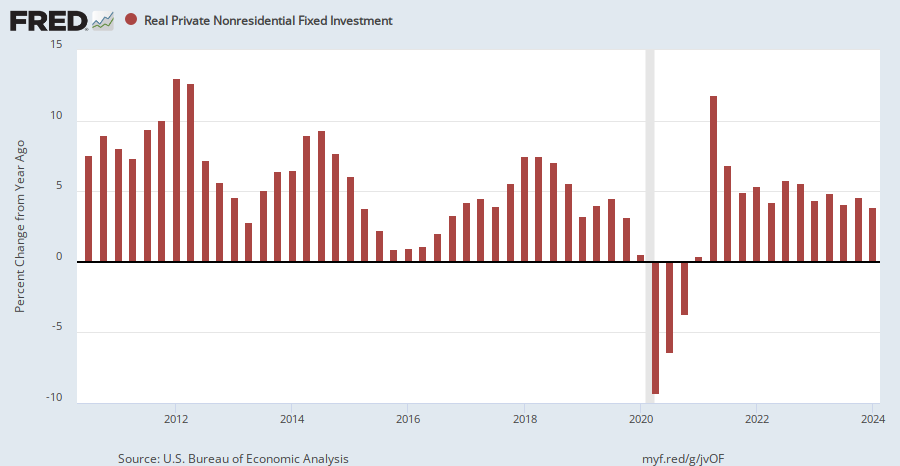

Likewise, there is nothing special to write home about with respect to the Donald's claim that "businesses are investing in our great country".

Well, yes again, but at no faster rate than before. As is evident in the chart below, business investment during a recovery tends to pulse forward in short-term mini-cycles. Accordingly, there is really nothing new in the trend that has prevailed since the recovery gained its footing in the second half of 2010.

In fact, the average quarterly (Y/Y) gain in real business investment during 2017 was 4.68%, which compares to an average Y/Y gain of 4.94% during the prior 26 quarters.

The only thing different last year was the timing of the pig-in-the-python effect. As seen in the chart, CapEx surged during the 2014-2015 global commodity and trade boom; then gave way during the subsequent 2016 bust, and finally rebounded modestly during 2017----helped not a little by the weaker dollar, energy investment recovery and the global capital spending upturn triggered by Mr. Xi's pre-coronation credit boom.

Just as the above can not be remotely described as evidencing a post-inaugural acceleration, the trend in real retail sales growth conveys the same story.

During 2011 through 2016, real Y/Y gains averaged 2.41%. During the past 15 months the have averaged 2.30%----meaning that most consumers are still living paycheck to paycheck, not suddenly "winning" so much they can't stand it.

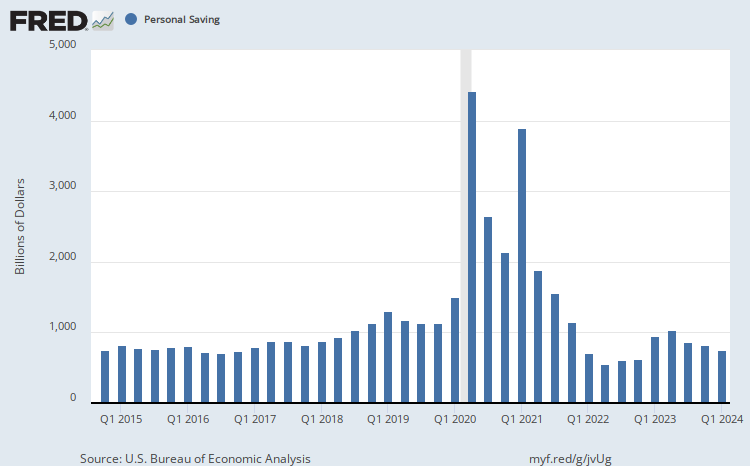

In point of fact, they are not really "winning " at all. They have actually been tapping into their rainy day funds in a desperate effort to tread water----and to the tune of nearly one-half trillion dollars per year.

That's right. US households have cut their savings rate (annualized dollars) from $850 billion in Q2 2015 to only $380 billion in Q4 2017.

To be sure, when consumers leave themselves high and dry in this manner, our Keynesian national GDP accounts imply its all to the good because spending is the be all and end all for any given quarter.

Then again, payback time always comes, and at just 3.0% of disposable personal income by the end of last year, the personal savings rate had plunged into the sub-basement of recorded history---just as it did on the eve of the 2009-2009 recession.

The same story holds true on the supply side of the economy. During the past year, labor productivity averaged 1.25% annualized growth compared to 1.23% during the prior 30 quarters. And we'd call this tiny uptake a rounding error, not evidence that the American economy has come bounding back.

Indeed, the real issue in the chart is that after the one-time rebound from its Great Recession plunge, labor productivity remains mired at levels barely half of its historic average.

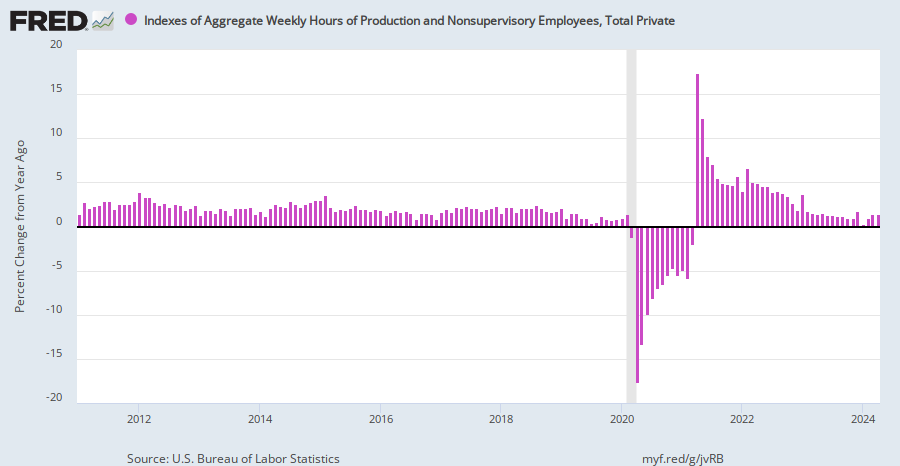

Finally, notwithstanding all the White House crowing about jobs, there has been no acceleration there, either, as is evident in the chart below. It measures aggregate hours worked by production and non-supervisory workers, which have averaged a 2.23% annualized rate of gain during the 15 months since Trump took office.

That compares to a 2.25% annualized average during the prior six years. But when it comes to government work, of course, second decimal place differences amount to rounding errors---even if you use a magnifying class to highlight them.

The bigger point here is that the has been no acceleration of the main street economy since January 20, 2017-----just a continuation of the deeply sub-par recovery that has been underway since 2010. In effect, the Donald is taking credit for the doings of the plain old business cycle, and at the worst possible time.

Namely, during the wee hours of a business expansion that is now exceedingly long in the tooth by all historic standards (106 months compared to a 61 month post-1950 average and the 119 month all-time record of the 1990s); and which was purchased with still another dose of borrowed prosperity that is now coming check-by-jowl with payback time.

In fact, absent the huge drawdown in savings last year, the already unspectacular real GDP gain of 2.2% year-over-year (Q4) during 2017 would have averaged well less than 1.5% per annum.

The several quarters of 3% seasonally maladjusted annualized growth rates, therefore, were not signs of an impending supply-side growth miracle. They were just an expression of the long-running pattern of syncopated, sub-par GDP growth that is now facing another round of debt payback time.

Even aside from that impending skunk in the woodpile, however, the far right-hand side of the chart bears no trace of a booming economic Waldo. The latter is nowhere to be found in Trumpite America.....except, except for the stock market.

Yes, the major indices are up 30% but that exactly the trouble. In the new world of Fed-driven Bubble Finance, business cycle end when bubbles crash under their own weight of distortion and rampant speculation in the casino. So the Donald is bragging about a Bubble that is fixing to crash, and take his vaunted booming economy with it.

Stated differently, the trend performance of the-current so-called recovery has been exceedingly sub-par yet the speculation ridden equity markets have pushed PE multiples and growth expectations into the upper regions of the financial stratosphere. 23% growth per year thru 2019.

And that get's us to the heart of the MAGA delusion. The Donald has been sold a bill of goods about the efficacy of tax cuts---and that's the only real basis for his mistaken assumption that the US economy is fixing to boom---by a motley combination of supply-side ideologues, GOP politicians pandering to their donor base and the K-street business lobbies.

But tax cuts are not efficacious if they are deficit-financed late in the cycle and thereby cause an off-setting spike in bond yields. And they are also not efficacious if they fund corporate financial engineering rather than investment in productive assets, or if on the individual side they are temporary and are delivered primarily through credits rather than marginal rate cuts.

Needless to say, all of the above negatives apply to the GOP's Christmas Eve tax cut bill in spades. And foremost among these is the "yield shock" that lies dead ahead.

As we see it, if the U.S. economy doesn't buckle first (i.e. tumble into recession and then all bets are off anyway), the 10-year UST yield will break through 4.0% before the end of FY 2019. Indeed, it is hard to see any other outcome when the household savings rate in the US is still in the sub-basement of history.